The FTSE Finish Line: January 15 - 2025

FTSE Gains As Homebuilders Are Bid On Softer Inflation, BoE Cut Bets Surge

The FTSE 100 has increased by over 1%, while the FTSE 250, which earns a larger share of its revenue from domestic sources, has risen by 1.4%, on course for its largest daily increase since July. The anticipation of lower interest rates following the inflation report is driving a rise in shares of UK homebuilders. A collection of these stocks is climbing by 3.8%, with Vistry Group leading the way with a 7.8% increase, despite indicating a challenging outlook. The UK homebuilder is also outperforming the broader STOXX 600, and a European group of real estate stocks has risen by 1.2%, making it the top-performing sector today. Conversely, luxury stocks have fallen by 0.7%, making them the worst-performing sector.

Single Stock Stories:

The index of UK housebuilders climbed 3.4% following data showing an unexpected slowdown in British inflation in December. Headline inflation eased to 2.5% from 2.6% in November, while core inflation fell to 3.2% from 3.5%, aligning with the Bank of England's (BoE) forecast for December.FTSE 100 home builders including Barratt, Redrow, Berkeley, Persimmon, Taylor Wimpey, and Vistry gained between 3% and 5.3%, while midcap builders Bellway and Crest Nicholson rose 4.4% and 3.2%, respectively.

Shares of British restaurant and pub operator Mitchells & Butlers rose 5%, ranking among the top gainers on London's FTSE 250 index. The company reported a 3.9% year-on-year increase in like-for-like (LFL) sales during the 15-week period ending January 11, driven by strong demand during the Christmas season, including record sales on festive days. Analysts at Jefferies noted that "M&B is well-positioned to gain market share in a cost-pressured sector." However, in 2024, Mitchells & Butlers shares have seen a ~3.5% drop.

Shares of British electrical retailer Currys surged 11.5% after the company announced an expected fiscal year 2025 adjusted profit before tax of £145 million–£155 million ($177.35–$189.58 million), surpassing analysts’ consensus of £140 million. Currys also reported a 2% year-on-year rise in Group like-for-like sales during the 10-week Christmas trading period ending January 4. Additionally, the board anticipates paying a year-end dividend. Notably, the stock has risen 87.9% in 2024.

Broker Updates:

Diploma shares rose 2.8% to 4,197p after the technical products and services provider reported 7% organic revenue growth in Q1, surpassing Jefferies' forecast of 6%. The company described its Q1 performance as "strong" and in line with expectations, noting that underlying sector trends remained broadly consistent with the prior year. Diploma reaffirmed its full-year guidance and highlighted that its strong operating margin met expectations. The stock has gained approximately 23.2% in 2024.

Technical & Trade View

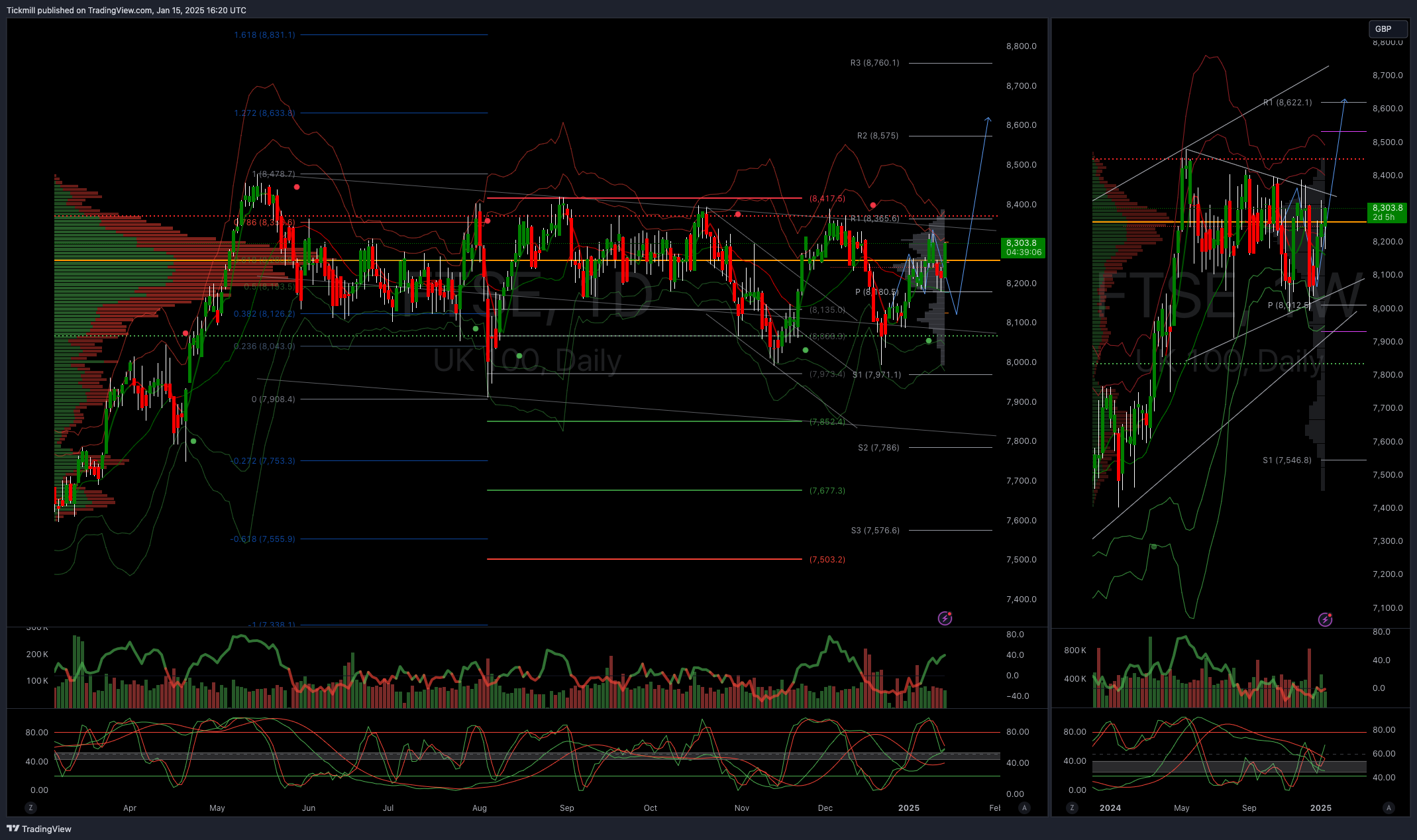

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!