Market Movers: Morgan Stanley Shares Pop On Bumper Q1 Results

Q1 Results Beat

After gapping lower at the open yesterday, Morgan Stanley shares surged higher by around 5% on the session as traders reacted to a solid set of Q1 results. On the back of weak results from State Street and mixed results from Goldman, there was a little trepidation in the market. However, in terms of headline numbers, MS reported Q1 EPS of $1.70 vs $1.68 expected on revenues of $14.517 billion vs $13.966 billion expected.

Fixed Income Trading Gains

The bank attributed its success in Q1 to the stellar performance of its wealth management business which rose 11% year-on-year, delivering $111 billion in new assets. Bond trading revenues in particular were a major bullish contributor for MS in Q1. Fixed income trading revenues came in at $2.58 billion, above the $2.33 billion Wall Street was looking for. Equities trading was also seen making gains on Q1 coming in at $2.73 billion vs $2.65 billion expected.

Results Down YoY

While the results were strong, its worth noting that overall earnings were down 19% compared with a year earlier with revenues down 2%. The main driver behind this was a surge in expenses. MS noted that compensation costs had ballooned leading overall expenses to come in around $430 million above Wall Street forecasts.

Looking ahead, MS CEO James Gorman struck an optimistic note saying that he didn’t feel the US was in a banking crisis, though some individual banks may be in crisis. Additionally, Gorman signalled the bank’s intention to expand its wealth management business going forward to capitalise on gains.

Technical Views

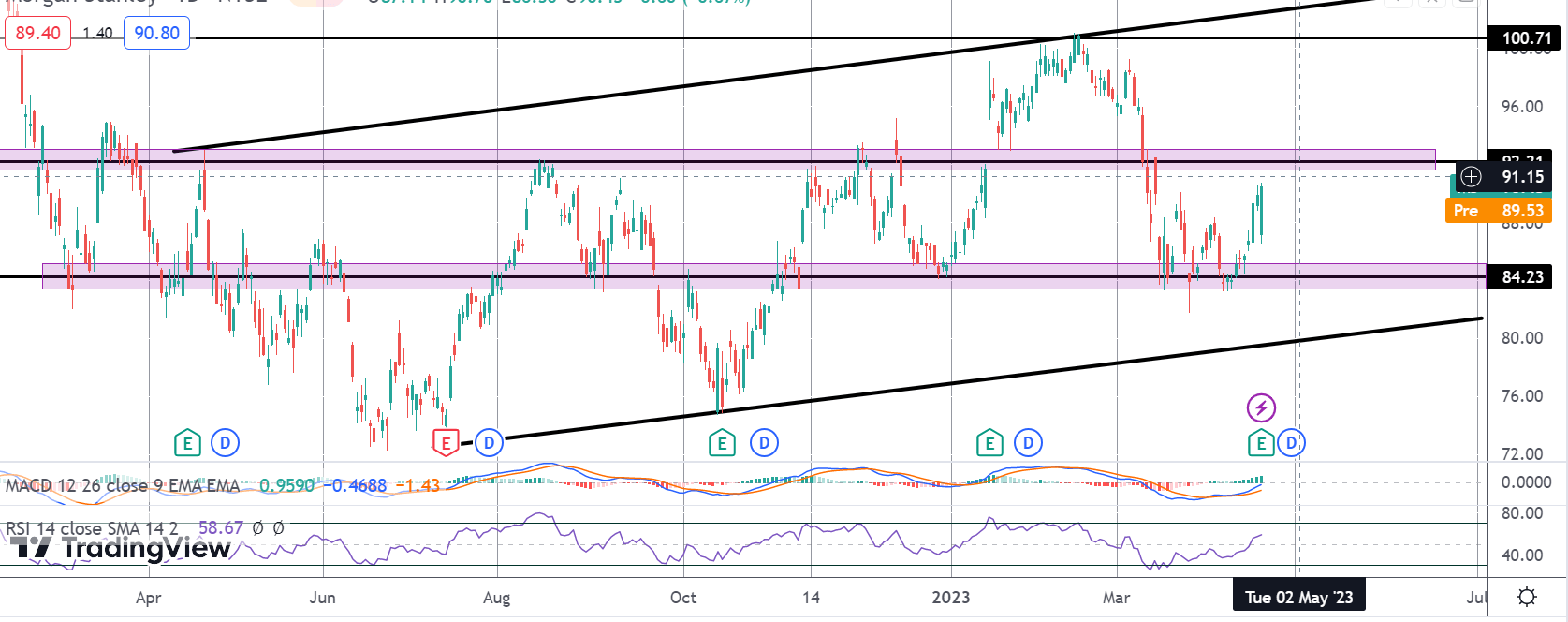

Morgan Stanley

Shares are currently sitting around the middle of the bull channel after bouncing off support at the 84.23 level. With momentum studies bullish and price sitting a little higher pre-market, the focus is on a continued push higher with a break of 92.21 to open the way for a move up to the 100.71 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.