Institutional Insights: UBS SP500 Market Internal Insight

.jpeg)

UBS Market Internal Insight

March 2025: A Significant Post-FOMC Event

Key Highlights:

- FOMC Buying Resurgence: Since November 2023, the Federal Open Market Committee (FOMC) has seen significant buying activity. The March 2025 FOMC event marks the first meaningful post-FOMC excess buy flow since that time.

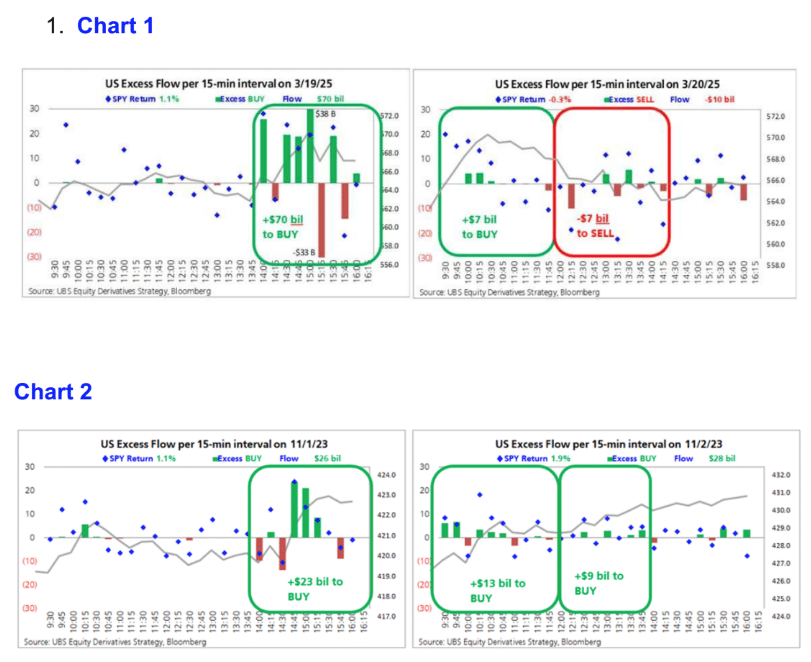

- Excess Buy Flow: Following the March 2025 FOMC, there was a 24-hour excess buy flow of +$70 billion, showcasing a persistent trend with no strong opposing flow (Chart 1). This is considered a critical signal in our model.

Historical Context and Comparison:

- November 2023 FOMC: Often referred to as a "Fed pivot" event, the November 2023 FOMC triggered a notable improvement in the Intraday Recovery Score, with a strong "buy-the-dip" trend. By January 2024, our model turned long-term bullish, predicting a +20% SPX upside within one year.

- March 2025 vs. November 2023:

- March 2025: Post-FOMC excess buy flow reached +$70 billion, followed by +$7 billion in buy flow and -$7 billion in sell flow by 2 PM the next day, maintaining a net persistent trend.

- November 2023: Post-FOMC excess buy flow was +$23 billion, followed by +$13 billion and +$9 billion in buy flows the next day, totaling +$45 billion with a similarly persistent trend.

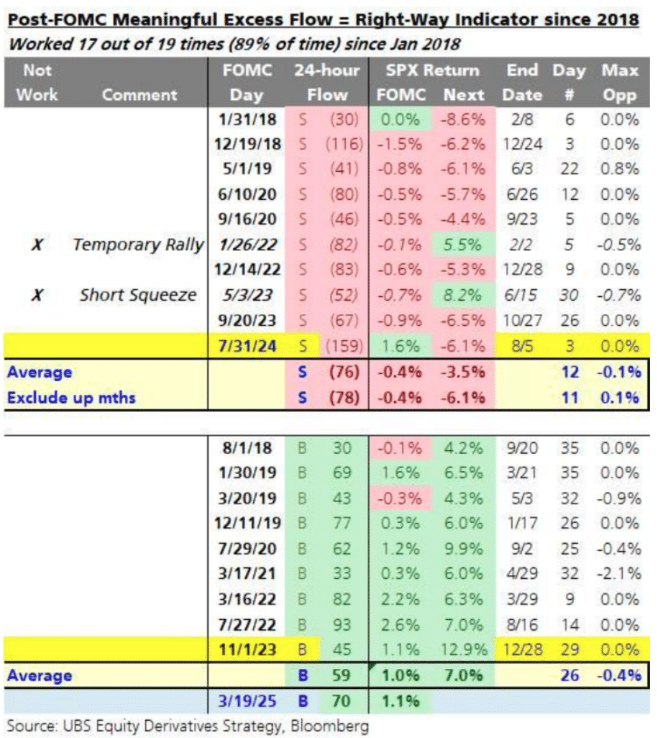

Historical Observations (Table 3):

- Rarity of Meaningful FOMC Events: Out of 58 FOMC meetings since 2018, only 20 (34%) have been classified as meaningful excess flow events.

- Accuracy of Predictions:

- On the buy side, meaningful excess flow events correctly predicted SPX outcomes 9 out of 9 times, with an average SPX upside of +7.0% within five weeks (excluding FOMC day).

- On the sell side, predictions were accurate 8 out of 10 times, with an average SPX downside of -6.1% within two weeks (excluding FOMC day).

Potential Implications of March 2025 FOMC:

While it is too early to confirm whether the recent March FOMC will similarly push the Intraday Recovery Score into bullish territory, historical data suggests short-term bullish implications. On average, SPX has shown a +7.0% upside within five weeks, with a range of +4% to +13% (excluding FOMC day).

Conclusion:

The March 2025 FOMC excess buy flow of +$70 billion signals a rare and meaningful post-FOMC event, comparable to the November 2023 FOMC. Historical trends suggest potential short-term bullish momentum for SPX, reinforcing the importance of monitoring these developments closely.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!