Daily Market Outlook, September 6, 2023

Daily Market Outlook, September 6, 2023

Munnelly’s Market Commentary…

Asian equity markets started the day with a bearish tone, influenced by the lacklustre performance on Wall Street. Investors there were grappling with concerns over rising yields, a strengthening dollar, and surging oil prices. However, the Nikkei 225 defied the broader trend, managing to breach the 33K handle, thanks to a weaker yen, which touched a new low for the year. On the other hand, the Hang Seng and Shanghai Composite faced losses, primarily driven by weakness in the tech sector. Notably, some property developers saw significant gains, fueled by hopes of additional policy support measures, with Sunac's stock surging by over 60% following its recent return to the Stock Connect program.

In the UK, market focus will centre on the afternoon session when Bank of England Governor Andrew Bailey, Deputy Governor Jon Cunliffe, and External MPC member Swati Dhingra are scheduled to appear before the Treasury Select Committee. The construction PMI for August is also set to be released, with July showing a return to growth in the sector (above 50), driven by robust commercial and infrastructure activity. However, residential output continued to decline. Expectations for August suggest that the overall index might dip just below the key 50 threshold to 49.8.

Eurozone retail sales for July are expected to show a slight decline. Retail sales were flat in Q2, ending a streak of five consecutive quarterly declines starting in 2022. Earlier today, Germany reported a sharp 11.7% month-on-month drop in July factory orders. Tomorrow, German industrial production figures will be released, with H1 GDP stagnating and the Bundesbank expecting Q3 to remain relatively flat.

Stateside, attention is on the ISM services survey and the release of the Fed Beige Book. The headline ISM index is projected to drop to 52.0 from 52.7, indicating a moderation in the pace of service sector expansion. The Beige Book will be closely watched for anecdotal insights into economic activity, including any special factors influencing growth. Global investors will also continue assessing the outlook for China's economy. Yesterday's Caixin services PMI for August revealed a larger-than-expected slowdown in expansion, falling to 51.8 from 54.1. On Thursday, external trade data from China will be released, with predictions of contractions in both imports and exports.

FX Positioning & Sentiment

Global activity data indicating weakness has resulted in a stronger US dollar, signalling potential shifts in currency markets. Last week's USD index candlestick line, characterised by a long tail, is viewed as a bullish indicator, suggesting a potential uptrend for the greenback. The USD's trajectory is closely tied to its largest components within the index, primarily the euro and the yen. A decline in the EUR/USD pair below its August low has raised concerns about the technical outlook for the euro, potentially favouring the dollar. Meanwhile, the USD/JPY pair has been on the ascent, with its sights set on breaking above its recent peak for 2023. Historically, the US dollar tends to make gains against the Japanese yen in September, a pattern that is being observed once again. These factors collectively suggest a strengthening position for the US dollar in the current currency landscape.

CFTC Data As Of 31-08-23

EUR net spec long 146,679 contracts by Tuesday vs 158,760 contracts previous week

JPY short grows to 98,473 contracts vs 95,323 previously

AUD short jumps to 70,185 contracts vs 63,786

GBP long 48,401 vs 59,107

CAD short 15,761 vs 12,070 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0740-50 (2.53BLN), 1.0800-05 (454M)

1.0900-05 (720M), 1.0950-60 (863M)

USD/JPY: 144.50 (1.0BLN), 145.50 (503M), 146.00 (224M), 146.50 (641M)

148.00-25 (531M)

USD/CHF: 0.8750 (520M). EUR/CHF: 0.9550 (200M)

GBP/USD: 1.2500 (1.21BLN), 1.2650 (756M). EUR/GBP: 0.8650-55 (352M)

AUD/USD: 0.6395-00 (551M), 0.6445 (739M), 0.6530 (250M), 0.6545-50 (696M)

0.6565 (360M). NZD/USD: 0.5955-60 (339M)

AUD/NZD: 1.0700 (715M), 1.0800 (400M), 1.1050 (688M), 1.1100 (736M)

EUR/AUD: 1.6700 (240M). USD/CAD: 1.3525 (244M), 1.3600 (1.45BLN)

