Daily Market Outlook, October 12, 2023

Munnelly’s Market Commentary…

Asian equity markets saw gains, supported by Wall Street's rebound and dovish Fed commentary. The Nikkei 225 advanced following softer PPI data and dovish comments from BoJ Board Member Noguchi. Hang Seng and Shanghai Comp. were up, with Hong Kong leading the way by breaching the 18K handle. Chinese banks were bolstered by reports of China's sovereign wealth fund increasing its stake in domestic banks for the first time since 2015.

The latest UK GDP data indicated a modest 0.2% monthly rebound in August, mainly due to the unwinding of one-off factors that impacted July's 0.6% decline, such as inclement weather and high strike activity. Services output increased by 0.4%, while construction and industrial production fell. The data suggests Q3 growth may come in below the Bank of England's forecast of a small output rise.

The September US CPI report is the significant release today, with expectations for headline inflation to remain at 3.7%, driven by a rise in gasoline prices. Core inflation is expected to have fallen further to 4.1% from 4.3% in July, reinforcing expectations that the US Federal Reserve will leave interest rates unchanged at its November 1st monetary policy update.

In the UK, the Bank of England will release the latest Credit Conditions and Bank Liabilities surveys, offering insights into the impact of recent interest rates on loan demand and supply. Central bank speakers are scheduled for the day, with some tied to the semi-annual IMF-World Bank conference in Marrakech. BoE Chief Economist Huw Pill will discuss the macroeconomic policy outlook on a panel, while several Fed policymakers in the US may provide immediate assessments of today's CPI data for interest rates. The European Central Bank will release minutes from last month's policy meeting, where interest rates were raised for the 10th consecutive time, and the ECB hinted that it might be the last increase.

FX Positioning & Sentiment

Before the CPI release, it's crucial for FX traders to take oil price movements into account, in late September, Brent crude oil was trading around $98 per barrel. However, just before the Israel-Hamas conflict, its price had dipped to $83.44. The conflict initially led to a moderate increase in oil prices, with Brent peaking at $89.00 on October 9 before settling around $85.41 right before the CPI data release. Since then, oil prices have retraced a substantial portion of their earlier gains, currently hovering in the middle of their expected range. The support for oil prices comes from factors such as U.S. demand for the Strategic Petroleum Reserve (SPR) and the psychological significance of the $100 per barrel threshold. Cheaper oil generally bolsters the currencies of import-dependent countries like the euro (EUR), Japanese yen (JPY), Indian rupee (INR), and Chinese yuan (CNY). In contrast, it tends to undermine the currencies of major oil-exporting nations, including the U.S. dollar (USD), Mexican peso (MXN), Canadian dollar (CAD), Norwegian krone (NOK), Russian ruble (RUB), and Indonesian rupiah (IDR).

CFTC Data As Of 3-10-23

EUR net spec long falls to 78,943 in week to Tues from 98,399

Smallest EUR long since October

JPY short increases to 113,988 contracts from 109,512

AUD short 81,987 versus 86,815 previous week

GBP flips to short 6,680 from long of 15,669

First sterling short since April

CHF short jumps to 16,742 -- biggest since November -- from 9,115. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0500 (1BLN), 1.0550 (1BLN), 1.0575 (1.3BLN)

1.0590-1.0610 (2.6BLN), 1.0640 (1BLN), 1.0700 (769M), 1.0750-55 (3BLN)

USD/CHF: 0.9035 (660M), 0.9125 (375M), 0.9150 (256M), 0.9200 (217M)

GBP/USD: 1.2100 (456M), 1.2130 (850M), 1.2250 (250M)

1.2290 (200M),1.2325 (200M), 1.2450-60 (489M)

EUR/GBP: 0.8560 (294M), 0.8580 (210M), 0.8600 (530M)

0.8650 (354M), 0.8730-35 (1.1BLN)

AUD/USD: 0.6425-30 (1BLN), 0.6440 (619M)

NZD/USD: 0.5900-15 (544M), 0.6100 (267M). EUR/SEK: 11.40 (200M)

USD/JPY: 148.00 (856M), 148.50 (320M), 148.75-80 (1BLN), 149.00 (1BLN)

149.50 (820M), 149.70 (300M),

Overnight Newswire Updates of Note

In September, Federal Reserve officials adopted a more cautious stance due to increasing economic uncertainty.

