Daily Market Outlook, March 25, 2024

Daily Market Outlook, March 25, 2024

Munnelly’s Macro Minute…

“Nikkei Retreats Into A Holiday Shortened Week”

On Monday, Asian stock markets are trading with a mix of results, influenced by the global market trends from Friday. Some traders are considering taking profits from the recent market strength. There is also a sense of optimism regarding the future of interest rates after the US Fed's recent monetary policy announcement. Although the exact timing of the first rate cut is still uncertain, there has been a resurgence in the likelihood of a quarter point rate cut in June. The Fed has upheld its projection for three interest rate cuts in the current year.

The upcoming week is expected to be relatively quiet for markets, with many centers observing holidays towards the end of the week. The focus will be on the U.S. February PCE price data, following a busy week of central bank meetings and important economic data. Key U.S. data releases include durable goods, final Q4 GDP, consumer confidence, Chicago PMI, University of Michigan consumer sentiment, and housing data such as new and pending home sales, and CaseShiller house prices. Additionally, speeches by Federal Reserve Governors Lisa Cook and Christopher Waller, along with a discussion with Chair Jerome Powell, will attract attention after the dovish tone of last week's Fed meeting.

In Europe, the focus will be on business climate, consumer inflation expectations, and final March consumer confidence. Germany will publish retail sales and unemployment data, while the UK's main release will be Q4 GDP. Later today, BoE member Catherine Mann is scheduled to speak at the Royal Economic Society’s annual conference. Market participants will closely monitor her speech for any hints regarding the duration she expects Bank Rate to be maintained at its current level. However, considering that Ms. Mann withdrew her advocacy for higher rates only at the March meeting, it's probable that she will suggest it's premature to consider reducing Bank Rate at this stage, based on her perspective.

In Japan, investors will be monitoring the Bank of Japan's summary of opinions from board members at its March 18-19 policy meeting, as well as the release of the closely watched Tokyo CPI for March, unemployment rate, industrial production, and retail sales. The Japanese stock market experienced a notable decrease overnight after four consecutive days of gains. The Nikkei 225 index is dropping below the 40.6k handle, influenced by varied signals from international markets on Friday. The decline is evident across multiple sectors, particularly impacting exporters and financial companies.

China's release of the NBS March manufacturing and non-manufacturing PMIs, along with data on industrial profits, will also be closely awaited after recent activity indicators raised hopes of an economic recovery.

Overnight Newswire Updates of Note

BoJ Board Agrees Chance Of Meeting Inflation Target Rising Gradually

Japan's Kanda: Yen Weakness Doesn't Reflect Fundamentals

China Blocks Use Of Intel And AMD Chips In Government Computers

Fed’s Powell Ready To Support Job Market, Even If It Means Lingering Inflation

Bank Of England Inches Closer To Rate Cuts As Hawks Retreat

Putin Says Gunmen Who Raided Moscow Concert Hall Tried To Escape To Ukraine

Putin Says Gunmen Who Raided Moscow Concert Hall Tried To Escape To Ukraine

Oil Snaps Three-Day Drop As Russia Attacks Add To Global Tension

Houthis Fired Missile At Chinese-Owned Ship In Red Sea, US Says

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (EU1.04b), 1.0780 (EU722.5m), 1.0900 (EU704.6m)

USD/JPY: 147.00 ($1.41b), 150.00 ($1.19b), 145.50 ($800m)

USD/BRL: 5.0000 ($1.12b), 4.5500 ($750m), 6.3000 ($711.6m)

AUD/USD: 0.6565 (AUD527.4m), 0.6500 (AUD327.1m)

USD/CAD: 1.3500 ($950.7m), 1.3485 ($844.2m), 1.3700 ($657.7m)

USD/CNY: 7.1000 ($842.7m), 7.1950 ($446.4m), 7.0345 ($400m)

GBP/USD: 1.2716 (GBP398.2m), 1.2825 (GBP361.9m)

NZD/USD: 0.6195 (NZD414.9m)

USD/MXN: 16.90 ($516.9m), 17.30 ($352.6m)