Overnight Newswire Updates of Note

Soaring Dollar Raises Alarm As China, Japan Escalate FX Pushback

Rate Hikes Curb Output For At Least A Decade, SF Fed Study Finds

Fed Nominee Jefferson Moves Step Closer To Senate Confirmation

US Commerce Sec Doesn't Expect Changes To Trump China Tariffs

China Says Economic Fundamentals Steady Despite Its Slowdown

BoJ Member Takata Pledges To Keep Easing, Ready To Act Flexibly

Japan Warns It Will Not Rule Out FX Options If Yen Selling Persists

Australia Economy Defies Rate Increases As Exports Drive Growth

Bank Of Canada Set To Pause As Economic Headwinds Strengthen

ECB’s Nagel: Peak ECB Rates Followed By Rapid Cuts Wrong Bet

Oil Tests November High After OPEC+ Leaders Extend Supply Cuts

VW Plant In Portugal To Suspend Production Due To Lack Of Parts

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

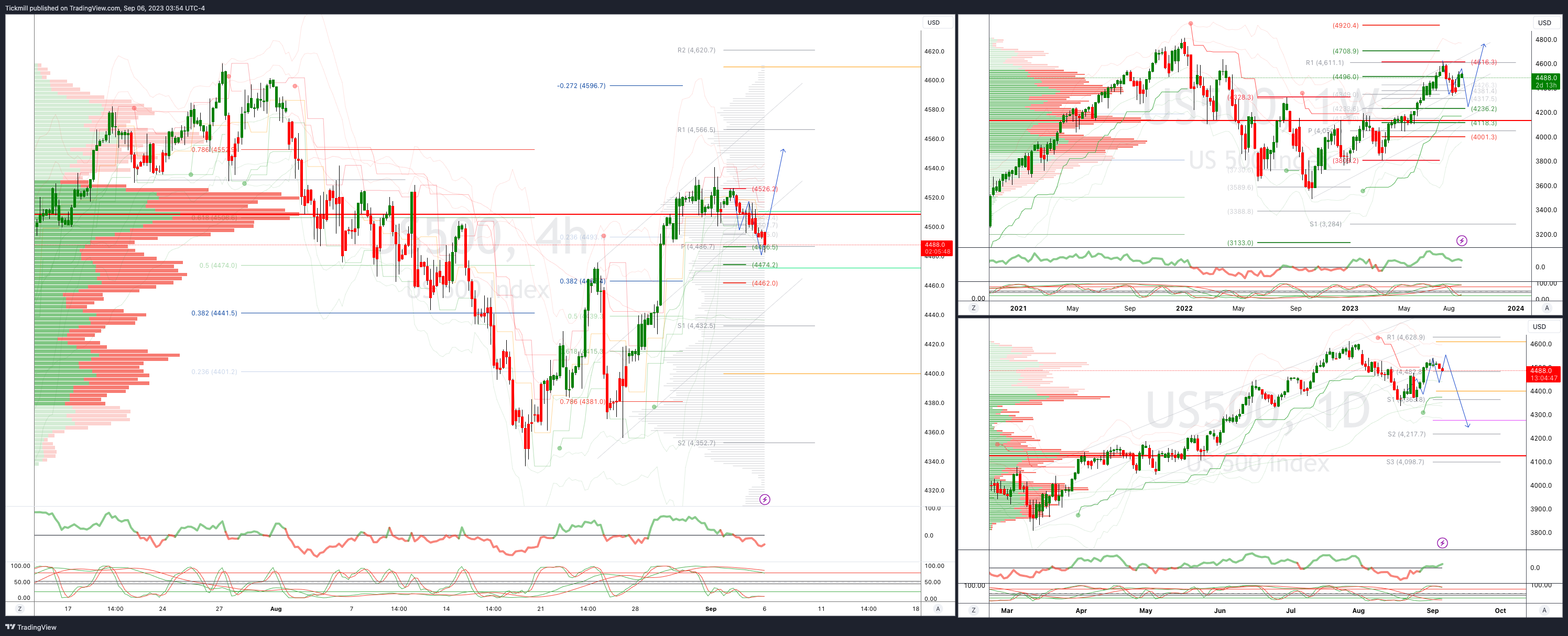

SP500 Intraday Bullish Above Bearish Below 4485

Below 4474 opens 4435

