Goldman Sachs: CPI Preview

FICC and Equities | 9 April 2025 | 9:19PM UTC

SPX implies a ~2.30% move through tomorrow’s close.

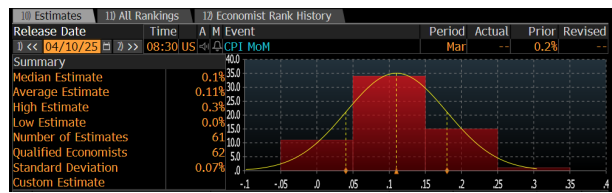

Key Forecasts (March CPI):

- Core CPI: +0.27% (vs. +0.3% consensus), YoY rate at 3.03% (vs. +3.0% consensus).

- Headline CPI: +0.08% (vs. +0.1% consensus), driven by +0.2% higher food prices and -2.5% lower energy prices.

- Core services CPI (ex-rent/OER): +0.36%; Core PCE: +0.22%.

Component-Level Trends:

1. Used car prices: -0.5% (lower auction prices); New car prices: +0.1% (lower dealer incentives).

2. Car insurance: +1.0% (higher premiums in online data).

3. Tariffs: Modest upward pressure on apparel, recreation, and communication categories.

Outlook:

- Tariff escalation to boost monthly inflation.

- Underlying trend inflation to decline due to easing auto, housing rental, and labor market pressures, offset by healthcare inflation.

- Year-end 2025 forecast: Core CPI inflation +3.7%, Core PCE inflation +3.5%.

Thoughts from around GS:

Joseph Briggs (US Econ):

CPI was overshadowed by tariff concerns this week. Recession fears eased with the delay of reciprocal tariffs, though we still see a 45% recession risk in the next 12 months. Tomorrow’s CPI is crucial as the Fed remains sensitive to inflation in a weak but non-contracting economy. We expect the first rate cut in June, and a firmer CPI may delay easing.

Karen Fishman (Senior FX Strategist):

CPI feels less impactful amid recession risks and tariff volatility. The 90-day tariff delay reduced stress, but a hot CPI print could challenge the Fed with growth and inflation risks. The focus should shift to UMich on Friday, especially on inflation expectations and job market sentiment. Despite relief, policy uncertainty and recession risks remain high. Weekly claims are key for labor market signals. We favor short AUD/JPY due to downside equity risks.

Shawn Tuteja (ETF/Basket Vol Trading):

VIX remains elevated, but the market welcomed a policy tone shift. CPI tomorrow might influence market moves: a light print could fuel upside rallies, while a higher number may be overlooked due to reduced tariff uncertainty. The 5700 level in ES serves as a near-term ceiling, with opportunities to scale out of long positions into shorts.

Joe Clyne (Index Vol Trading):

Volatility retraced with the 90-day tariff pause. The market hopes for a lighter CPI, but a hot number could reverse gains. Skew dynamics may stabilize with another topside move. The desk favors owning vol beyond the front of the curve, particularly in the 3-month tenor.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)