Daily Market Outlook, May 17, 2021

Daily Market Outlook, May 17, 2021

A number of Asian equity markets were trading lower overnight, as rising virus cases and a stepping-up of lockdown measures weighed on sentiment. Notably, schools in Singapore are set to close again from Wednesday, while dining out and social gatherings are also set to be restricted. Additionally, restrictions across Japan were extended to include more regions, while Taiwan has imposed its strictest restrictions thus far during the pandemic, with masks now required outdoors. Equities in China, however, advanced as expectations of further policy support rose following the release of weaker-than-expected activity data reports for April.

Despite rising cases of the Indian variant of Covid-19 in the UK, a further easing in lockdown restrictions is due to take place across the country today. The latest relaxation will provide welcome support for those areas of the economy most impacted by restrictions since the onset of the pandemic. Notably, pubs and restaurants will be allowed to serve indoors, while large parts of the arts and entertainment sector will also be allowed to resume operating, including cinemas, outdoor sports venues and children’s play areas. Under the government’s roadmap, the earliest that the next stage of loosening would take place is the 21st June, at which point all legal restrictions on social distancing would be removed. While the UK government has suggested that the country remains on track for such an outcome, a number of officials have also highlighted the potential for the Indian variant to force a change of course. In response, the government is putting in place measures to speed up the delivery of vaccines, alongside surge testing in order to combat its spread.

Ahead of a busy week for key UK data releases, today’s calendar represents something of a lull. Nevertheless, US surveys in the shape of the NAHB housebuilders’ survey and the Empire State manufacturing survey should provide some useful insights into current trends. Both are for May and are expected to show activity remaining buoyant. However, the key focus is likely to be on signs that supply chain issues and rising commodity prices could disrupt the economic recovery. Fed members Clarida and Bostic are due to participate in a discussion this afternoon at the Atlanta Fed’s 2021 Financial Markets Conference, with the outlook for inflation likely to be a key topic of discussion.

Overnight, GDP data from Japan is expected to show that the economy contracted in Q1, reflecting the impact of emergency measures put in place to control the spread of Covid-19. Meanwhile, the latest UK labour market report is expected to show the three-month rolling measure of employment change flip back into positive territory, reflecting increased demand for labour as restrictions began to be lifted in March. In the three months to March, look for the unemployment rate to have dipped again, while measures of annual pay growth are expected to have picked up as workers returned from furlough.

CFTC Data

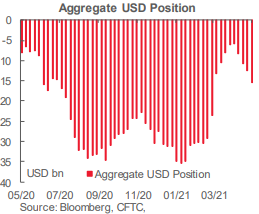

Net CAD Longs Advance Again; USD Sentiment Weakens Data covers up to Tuesday May 11 and were released on Friday May 14.

IMM data for the week through Tuesday May 11th showed a further fourth consecutive increase in aggregate USD shorts, which rose a little shy of USD3bn to USD15.4bn, the biggest bearish bet on the USD since early March.

Speculative accounts have finally jumped on the CAD bullish bandwagon in a more meaningful way in the past couple of weeks. Negative sentiment persisted for much of the CAD’s recovery from its low point last March and net positioning only flipped to—modestly—net long around the turn of the year. Indeed, net CAD longs advanced the most since December over the past week, rising just over USD1bn to USD3bn. Gross CAD longs have risen significantly in the past two weeks and are now are now at the highest since late 2019. Positioning is elevated but not excessive.

Net CAD longs now represent the second-largest single currency bet against the USD after the EUR ; net EUR longs rose USD1.5bn to USD14.26bn while net GBP longs rose a more modest 768mn to USD2.49bn. The shifts in positioning in the CAD, EUR and GBP account for the bulk of the increase in bearish sentiment on the USD this week.

Positioning in the AUD remains flat and was little changed on the week; net NZD longs changed even less over the week and overall positioning also reflects little real conviction. Net MXN shorts effectively doubled this week but sentiment also remains broadly flat.

CHF sentiment deteriorated mildly, with net shorts totaling USD394mn, from virtually zero last week. Speculative accounts remain bearish on the JPY (with net positioning here at USD4.8mn providing some counterweight to the generally bearish USD sentiment) but the net change this week of just USD58mn was the smallest week/week change amongst the major currencies. Note that outside of the currencies, net gold longs rose USD4.95bn.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.2120 (635M), 1.2150 (1.9BLN), 1.2155 (236M)

USD/CHF: 0.9050 (200M)

GBP/USD: 1.4000 (282M)

AUD/USD: 0.7755-60 (1.4BLN)

USD/JPY: 108.80-85 (470M), 109.25 (270M), 109.90-110.00 (370M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.2120 bullish above

EURUSD From a technical and trading perspective, the close through 1.2120 is constructive but bulls must defend 1.21 to set up a test of 1.2240/50. Failure to find sufficient support at 1.21 would suggest a false upside break opening a retest of 1.2050.

Flow reports suggest topside offers through the 1.2160 area and increasing into the 1.2200 level with weak stops likely to be absent and congestion through to the 1.2220 level before hopping any possibility of testing the highs of the year through 1.2300 and stronger stops still likely to slow any further movement. Downside bids light through to the 1.2020 area and then stronger bids starting to form in the area, weak stops on a move through the 1.1980 area opening a chance of a quick break back to the 1.1900 level before stronger bids appear.

GBPUSD Bias: Bullish above 1.40 bearish below

GBPUSD From a technical and trading perspective, as 1.3960 now acts as support, bulls will target a retest of 1.4230’s. Only a close back below 1.40 would concern the bullish thesis.

Flow reports suggest downside bids through the 1.4000 level quickly run into weak stops and congestive bids competing through to the 1.3950 area and increasing bids from there to the 1.3900 level and stops then beyond the area opening a deeper move, topside offers through to the 1.4150 level and increasing into the 1.4200 level with weak stops likely on a push through Feb’s highs around the 1.4220 area. Opening the market to the next leg through to the 1.4400 area.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as 107.50 acts as support there is potential for a test of the pivotal 108.50, through here will open another look at 110.

Flow reports suggest downside bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, topside offers through to the 110.00 level with light congestion through the figure level and weak stops possibly limited and stronger offers likely increasing on a move higher towards the 111.00.

AUDUSD Bias: Bearish below .7790 bullish above

AUDUSD From a technical and trading perspective, as .7790 now acts as support bulls will target a retest of prior cycle highs above .80 cents. The breach of .7790 refocuses attention on the downside as .7820 contains upside attempts, look for a test of .7680.

Flow reports suggest topside offers light through to the 0.7880 area and likely to be strong offers continuing through to the 0.7920 area before weak stops appear and the market then running into further resistance once it starts projecting through the 0.7960 area with increasing offers the closer to the significant sentimental levels into 80 cents, downside bids into the 0.7700 area and weak stops on an extension through the 0.7680 area but quickly running into supportive bids into the 0.7650 area and continuing through to 0.7600 level with some possibly decent bids mixed with weak stops

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!