EUR/GBP: 0.8590 (EU408.6m)

CFTC Data As Of 22/03/24

Bitcoin net short position is -2,096 contracts

Euro net long position is 48,342 contracts

Japanese Yen net short position is -116,012 contracts

Swiss Franc posts net short position of -20,500 contracts

British Pound net long position is 53,200 contracts

Equity fund speculators trim S&P 500 CME net short position by 57,268 contracts to 416,777

Equity fund managers raise S&P 500 CME net long position by 35.431 contracts to 949,421

Technical & Trade Views

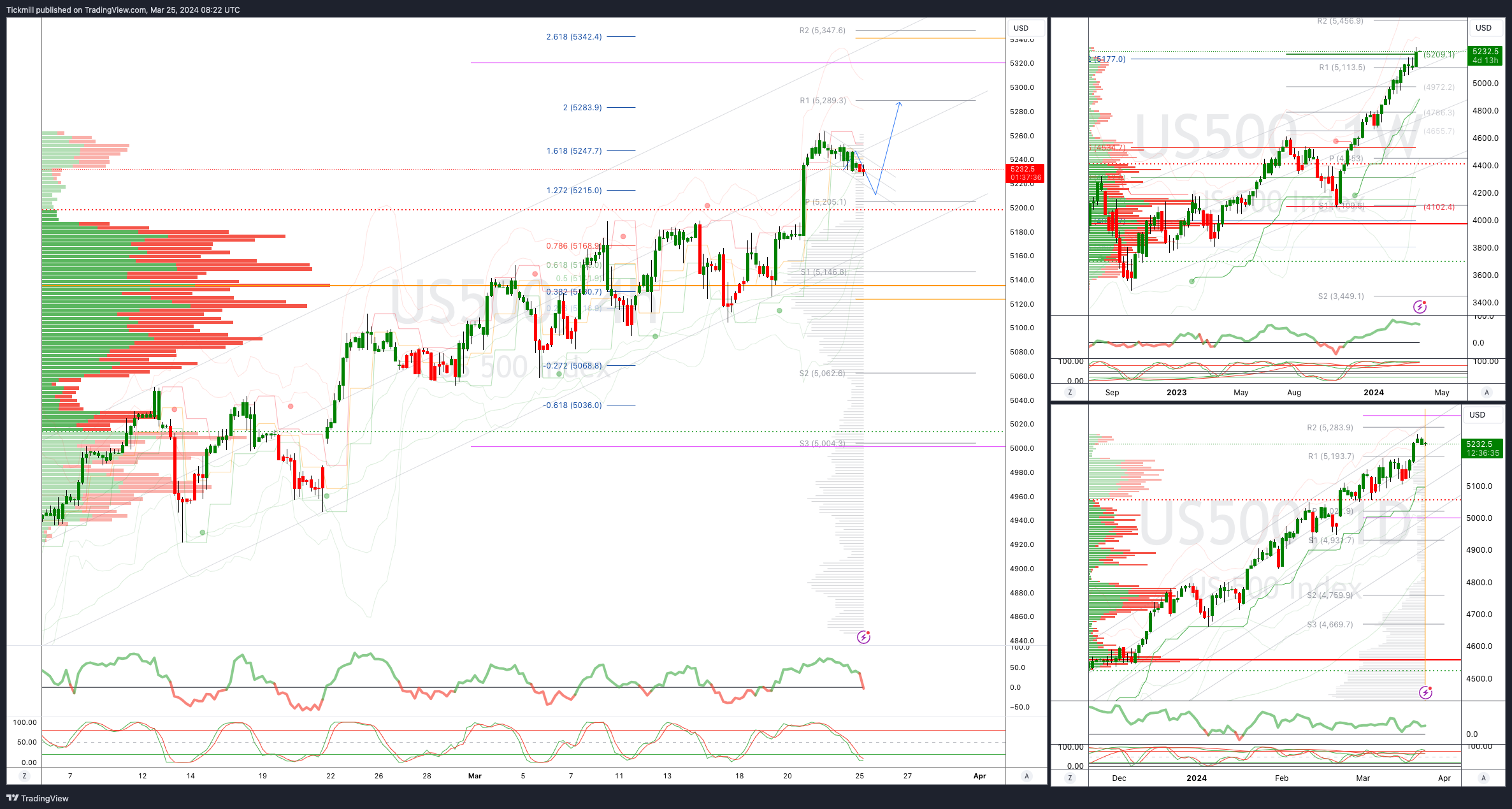

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

