Daily Market Outlook, October 11, 2023

Munnelly’s Market Commentary…

Asian equity markets followed the positive global sentiment driven by recent dovish comments from the Federal Reserve and optimism regarding potential stimulus measures in China. The Nikkei 225 gained, briefly surpassing the 32k handle. Hang Seng and Shanghai Comp. also traded higher, with expectations of increased financial support and possible stimulus measures in China, including a higher budget deficit for the year to achieve its growth target.

The highlight in the UK this week is tomorrow's release of monthly GDP data for August, expected to rebound after strike actions and adverse weather conditions led to a drop in July. The services sector, particularly consumer-facing services, is anticipated to benefit from improved weather conditions. Construction activity is also expected to be supported. The overall forecast suggests that the UK's economy is on track for 0.1% quarter-on-quarter growth in Q3, indicating a slowing but non-contracting economy. This morning the European Central Bank's consumer expectations survey, gauging Eurozone inflation risks, will be of interest, given recent actual inflation trends.

Stateside, focus is on the release of the Federal Open Market Committee (FOMC) minutes from the September policy meeting, where the Fed paused but hinted at a potential rate hike in Q4. Federal Reserve Chair Powell emphasised the central bank's cautious approach, taking into account robust economic growth and a tight labour market. Powell noted that while inflation remains above the 2% target, it has moderated somewhat. He mentioned that most policymakers believe another interest rate hike is probable, even though the markets are sceptical. Powell refrained from discussing the timing of potential rate cuts and suggested that the neutral rate may have increased in the short term, contributing to the economy's resilience. Additionally, the latest producer price inflation data will be closely monitored, particularly to assess the impact of rising energy prices on core inflationary pressures. September's core PPI is expected to edge up to 2.3% from 2.2%. The speakers scheduled for the day include Federal Reserve Governors Bowman and Waller, along with non-voting members Bostic and Collins, who are not part of the 2023 policy-setting committee.

FX Positioning & Sentiment

FX option implied volatility is on the rise as long U.S. dollar positions are trimmed in anticipation of Thursday's U.S. CPI data. This data has gained importance following last Friday's jobs report.

Shorter-dated implied volatility remains robust as it anticipates increased realised FX volatility post-CPI. There might be value in EUR/USD topside gamma if the CPI data shows a significant drop in U.S. inflation. However, broader EUR/USD options haven't yet reduced recent downside positioning or the volatility risk premium. USD/JPY one month implied volatility, which had been declining, has stabilised in the upper 8s due to increased realised volatility and geopolitical risk stemming from events in the Middle East. Recent pricing and trade flows indicate that the upside in USD/JPY may now be limited above 150.00, and traders remain cautious about intervention.

CFTC Data As Of 3-10-23

EUR net spec long falls to 78,943 in week to Tues from 98,399

Smallest EUR long since October

JPY short increases to 113,988 contracts from 109,512

AUD short 81,987 versus 86,815 previous week

GBP flips to short 6,680 from long of 15,669

First sterling short since April

CHF short jumps to 16,742 -- biggest since November -- from 9,115. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0500 (544M), 1.0520 (745M), 1.0600 (630M), 1.0700 (631M)

USD/CHF: 0.9000 (600M). GBP/USD: 1.2190-1.2200 (486M)

EUR/GBP: 0.8650 (400M). USD/CAD: 1.3540 (567M)

AUD/USD: 0.6450-55 (695M), 0.6475 (952M)

USD/JPY: 148.00 (419M), 148.20-25 (2BLN), 148.55 (728M)

149.00 (300M), 149.25 (410M), 150.40 (500M)

Overnight Newswire Updates of Note

Fed's Daly sees the risks of doing too much versus too little as "roughly balanced."

Fed's Kashkari suggests that "possible" higher bond yields mean the Fed can do less.

Kashkari sees the potential for a soft landing but acknowledges that risks remain.

A spike in Treasury yields casts a shadow over Biden and the Fed's hopes for a smooth return to normal.

U.S. bank profits are set to rise due to higher rates, while Wall Street lags behind.

A poll indicates that Japan's manufacturers' sentiment is weighed down by overseas risks.

Japan's bank clearing system faces glitches for a second day.

China's car sales accelerated in September, with exports rising by 50%.

