Daily Market Outlook, September 18, 2023

Daily Market Outlook, September 18, 2023

Munnelly’s Market Commentary…

Asian equity markets opened lower, following the declines on Wall Street from the previous Friday. Market sentiment remained cautious, as the week started with reduced trading activity due to a holiday in Japan. The Hang Seng and Shanghai Composite both started with declines, particularly in Hong Kong, where tech and property stocks, including Evergrande shares, slumped by more than 20% early in the trading session. This drop in Evergrande's stock came after some of its wealth management employees were detained by Chinese authorities. However, mainland China's losses were later reversed, partly due to the People's Bank of China's (PBoC) efforts to maintain firm liquidity and a previously unannounced meeting between Chinese Foreign Minister Wang Yi and U.S. National Security Adviser Sullivan.

Against the backdrop of the recent interest rate hike, ECB President Lagarde suggested that it might be the last in the current cycle, hinting that rates in the Eurozone might have reached their peak. With central banks like the Bank of England and the U.S. Federal Reserve announcing their latest policy decisions in the coming days, market watchers are eager to see if a similar message regarding rate peaks emerges.

The Bank of England (BoE) is expected to raise rates by another 25 basis points to reach 5.50%, marking the 15th consecutive rate increase. However, recent economic data, especially on activity, have been mixed, leading to increasing uncertainty about whether UK rates will continue to rise beyond this point. The probability of a rate increase this week has dropped to around 75%, compared to near certainty not long ago. Additionally, the expected peak rate has significantly decreased from earlier projections this year. The BoE's forward guidance will be closely monitored, with any softening of previous statements possibly indicating that rates have peaked, even though the central bank may continue to stress that policy is likely to remain restrictive for an extended period. In contrast, the U.S. Federal Reserve is expected to keep its policy rates unchanged this week, marking its second pause this year. The pause is widely anticipated given the Fed's preference not to surprise the markets with immediate rate changes. Therefore, the focus will be on the Fed's forward guidance, particularly regarding whether rates have peaked and the timing of potential rate cuts. The Bank of Japan (BOJ) is scheduled to hold its policy setting meeting on Friday, and the prevailing expectation is that there will be no change in policy. However, BOJ Governor Ueda's comments early last week created some market turbulence. He mentioned the possibility of ending negative interest rates, suggesting that there might be enough data to make that decision by the end of the year. Market participants interpreted these remarks as an attempt to curb the weakness of the JPY.

In terms of the economic docket for the day, the calendar offers limited macro drivers. There are no major releases scheduled in the UK or the Eurozone. In the U.S., attention is primarily on the NAHB housing market index, with sentiment likely to have declined in September as higher interest rates continue to impact the housing market.

FX Positioning & Sentiment

Hedge funds made a significant shift in their positioning in the foreign exchange market last week, reducing their net short dollar position by nearly $5 billion. This marks the most substantial move towards a more bullish stance on the dollar since May of the previous year.

Despite the recent trend of moving away from a bearish dollar position and the dollar's rally over the past couple of months, there is growing anticipation of a potential period of consolidation or a reversal driven by profit-taking. Data from the Commodity Futures Trading Commission (CFTC) indicates that the total value of funds' short dollar positions against a basket of G10 currencies, along with the Mexican peso and Brazilian real, decreased to $2.25 billion in the week ending September 12. This was a notable decline from the previous week when the short dollar position stood at $7.17 billion. This marks the sixth time in the last seven weeks that speculators have turned more bullish on the dollar, or less bearish, depending on how you view it. Furthermore, they are now on the verge of shifting to an outright net long position for the first time since November. This shift towards a more positive stance on the dollar has been driven by robust U.S. economic data, rising bond yields, and expectations of interest rate increases, both in nominal terms and relative to other major currencies. It's noteworthy that just less than two months ago, hedge funds were holding a significant net short position on the dollar, amounting to $21.3 billion, marking the most substantial bet against the U.S. currency since June of the previous year.

