Daily Market Outlook, September 20, 2023

Daily Market Outlook, September 20, 2023

Munnelly’s Market Commentary…

Asian equity markets generally faced a downward trend as investors adopted a cautious stance ahead of forthcoming central bank policy announcements, including the Federal Open Market Committee (FOMC) rate decision and dot plot projections. Nikkei 225 weakened as the latest trade data indicated that Japanese exports and imports remained in contraction territory, though not as severe as anticipated. Hang Seng and Shanghai Comp.followed the subdued market sentiment. The People's Bank of China (PBoC) maintained its benchmark one-year and five-year Loan Prime Rates at 3.45% and 4.20%, respectively. Country Garden, a property developer, missed a coupon payment on its dollar bonds, causing concern among bondholders. The developer still has a 30-day grace period for payment.

The UK's Consumer Price Index (CPI) data for August revealed an unexpected drop in annual inflation to 6.7% from 6.8% in July. This defied economist expectations of rising inflation due to increased petrol prices, but other factors offset the increase. The "core" rate of inflation (excluding food and energy) also fell significantly to 6.2% from 6.9% in July. This data fuels speculation that UK interest rates may be nearing a peak, making the Bank of England's upcoming interest rate decision a closer call.

Stateside focus is firmly on The US Federal Reserve who are expected to keep interest rates unchanged, marking the second "pause" this year. While markets do not anticipate a rate hike, attention will be on the guidance regarding future actions, including whether rates have peaked and when they may be cut. The Fed's updated projections, including the "dot plot" of interest rate projections, will provide insights into these questions. Federal Reserve Chair Jerome Powell is likely to emphasise that they are managing inflation successfully but still face risks, as evidenced by the recent rise in headline inflation. Powell may not indicate that US interest rates have peaked or are expected to fall soon. The dot plot may retain one more rate increase for this year and a projected rate cut of around 100 basis points in 2024, supporting market hopes for significant reductions. However, Powell may caution against placing too much emphasis on these projections due to the high level of uncertainty.

FX Positioning & Sentiment

The majority of economists anticipate that the United States Federal Reserve will maintain its interest rates within the range of 5.25% to 5.50%. Only a very small minority of economists expect the Fed to implement a rate hike this evening. During this decision, the Fed will release new economic projections and assess whether additional rate increases are necessary. Traders currently believe that the tightening cycle has concluded, with the next expected move being a rate cut in July 2024. The highest probability for another rate hike is in December, standing at 40%. Traders have covered all short positions in the US dollar ahead of the rate decision, suggesting caution and uncertainty in the market. Despite this, emerging market currencies have displayed notable resilience. The US dollar index has risen by 6%, achieving its target to correct its previous steep decline. The Fed's decision may result in increased volatility in foreign exchange trading markets.

CFTC Data As Of 15-09-23

EUR net spec long drops to 113,080 contracts from 136,231

JPY short rises to 98,713 from 97,136

AUD short lower at 79,533 from 83,537

GBP long slightly smaller at 46,174 from 46,384 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600 (445M), 1.0625-35 (565M) 1.0650 (355M)

1.0670-80 (1.11BLN), 1.0700-10 (850M), 1.0735-50 (1.13BLN)

1.0775 (422M), 1.0800 (647M)

USD/JPY: 146.25 (991M), 146.50 (1.3BLN), 147.00-05 (835M)

147.15-25 (637M), 147.45-50 (920M), 148.00 (828M)

USD/CHF: 0.8890-00 (1.13BLN), 0.9000 (300M)

EUR/CHF: 0.9650 (228M), 0.9675 (228M)

GBP/USD: 1.2325 (400M), 1.2350 (774M), 1.2385-00 (1.4BLN)

1.2440 (458M), 1.2495-05 (680M)

AUD/USD: 0.6450 (519M), 0.6525 (860M), 0.6540-50 (622M)

0.6595 (514M). NZD/USD: 0.5850 (492M)

USD/CAD: 1.3490-00 (1.0BLN), 1.3545-60 (1.1BLN)

