SP500 LDN TRADING UPDATE 15/05/25

SP500 LDN TRADING UPDATE 15/05/25

WEEKLY & DAILY LEVELS

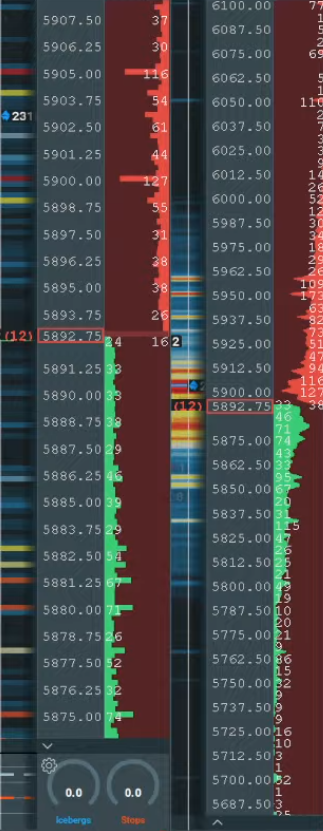

WEEKLY BULL BEAR ZONE 5740/30

WEEKLY RANGE RES 5810 SUP 5550

DAILY BULL BEAR ZONE 5860/50

DAILY RANGE RES 5967 SUP 5844

2 SIGMA RES 6066 SUP 5746

GAP LEVELS 5741/5710

5967 - 2025 OPENING LEVEL

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

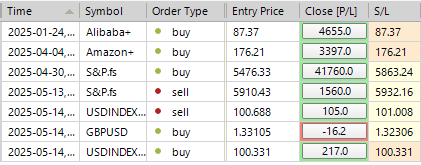

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 2 SIG

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. Equities Update: Dispersion

**FICC and Equities | 14 May 2025 |

- S&P 500: Up 10 basis points, closing at 5,892 with a Market on Close (MOC) buy of $5.7 billion.

- Nasdaq 100 (NDX): Up 57 basis points, closing at 21,319.

- Russell 2000 (R2K): Down 84 basis points, closing at 2,090.

- Dow Jones: Down 21 basis points, closing at 42,051.

- Trading Volume: 19.7 billion shares traded across all U.S. equity exchanges, compared to the year-to-date daily average of 16.4 billion shares.

- VIX: Up 220 basis points, at 18.62.

- Crude Oil: Down 126 basis points, at $62.87.

- U.S. 10-Year Treasury Yield: Up 7 basis points, at 4.54%.

- Gold: Down 196 basis points, at 3,184.

- DXY (Dollar Index): Up 12 basis points, at 101.125.

- Bitcoin: Down 114 basis points, at $103,400.

Market Overview:

The market experienced a relatively flat day as it paused for breath. Megacap tech stocks showed strength, partly offsetting weakness in other market areas. Google (GOOGL) rose 3% ahead of its YouTube upfront, sell-side conference appearance, and Google I/O event. The AI sector was active, with Nvidia (NVDA) and AMD both up 4% on news of increased AI deals, despite Hon Hai lowering its FY guidance but noting a rise in Q2 AI server revenues.

Sector Highlights:

- Healthcare: Continued to lag, reaching over five-year lows compared to the S&P 500. The sector saw significant sell skew (about 3.5 times more selling than buying), with trading volumes above the 4-week average, focused on Pharma and MCOs, primarily driven by the LO community. Factors contributing to the downturn include CMS draft pricing concerns, MFN uncertainty, upcoming sector tariffs, negative commentary from competitor conferences, excessive Monday rally, UNH capitulation, and the sector being a source of funds for others.

Trading Activity:

- Our trading floor activity was moderate, rated a 5 out of 10. The floor finished approximately flat versus a 30-day average of +125 basis points. There was a slight net buying interest in tech, financials, and discretionary sectors, offset by outsized supply in healthcare. Hedge funds ended as net sellers by $1 billion, driven by supply in tech, industrials, financials, and consumer sectors. Short covering continued but was less pronounced than earlier in the week.

Noteworthy Events:

- eToro Group had a successful debut, priced at $52, opened at $69.69 on 1.2 million shares, and closed at $67.

- After the bell: Cisco (CSCO) rose 3% with a solid earnings beat and guidance, while New Fortress Energy (NFE) fell 20% due to Q1 revenue and adjusted EBITDA missing expectations.

Upcoming Economic Data and Earnings:

- Tomorrow's agenda includes macroeconomic data (Retail Sales, PPI, Empire Manufacturing, Philadelphia Fed, jobless claims) and earnings from companies like Alibaba (BABA), Deere & Co (DE), Walmart (WMT), and others. For Walmart, investors were prepared for some general merchandise weakness, but concerns have eased. A 4%+ comparable sales growth would be well-received.

Bond Market:

- Bond yields are edging higher, with speculation that systematic trend followers may be influencing today's movements. Current forecasts suggest potential selling of $41.5 million DV01 this week, with up to $126 million DV01 over the next month if trends persist.

Derivatives Market:

- Despite a lack of significant spot movement, volatility remained stable. Activity was two-way as the market experienced one of the quieter days recently. Investors bought downside in SPY and upside in QQQs, and some unwound/rolled GLD/GDX downside positions. XLV puts are trading higher than SPY puts for the first time in four years. QQQ volatility was notably bid yesterday, and there is interest in owning SPX upside options.

For the remainder of the week, investors will focus on Powell's speech on Thursday and any trade/tariff news. The straddle through Friday's close is priced at approximately 1.05%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!