Daily Market Outlook, September 11, 2023

Daily Market Outlook, September 11, 2023

Munnelly’s Market Commentary…

Asian equity markets displayed a mixed performance driven by rising yields, triggered by comments from BoJ Governor Ueda. Ueda mentioned the possibility of having enough data by year-end to decide on ending negative interest rates, emphasising a smooth exit strategy. This led to varied outcomes in major indices. The Nikkei 225 declined by 0.5%, reacting to Governor Ueda's comments, which pushed the 10-year JGB yield above 0.70% for the first time since 2014. However, losses in the index were cushioned by optimism in the banking sector, driven by the exit-related discussions and Japan's plans for substantial economic stimulus measures.

In contrast, the Hang Seng index in Hong Kong dropped by 1.5%. It struggled to recover from the losses incurred last Friday, exacerbated by disruptions caused by a black rainstorm closure. Weakness in the property sector further weighed down the index, and Alibaba shares faced challenges as its former CEO, Daniel Zhang, stepped down from the cloud business.

Conversely, the Shanghai Composite in mainland China saw a 0.6% gain. This was partly due to mixed inflation data, which showed that the headline Consumer Price Index (CPI) year-on-year was softer than expected but no longer in deflationary territory. Additionally, China's National Administration of Financial Regulation eased rules, allowing insurers to purchase stocks.

Looking ahead, in the Eurozone the focus will shift to the European Central Bank's (ECB) policy update scheduled for Thursday. The decision on whether to maintain the status quo or continue with a tenth consecutive interest rate hike hangs in the balance. Economists are divided in a Bloomberg survey, while market sentiment slightly favours a decision to keep rates unchanged, with a 35-40% probability of a hike. The debate between hawkish and dovish ECB members continues, with concerns about the Eurozone's weakening growth outlook supported by recent PMI surveys pointing towards GDP contraction in Q3.

The upcoming week Stateside will revolve around key economic data releases, with a significant spotlight on Wednesday's Consumer Price Index (CPI) report. This heightened attention is a result of the recent increase in Treasury yields, driven by market expectations that the Federal Reserve might consider raising interest rates in November, thanks to the continued resilience of the U.S. economy. Specifically, markets anticipate that the August core CPI will moderate, showing a yearly rate of 4.3%, down from July's 4.7%. Should the actual reading surpass this projection, it would heighten the probability of the Federal Reserve implementing at least one additional rate hike in the near term. Such an outcome would underscore ongoing inflationary pressures.

FX Positioning & Sentiment

.In recent trading activity, there has been a reduction in the number of traders who are betting on the EUR/USD currency pair to rise. Since July 21st, the EUR/USD exchange rate has experienced a notable decline, moving from 1.1276 to 1.0686. Despite this decline, it's worth noting that only $6.8 billion out of the total $25.1 billion of bullish bets on the EUR/USD have been scaled back. As of the latest data, there are still substantial long positions in the market, with approximately $18.2 billion worth of bullish bets remaining. This suggests that while some traders have adjusted their positions due to the recent decline in the EUR/USD, a significant portion of market participants still maintain a positive outlook on the currency pair.

CFTC Data As Of 08-09-23

USD net USD G10 short -$3.4bn in Aug 30-Sep 5 period, $IDX +1.17% in period

Fed high for longer versus whiff of steady ECB, less austere BoE lifts USD

EUR$ -1.42% in period, specs -10,448 contracts now +136,231

Sellers overwhelm bottom-fishers as king USD reigns, pair flat since Tuesday

$JPY +1.23% in period, specs +1,337 contracts now -97,136

Longs sell USD ahead of expected intervention area near 150

GBP$ -0.68% in period, specs sell 2,017 contracts now long 46,384

Traders sense dovish BoE shift, high BoE rate path tempers GBP weakness

CAD & AUD shorts rise 9k & 13k respectively amid weak China growth view

BTC -6.79% in period, specs buy 532 contracts long grows to 2,039 contracts (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0580 (260M), 1.0700 (681M), 1.0830 (281M)