Primary support is 4435

Primary objective is 4550

20 Day VWAP bullish, 5 Day VWAP bearish

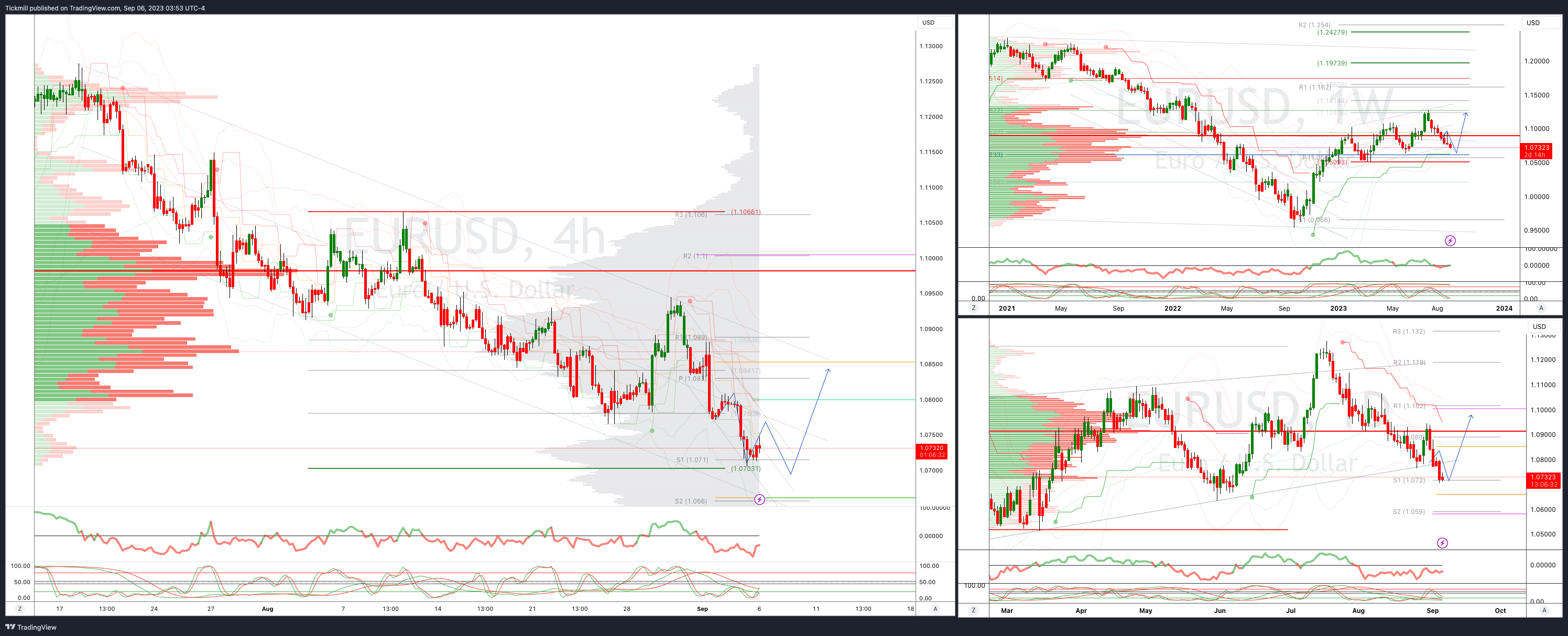

EURUSD Intraday Bullish Above Bearsih Below 1.0810

Above 1.09 opens 1.095

Primary resistance is 1.1066

Primary objective is 1.07

20 Day VWAP bearish, 5 Day VWAP bearish

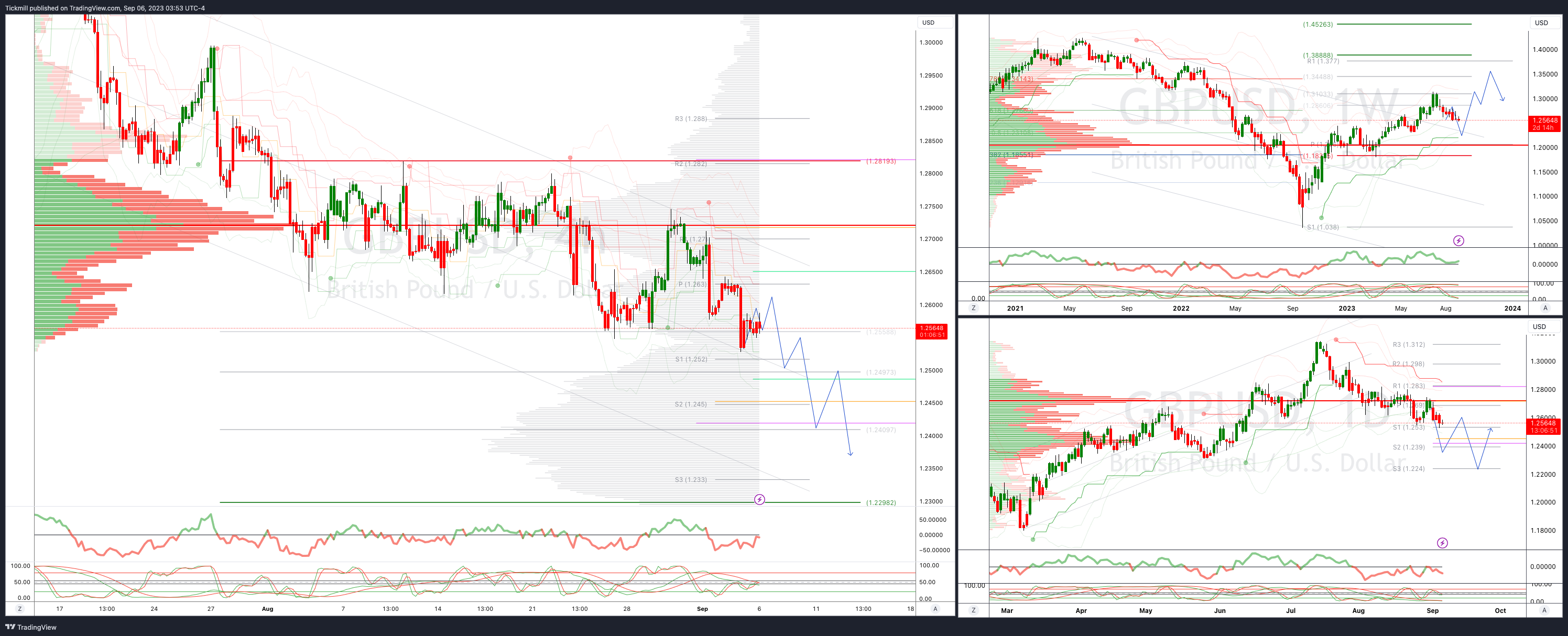

GBPUSD: Intraday Bullish Above Bearish Below 1.2650

Above 1.27 opens 1.2750

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