According to Federal Reserve's Collins, the full impact of the Fed's rate hike cycle has yet to be felt by the economy.

Collins suggests the central bank may need to consider further rate hikes if economic data warrants it.

The Fed's combination of quantitative tightening (QT) and interest rate hikes may be capping long-term yields rather than spurring them.

President Biden issued a warning to Iran regarding the Gaza situation, and Israel has established an emergency war cabinet.

The G7 finance chiefs may engage in discussions about the potential risks stemming from the Middle East conflict, as chaired by Japan.

Bank of Japan's Noguchi highlights that wage growth momentum is a significant focus for Japan's economy.

Japan's Ministry of Finance's Kanda acknowledges that the Israel-Hamas conflict is impacting the markets and they are prepared to respond to developments.

A poll reveals that most Japanese firms expect China's economic slowdown to persist until 2025.

The United States will participate in a Beijing defence forum, indicating improving diplomatic relations.

Reports indicate that China has barred brokerages from accepting new mainland clients for offshore trading.

Chinese stocks experienced gains following state funds increasing their stakes in the 'Big Four' banks.

An ECB policymaker argues that China should commit to yuan convertibility rules.

According to the Bank of England's Dhingra, only a portion of the impact of rate hikes, around 20% to 25%, has been transmitted to the economy.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

