Daily Market Outlook, May 30, 2024

Daily Market Outlook, May 30, 2024

Munnelly’s Macro Minute…

“Markets Jittery On US Yield Rise Ahead Of Auctions & Inflation Data”

Asian stocks and currencies fell on Thursday due to restrained risk appetite from US Treasury yields near this year's peak. The MSCI Asia Pacific Index dropped to a three-week low, with South Korea and Japan being the most affected. US stock futures contracts also declined in Asian trading. Hong Kong-based Chinese technology shares approached a technical correction. Treasury bonds fell across the curve following weak demand in the $44 billion auction of seven-year securities. Concerns increased about rising yields in an environment where the Federal Reserve is not rushing to lower rates to finance the US deficit.

With the absence of new significant market-moving events on Thursday the expectation of higher interest rates for a longer period of time is likely to continue, unless upcoming economic data proves otherwise. It is doubtful that the highly anticipated data releases at the end of the week, including euro zone inflation and the U.S. PCE report, will have a substantial impact on the global monetary policy outlook, particularly as inflation in major economies remains inconsistent. The unexpected increase in consumer prices in Germany has drawn more attention to the upcoming bloc-wide inflation data on Friday, which precedes the anticipated rate cut by the European Central Bank next week. Although a rate cut in June is widely expected, the lack of clear guidance from ECB policy makers on the extent and pace of future rate cuts is causing unease in the markets. As investors prepare for the important releases on Friday, market conditions are becoming increasingly nervous. The two-year U.S. Treasury yield is trading just shy of the 5% mark, while the 10-year yield also remains elevated compared to recent weeks. Although U.S. yield spreads compared to other countries may not be widening significantly in favor of the dollar, they are still wide enough to maintain the dollar as the preferred currency for investors.

Overnight Newswire Updates of Note

Fed’s Bostic Says Many Inflation Measures Moving To Target Range

RBA Sees Some Households Struggling, Suggesting Rate-Hike Limits

Australian Building Approvals Muted And To Stay Subdued All Year

New Zealand Building Permits Issuance Declines -1.9% In April

Fed’s Beige Book Points To Modest Growth In US Economy, Prices

Japanese Yen Appreciates As Traders Bet On Another Rate Hike By BoJ

Oil Steadies As Traders Look To OPEC+ Meeting, US Inventories

Salesforce Drops On First-Ever Single Digit Sales Growth Outlook

HP Reports Sales That Top Estimates On First PC Boost Since 2022

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0750 (1.4BLN), 1.0775-85 (1.6BLN), 1.0800 (1.2BLN)

1.0815-25 (2.6BLN), 1.0830-40 (1BLN), 1.0850 (2BLN)

USD/CHF: 0.9100 (353M), 0.9150 (310M), 0.9225-30 (480M)

GBP/USD: 1.2660 (547M), 1.2700 (300M), 1.2730-40 (430M), 1.2775 (518M)

EUR/GBP: 0.8500 (500M)

AUD/USD: 0.6525 (877M), 0.6560-80 (807M), 0.6600 (488M), 0.6625 (484M)

USD/CAD: 1.3695-1.3700 (1BLN), 1.3800 (247M)

USD/JPY: 156.00 (1.9BLN), 156.05-15 (1.4BLN), 156.50-55 (1.2BLN)

157.00 (800M), 157.50 (531M), 158.00 (891M)

EUR/JPY: 169.00 (549M), 169.70 (646M), 170.00 (730M), 170.25 (500M)

FX options with one-week expiry are now factoring in the risk from the European Central Bank (ECB) and Non-Farm Payrolls (NFP) data. The implied volatility indicates a risk-off sentiment and also recognizes the volatility risk. The implied volatility for EUR/USD 1-week FX options has increased by 1.0 to 5.9 since the ECB inclusion. Despite the broader FX risk-off boost, this increase is not significant. The market has already priced in a 25 basis points ECB cut for next Thursday. It is expected that further gains in 1-week implied volatility will reflect the NFP risk from Friday.