Overnight Newswire Updates of Note

US Federal Reserve Set To Hold Rates At 22-Year High

Traders Make Late Dash Into Bets Fed Stays Higher For Longer

Bank Of Canada’s Kozicki Sees Signs Rate Hikes Are Working

Energy Prices Set To Push UK Inflation In Wrong Direction

UK Pay Deals Lose More Steam As Bank Of England Meets On Rates

China Leaves Benchmark Lending Rates Unchanged In September

China Analysts: China Has Room For Further RRR, Rate Cuts This Year

Japan's Exports Extend Declines As China Slowdown Bites

Australia’s Rate-Hike Prospects Split Economists, Survey Shows

Yellen, Kanda Put Spotlight On Yen Intervention As Fed Looms

Oil Prices Fall Ahead Of Fed Rate Policy Announcement

JPMorgan: Oil Could Rise To $120 Because Supply Cuts May Not Be Over

WH No Longer Sending Top Officials To Detroit For UAW Strike Talks This Week

Amazon Adding 250,000 Workers For The Holidays And Bumping Average Pay

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

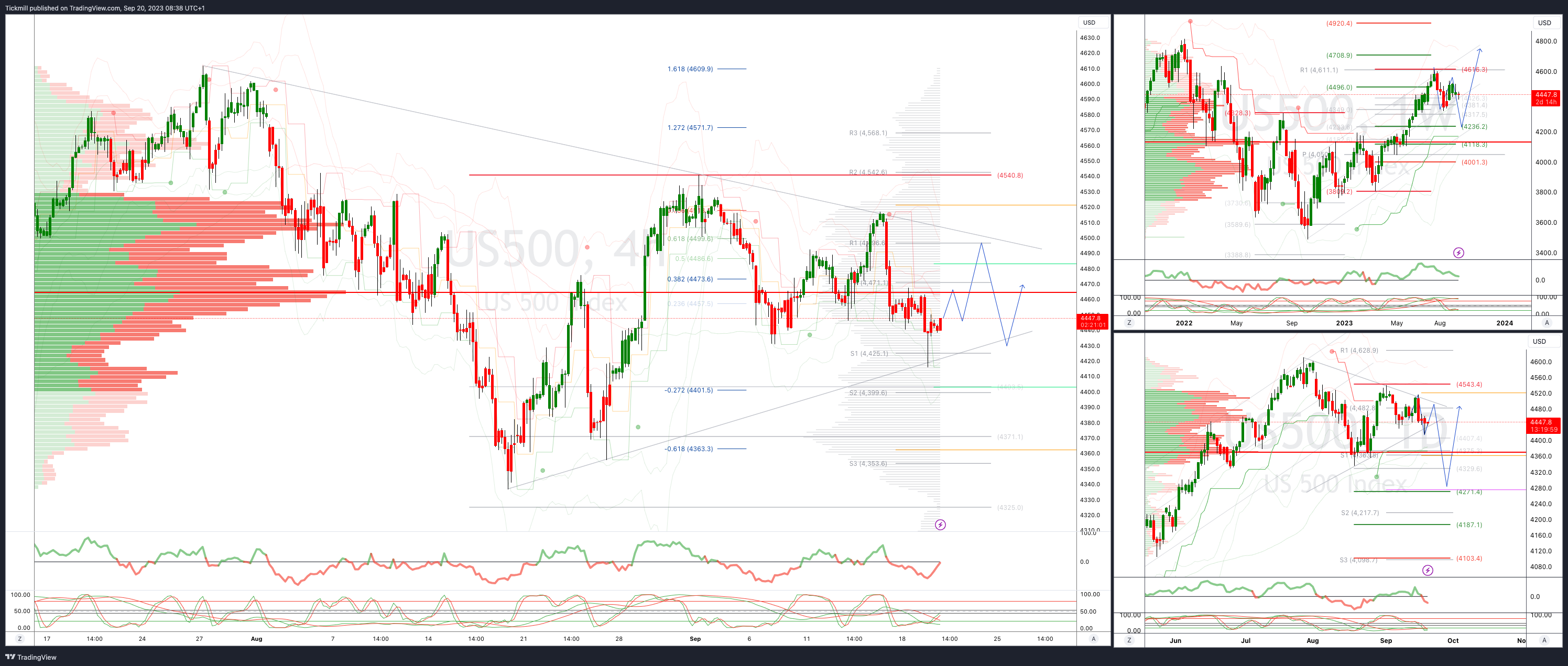

SP500 Bias: Bullish Above Bearish Below 4475

Above 4500 opens 4540

Primary resistance is 4540

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

EURUSD Bias: Bullish Above Bearish Below 1.07

