Daily Market Outlook, March 26, 2024

Daily Market Outlook, March 26, 2024

Munnelly’s Macro Minute…

“Markets Mixed On Rates Outlook, Nikkei Pullback Persists”

On Tuesday, Asian stock markets are experiencing a mix of trading activity, influenced by the overall negative performance of Wall Street the previous day. Traders appear hesitant to make substantial moves as they await the release of important economic data, such as US inflation numbers on Friday. Most Asian markets ended lower on Monday. The US Fed has indicated a possibility of three rate cuts this year, while the European Central Bank and the Bank of England are also anticipated to lower interest rates in the near future. Continuing from the declines in the last trading day, the Japanese stock market is slightly down in volatile trading on Tuesday. The Nikkei 225 has dropped below the 40.4K handle, influenced by the overall negative performance of Wall Street yesterday. The losses in index heavyweights and financial stocks are somewhat balanced out by gains in exporters and technology stocks.

Today's economic calendar lacks significant UK data, shifting the focus primarily to the United States. Monthly durable goods orders will offer insights into the factory sector's activity. Recent survey data has hinted at a potential leveling off in manufacturing activity, with the PMI index remaining above the 50 expansion threshold for the third consecutive month in March, albeit the ISM index still remains below 50. Durable goods orders, often seen as a leading indicator for the more cyclical segments of manufacturing, have predominantly indicated a continued decline in output. Much of this downturn can be attributed to the volatile transport sector, particularly Boeing orders. However, orders for other durable goods also saw declines in January and have slipped in three out of the last four months. A forecasted rise for February would signal a significant shift in activity. Market observers will closely monitor movements in US consumer confidence, which serve as indicators of future economic activity. Consumer confidence measures have exhibited volatility recently, with the Conference Board's indicator reaching its highest level since July last year in January but sharply declining in February. These fluctuations likely reflect uncertainty regarding the pace of inflation and interest rate adjustments. Some other indicators of consumer sentiment have suggested a decline in March, indicating a potential further decrease in the Conference Board's reading.

BREAKING HEADLINE - Key Bridge in Baltimore, Maryland collapses after being struck by a cargo ship. Reports of vehicles and construction workers on the bridge as it collapsed.

Overnight Newswire Updates of Note

PBoC Extends Yuan Support As It Boosts Fix By Most Since January

Australia’s Consumer Sentiment Drops As Rate-Cut Prospects Dim

China Seen Delivering More RRR Cuts This Year To Boost Economy

Japan's Suzuki Says No Steps Ruled Out On FX Moves

Weak Yen Bets Seen In Japanese Skipping Hedges On Overseas Deals

New Zealand Joins UK And US In Condemning China-Linked Hacks

Israel Cancels Visit To Washington After US Abstains On UN Cease-Fire

Treasury Yields Inch Higher As Investors Look To Key Data In Week Ahead

Oil Prices Buoyed By Tight Supply Bets; Gaza Ceasefire In Focus

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0860 (EU2.26b), 1.0925 (EU1.86b), 1.0865 (EU1.57b)

USD/JPY: 151.25 ($652.3m), 151.00 ($528.9m), 147.50 ($380m)

AUD/USD: 0.6560 (AUD1.32b), 0.6545 (AUD1.24b), 0.6475 (AUD800m)

USD/BRL: 4.9500 ($570m), 4.7800 ($500m), 5.4725 ($360m)

USD/CNY: 7.1700 ($530m), 7.3000 ($357.6m)

GBP/USD: 1.2700 (GBP435m), 1.2690 (GBP425.5m)

NZD/USD: 0.6170 (NZD694.8m)

EUR/GBP: 0.8750 (EU377.1m)

USD/MXN: 16.85 ($499.1m), 17.10 ($434.6m)

USD/KRW: 1328.55 ($425m)

CFTC Data As Of 22/03/24

Bitcoin net short position is -2,096 contracts

Euro net long position is 48,342 contracts

Japanese Yen net short position is -116,012 contracts

Swiss Franc posts net short position of -20,500 contracts

British Pound net long position is 53,200 contracts

Equity fund speculators trim S&P 500 CME net short position by 57,268 contracts to 416,777

Equity fund managers raise S&P 500 CME net long position by 35.431 contracts to 949,421

