SP500 LDN TRADING UPDATE 09/04/25

SP500 LDN TRADING UPDATE 09/04/25

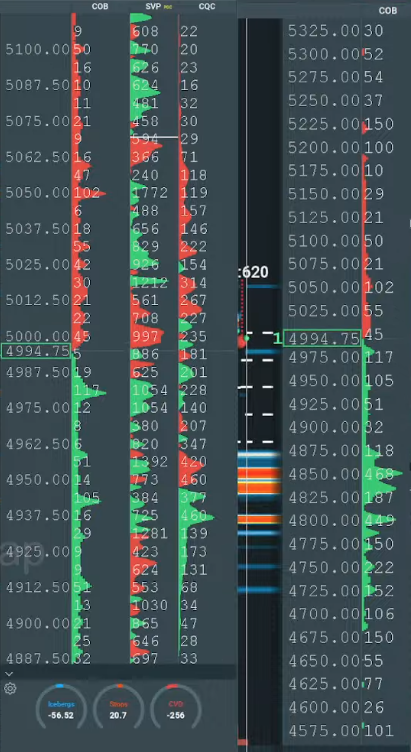

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5443 SUP 4749

DAILY BULL BEAR ZONE 5060/70

DAILY RANGE RES 5061 SUP 4942

2 SIGMA RES 5214 SUP 4810

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 35 POINTS)

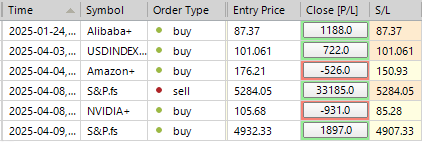

TRADES & TARGETS

LONG ON TEST/REJECT WEEKLY RANGE SUP TARGET DAILY RANGE SUP

SHORT ON TEST REJECT OF DAILY BULL BEAR ZONE TARGET DAILY>WEEKLY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET 5103>5170>2 SIG RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

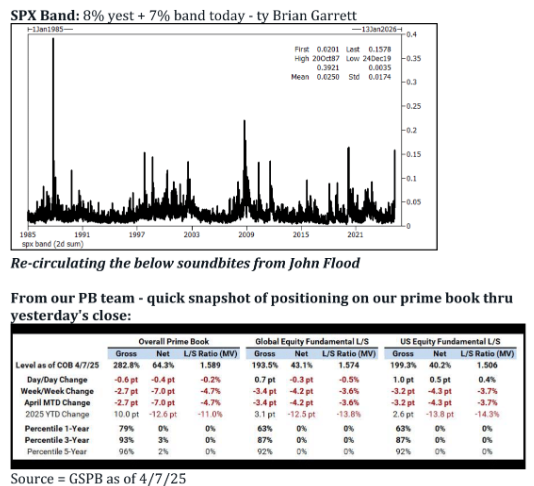

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: STEADY DECLINE

FICC and Equities | 8 April 2025 |

Market Performance:

- S&P 500: Down 157bps, closing at 4,982 with a MOC (Market-on-Close) imbalance of $760mm to sell.

- Nasdaq 100 (NDX): Down 195bps, closing at 17,090.

- Russell 2000 (R2K): Down 253bps, closing at 1,776.

- Dow Jones: Down 84bps, closing at 37,645.

- Total volume: 23.3 billion shares traded across U.S. equity exchanges, significantly above the YTD daily average of 16 billion shares.

Volatility & Other Assets:

- VIX: +10%, closing at 51.97.

- Crude Oil: Down 359bps, closing at $58.55.

- U.S. 10-Year Treasury Yield: +9bps, closing at 4.27%.

- Gold: +85bps, closing at $2,999.

- DXY (Dollar Index): Down 29bps, closing at 102.95.

- Bitcoin: Down 270bps, closing at $76,791.

Key Highlights:

- Today marked the largest-ever point reversal in the S&P 500, surpassing the October 14, 2008, Great Financial Crisis reversal.

- Reciprocal tariffs are set to take effect at midnight. White House Press Secretary Leavitt announced an additional 104% tariff on China, effective immediately, following China's lack of retaliation rollback.

- Apple (AAPL) faced pressure after Leavitt's comment that President Trump believes the U.S. workforce is capable of manufacturing iPhones domestically.

Trading Floor Insights:

- Activity levels were rated a 7 out of 10.

- The trading floor ended +4% versus the 30-day average of -180bps.

- Asset Manager flows stabilized, with net buying in technology and industrials sectors. Discretionary stocks saw net selling.

- Industrials experienced a strong buy skew, ranking in the 98th percentile on a 52-week basis.

- Hedge Funds (HFs) were slight net buyers overall, with early-session demand dominated by ETFs (~67%). However, HFs ended the day as net sellers in TMT/Communication Services.

Derivatives Market:

- The SPX traded within a massive 680bps intraday range.

- The market opened higher due to short covering from the previous session, driving SPX futures to 5,300 before sharply reversing lower.

- Morning activity included monetizing right tails and minor upside interest in SPX and tech.

- As gains paired back, clients re-established short positions.

- Volatility spiked dramatically: short-dated SPX volatility (June) dropped nearly 2.5 points in the morning but ended over 2 points higher.

- Flows were balanced, with significant short-dated buying on both upside and downside. As the market sold off, investors added short-dated downside positions.

Looking Ahead:

- Investors are awaiting further tariff guidance.

- Key economic catalysts include Thursday’s CPI data (forecast: GS +0.27%, consensus +0.3%) and the start of bank earnings on Friday.

- Liquidity remains exceptionally low.

In conversations with long-term investors, it seems they will begin buying the S&P 500 at 5k and become more aggressive around the mid 4000s. The S&P 500 peaked at 6144 on 2/19 this year. Historically, the median decline from highs in the 12 recessions since WW2 is 24%, which corresponds to an S&P level of about 4600.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!