Daily Market Outlook, March 29, 2021

Daily Market Outlook, March 29, 2021

US equities ended higher on Friday, as markets digested news of high-volume sales through block trades ahead of the weekend. Credit Suisse warns in pre-market statement of a “highly significant” hit to to its first-quarter results, after it began exiting positions with a large U.S. hedge fund that defaulted on margin calls last week Risk sentiment has been mixed during the Asian trading session and US equity futures are lower. US Treasury yields eased, while oil prices are also down on news that the container ship stuck in the Suez Canal has been partially refloated. In other news, the US said that it is not ready to lift tariffs on Chinese imports.

The economic calendar is relatively light this week in the run-up to Easter. The highlight from a global perspective is likely to be (Good) Friday’s US payrolls, for which the consensus predicts a rise of more than 600k. Most markets, though, will be closed on that day. Also in focus is US President Biden’s infrastructure plan, expected to be unveiled on Wednesday.

Markets will also continue to focus on Covid-19 news. A further modest easing in restrictions will occur in England today (including the rule of 6 or two households mixing outside). That in itself will probably have little economic impact but, with more significant moves scheduled for April, and May the impact of next week’s changes on the reported number of Covid-19 cases (now plateauing rather than falling) will be watched closely. In Europe, the situation is becoming very worrying, with cases accelerating in Germany and France, and concerns that the third wave will “wash up on our shores” (to quote PM Johnson). German Chancellor Merkel may reportedly assert federal control to stem the rise in infections, underlining the seriousness of the situation.

Today’s Bank of England credit money supply and lending data will attract some attention. Consumer credit is expected to have contracted again in February, while the number of mortgage approvals is forecast to remain high at around 95k. The Lloyds Business Barometer for March, due early tomorrow morning, will provide further insight into business confidence. Last month’s reading was the highest since March 2020. As there have been further positive developments since then, including the start of the easing of restrictions and the extension of the government’s support measures for business, markets may look for further improvement.

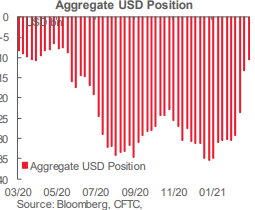

CFTC Data

This week’s CFTC data showed a fourth consecutive decrease in the aggregate USD short position in the currencies that we cover, albeit with a much smaller decline than in the previous week. Speculative accounts pared the net bearish bet on the dollar by USD2.5bn (vs. USD10.4bn last week) with most of the positioning shift taking place in JPY contracts. The net dollar short sits at its lowest point since last June at USD10.6bn from as high as USD35.4bn just ten weeks ago.

Speculators extended their replenished bet against the JPY with a weekly net bet against the yen of USD1.6bn following last week’s USD5.3bn increase (the largest week-on-week move against the JPY since 2011). The net JPY short of 53k contracts is just shy of last Feb’s high of 56.4k contracts which swung to as high as a 50k contracts net bullish position in early-2021. The JPY is the worst performing currency among those tracked in this report year to-date, with a 5.8% decline.

Investors trimmed the net GBP long for a third consecutive week as the currency falls off multi-year highs in late-Feb. The USD608mn reduction in the GBP’s long represents the second largest bearish move in the currencies that we cover after the move seen in the JPY position. The EUR saw its first net long increase in six weeks, with the USD436mn w/w bullish bet only undoing about a quarter of the previous week’s bearish move (USD1.8bn)

Net CAD longs were halved by USD419mn to their lowest level (USD405mn) since the position flipped from a net short in mid-Dec. The move was mainly the result of a reduction in long contracts. The CAD’s commodity peers saw only moderate changes in their respective positions versus the USD, with the AUD and NZD net longs declining by similar amounts (USD 137mn and USD103mn). The net MXN short was reduced by USD213mn to about USD500mn—around its biggest net short position since March 2017

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1700-15 (610M), 1.1800 (367M), 1.1935 (1.1BN)

USD/JPY: 108.70-75 (1.9BN), 108.95-109.10 (671M)

AUD/USD: 0.7700-05 (519M)

EUR/GBP: 0.8585-90 (1.2BN), 0.8600 (677M), 0.8605-10 (840M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the failure to recapture 1.20 on the upside leaves the 1.1830 lows exposed, through here bears will press for a test of the yearly pivot at 1.1720.

Flow reports suggest light offers through the 1.1800 area with weak stops on a move through the 1.1820 area with limit with light offers then running through the 1.1840-60 area before stronger offers start to appear on a test through the 1.1880 level and stronger through the 1.1900 area. Downside bids into the 1.1740-50 area and then increasing on a dip through the 1.1720-1.1680 level with congestion through to the 1.1600 area.

GBPUSD Bias: Bullish above 1.3750 bearish below

GBPUSD From a technical and trading perspective, the loss of 1.3750 is a significant development opening a move to test a corrective equality objective 1.3550, only a close back through 1.39 would suggest the correction lower is complete.