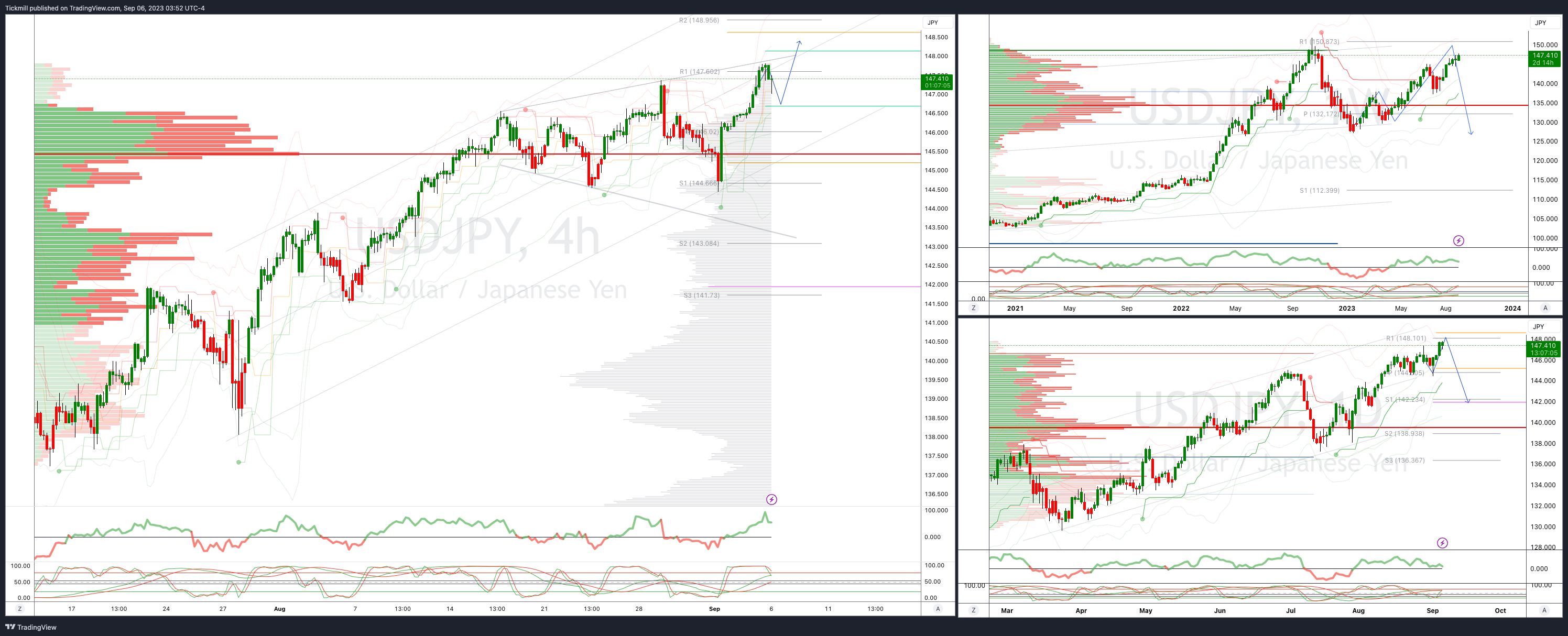

USDJPY Bullish Above Bearish Below 146.50

Below 145 opens 144.90

Primary support 143.90

Primary objective is 148

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Intraday Bullish Above Bearish Below .6450

Above .6525 opens .6575

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bearish

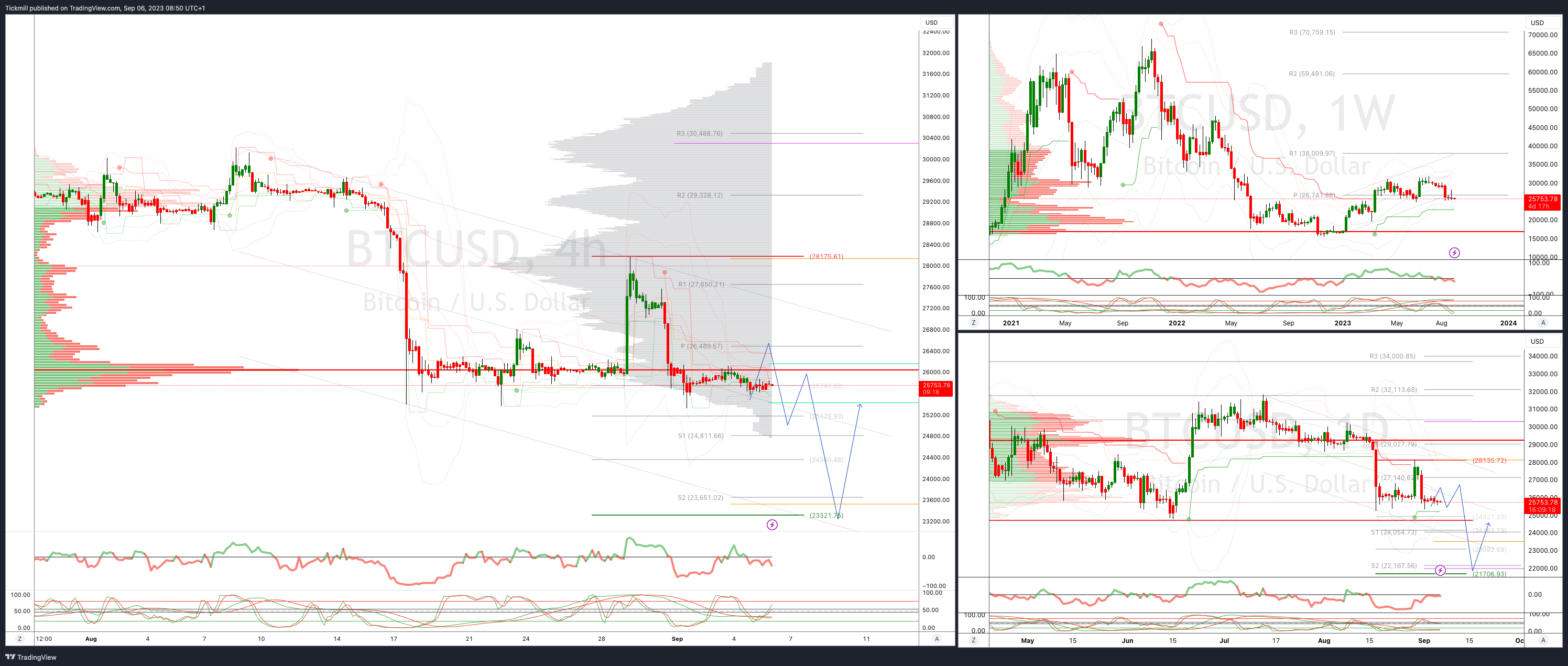

BTCUSD Intraday Bullish Above Bearish below 26175

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!