Technical & Trade Views

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

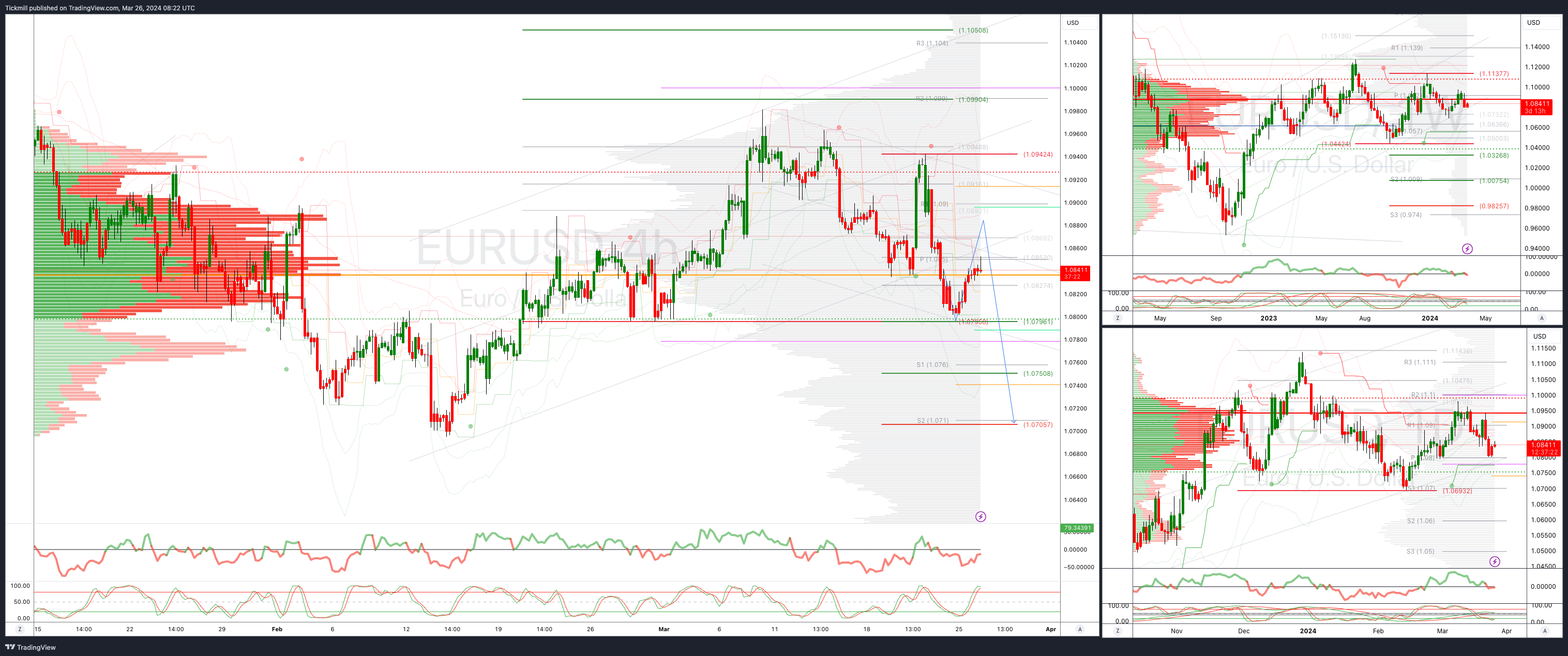

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

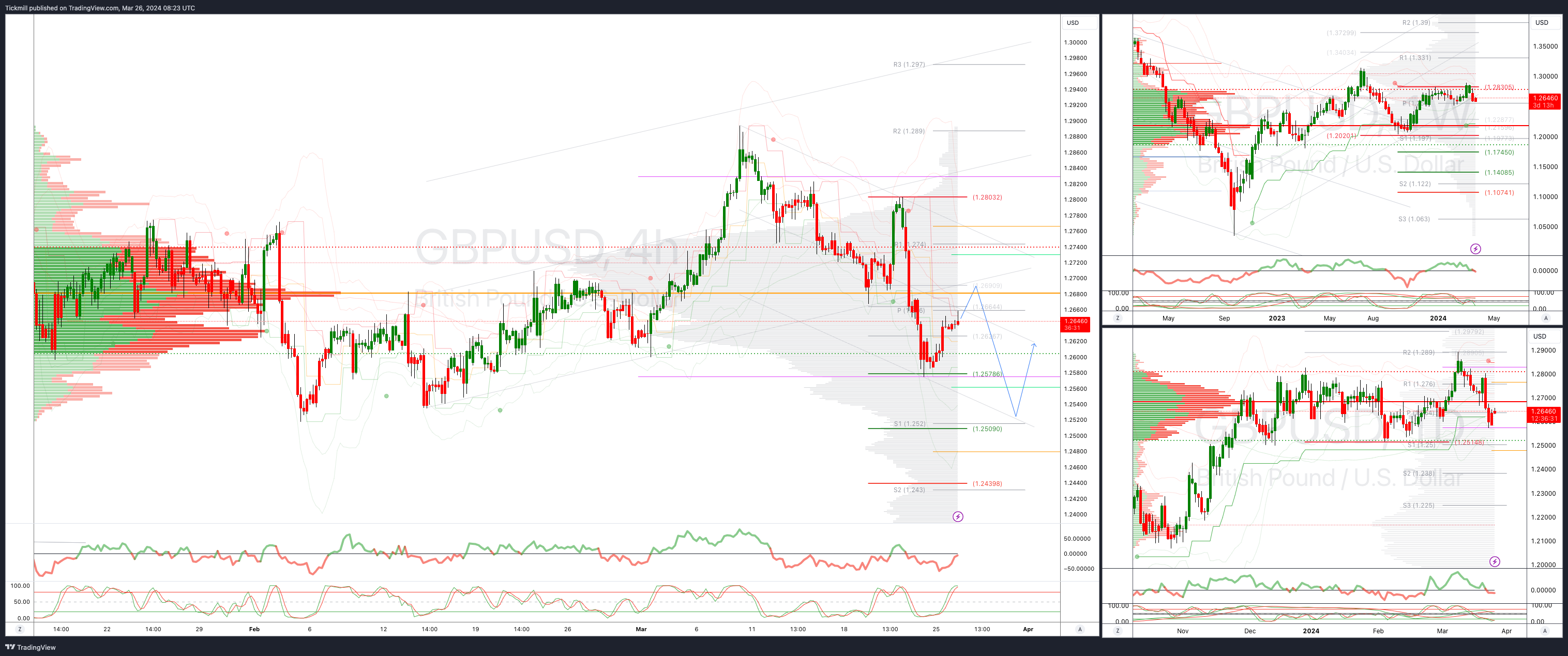