Flow reports suggest downside congestion around the 1.3660-40 area with stronger bids on any push towards the 1.3600 level and weak stops likely on a dip through opening to a deeper move, Topside offers through light through to the 1.3800 level with congestion through to the 1.3850 area before opening up to light offers and weak stops through the 1.3900 level and then stronger congestion.

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 108.30 continues to attract demand bulls will target a test of pivotal 109.85 ahead of the yearly R1 pivot at 110. UPDATE...upside objective achieved look for any initial foray through 110 to prompt a profit taking pullback to retest bids to 108.50

Flow reports suggest topside congestion is likely to soak up some of the weak stops above the 110.00 and like the previous spikes at the beginning of last year any move is likely to find resistance above and continuing through the 110.20 with break out stops likely to be a little more nervous, downside bids light through to the 108.00 level with weak stops on any retrace through the 107.80 level and opening a dip to the 106.00 area possible over the coming week

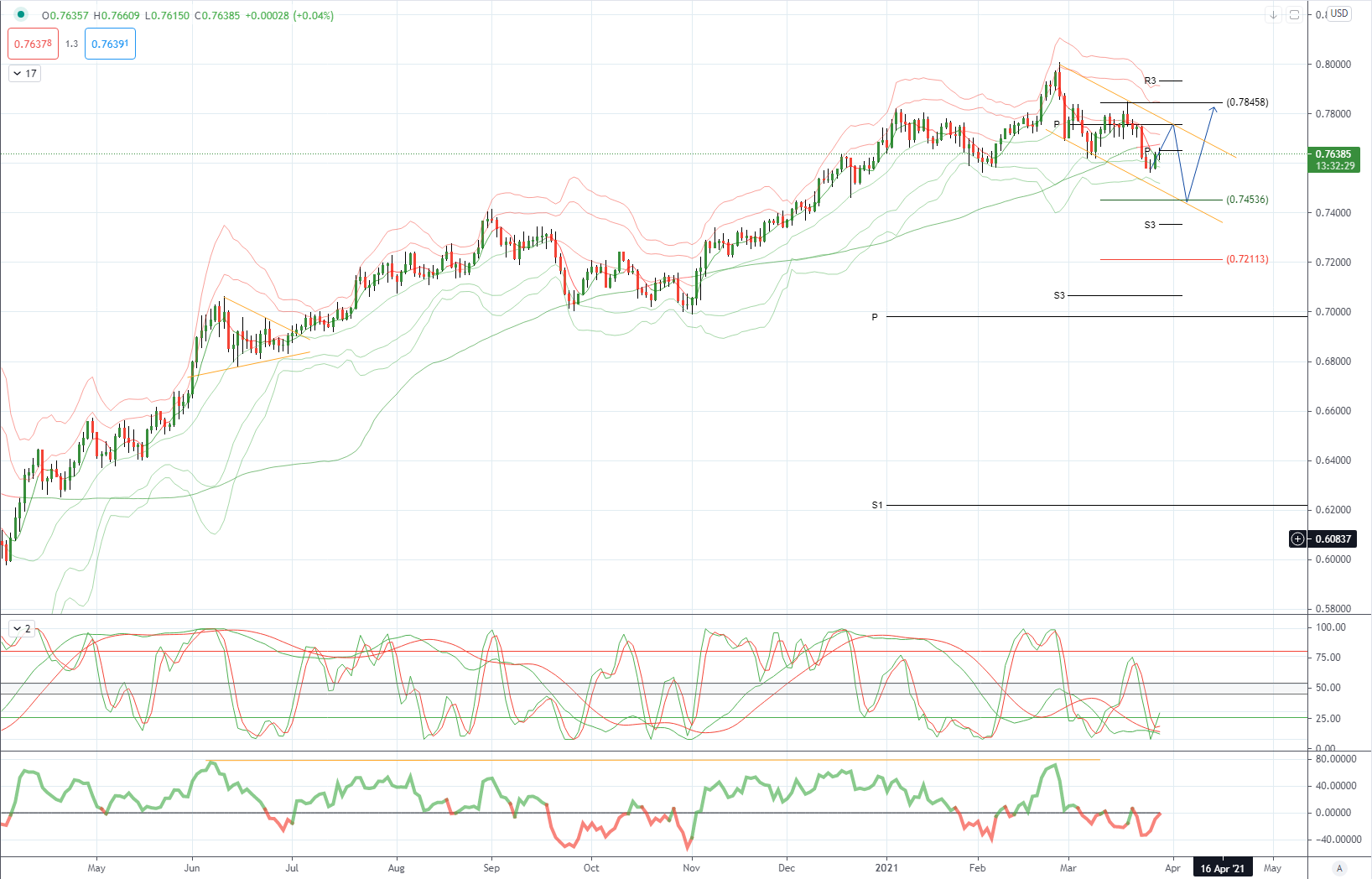

AUDUSD Bias: Bullish above .7560 bullish targeting .8200

AUDUSD From a technical and trading perspective, as .7820 contains upside attempts there is potential for a head & shoulders pattern to develop, a loss of pivotal .7560 would open a move to test trend support at .7400 next

Flow reports suggest light topside offers through to the 0.7700 area with weak stops on a move above the 0.7720 area Then stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!