1.0910 (684M)

USD/JPY: 145.00 (895M), 146.00-20 (565M), 149.00 (599M)

EUR/JPY: 159.00 (322M)

USD/CHF: 0.8650 (866M), 0.8950-55 (305M)

GBP/USD: 1.2475 (254M), 1.2590-00 (590M)

AUD/USD: 0.6325 (300M), 0.6480 (280M)

NZD/USD: 0.5700 (231M), 0.6500 (226M)

AUD/NZD: 1.1050 (398M). USD/CAD: 1.3600 (478M)

Overnight Newswire Updates of Note

China’s CPI Rise 0.1% In August, Pointing To Weak Demand But Easing Deflation Fears

BoJ Ueda: BoJ Could End Negative Interest Rate Policy, Watching Wages & Prices

Japan PM Says He Plans Cabinet Reshuffle, 'Drastic' Economic Measures

PBoC: FX Market Is ‘Operating Steadily,’ Is Confident In Maintaining Yuan Stability

Australian PM Keen To Ink EU Free Trade Agreement 'As Soon As Possible'

Yellen ‘Feeling Very Good’ About Soft Landing For US Economy

Biden Says China Less Likely To Invade Taiwan Amid Economic Downturn

Sunak Hints At Benefits Cut After 'Huge' Rise In Payments

Meloni Tells China That Italy Plans To Exit Belt And Road

Yen Rises After Ueda Comments On Wage Growth And Negative Rates