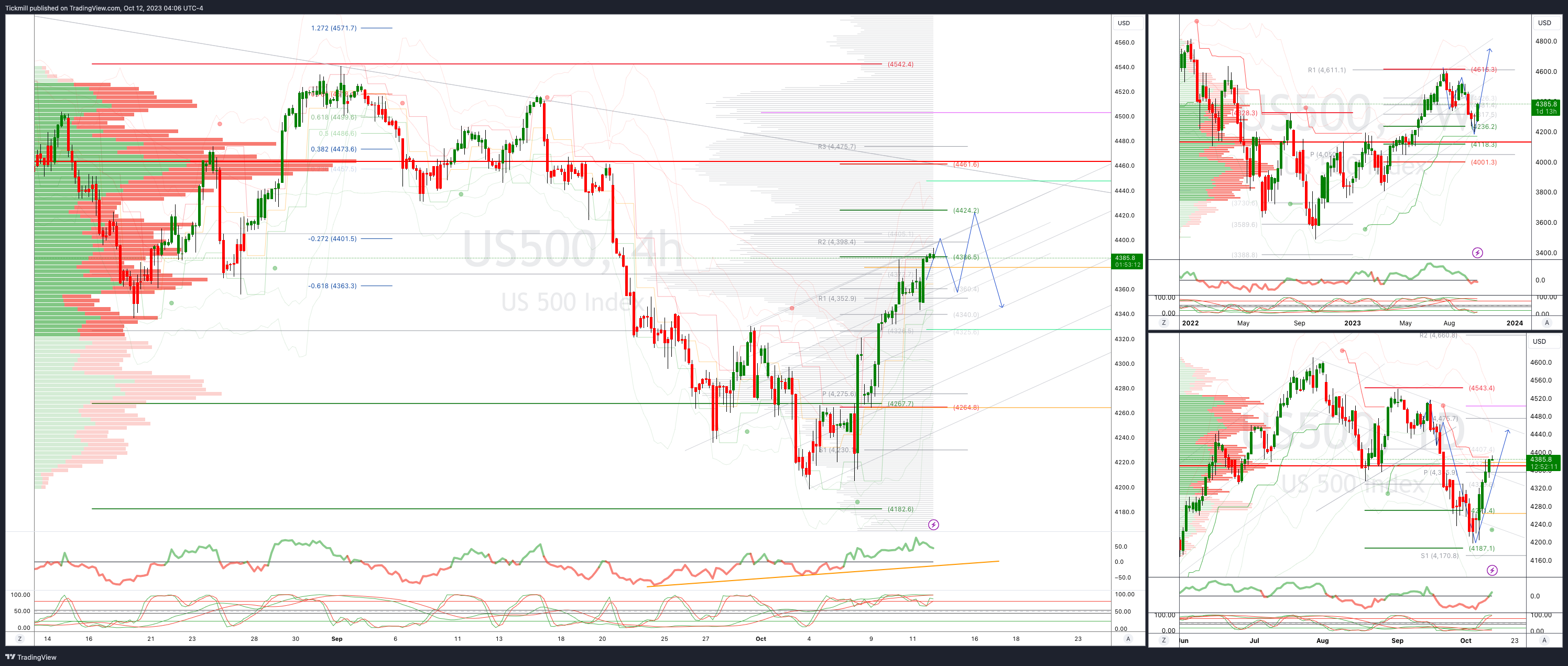

SP500 Bias: Bullish Above Bearish Below 4340

Below 4330 opens 4310

Primary resistance is 4450

Primary objective is 4424

20 Day VWAP bullish, 5 Day VWAP bullish

EURUSD Bias: Bullish Above Bearish Below 1.06

Below 1.06 opens 1.0570

Primary support is 1.05

Primary objective is 1.0680

