SP500 LDN TRADING UPDATE 14/05/25

SP500 LDN TRADING UPDATE 14/05/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5740/30

WEEKLY RANGE RES 5810 SUP 5550

DAILY BULL BEAR ZONE 5890/80

DAILY RANGE RES 5962 SUP 5839

2 SIGMA RES 6060 SUP 5740

GAP LEVELS 5741/5710

5967 2025 OPENING LEVEL

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

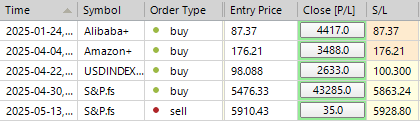

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 2 SIG

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: S&P 500 UP YEAR-TO-DATE

FICC and Equities | 13 May 2025 |

The S&P 500 closed up 72 basis points at 5,886, with a Market on Close (MOC) buy order of $450 million. The Nasdaq 100 (NDX) increased by 158 basis points to 21,197, while the Russell 2000 (R2K) gained 32 basis points to 2,107. The Dow Jones Industrial Average (Dow) decreased by 64 basis points to 42,140. A total of 17.8 billion shares were traded across all U.S. equity exchanges, surpassing the year-to-date daily average of 16.4 billion shares. The VIX dropped 82 basis points to 18.24. Crude oil rose 281 basis points to $63.69, the U.S. 10-year Treasury yield remained steady at 4.48%, gold increased by 80 basis points to $3,253, the dollar index (DXY) fell 81 basis points to 100.96, and Bitcoin climbed 187 basis points to $104,610.

"Stocks are back." Today's rally was driven by a more favorable inflation environment as the trade war eases, bringing the S&P 500 up for the year. Hard data continues to outperform expectations. April's core CPI rose by 24 basis points month-over-month, slightly below the expected 30 basis points, with lower airfares and shelter costs contributing to the decline. David Mericle and his team have raised their 2025 Q4/Q4 GDP growth forecast by 50 basis points to 1.0% due to the reduced China tariffs. David Kostin and his team have increased their 2025 S&P 500 EPS estimate to $262 from $253 and raised the 12-month price target to 6,500 from 6,200.

Today's market action was healthier, with momentum rising by 3% as growth stocks outperformed value stocks and long positions exceeded shorts. As anticipated, traditional defensive sectors were used as a source of funds, particularly in Managed Care (UNH dropped 18% following its CEO departure and guidance withdrawal, adding uncertainty to the sector), Staples (general rotation and negative sentiment from the GS conference, with HPC not performing well and Texas AG taking action against General Mills), and telecoms (VZ, TMUS, T down 1-2%).

Our trading floor activity was rated a 6 on a 1-10 scale. The floor finished up 4% to buy, compared to a 30-day average of +96 basis points. Long-only investors were net buyers by $2.5 billion, primarily driven by macro expressions in tech, while hedge funds were net sellers by $400 million, influenced by supply in industrials and staples. There were no signs of single stock chasing from long-duration investors. Flows were orderly and more passive compared to yesterday. Notably, following yesterday's move, CTA demand is escalating with approximately $11 billion in S&P to buy in a stable or rising market.

Prime data highlights from yesterday include: 1) Global equities experienced the second-largest net buying day in five years (3.7 sigma); 2) Buying was significantly driven by short covering (1.6 to 1); 3) Net exposure increased by 2.6 percentage points in a single session (73% net) from 65% a month ago.

This summarizes the current market dynamics of poor sentiment and light positioning clashing with strong earnings and solid economic data. Mastercard noted, "There's the fact and then there's the sentiment. The sentiment is slightly different than what the facts are." The fact is, "The consumer continues to be healthy as we see it," and "We had a solid first quarter driven by strong consumer spending."

DERIVATIVES: The market is in a slow upward grind as CPI data came in cooler than expected. Today's flows involved clients restructuring put strikes up and out as the S&P increased by 4% this week. The main theme of volatility compression persists, with SPX June 25d Calls having an implied volatility of 13. For clients looking to hedge this move, the VIX June 23 33 Call Spread aligns well with approximately a 14x gross payout. The straddle for the rest of the week is priced at 1.25%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!