CFTC Data As Of 24/05/24

Japanese Yen net short position is -144,367 contracts

British Pound net long position is 1,053 contracts

Euro net long position is 41,475 contracts

Bitcoin net short position is -890 contracts

Swiss Franc posts net short position of 40,645 contracts

Equity fund managers raise S&P 500 CME net long position by 25,714 contracts to 946,576

Equity fund speculators increase S&P 500 CME net short position by 38,575 contracts to 317,912

Gold NC Net Positions: $229.8K vs $204.5K

Technical & Trade Views

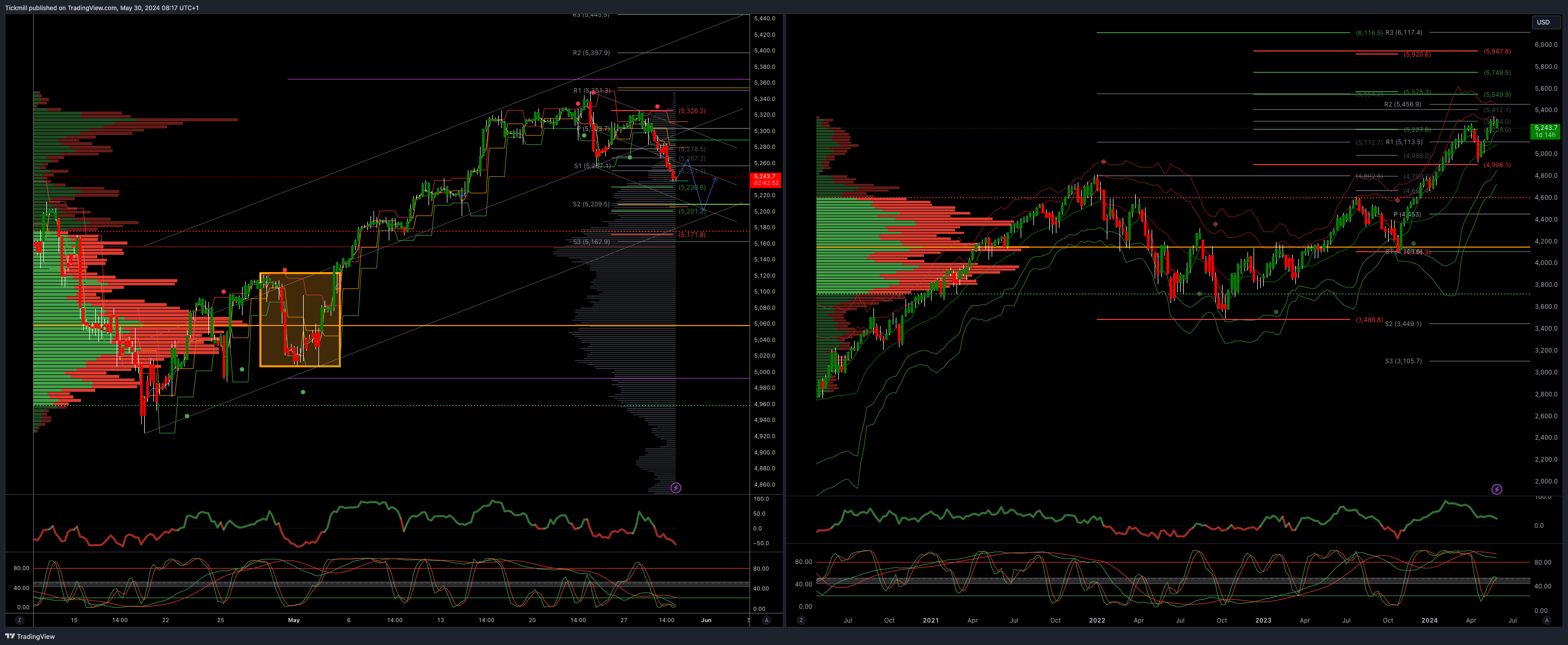

SP500 Bullish Above Bearish Below 5270

Daily VWAP bearish

Weekly VWAP bullish

Below 5230 opens 5190

Primary support 5190

Primary objective is 5379

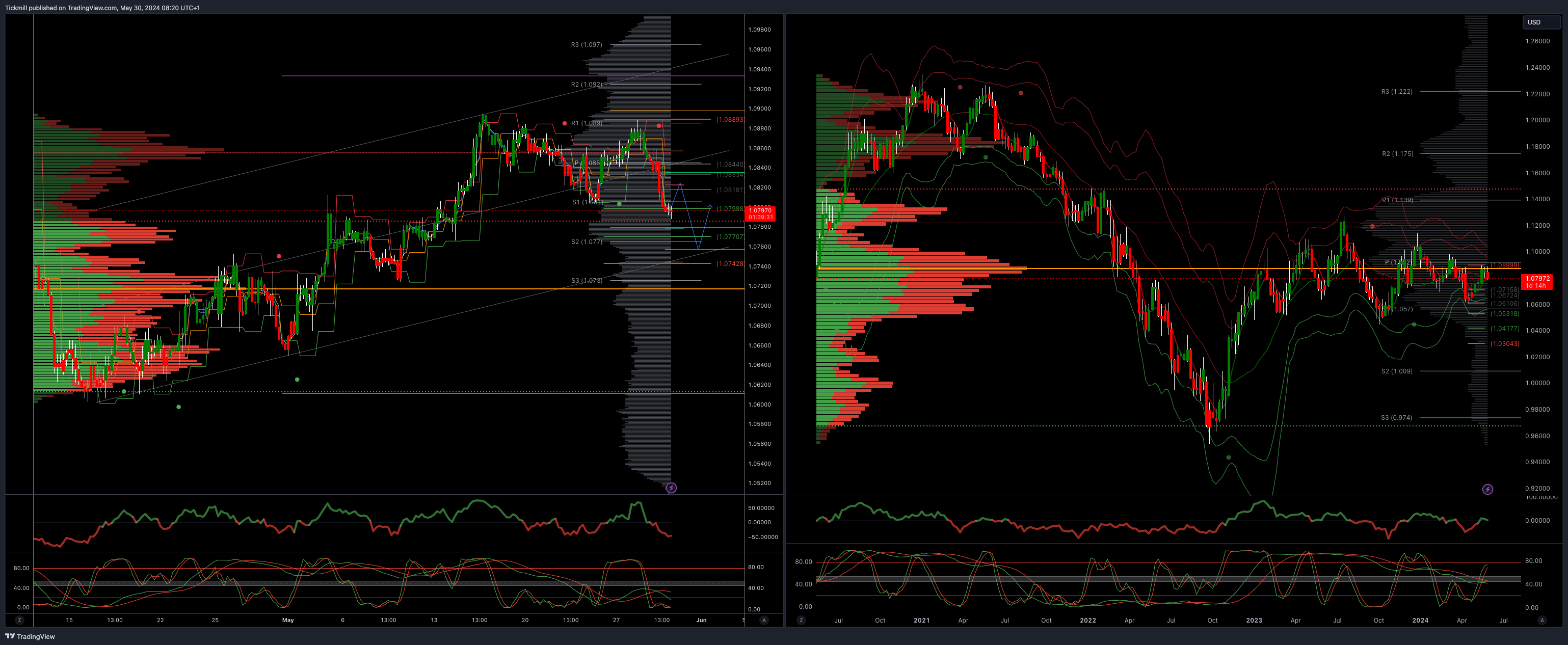

EURUSD Bullish Above Bearish Below 1.0830

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

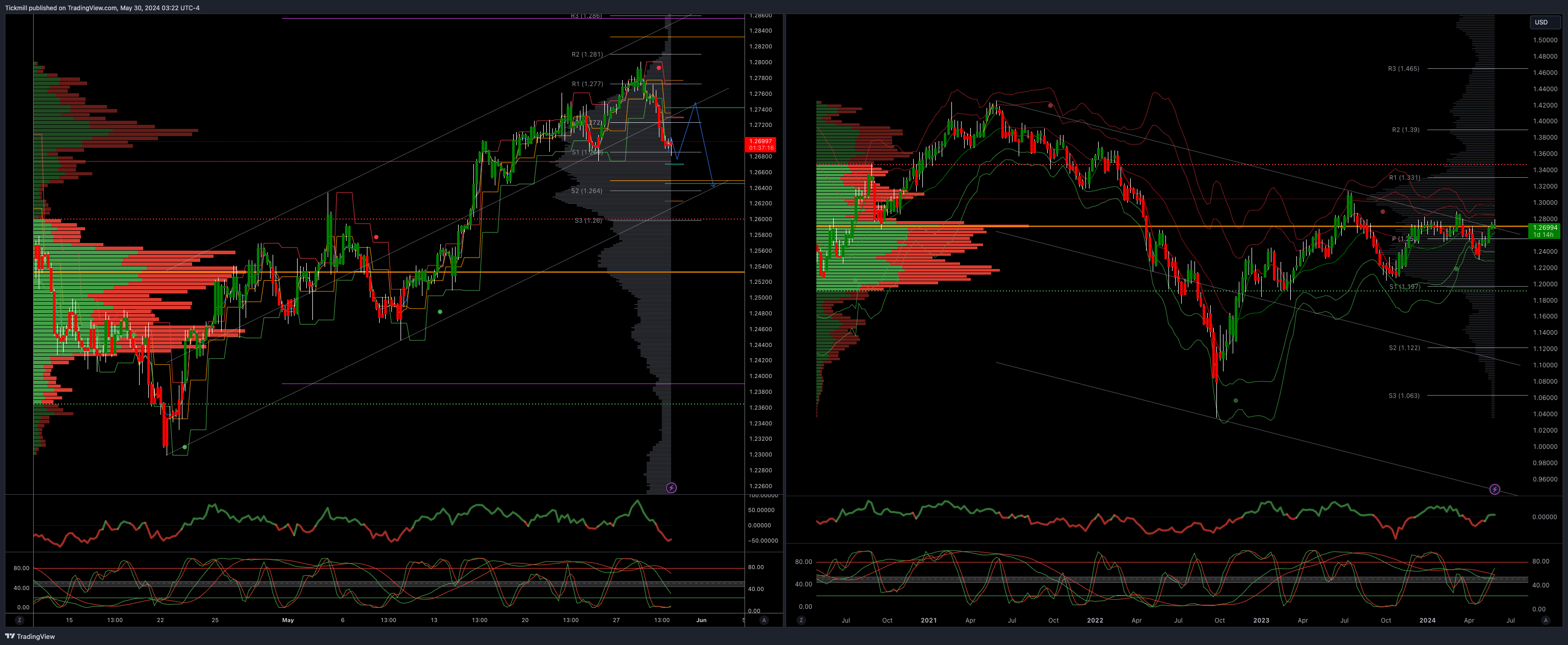

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2780 TARGET HIT NEW PATTERN EMERGING

