Institutional Insights Barclays FX Views

-1730373350.jpeg)

Institutional Insights Barclays FX Views

US election: How to hedge

The binary nature of next week’s contest implies significant FX moves after the event. In G10, SEK and GBP options offer relatively cheap hedges, while the EUR and CHF screen as expensive. In EM, CEE FX and ZAR options offer relatively good value, while the MXN, CNY, TWD and KRW are more expensive.

•The US presidential election (5 November) has been a powerful driver of the FX market,leading to a recent dollar rally on the back of repriced probability of a return to the WhiteHouse for Donald Trump. But the polls1are still close and uncertainty about the marketresponse to the elections remains high.

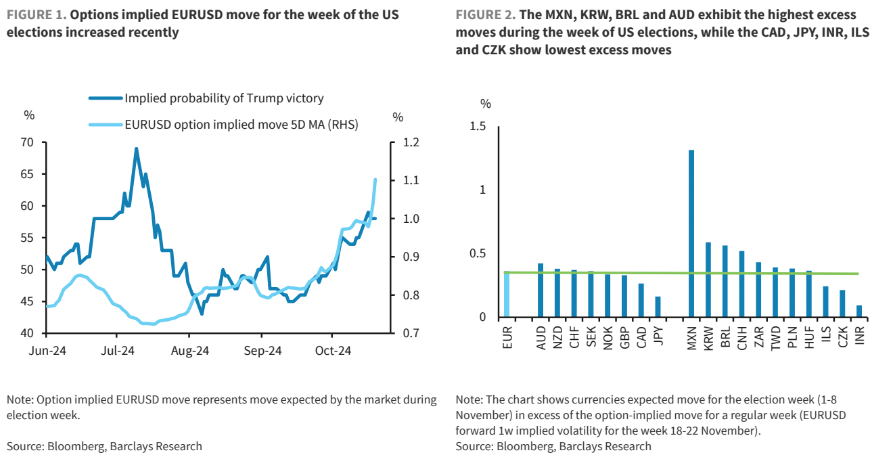

•We examine FX market pricing of 'event vol' risk, ie, the size of a move implied by FX option structures for the week around the election (1-8 November). We find that the options-impliedEURUSD move for that week has increased significantly this month (Figure 1), even though the spot market has moved in a way that would suggest higher chances of a Trump win. This implies that demand for election FX hedges has increased, making options more expensive.

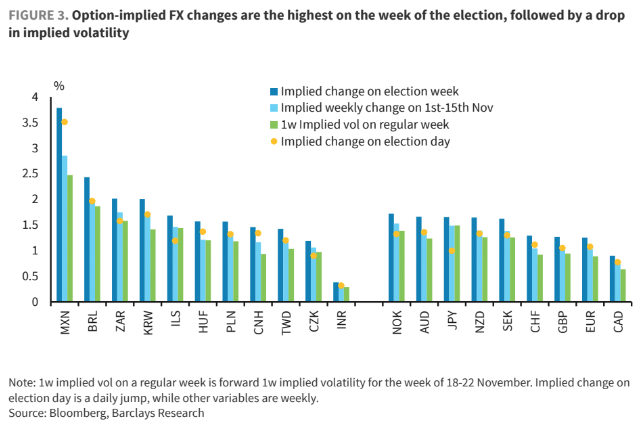

•According to FX options, the market expects the bulk of the FX reaction to materialize in theweek around the election (Figure 3). This can be justified by two things: first, the result mightstill be uncertain on the day after the election, and second, the Fed is scheduled to meet this same week.

•Our analysis shows that FX moves around election week implied by options do not match the patterns of historical FX reactions to global shocks. In our view, this shows that there are still pockets of relatively cheap and expensive hedges in DM and EM FX. Options indicate the largest market move for the MXN, BRL, ZAR and KRW in EM, andAntipodean, Scandi FX and the JPY in DM, while the CZK, INR, GBP and CAD seem to be the most resilient to any election outcome (Figure 3)

Heterogeneity in option-implied moves across different currencies can be partially explained by different-implied FX volatilities in the non-event weeks. Hence, Figure 2 reports "excess(difference between US election and non-event weeks) option-implied FX moves. On that measure, the moves seem to be small for G10 and CEE FX, but have already increased in the EMspace relative to the values we flagged two weeks ago (see Emerging Markets Weekly, 18October 2024). The market clearly shows uniform option-implied FX changes for the G10 space,while in EM, the MXN, KRW, BRL and CNH screen as the most sensitive to the US election, for which options imply 0.5-1.5pp in excess movements, while the INR and CZK are more resilient to that risk, options implying less than a 0.25% excess move. Low implied moves for the JPY and ILS mainly reflect already elevated current volatility for these two currencies.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!