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2514

Primary objective 1.29

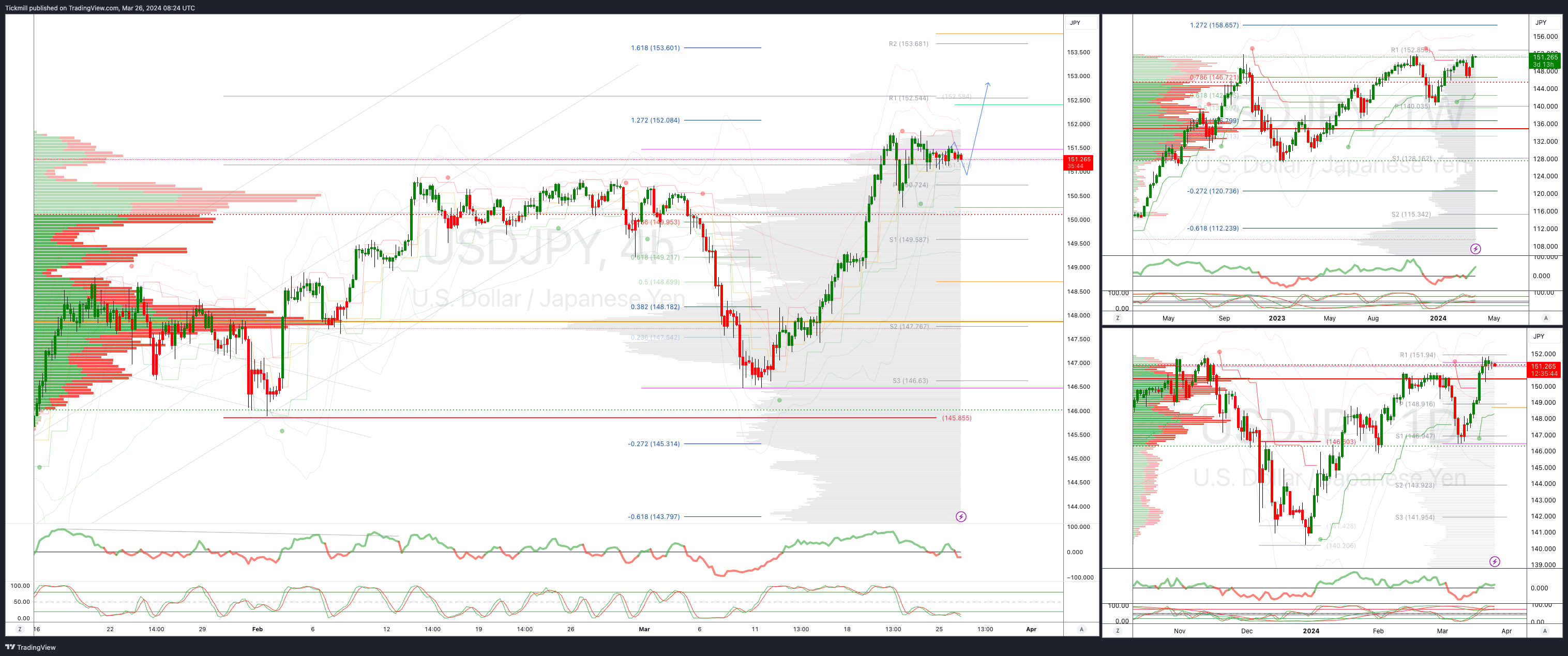

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6470

