Daily Market Outlook, October 2, 2023

Munnelly’s Market Commentary…

Asian equity markets saw mixed trading as the region was significantly affected by holiday closures. The Nikkei 225 initially showed gains, but it later pulled back, slipping below the 32,000 level. The Hang Seng and Shanghai Composite were closed for the National Day Golden Week celebrations, and other countries like South Korea and India also had holiday closures. In the US, the recent government shutdown threat was averted, allowing for the nonfarm payrolls report for September to be released at the end of the week. This report will be a crucial factor for Federal Reserve policymakers in their decision-making regarding interest rates.

This week promises to be eventful, with a focus on top-tier data releases in the United States, including the September jobs report. Treasury yields are on the rise as the Federal Reserve maintains a hawkish stance, closely tied to economic data. The central bank calendar includes interest rate decisions in Australia and New Zealand, which will draw significant attention.

In the United States, aside from the Payrolls print, other key data releases this week include the ISM manufacturing and non-manufacturing PMIs, ADP jobs report, durable goods orders, factory orders, and international trade figures. In Europe, the schedule is relatively quiet, data includes August retail sales and German industrial orders. Japan will release its Q3 Tankan survey early in the week, along with final September PMIs, household spending, and overtime pay data for August. The Bank of Japan will publish a summary of opinions from its board members regarding its September 21-22 policy meeting.

The economic calendar for the day ahead primarily featured "final" manufacturing PMI reports for September from various regions, including the Eurozone, US, and UK. The UK's manufacturing PMI had been weak, contributing to the Bank of England's decision to keep interest rates steady at its recent policy meeting. The US manufacturing PMI is also expected to remain below the 50 mark in September, reflecting ongoing challenges in the sector.

Several Federal Reserve officials are scheduled to speak, including Chair Powell, Harker, and Williams. Their remarks will be closely watched for any hints about the possibility of an interest rate hike at the November policy meeting. Additionally, Bank of England's Mann, who voted for a rate increase at the last meeting, is scheduled to speak later in the day.

FX Positioning & Sentiment

Traders in the foreign exchange (FX) options market are increasingly positioning for the USD/JPY currency pair to rise well above the key level of 150.00. Concerns about potential intervention by Japanese authorities to curb the yen's depreciation have prompted traders to explore options that anticipate USD/JPY reaching levels around 151 to 152.00 over the coming weeks. Many of these option purchases involve bets on higher strike prices, which are now being offset by selling lower strike prices. This strategy allows traders to protect themselves against potential adverse price movements while still maintaining exposure to the possibility of further gains in USD/JPY. Notably, the USD/JPY pair reached 151.94 on October 21, 2022, marking its highest level in over 30 years. The level of 152.00 is considered significant due to the presence of FX option barriers, which can act as technical resistance levels. Recent comments from market participants, including well-known FX strategist Eisuke Sakakibara (also known as "Mr. Yen"), have suggested that an intervention level for the Japanese yen could be around 155.00. This indicates that some traders believe there is room for further appreciation of the USD/JPY exchange rate before potential intervention by Japanese authorities becomes more likely.

CFTC Data As Of 26-09-23

Net USD G10 long grew slightly to $5.1bn in Sep 20-26 period, $IDX +1.01%

EUR$ -1.01% in period specs -3,582 contracts now +98,399

$JPY +0.81%, specs -7,893 contracts now -109,512; USD longs eye 150

GBP$ -1.92% in period, specs -18,014 contract, long cut to 15,669

Specs wary of diminishing BoE hike outlook, falling UK growth

CAD, AUD buck the trend specs +15k CAD, +10k oz as commodities rise, oil abv $90

BTC -3.82% in period specs +197 contracts on dip, now +1,794; central banks near end of hike cycle supports BTC. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0550 (295M), 1.0575 (277M), 1.0600-10 (572M)

USD/CHF: 0.9115-20 (662M)

GBP/USD: 1.2150 (300M), 1.2275 (950M), 1.2300-10 (571M)

