SP500 LDN TRADING UPDATE 01/05/25

SP500 LDN TRADING UPDATE 01/05/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5482/92

WEEKLY RANGE RES 5700 SUP 5400

DAILY BULL BEAR ZONE 5610/00

DAILY RANGE RES 5679 SUP 5559

2 SIGMA RES 5969 SUP 5269

5339 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=ZrfpPpegL-k&t=80s

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT O TEST/REJECT WEEKLY RANGE RES TARGET DAILY RANGE SUP

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

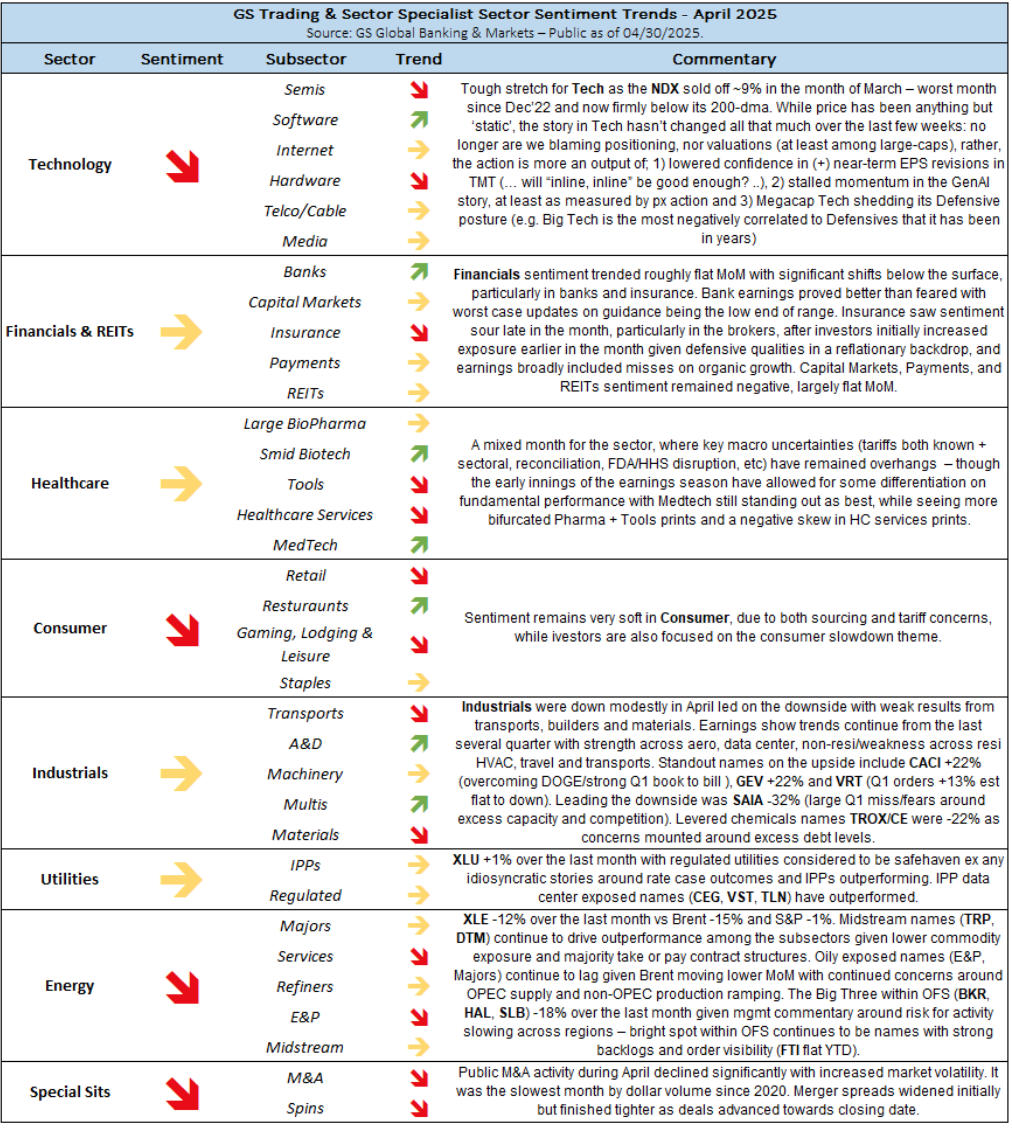

GOLDMAN SACHS TRADING DESK VIEWS

U.S. Equities Overview: MELT UP

Date: 30 April 2025

S&P 500 closed up 15 basis points at 5,5569, marking its seventh consecutive session of gains with a Market-on-Close (MOC) order of $5.5 billion to buy. The Nasdaq (NDX) rose 13 basis points to 19,571, while the Russell 2000 (R2K) fell 63 basis points to 1,964, and the Dow increased 35 basis points to 40,669. Trading volume reached 17.2 billion shares across all U.S. equity exchanges, surpassing the year-to-date daily average of 16.4 billion shares.

Volatility Index (VIX) climbed 219 basis points to 24.70. Crude oil dropped 371 basis points to $58.16. The U.S. 10-Year Treasury yield decreased by 3 basis points to 4.16%. Gold fell 115 basis points to $3,295, while the Dollar Index (DXY) gained 43 basis points to 99.66. Bitcoin declined 17 basis points to $94,712.

Despite stagflationary economic data, including slightly weaker GDP and firmer PCE, stocks managed a ~2.5% rise from morning lows. Anticipation of solid performances from megacap bellwethers contributed to the positive sentiment. After-hours trading saw Microsoft (MSFT) up 6%, beating expectations with Azure's 35% year-over-year growth. Meta (META) exceeded top-line estimates and unexpectedly raised its capital expenditure forecast, boosting Nvidia (NVDA) by 3%.

Activity levels on our floor were rated 5 on a 1-10 scale, finishing 8% higher than the 30-day average of -19 basis points. The trading desk experienced relatively quiet activity, with market volumes down 7% compared to the 20-day moving average. Initial selling pressure from hedge fund shorts in semiconductors and ad-levered internet stocks eased as the session progressed. Long-only investors ended as net buyers with $2.5 billion across sectors, while hedge funds balanced supply in tech and discretionary with macro covers. Liquidity challenges persist, with S&P top-of-book depth below $3 million, compared to the historical average of $13 million.

Derivatives: Volatility increased during a choppy session. Skew remained bid as clients sought to add or restructure hedges, maintaining demand for volatility. The desk favors owning index gamma, particularly outright, as volatility is sufficiently low. This is evident in QQQ, where spreads have adjusted relative to SPX, and megacap tech earnings should sustain volatility throughout the season. Dealer gamma remains short, not materially long since mid-February. The straddle through Friday is priced at 1.80%, down from 1.95% earlier in the day.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!