20 Day VWAP bullish, 5 Day VWAP bullish

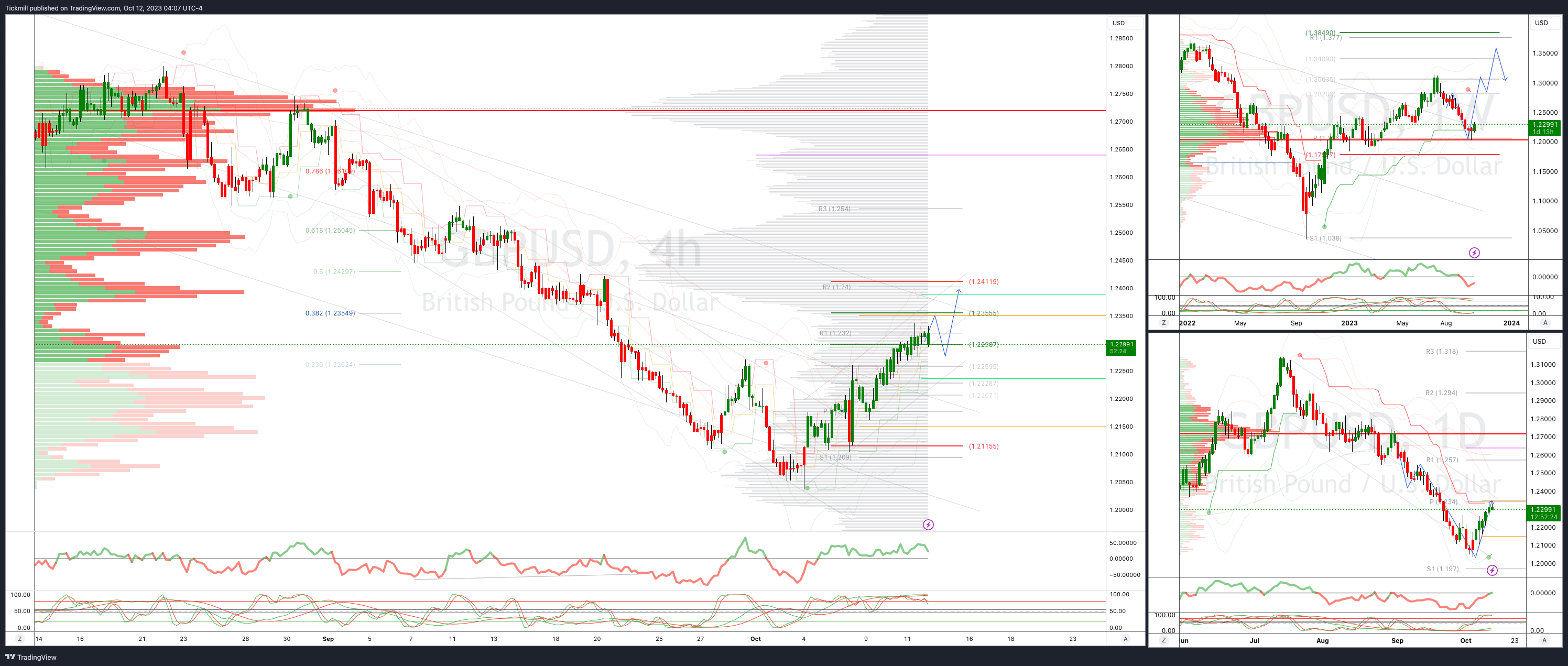

GBPUSD Bias: Bullish Above Bearish Below 1.2230

Below 1.22 opens 1.2150

Primary resistance is 1.2410

Primary objective 1.2350

20 Day VWAP bullish, 5 Day VWAP bullish

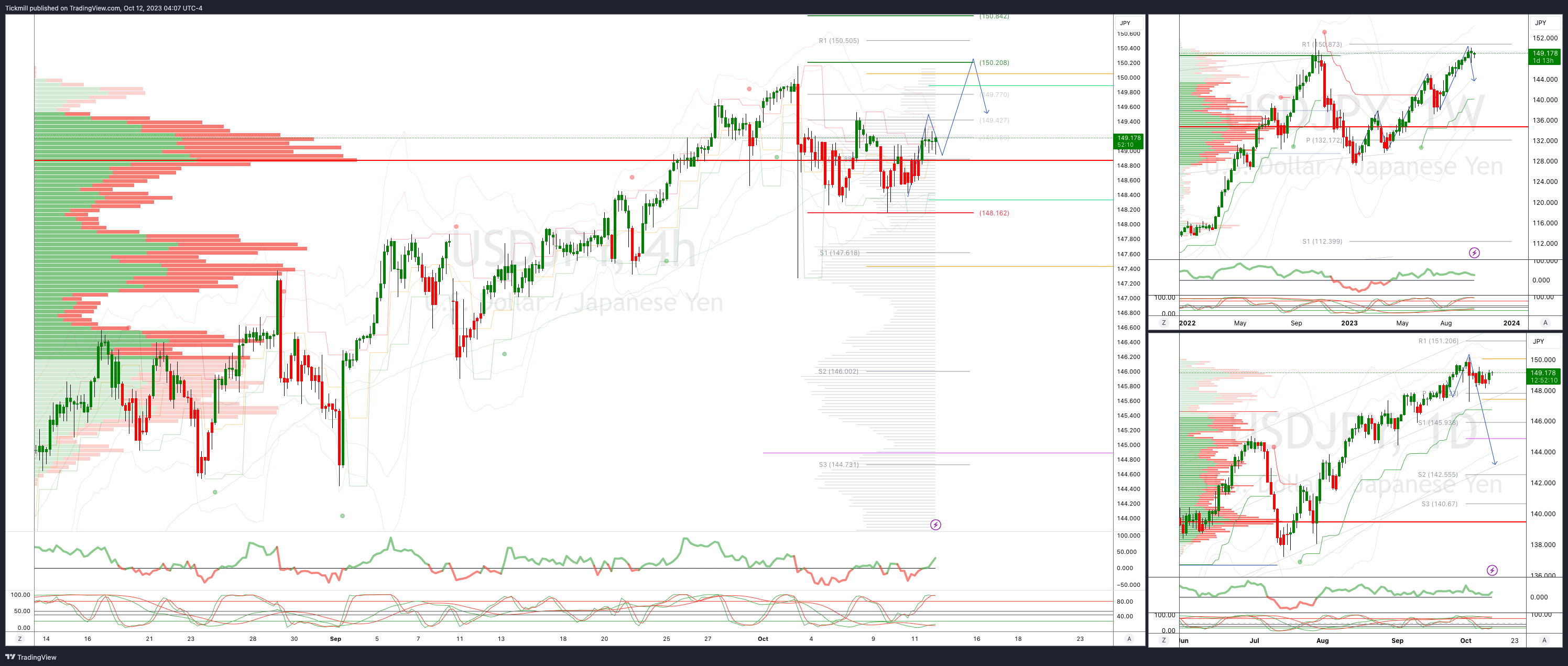

USDJPY Bias: Bullish Above Bearish Below 148.25

