SP500 LDN TRADING UPDATE 28/03/25

SP500 LDN TRADING UPDATE 28/03/25

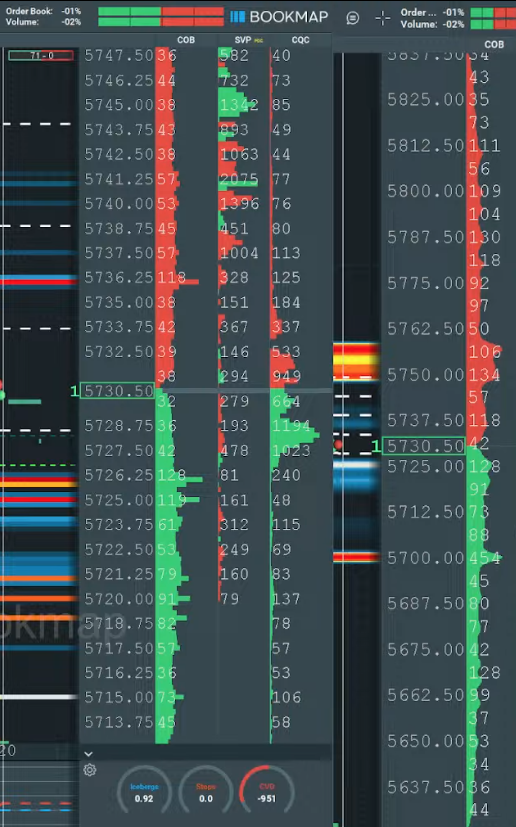

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5690/5700

WEEKLY RANGE RES 5850 SUP 5590

DAILY BULL BEAR ZONE 5700/10

DAILY RANGE RES 5784 SUP 5698

2 SIGMA RES 5888 SUP 5580

5837 50% RETRACE FROM ATH’S

5640 MARCH CONTRACT GAP

5912 ABC CORRECTION TARGET

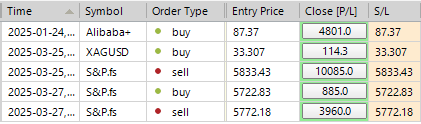

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY/WEEKLY RANGE RES

LONG ON ACCEPTANCE ABOVE WEEKLY RANGE RES TARGET 5912

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF 5912 TARGET 5837

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: ANOTHER SUBDUED SESSION

FICC and Equities | 27 March 2025

Market Performance:

- S&P 500: -33 bps, closing at 5,693 with MOC flows of $530M to BUY.

- NASDAQ 100 (NDX): -59 bps, closing at 19,798.

- Russell 2000 (R2K): -31 bps, closing at 2,083.

- Dow Jones (DJIA): -37 bps, closing at 42,299.

- Trading Volume: 14.7B shares traded across U.S. equity exchanges, below the YTD daily average of 15.4B shares.

- Volatility Index (VIX): +196 bps, closing at 18.69.

Commodities & Other Assets:

- Crude Oil: +27 bps, closing at $69.84.

- U.S. 10-Year Treasury Yield: Unchanged at 4.36%.

- Gold: +151 bps, closing at $3,098.

- DXY (Dollar Index): -25 bps, closing at 104.28.

- Bitcoin: Unchanged at $87,295.

Session Overview:

Markets remained rangebound and subdued following yesterday’s sell-off as participants digested the implications of the new auto tariff announcement. President Trump’s comments about potentially “far larger than currently planned” tariffs on Canada and the EU added to the cautious sentiment.

- Auto Sector: General Motors (GM) dropped 7%, and Ford (F) declined 3%. GIR estimates suggest that approximately 20% of GM’s and 10-15% of Ford’s U.S./Canadian market volumes are produced in Mexico.

- Retail Sector: Retail stocks held up relatively well, with some pockets of discretionary demand showing resilience despite the negative headlines.

- Technology Sector: Tech struggled, with AMD declining 3% on a downgrade, while NVDA and TSM remained weak.

- Momentum Stocks: Momentum names sold off another 260 bps, and APP plunged 20% following reports of a Muddy Waters short position (via Bloomberg).

Overall, market participants remained defensive, with activity levels on our floor rated at a 3 on a 1-10 scale.

Flows:

- Long-Only Investors: Finished balanced.

- Hedge Funds: Net sellers of $385M.

- Asset Managers: Buyers in Telcos and MedTech, while selling Pharma, likely influenced by the Pfizer tax controversy. (*Wyden: Pfizer Dodged Billions in U.S. Taxes in One Year Alone – Bloomberg*). Hedge fund flows were mixed, with some covering shorts in Pharma laid out earlier in the week.

Key Data to Watch:

- PCE Inflation: GIR estimates core PCE at +34 bps MoM versus +30 bps consensus.

- UMich Sentiment: Results expected tomorrow.

Derivatives:

Post-open, the market dropped sharply, prompting clients to monetize short-dated downside hedges in SPY and IWM. As the market gradually recovered, volatility continued to decline due to lower realized moves. Clients remained focused on hedging next week’s tariff announcements through April VIX calls and call spreads. Dealer gamma positioning appears roughly flat at current levels. The desk suggests June upside in SPX could be attractive, especially with systematic flows potentially acting as a tailwind in a lower liquidity environment.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!