JGB Yields Rise After Report Says BoJ Governor Signals Possible Rate Hikes

China’s Yuan Rallies Off Recent Lows On Record Strong Fix Signal

Country Garden Nears Key Deadline On Bid To Extend Yuan Bonds

Chevron Appeals To Workplace Tribunal To Halt Australia LNG Strike Action

Japan Banks Surge With Yields On Ueda Comments On Negative Rates

Alibaba Says Daniel Zhang Quits Cloud Business In Surprise Move

Meta Is Developing A New, More Powerful AI System As Tech Race Escalates

Instacart To Target Much-Diminished Valuation Range Of Under $10 Bln In IPO

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

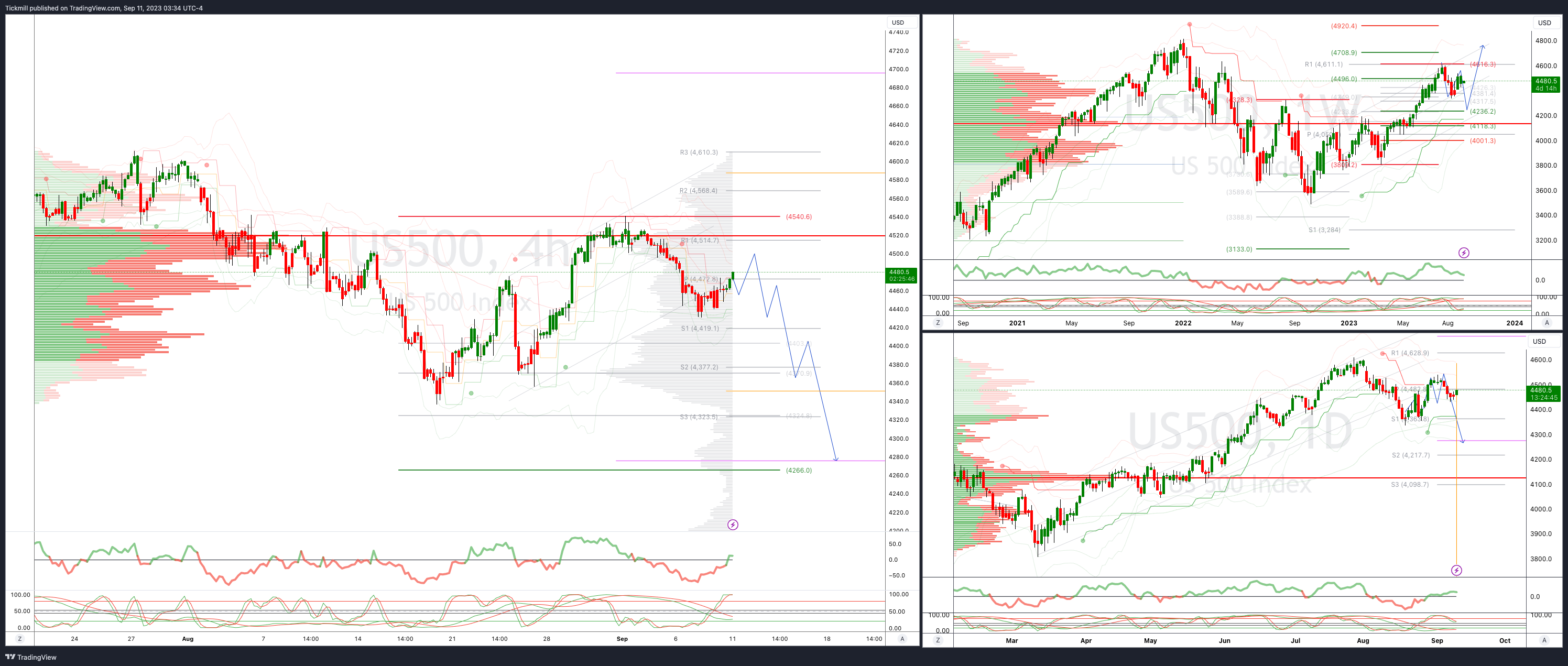

SP500 Bias: Bullish Above Bearish Below 4500

Above 4500 opens 44540

Primary resistance is 4450

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

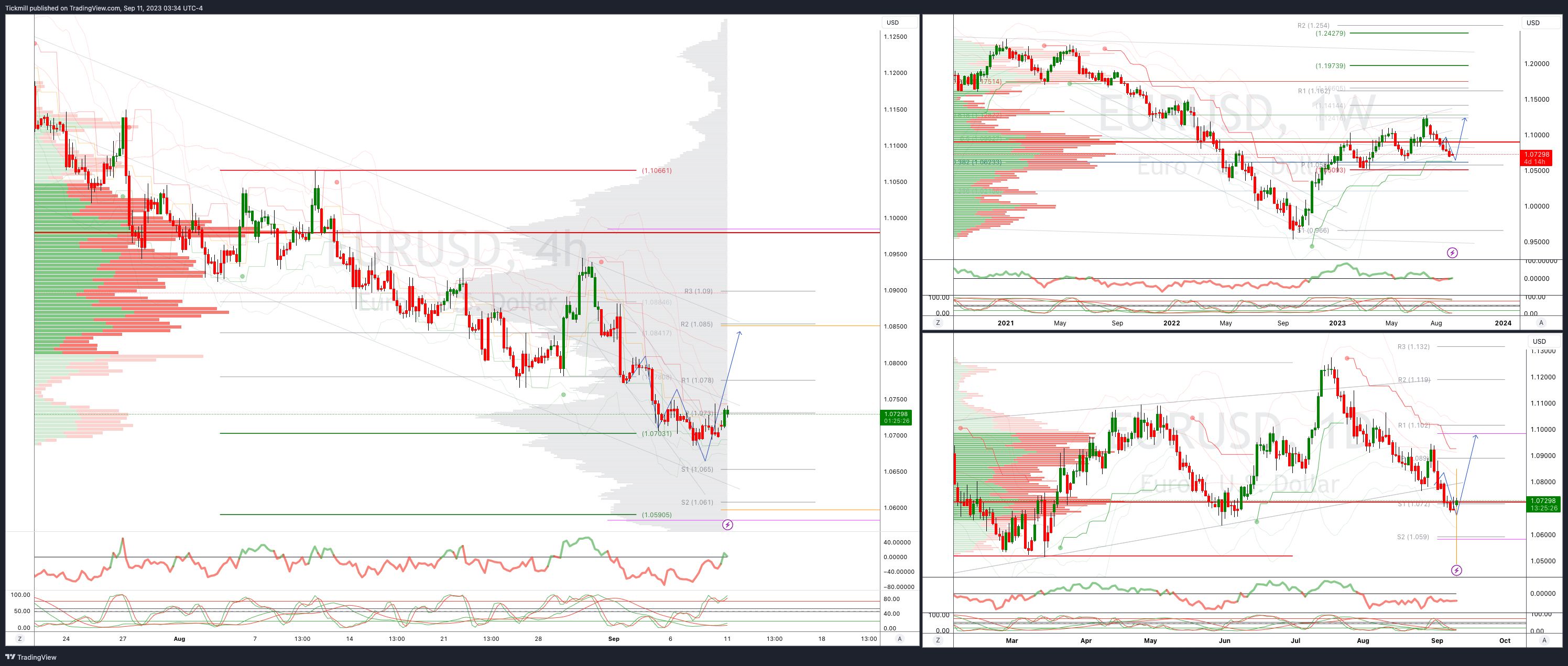

EURUSD Bias: Bullish Above Bearish Below 1.0810

Above 1.860 opens 1.0945

Primary resistance is 1.1066

Primary objective is 1.0660

20 Day VWAP bearish, 5 Day VWAP bearish

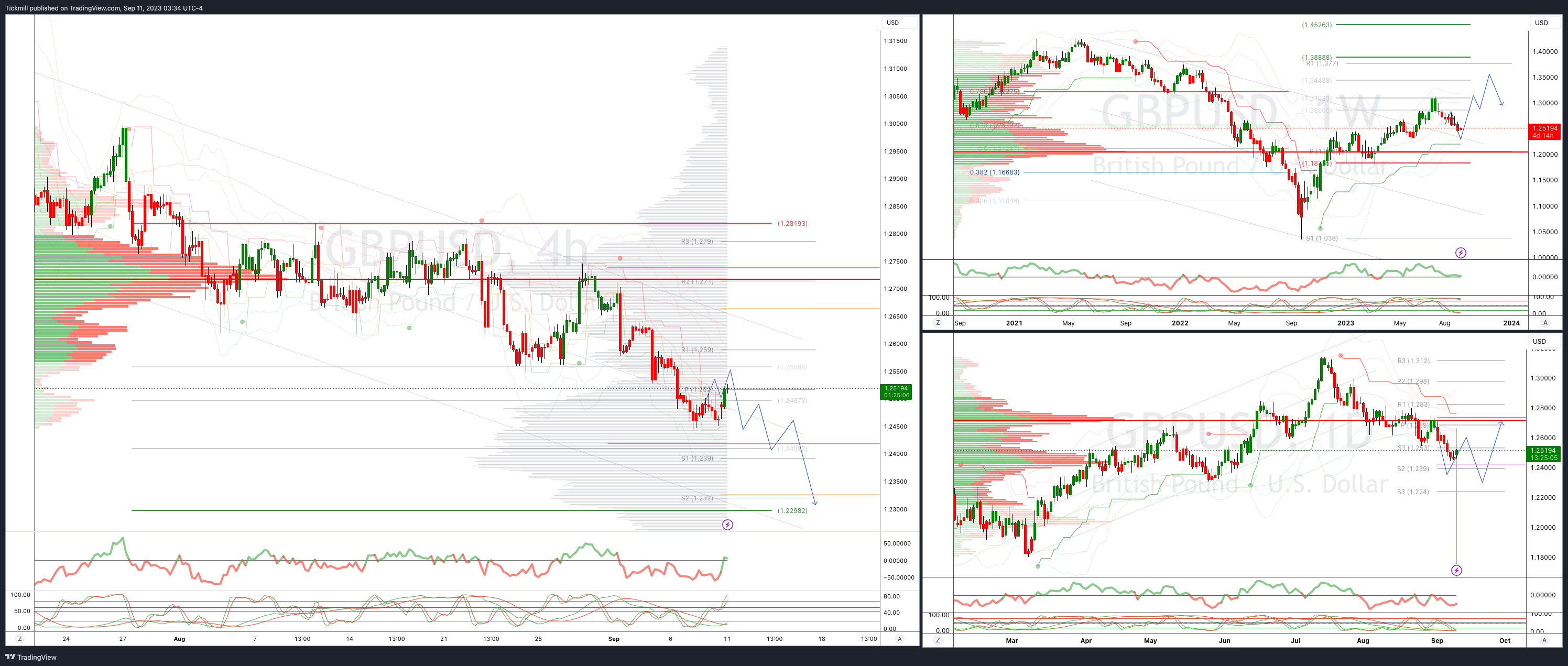