CFTC Data As Of 15-09-23

EUR net spec long drops to 113,080 contracts from 136,231

JPY short rises to 98,713 from 97,136

AUD short lower at 79,533 from 83,537

GBP long slightly smaller at 46,174 from 46,384 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600 (417M), 1.0625 (500M), 1.0675-85 (402M)

1.0690-00 (521M), 1.0715-20 (348M), 1.0730-40 (715M)

1.0745-50 (350M), 1.0765-75 (291M), 1.0800-20 (744M)

USD/JPY: 145.00 (926M), 145.15 (500M), 145.50 (200M)

146.00 (462M), 146.50 (215M), 147.00 (1.22BLN)

148.00 (958M), 148.25-35 (1.5BLN), 148.50 (1.49BLN)

USD/CHF: 0.8800 (452M), 0.8935 (304M), 1.001 (300M)

GBP/USD: 1.2430-35 (593M), 1.2465-75 (285M)

1.2500-05 (230M)

EUR/GBP: 0.8615-25 (369M), 0.8800-15 (542M)

AUD/USD: 0.6250 (486M), 0.6300 (525M), 0.6500 (428M)

0.6550 (200M), 0.6650 (311M)

Overnight Newswire Updates of Note

Busy Week For Central Banks As Fed, BoE And BoJ Set Interest Rates

Goldman Sachs: Fed Unlikely To Raise Rates In November

Critical House GOP Factions Reach Temporary Spending Deal To Avoid Shutdown