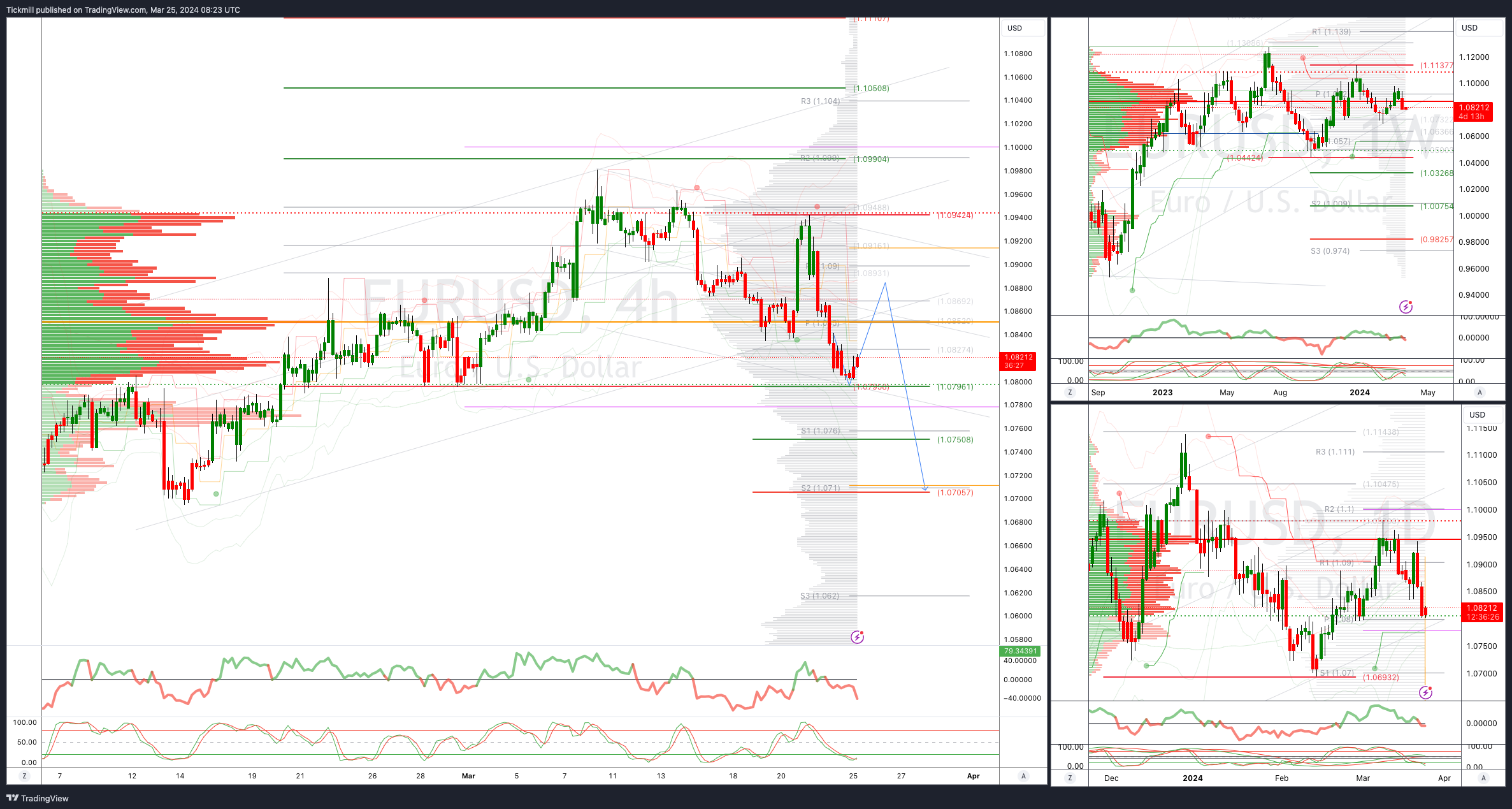

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

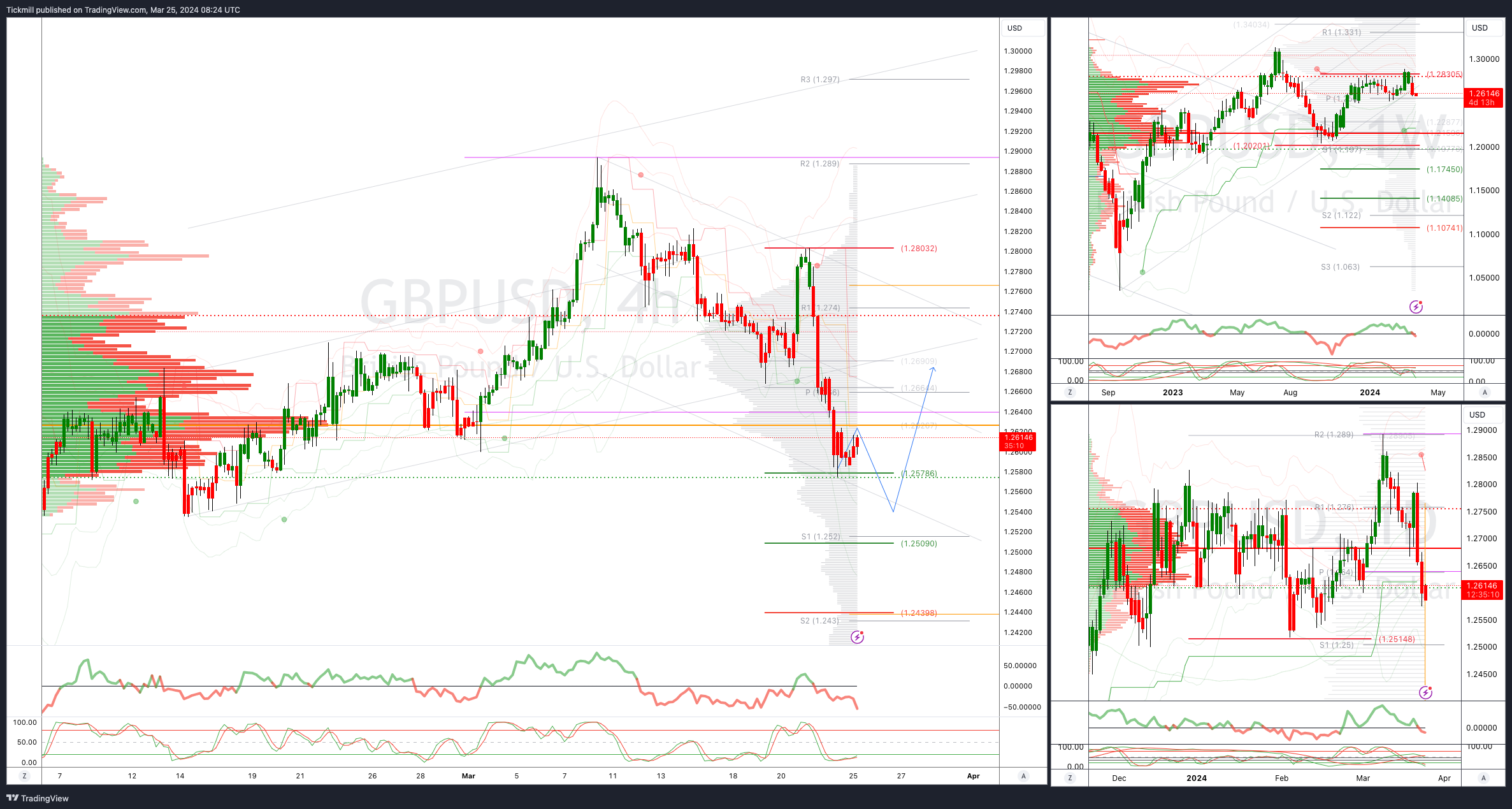

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2514

Primary objective 1.29