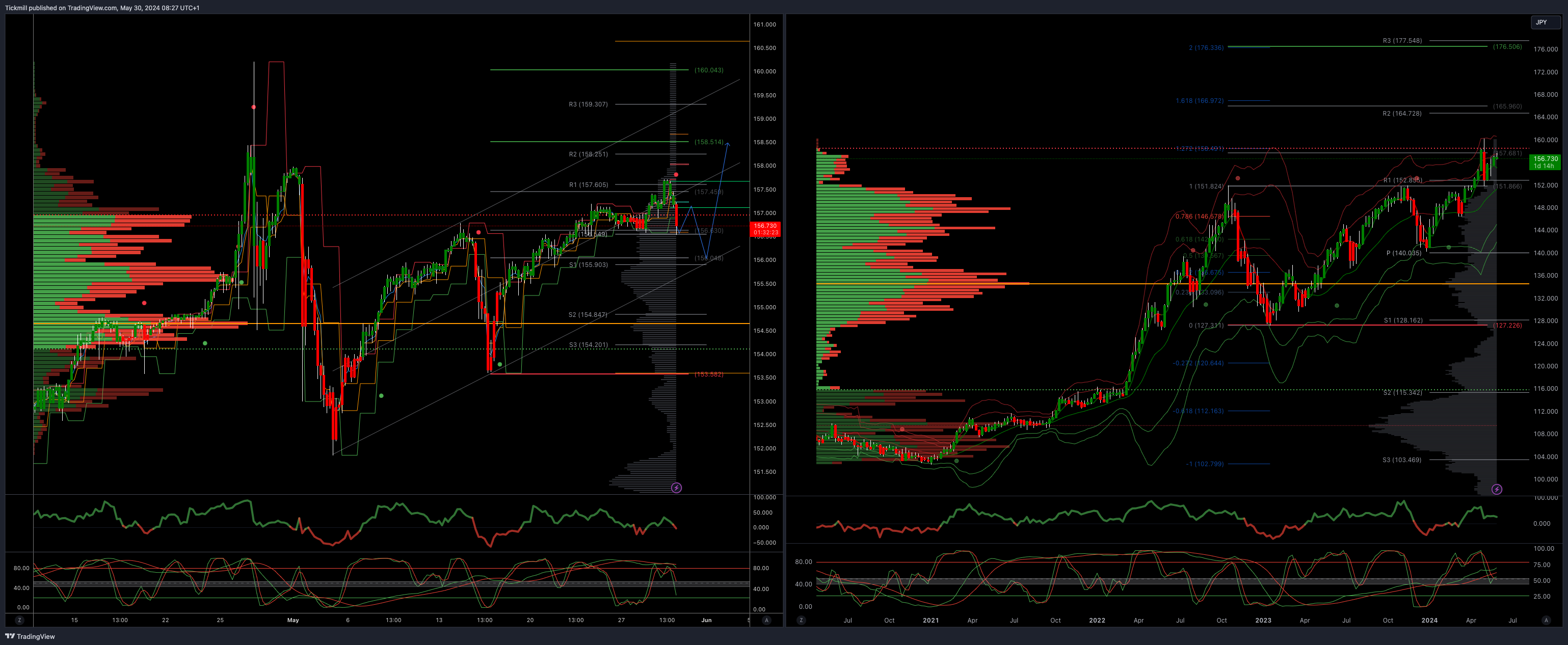

USDJPY Bullish Above Bearish Below 156

Daily VWAP bullish

Weekly VWAP bullish

Below 156 opens 154.50

Primary support 152

Primary objective is 165

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2239 Below 2300