Above 1.860 opens 1.0945

Primary resistance is 1.1066

Primary objective is 1.06

20 Day VWAP bearish, 5 Day VWAP bullish

GBPUSD Bias: Bullish Above Bearish Below 1.2450

Above 1.2450 opens 1.25550

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

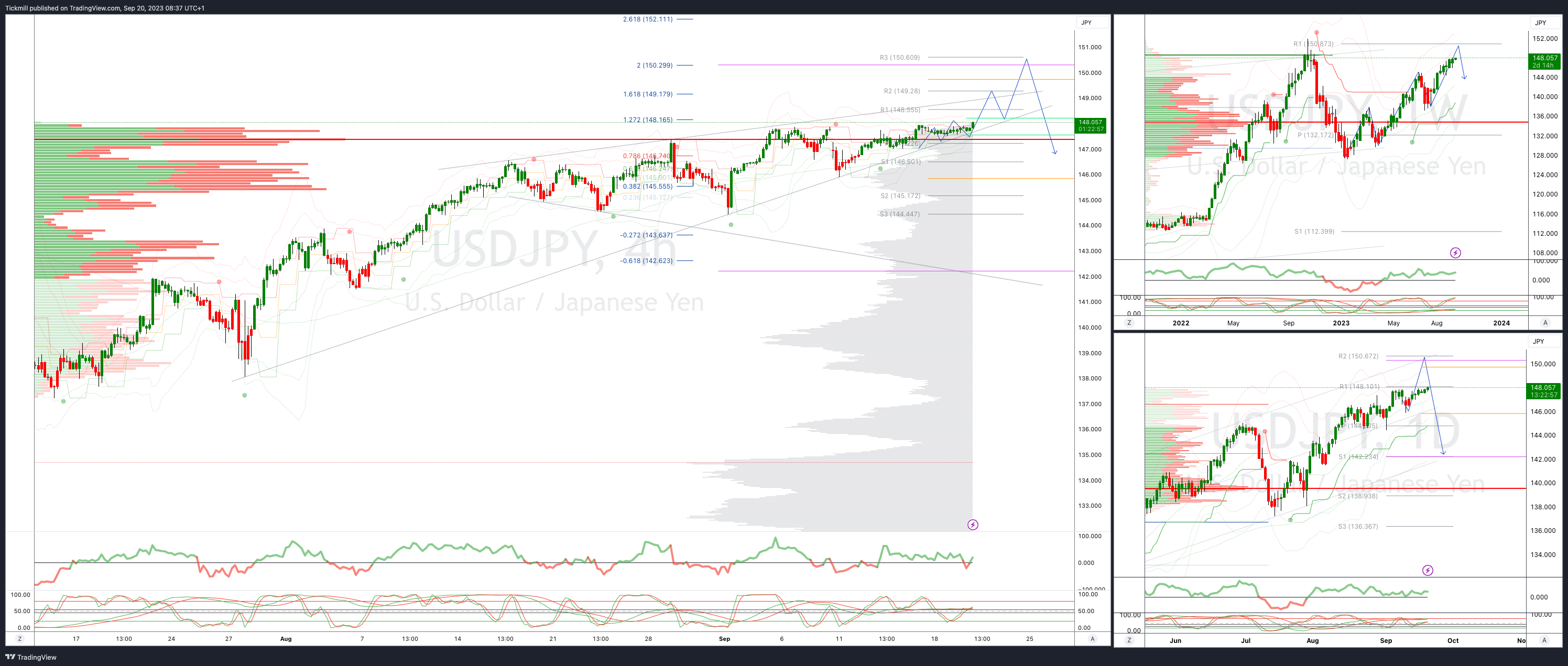

USDJPY Bias: Bullish Above Bearish Below 146.50

Below 146 opens 144.90

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

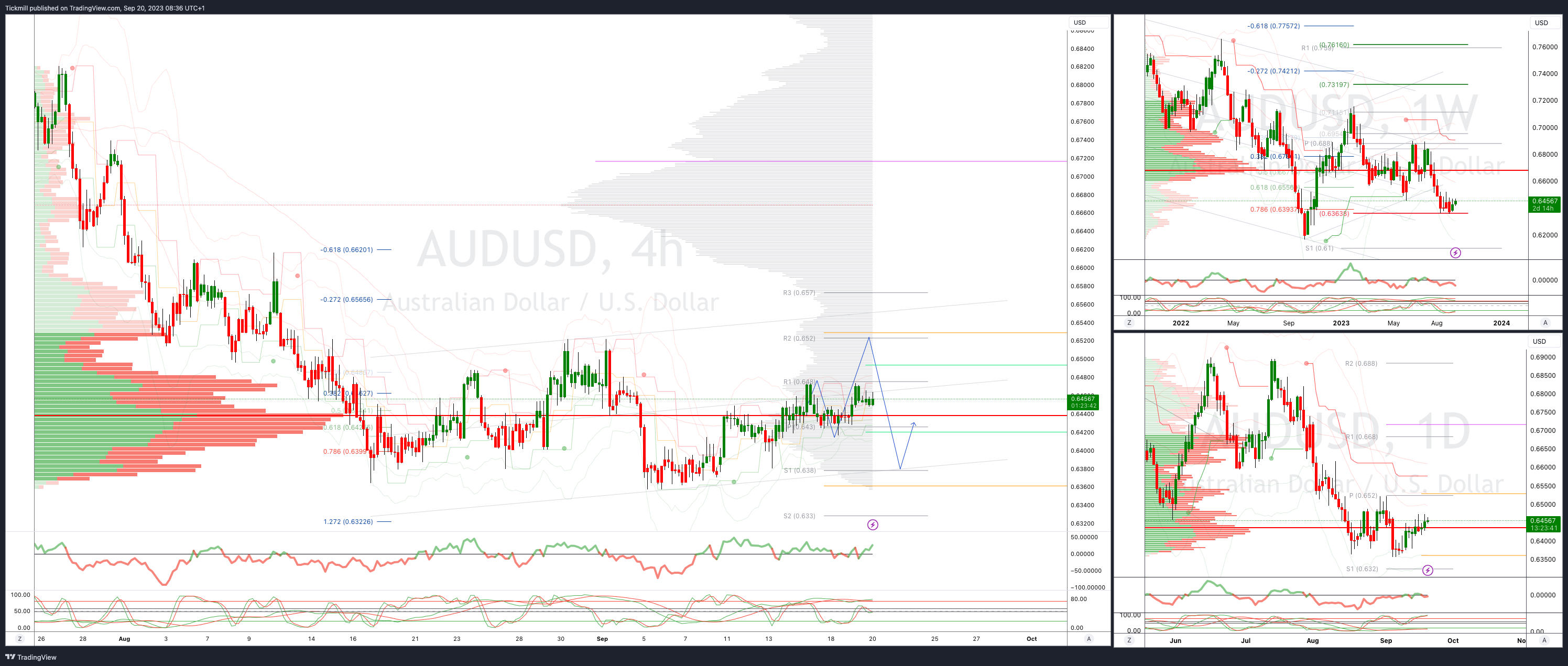

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

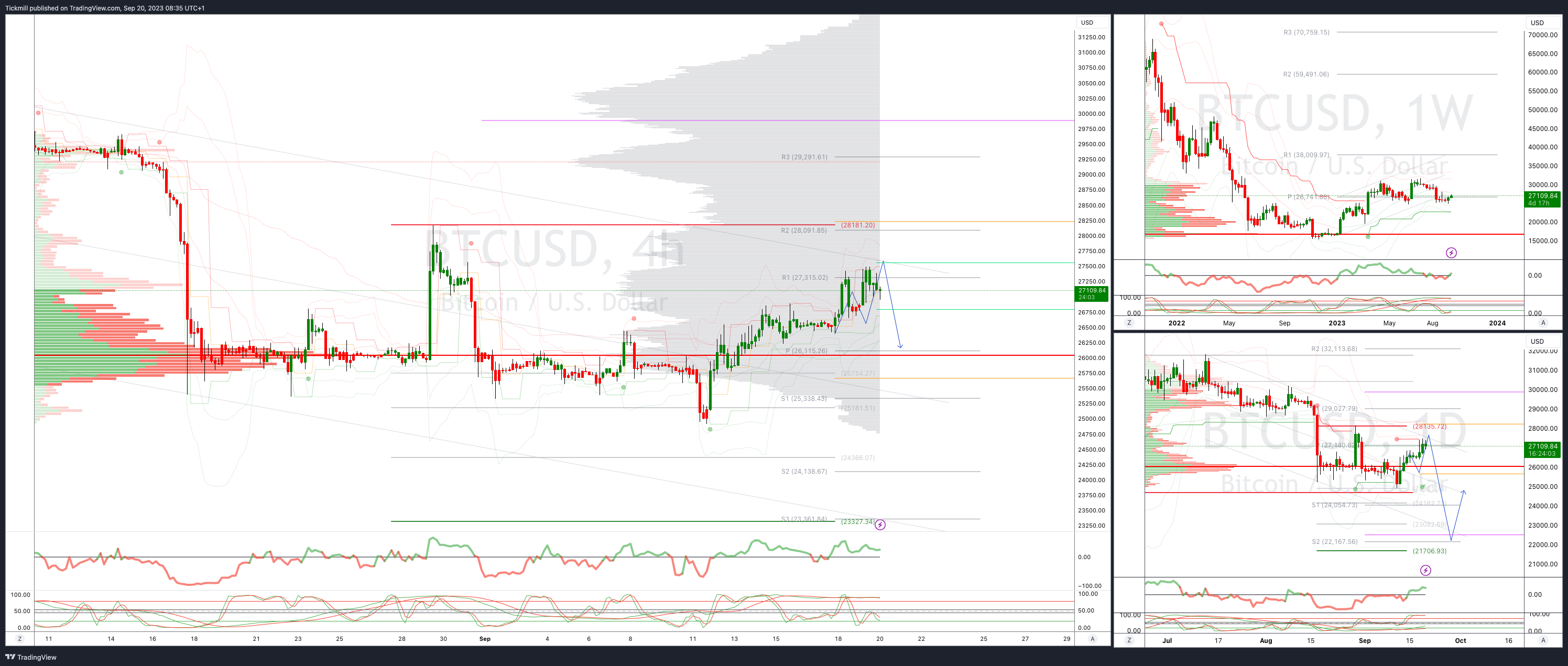

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!