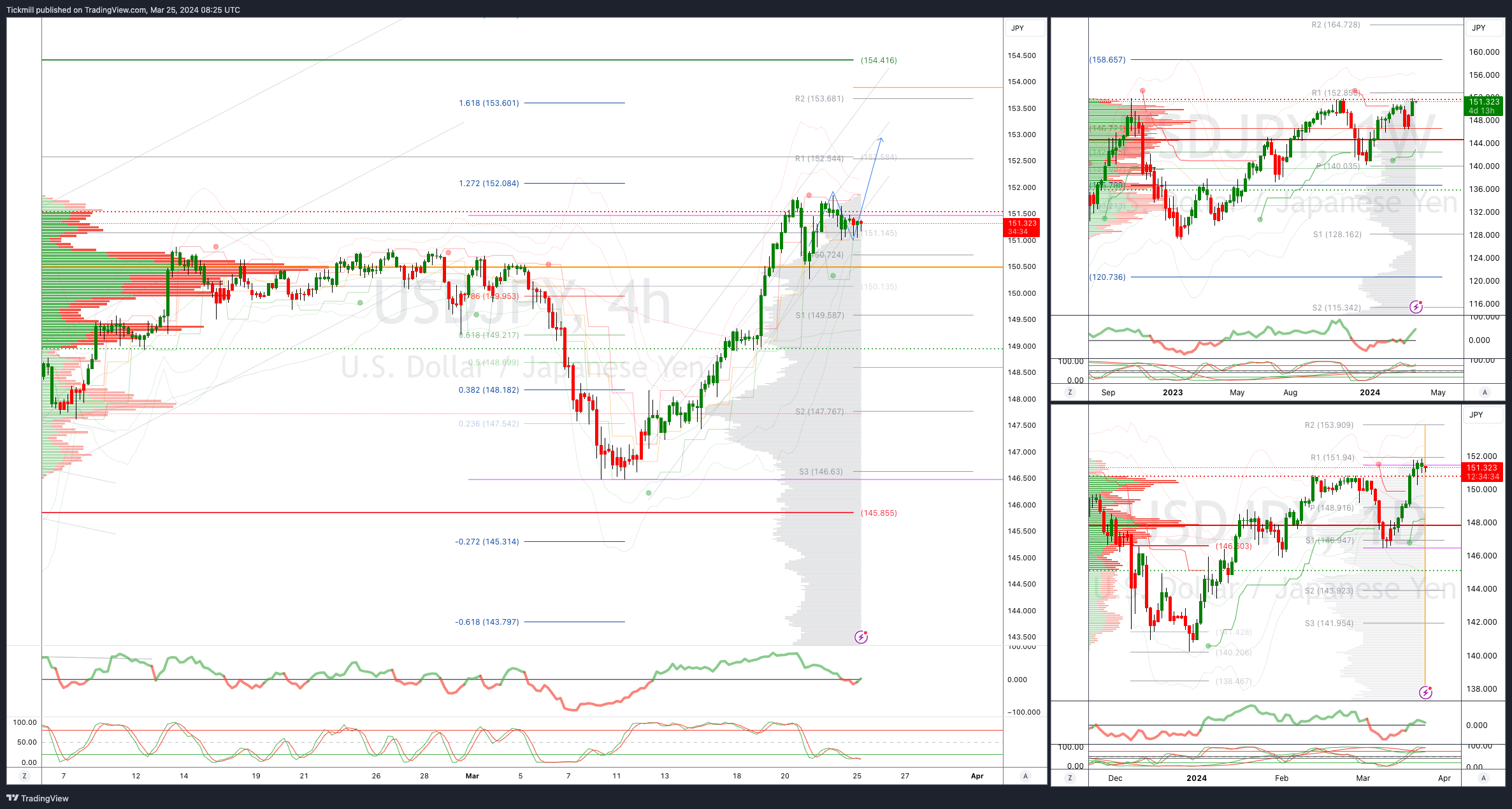

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

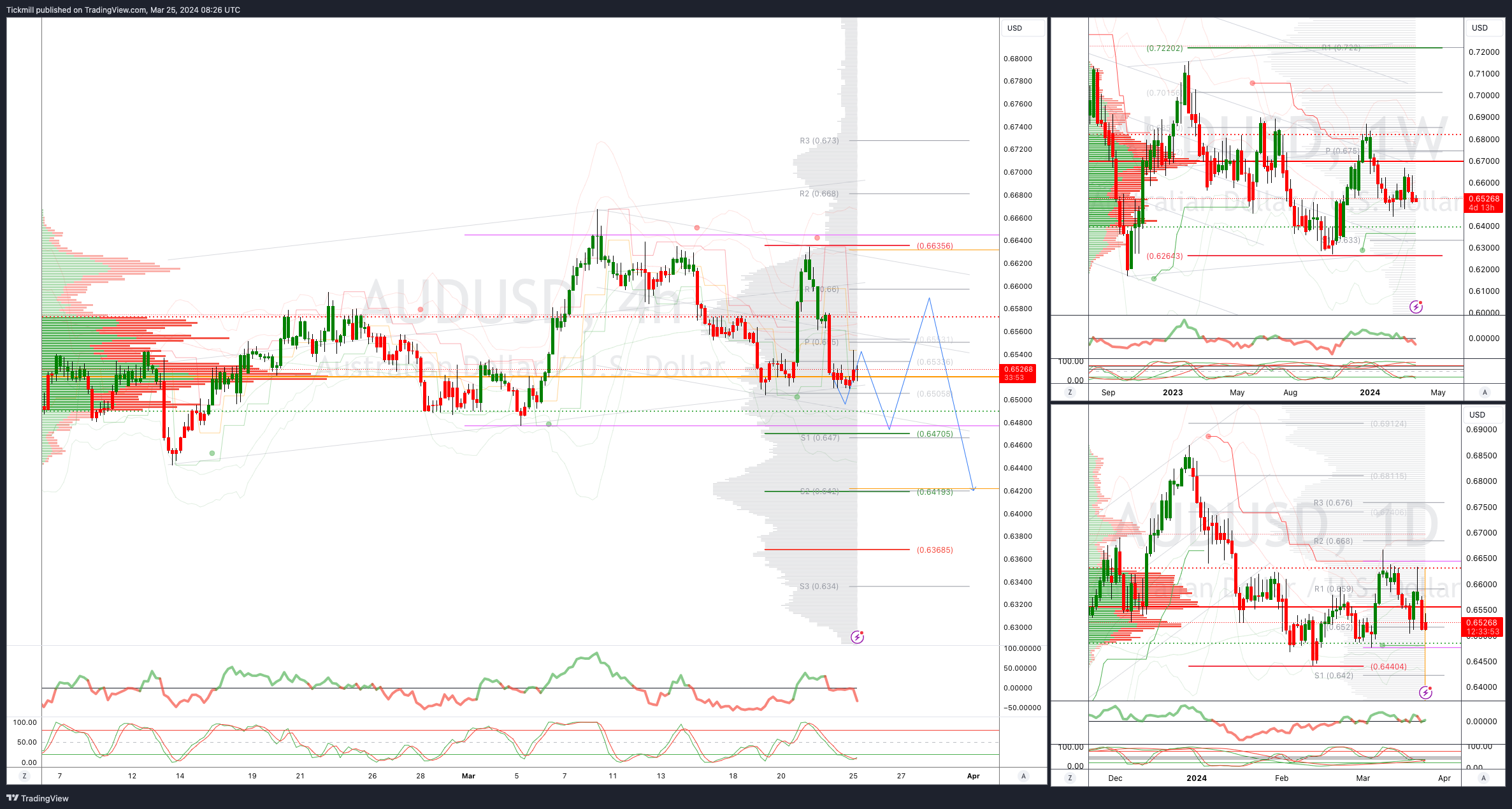

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6470