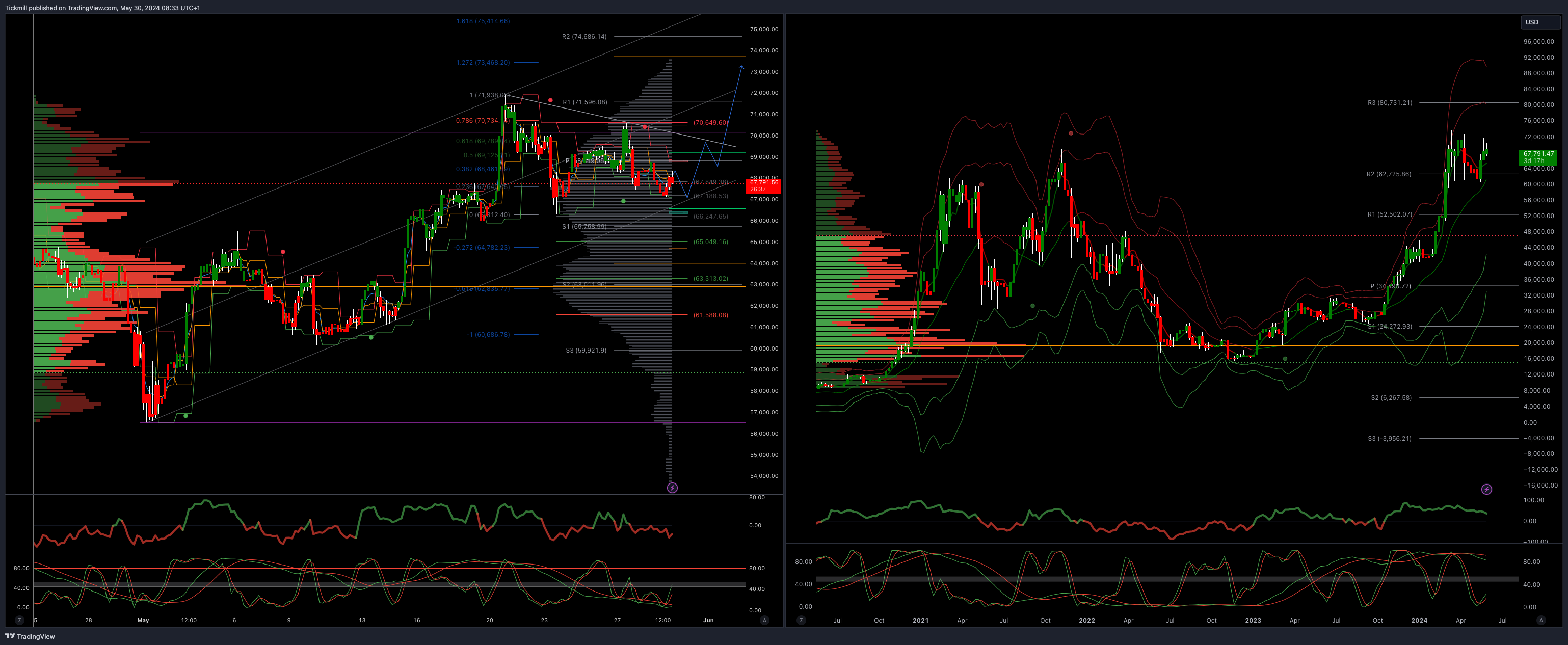

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bearish

Weekly VWAP bullish

Below 67000 opens 65500

Primary support is 65000

Primary objective is 73400

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!