Gold Attempting to Break Higher

Gold Recovering

Gold prices are almost back to flat on the week after a strong rally yesterday. The move comes amidst a cross-asset recovery following heavy selling at the start of the week. Seismic moves in JPY had stolen the show at the start of the week, driving an outflow of capital from gold as traders rushed back into JPY for safety, buoyed by tighter BOJ policy. An accompanying shift in traders’ USD outlook has also played a factor this week. On the back of a heavy slowdown in US jobs growth last month, and the unemployment rate rising to a 3-year high, traders are now expecting a faster paced easing path from the Fed this year. Ultimately, such conditions should prove favourable for gold, particularly if accompanied by further USD weakness.

Near-Term Outlook

The near-term picture for gold looks likely to remain choppy as traders adjust to the new dynamic between USD and JPY which has seen a huge unwinding of the long-held carry trade. With the potential for further USDJPY downside, gold prices could still struggle to gain higher ground near-term as capital moved into JPY. However, looking ahead to the coming quarter, as the carry trade unwind finds equilibrium and Fed easing begins, gold prices should start to trend higher again.

Technical Views

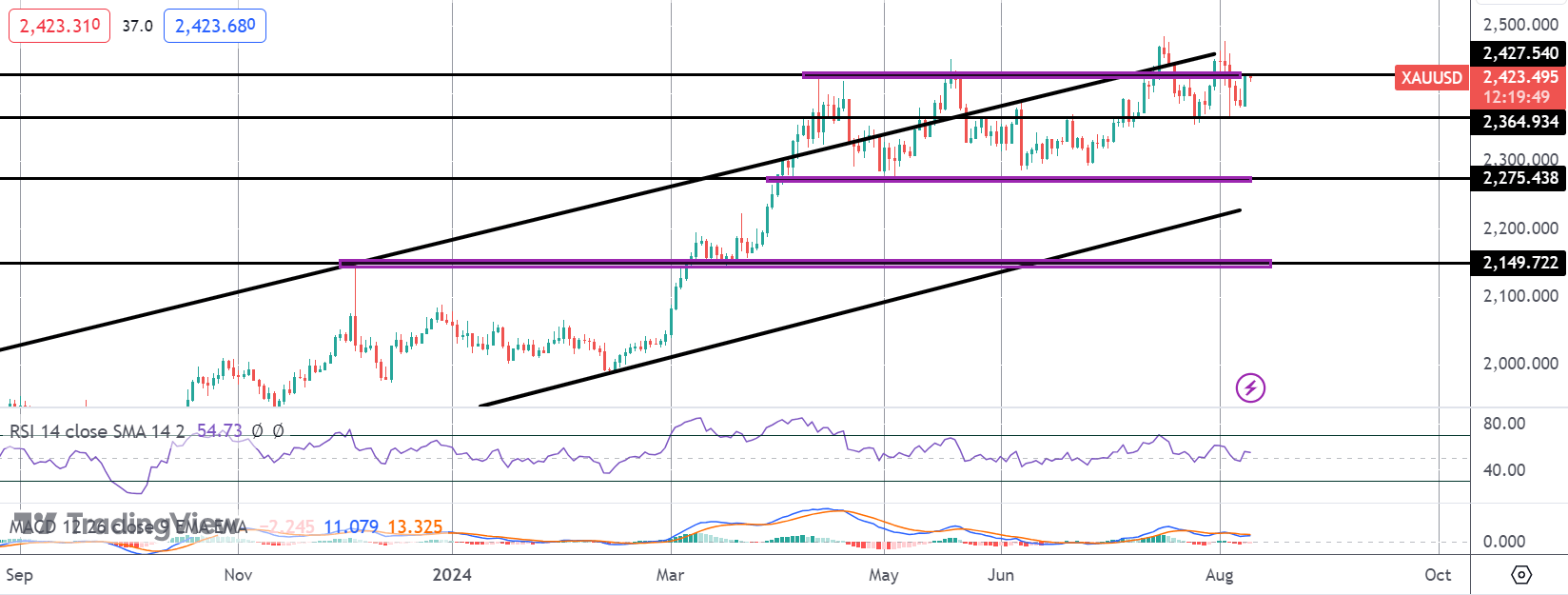

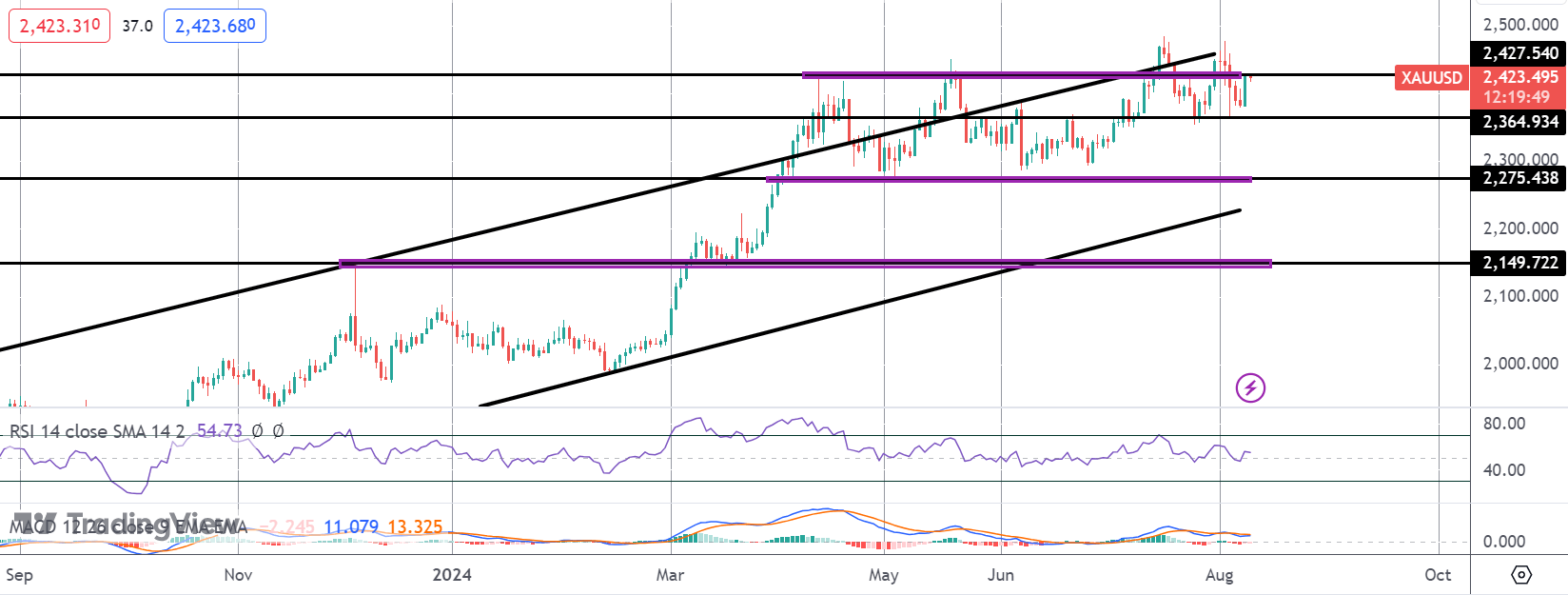

Gold

For now, gold prices remain stalled around the 2,364.93 – 2,427.54 levels in the upper part of the bull channel. While support holds, focus is on an eventual break higher. Should we slip back, however, focus turns to 2,275. 43 as deeper support to monitor.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.