Lagarde Seized ECB Colleagues’ Handsets To Prevent Leaks

Europe Must Cut Down On Its Dependence With China, Baerbock Says

Labour Leader Keir Starmer Pledges To Seek Major Brexit Deal Rewrite

UK Residential Rents Rise At Record Pace In August

Oil Inches Higher On Supply Concerns, China Demand Recovery

France To Allow Selling Fuel At Loss In Effort To Curb Inflation

Chevron’s Australian LNG Plant Resumes Full Output Amid Strikes

US Auto Workers Strike Against Detroit Three Enters Third Day

Volkswagen Stops Production In Dresden Factory

Chinese Stocks in Hong Kong Drop as Property Woes Sour Sentiment

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

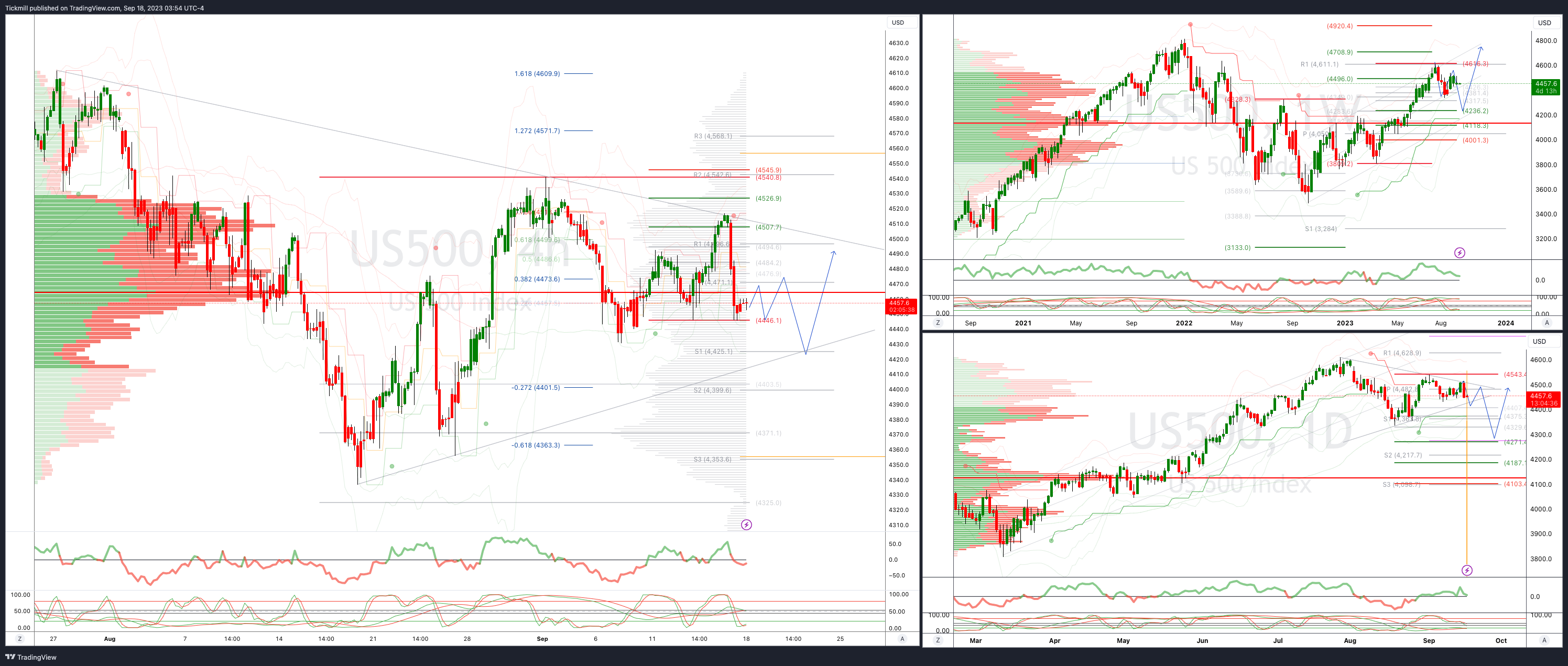

SP500 Bias: Bullish Above Bearish Below 4475

Above 4500 opens 4540

Primary resistance is 4550

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

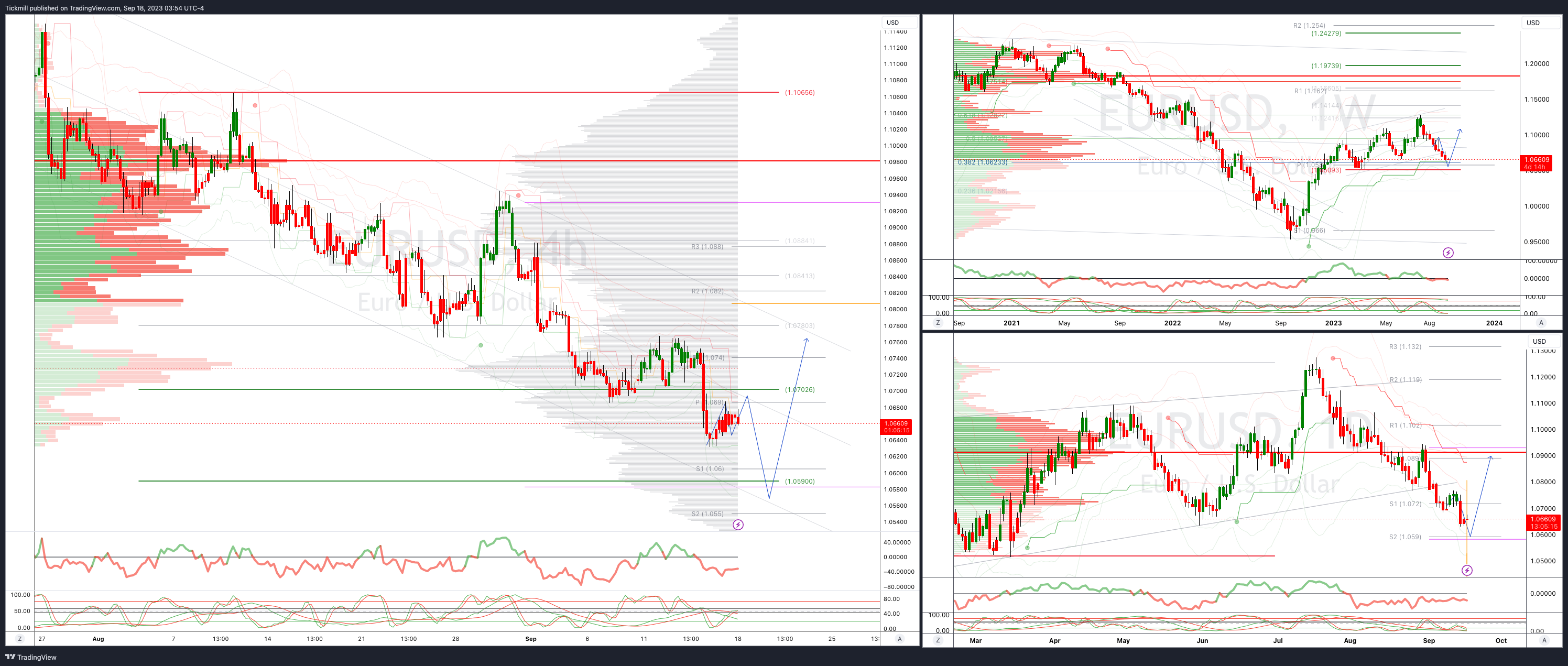

EURUSD Bias: Bullish Above Bearish Below 1.07

Above 1.750 opens 1.0810

Primary resistance is 1.1066

Primary objective is 1.06

20 Day VWAP bearish, 5 Day VWAP bearish