China is set to host the Belt and Road forum in Beijing on October 17-18.

RBA's Kent notes that interest rates are working to slow demand and inflation, suggesting it's time to assess policy impact.

The Bank of England raises concerns over longer mortgages and the rise in credit card use.

The IMF warns that UK interest rates will likely need to stay high into 2024.

Israel prepares for a ground offensive, and President Biden condemns the "sheer evil" of Hamas attacks.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

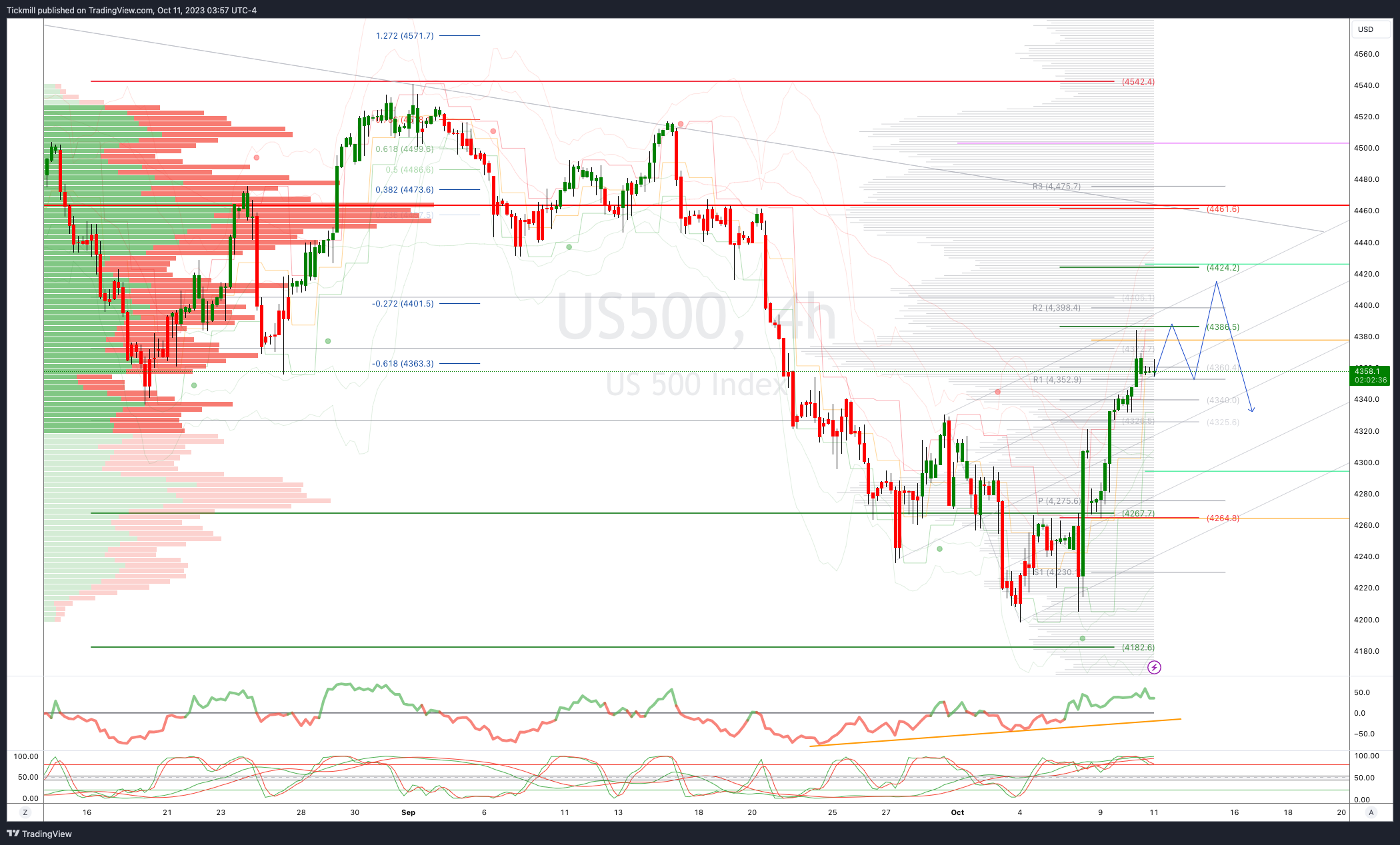

SP500 Bias: Bullish Above Bearish Below 4330

Above 4280 opens 4330

Primary resistance is 4450

Primary objective is 4386

20 Day VWAP bearish, 5 Day VWAP bullish

EURUSD Bias: Bullish Above Bearish Below 1.0488

Above 1.0610 opens 1.0650