Primary support .6477

Primary objective is .6700

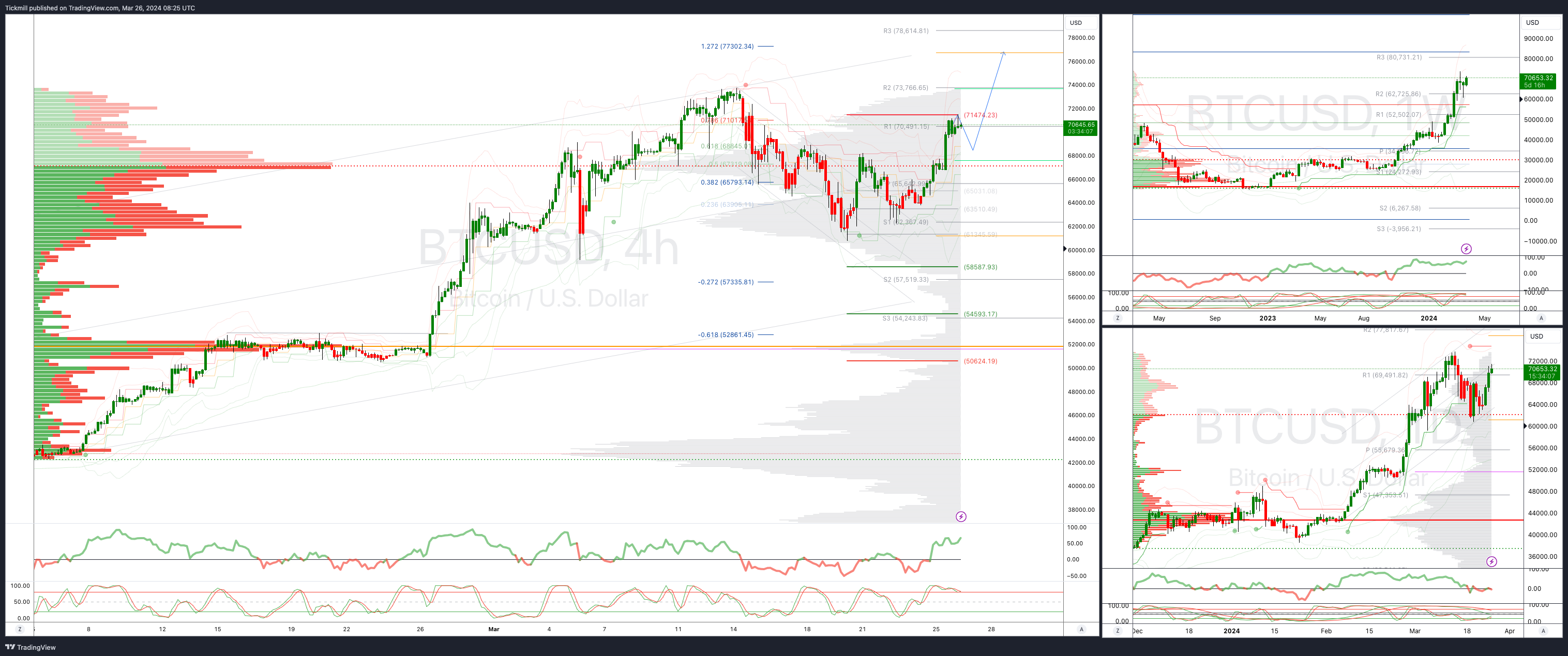

BTCUSD Bullish Above Bearish below 68300

Daily VWAP bullish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!