AUD/USD: 0.6360 (214M), 0.6375 (270M), 0.6400 (213M)

0.6440-50 (548M), 0.6500 (739M)

USD/JPY: 149.00 (931M), 150.00 (729M)

Overnight Newswire Updates of Note

China NBS Manufacturing PMI Sep: 50.2 (est 50.0; prev 49.7)

China Caixin Manufacturing PMI Sep F: 50.6 (prev 51.8)

Japan Jibun Bank Manufacturing PMI Sep F: 48.5 (prev 48.6)

Australia Judo Bank Manufacturing PMI Sep F: 48.7 (prev 48.2)

NZ Building Permits (M/M) Aug: -6.7% (prev R -5.4%)

BoJ Board Discussed Factors That Could Affect Exit Timing

BoJ To Conduct Additional Buying Operation For 5-10 Year JGBs

New Zealanders Start Voting In Oct. 14 General Election

Asia Faces Worst Economic Outlook In Half A Century, World Bank Warns

Vote To Oust McCarthy Is Planned After Shutdown Averted

‘Last Mile’ Of Disinflation The Hardest, Warns ECB Deputy Head

UK’s Hunt To Offer Wage Boost For Lowest-Paid Amid Tax Cut Calls

Evergrande Chair Investigated Over Attempts To Transfer Assets Offshore

Japan To Ease IPO Rules In October, Allowing Greater Price Flexibility

UAW Workers And Mack Trucks Reach Deal To Avoid Strike

