Institutional Insights: JPMorgan Trading NFP

TRADING NFP – OCTOBER 2025 JPM US MARKET INTELLIGENCE

US MKT INTEL’S NFP SCENARIO ANALYSIS

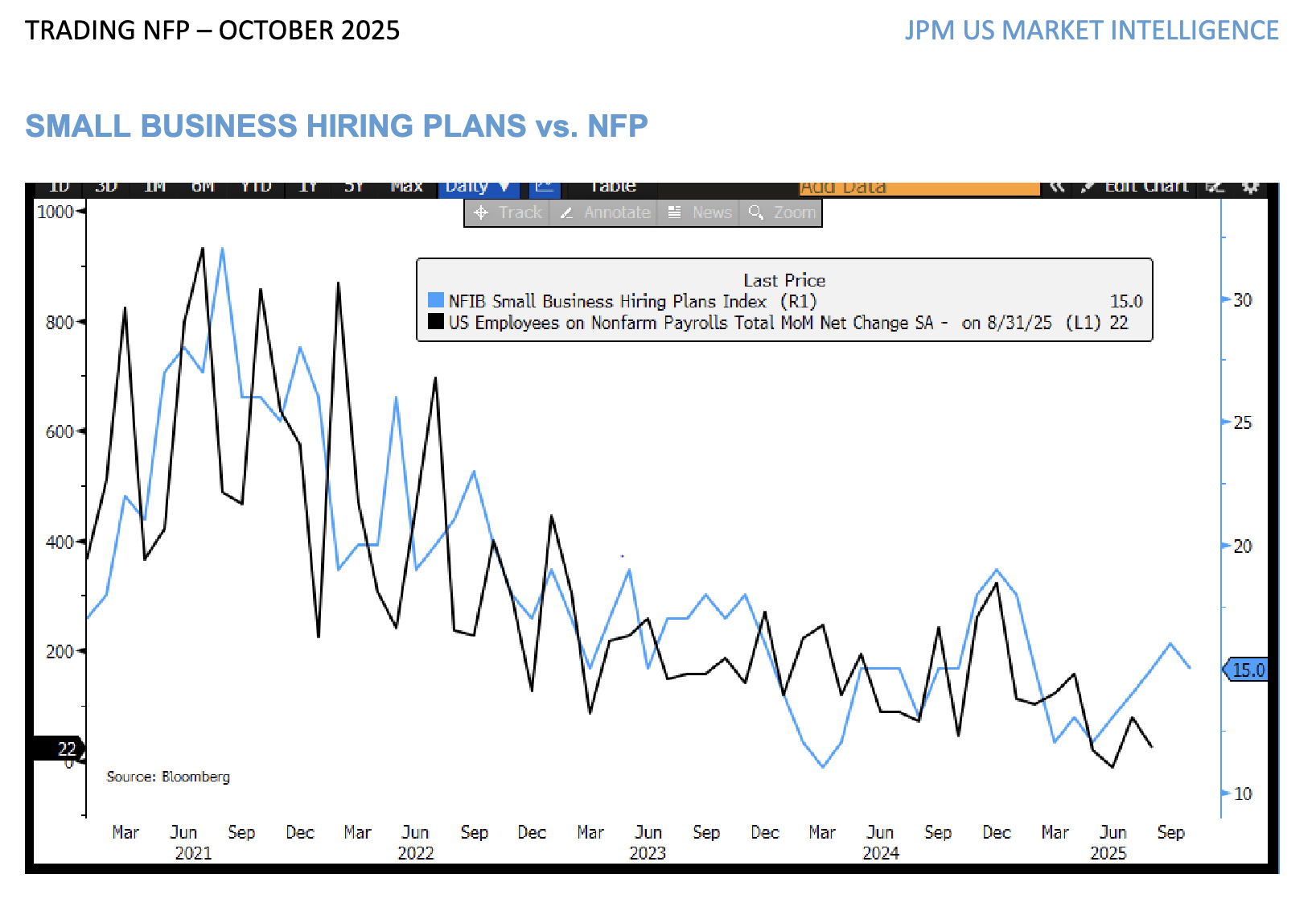

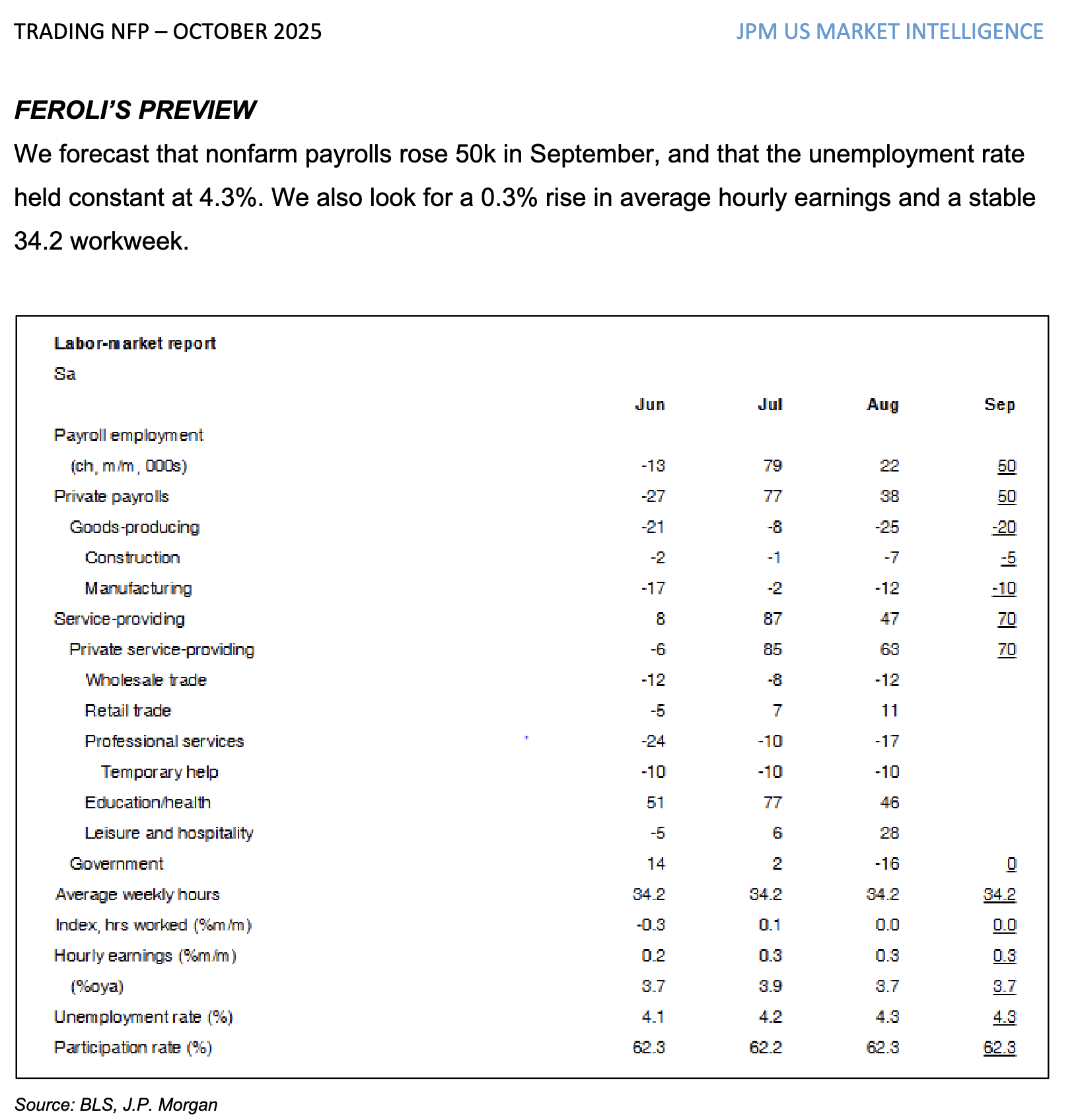

Feroli’s sees 50k jobs being added, slightly below the Street’s estimate of 57k; in August, 22k jobs were added. For the unemployment rate (U.3) he sees 4.3%, in line with the Street’s estimate. For Average Hourly Earnings, he sees +0.3% MoM and +3.7% YoY.

The following scenario analysis is a trading desk view from JPM US

Market Intelligence.

• [5%] Above 100k. SPX is flat to losing 1.5%

• [25%] Between 70k – 100k. SPX +0.5% to -0.5%

• [40%] Between 30k – 70k. SPX gains 0.5% – 1%

• [25%] Between 0k – 30k. SPX gains 0.25% - 0.5%

• [5%] Below 0k. SPX is flat to losing 1%.

• WHAT ARE OPTIONS PRICING? For options expiring on October 3, the market is

pricing ~2% move, as of market close on Nov 17, though this may also include heightened vol around NVDA’s earnings.

• US MKT INTEL ON NFP – Currently, we are scheduled to receive Sep NFP on

Thursday and Nov NFP on Dec 5; it is unclear that Oct data will be released, wholly

or partially. An inline print is Goldilocks, as it enough to propel the market forward

since it will be strong enough that fears of slowing economic growth should be

assuaged but not strong enough of a print to reignited inflation fears. Too strong of a

print pushes the Fed to the sidelines; if the Fed is paused because growth is too

strong, this is positive. SPX earnings are more correlated to nominal GDP growth

than to real GDP growth. Alternatively, a too cool print will spark recession /

stagflation fears. Given recent hawkish Fedspeak, 50bp may be too high a bar for

the Fed to jump over, highlighting one risk to a cooler print. Separately, the Fed and

the market are adjusting to finding the new equilibrium level of jobs given flat /

declining population growth

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!