Primary resistance is 1.0760

Primary objective is 1.0605

20 Day VWAP bearish, 5 Day VWAP bullish

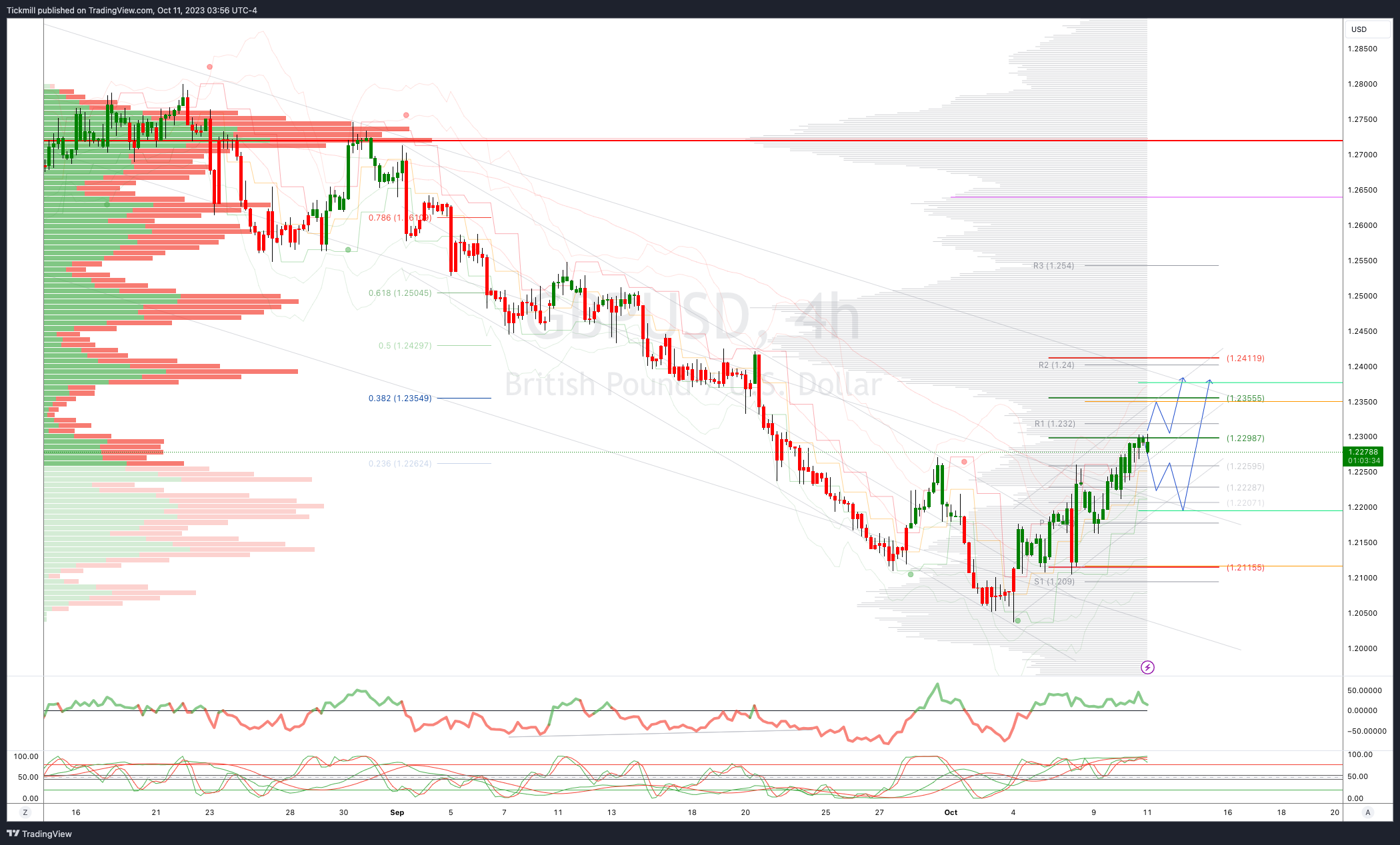

GBPUSD Bias: Bullish Above Bearish Below 1.2115

Below 1.21 opens 1.2037

Primary resistance is 1.2410

Primary objective 1.2298

20 Day VWAP bearish, 5 Day VWAP bullish

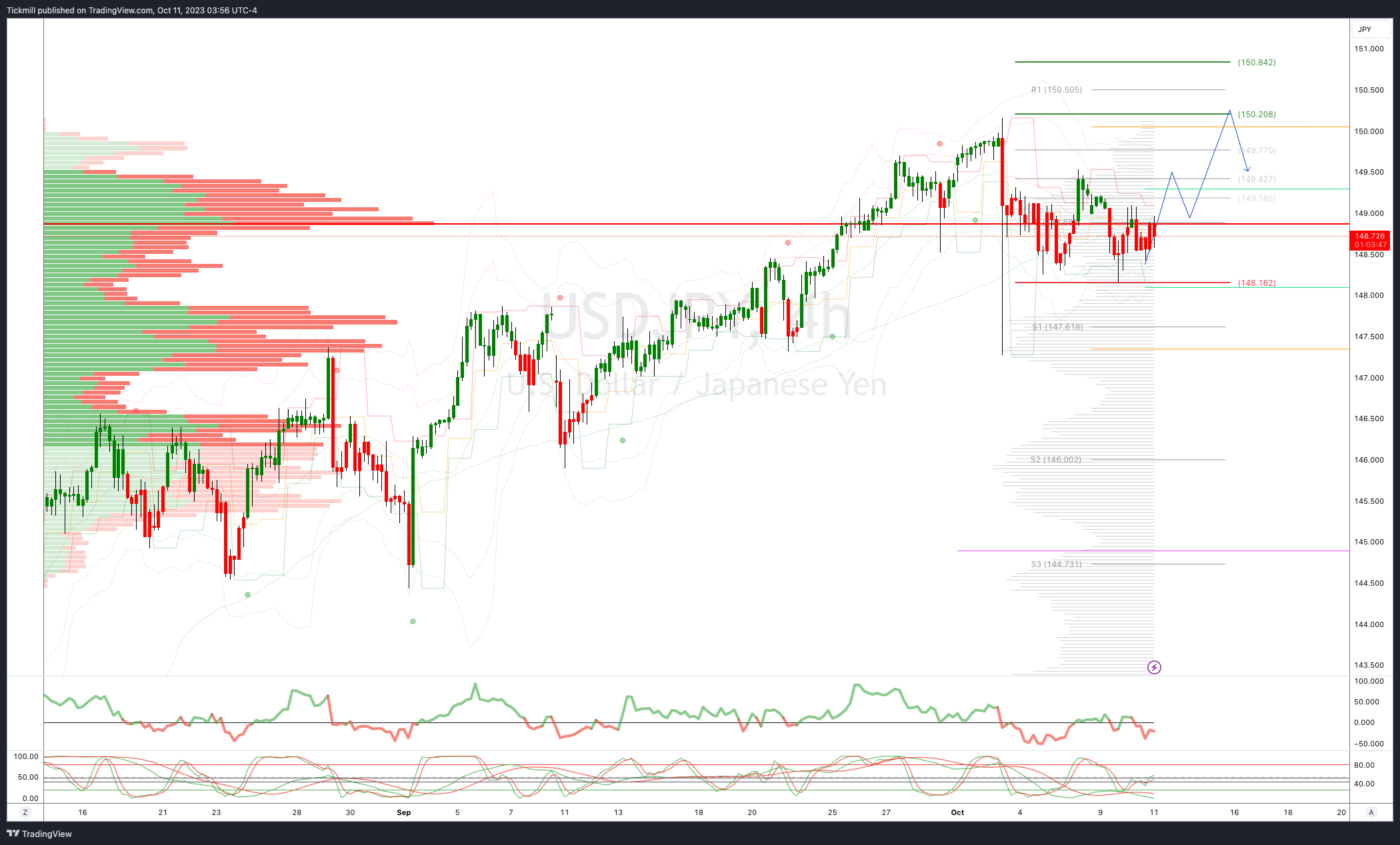

USDJPY Bias: Bullish Above Bearish Below 148.25