BAE Systems Wins GBP3.95 Bln Contract For AUKUS Nuclear Submarines

European Telecom Groups Ask Brussels To Make Big Tech Pay More For Networks

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

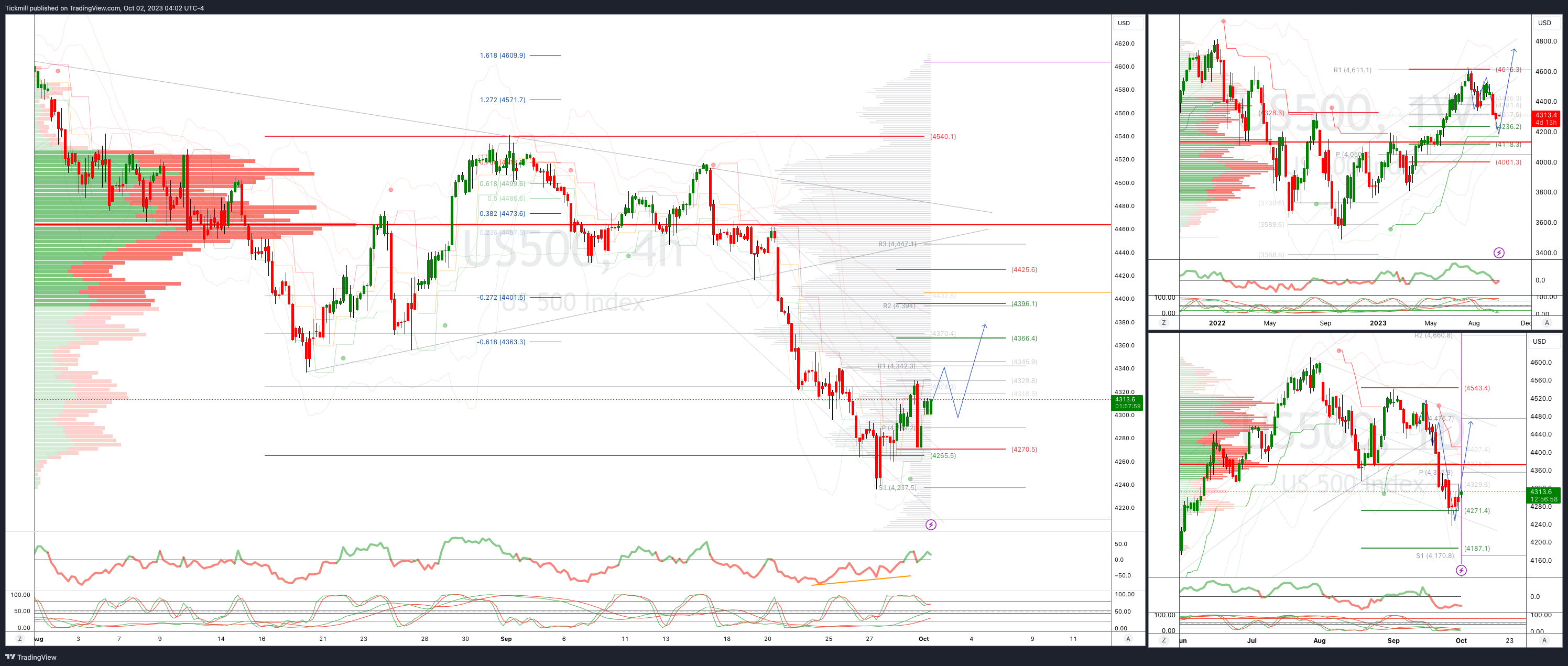

SP500 Bias: Bullish Above Bearish Below 4300

Below 4270 opens 4237

Primary resistance is 4400

Primary objective is 4366

20 Day VWAP bearish, 5 Day VWAP bearish

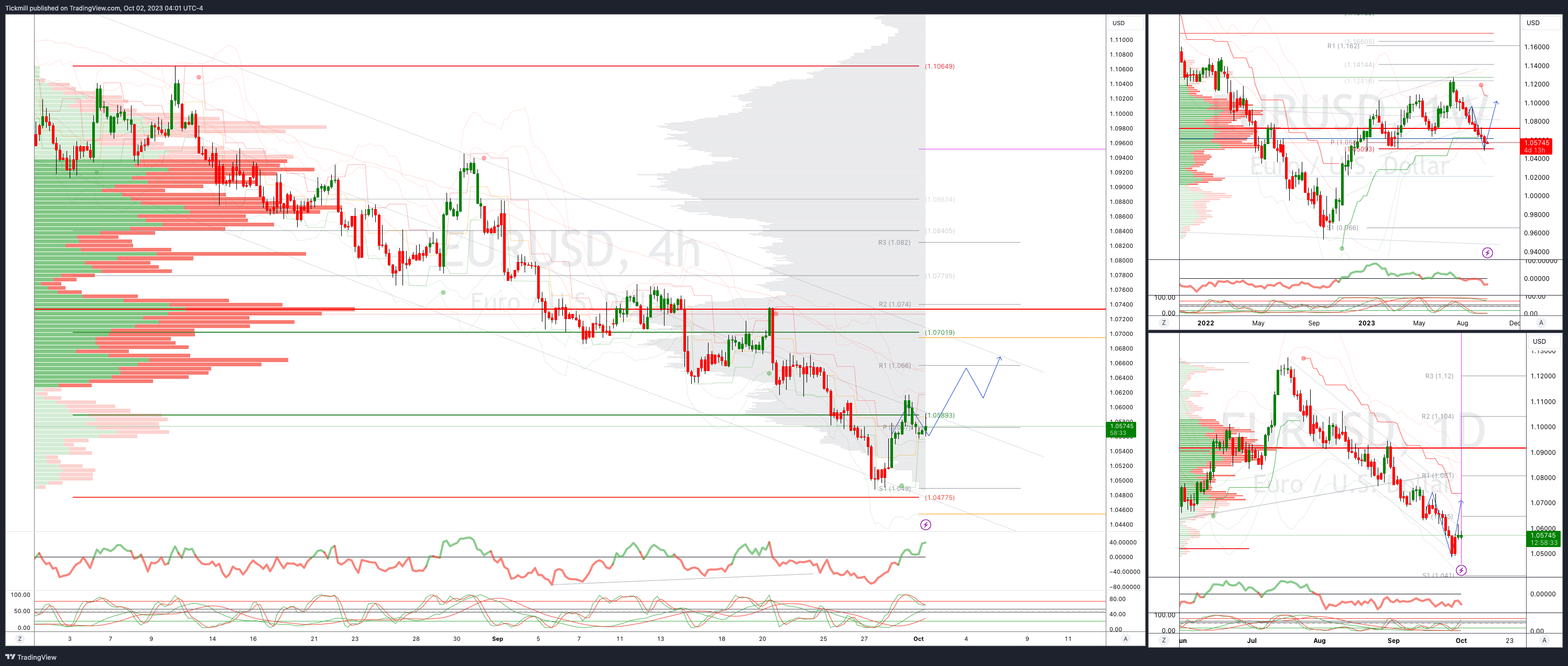

EURUSD Bias: Bullish Above Bearish Below 1.0610

Above 1.06 opens 1.0650

