Institutional Insights: Credit Agricole FX Weekly 12/12/25

USD: struggles all the way," highlights a shifting landscape in global foreign exchange as we approach the end of 2025. The core narrative drives a bearish outlook for the US Dollar following a "more dovish-than-expected" Federal Reserve meeting. The analysis suggests that eroding yield advantages and new Fed reserve management strategies are weighing on the Greenback, while other G10 central banks (like the BoJ and BoE) present idiosyncratic risks and opportunities.

The USD & Global Outlook

The US Dollar is facing significant headwinds, with the report identifying several key drivers for its underperformance:

Dovish Fed Impact: The December Fed meeting eroded the USD's relative rate appeal. Additionally, the start of the Fed’s "reserve management purchases" is eating into the USD liquidity premium.

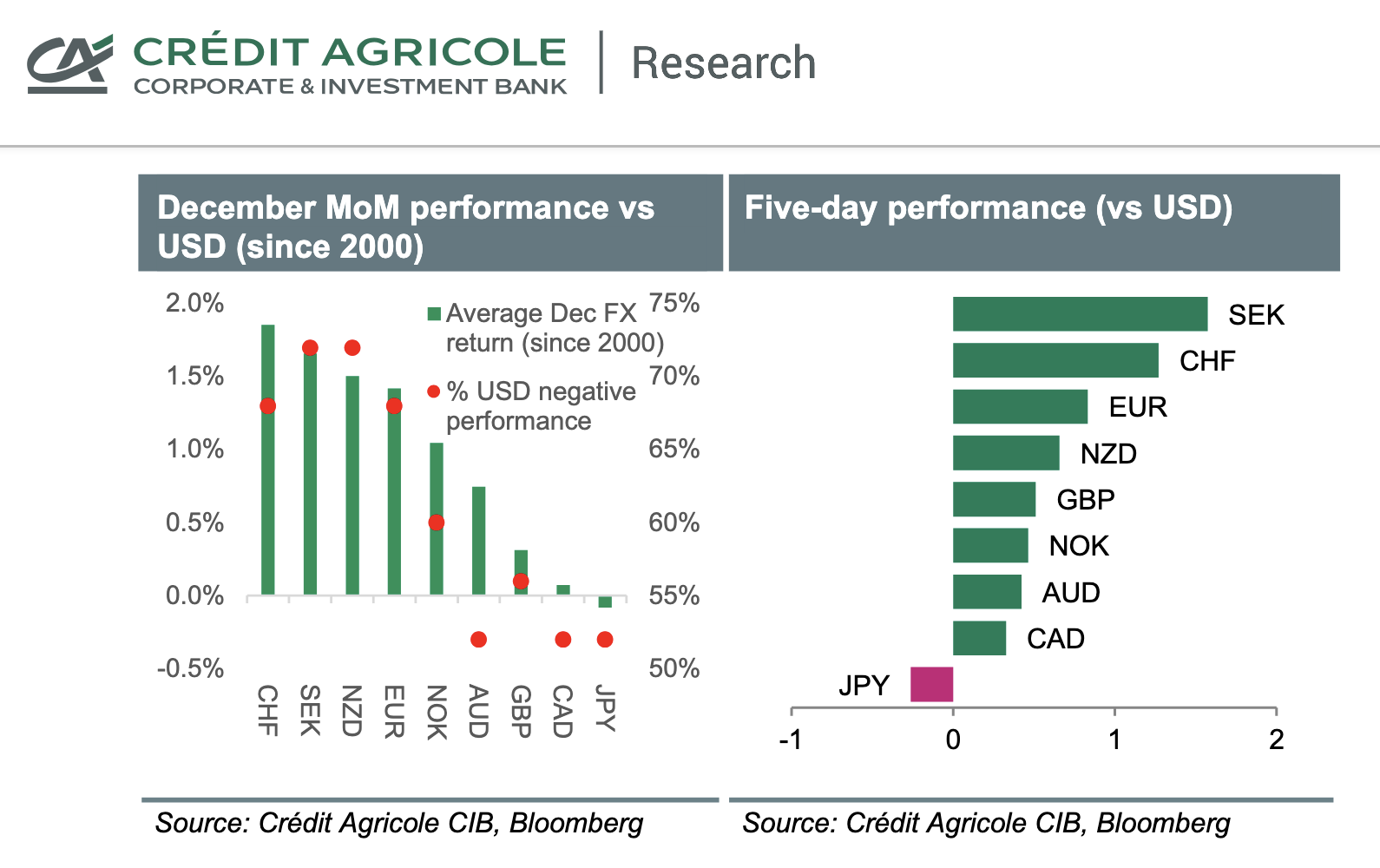

Year-End Flows: Analysts expect year-end FX hedging and profit repatriation to gain momentum, potentially hurting the USD further as hedging costs ease.

Future Risks: While some negatives are priced in, the upcoming US Supreme Court ruling on the Trump administration’s trade tariffs remains a wildcard. A ruling that reignites trade policy uncertainty could damage global growth outlooks.

Gold (XAU): Remains supported by sticky inflation and fears regarding government borrowing/debt sustainability in G10 nations.