GBPUSD Bias: Bullish Above Bearish Below 1.2560

Above 1.2650 opens 1.27

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

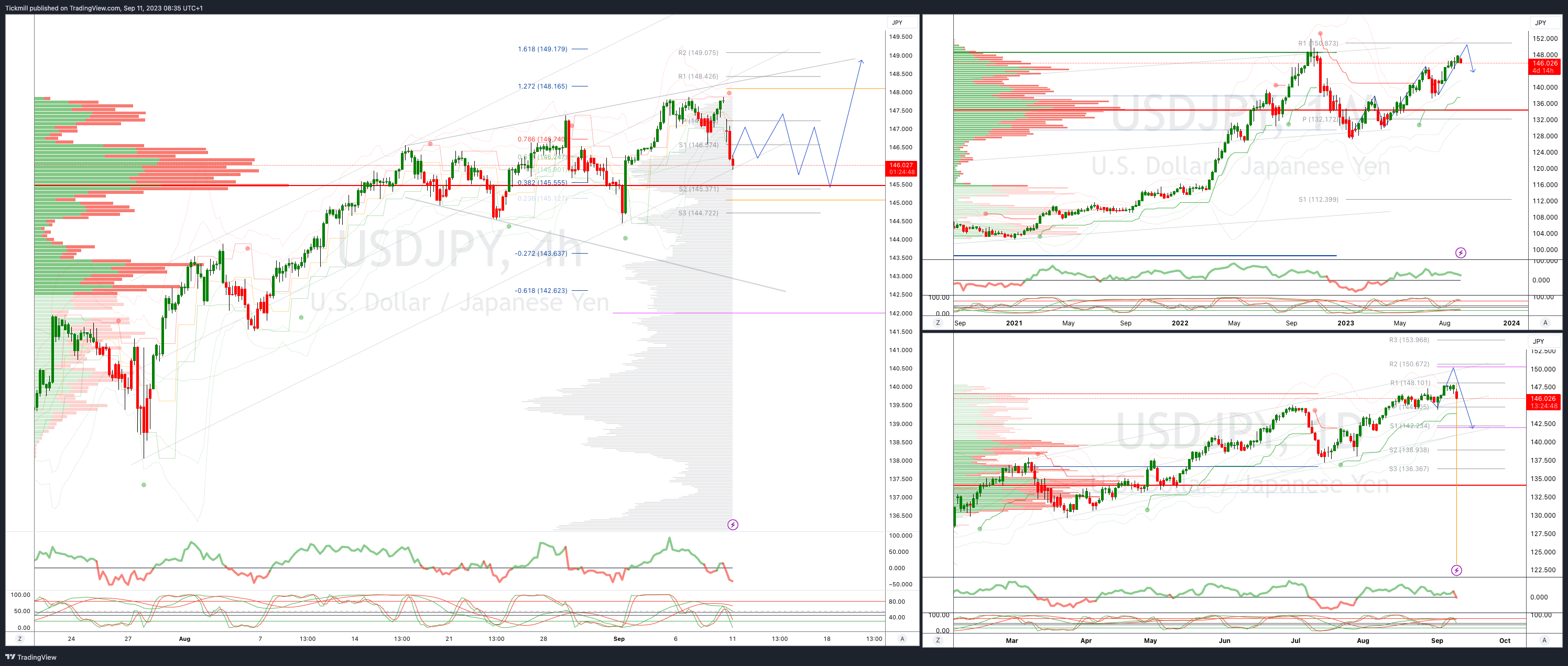

USDJPY Bias: Bullish Above Bearish Below 146.50

Below 146 opens 144.90

Primary support 143.90

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bearish

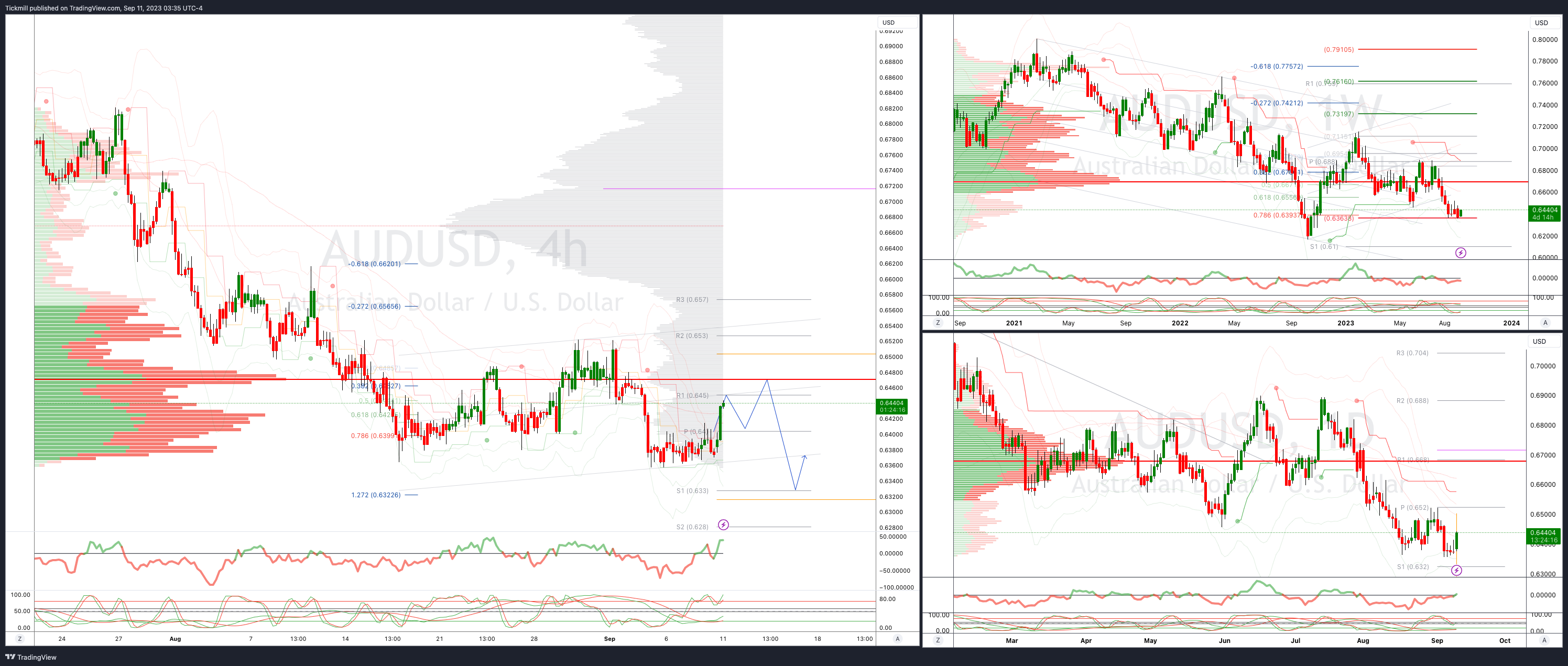

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6525 opens .6575

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 26175

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!