Primary resistance is 1.0760

Primary objective is 1.0477

20 Day VWAP bearish, 5 Day VWAP bullish

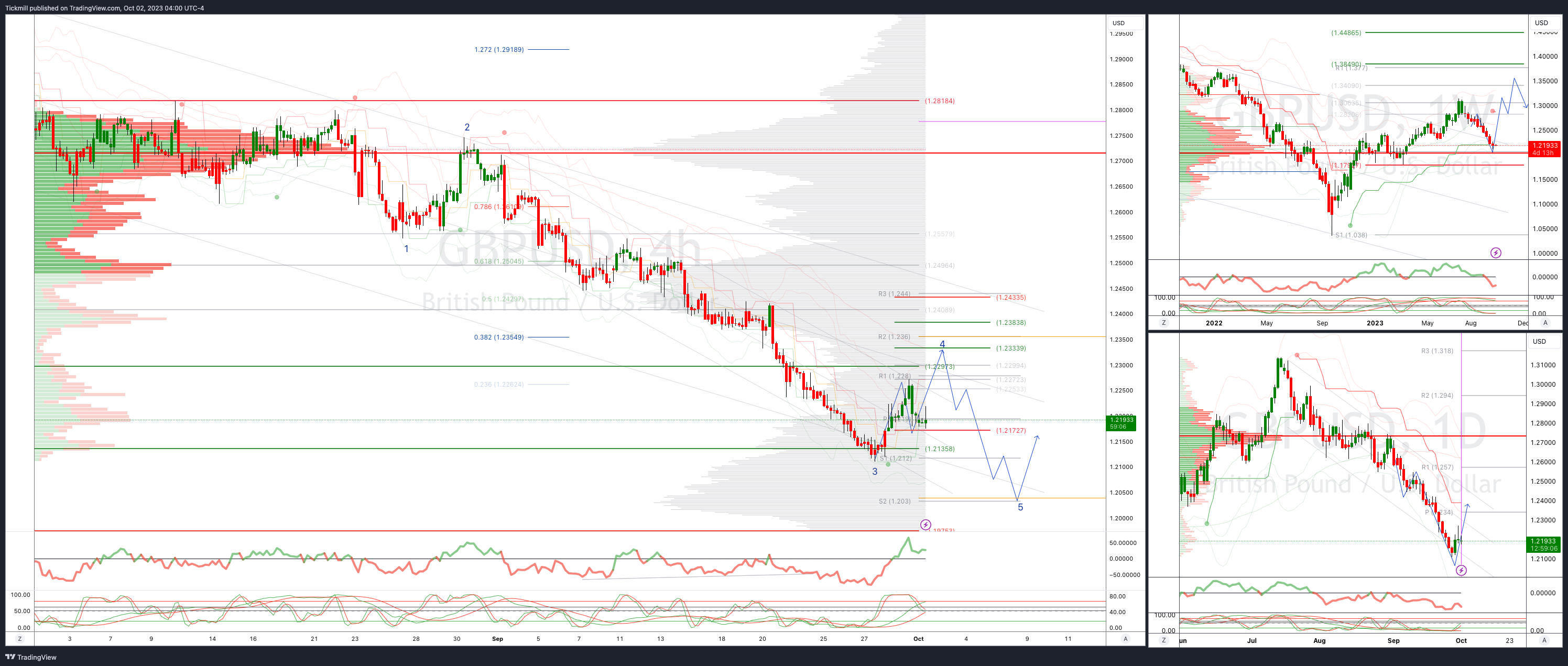

GBPUSD Bias: Bullish Above Bearish Below 1.22

Above 1.22 opens 1.23

Primary resistance is 1.2450

Primary objective 1.2060

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 148.50

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bearish

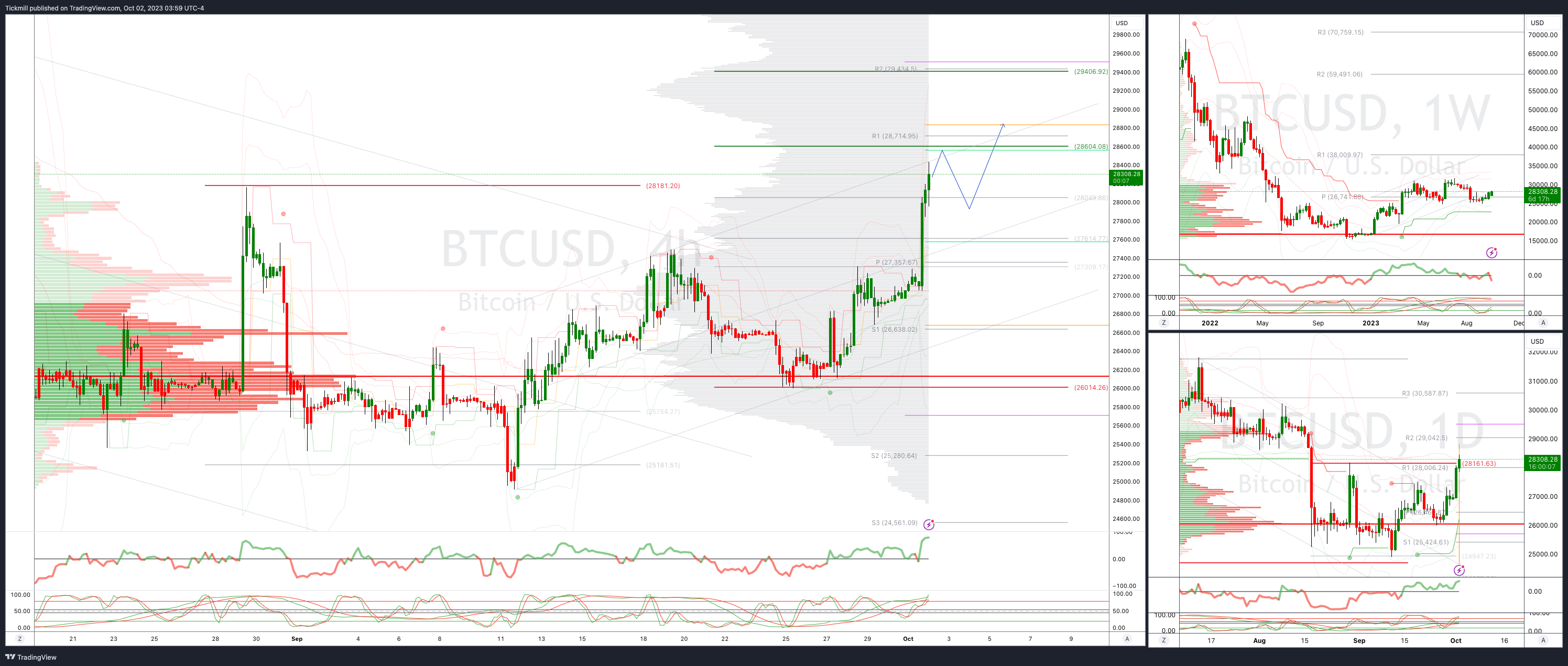

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28600 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!