Primary support .6477

Primary objective is .6700

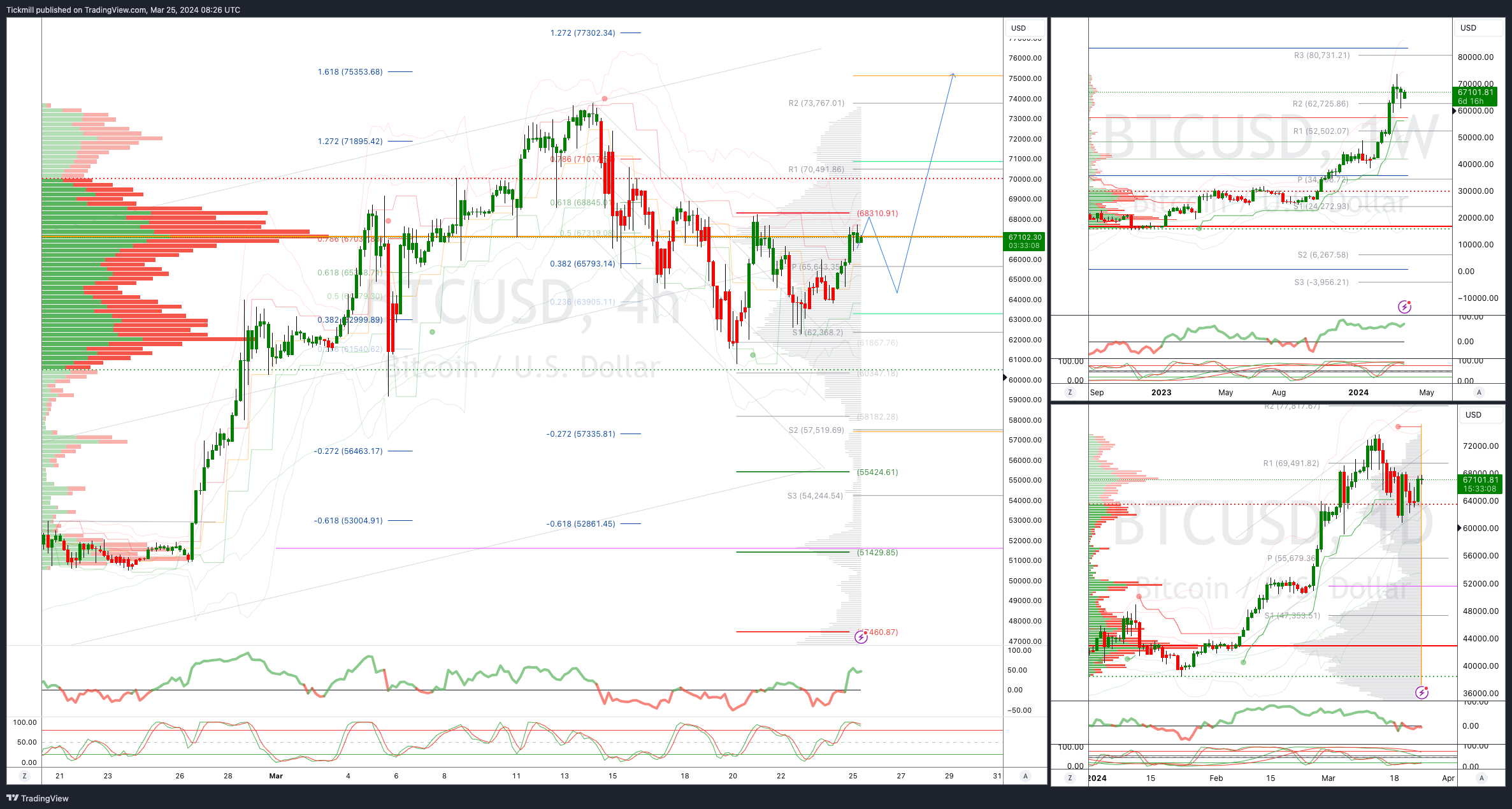

BTCUSD Bullish Above Bearish below 68300

Daily VWAP bullish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!