Key G10 Currency Analysis

🇪🇺 EUR (Euro) & 🇬🇧 GBP (British Pound)

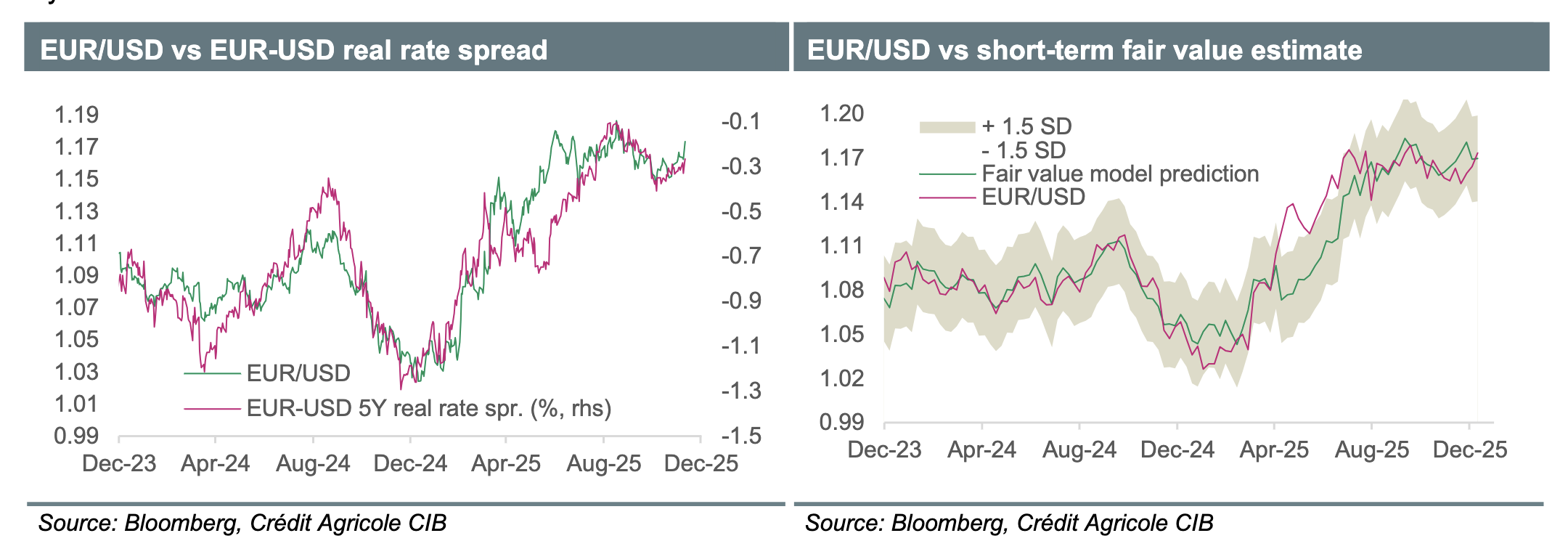

Euro: Investors are looking to the upcoming ECB meeting to validate hawkish long-term views. However, the report warns that positive news is likely already priced in. If President Lagarde sticks to a cautious, data-dependent approach, it could disappoint bullish investors. Political risks in France (2026 Budget) remain a medium-term concern.

British Pound: The outlook has improved ("Things can only get better"). The government's autumn statement provided fiscal headroom, soothing market fears. While the market expects a Bank of England (BoE) rate cut, the report suggests the BoE may remain cautious, potentially boosting GBP against the USD and EUR.

🇯🇵 JPY (Japanese Yen) & 🇨🇭 CHF (Swiss Franc)

Japanese Yen: All eyes are on the Bank of Japan (BoJ). A rate hike of 25bp to 0.75% is widely expected. The key driver will be Governor Ueda's rhetoric; a hawkish tone is needed to break the USD/JPY 155 level.

Swiss Franc: The CHF has cooled off after hitting highs. With Swiss inflation dropping to 0%, the CHF is expected to depreciate gradually but will likely remain a key funding currency.

⛏️ Commodity & Scandinavian Currencies

CAD (Canadian Dollar): The USD/CAD uptrend has broken, with the pair correcting lower due to upbeat Canadian GDP and jobs data. The pair is expected to consolidate or drift lower toward 1.35.

AUD (Australian Dollar): The RBA remains hawkish due to productivity concerns and inflation risks. The report sees a potential for a rate hike in February 2025 depending on Q4 inflation data.

SEK (Swedish Krona): The surprise outperformer of the year. However, profit-taking and the Riksbank's hedging program might cap further rallies.

NOK (Norwegian Krone): Currently undervalued. Despite recent struggles, robust fundamentals and a hawkish Norges Bank suggest long-term appreciation potential.

📊 Quick Outlook Summary

Currency | Short-Term Sentiment | Key Driver / Catalyst |

|---|---|---|

USD | 📉 Bearish | Dovish Fed, liquidity changes, tariff rulings. |

EUR | ↔️ Neutral/Cautious | ECB meeting; risk of "buy the rumor, sell the fact." |

JPY | 📈 Bullish (Conditional) | BoJ rate hike (0.75% expected); Ueda's rhetoric. |

GBP | 📈 Constructive | Fiscal stability; BoE likely less dovish than market pricing. |

CAD | 📈 Bullish | Strong domestic data (GDP/Jobs); breaking technical trends. |

AUD | 📈 Bullish | RBA holding rates or hiking; stagflation risks. |

💡 Strategic Positioning

The report's "FAST FX" model and positioning data indicate that the EUR remains the biggest long position in G10 FX, while the NZD remains the largest short. The portfolio strategy generally favors fading USD strength and looking for value in undervalued currencies like NOK.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!