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150.30

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6400

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bullish

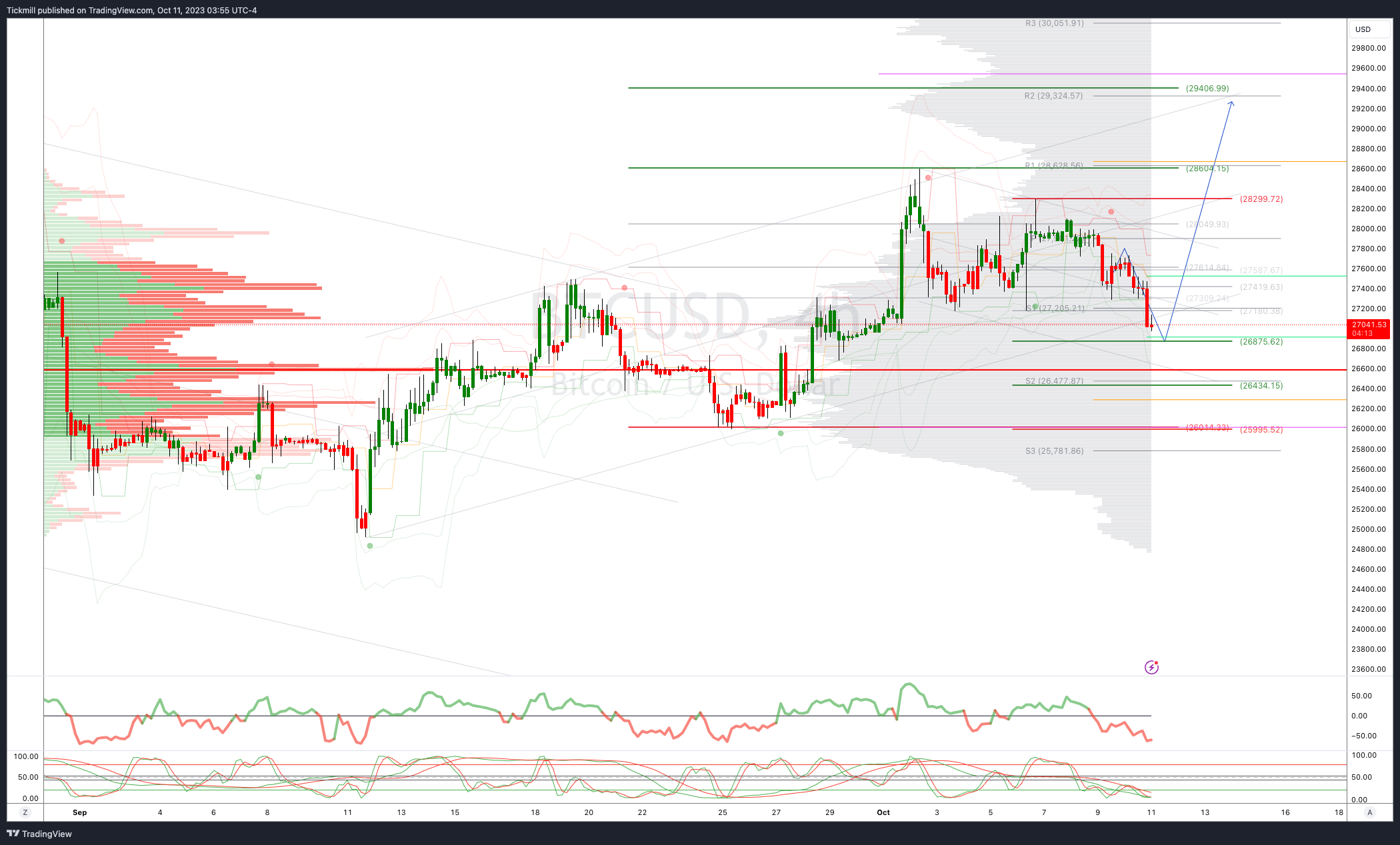

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28600 opens 30000

Primary resistance is 28175

Primary objective is 30000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!