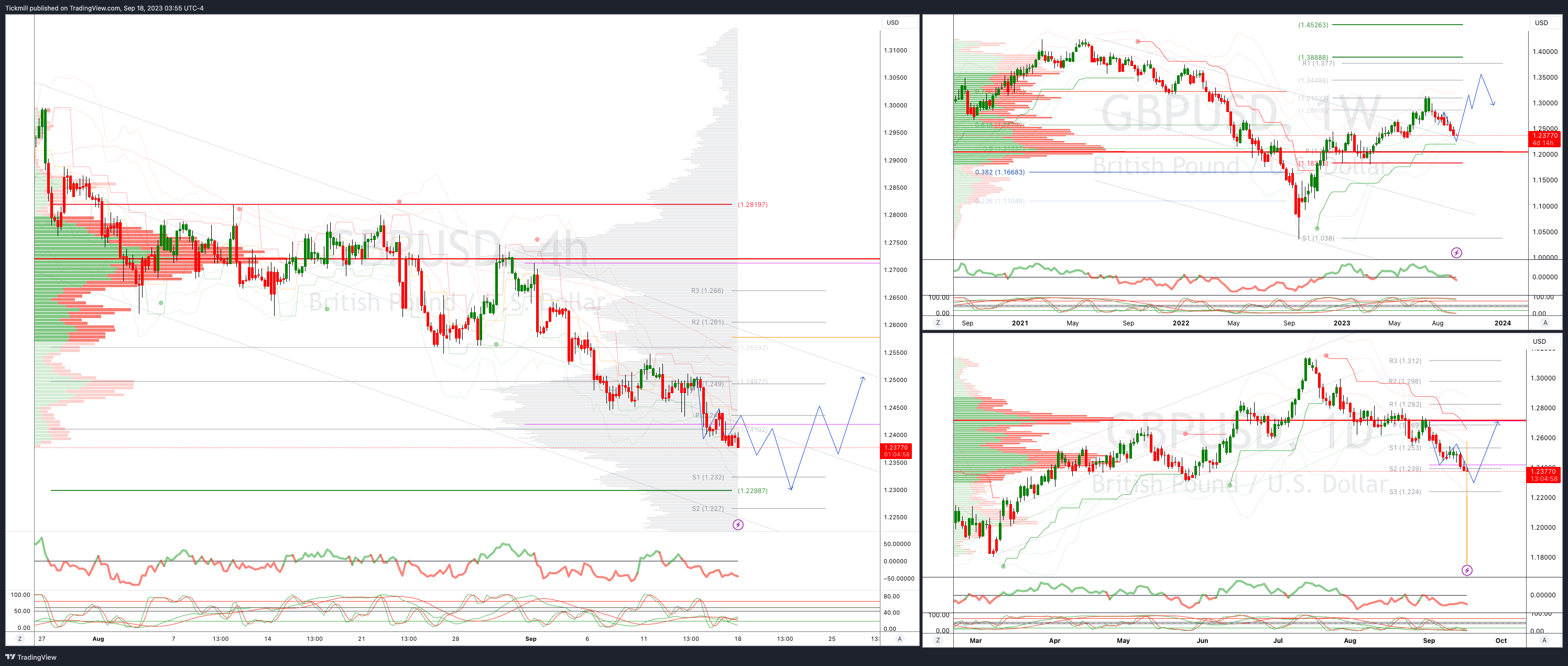

GBPUSD Bias: Bullish Above Bearish Below 1.2450

Above 1.2450 opens 1.25550

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

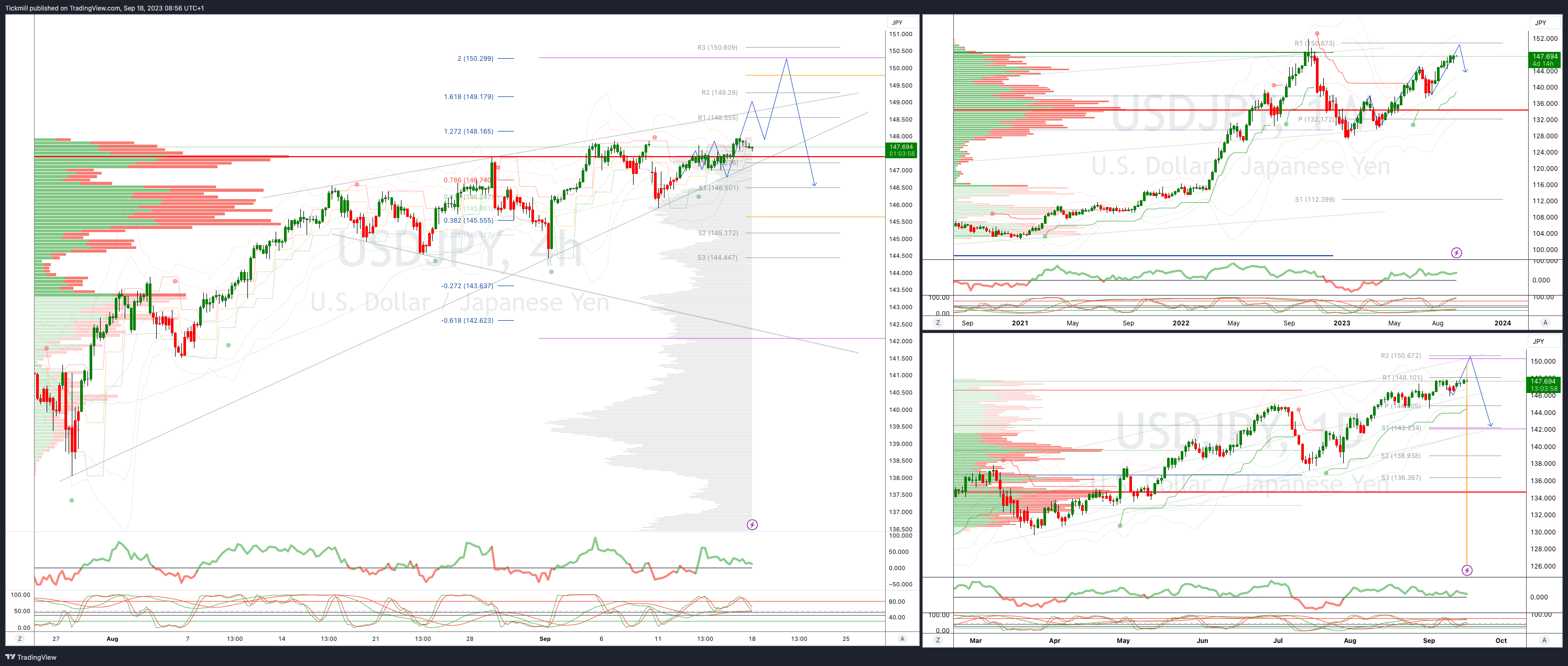

USDJPY Bias: Bullish Above Bearish Below 146.50

Below 146 opens 144.90

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

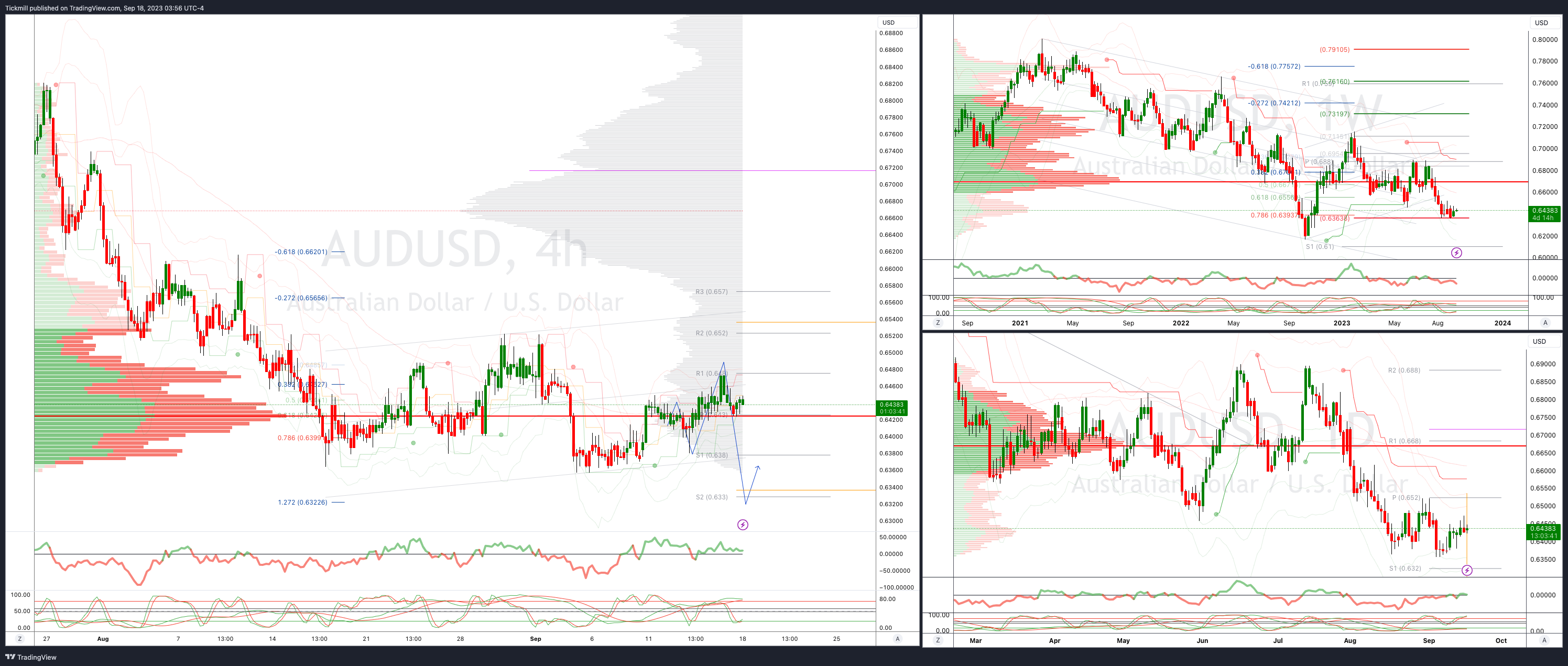

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

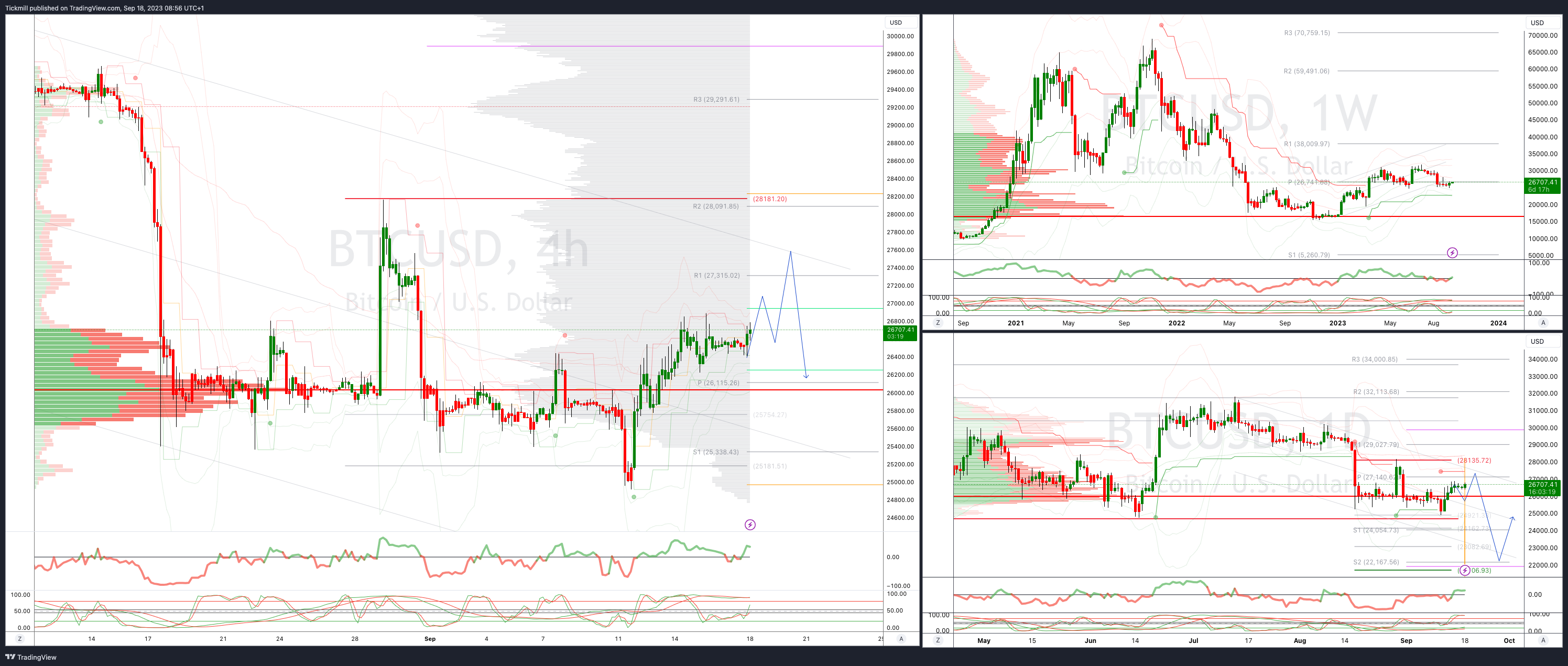

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!