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150.30

20 Day VWAP bullish, 5 Day VWAP bullish

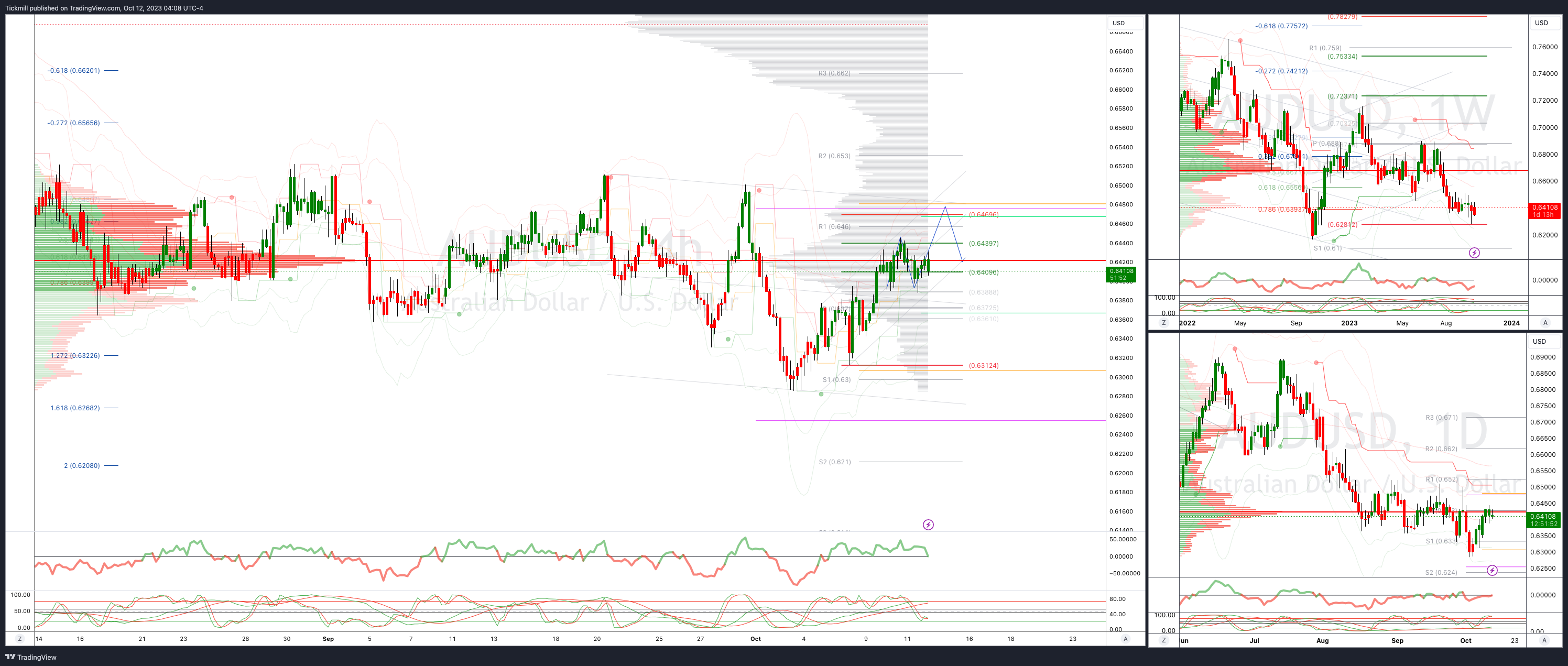

AUDUSD Bias: Bullish Above Bearish Below .6400

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28600 opens 30000

Primary resistance is 28175

Primary objective is 30000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!