Daily Market Outlook, March 15, 2024

Daily Market Outlook, March 15, 2024

Munnelly’s Macro Minute…

“Markets Attention Shifting To Next Week’s Central Bank Updates”

Most Asian stock markets are experiencing a decline in trading on Friday, in response to the negative signals from Wall Street the previous night. This comes as there are growing worries about the US Fed delaying its first interest rate cut until after June, due to the release of producer price inflation data for February which was higher than expected. The Nikkei 225 experienced a retreat amid caution leading up to the RENGO wage announcement. Reports had indicated that strong wage hikes could potentially influence the Bank of Japan's policy decisions at next week's crucial meeting, prompting investors to adopt a cautious stance.

Today's Bank of England/Ipsos inflation attitudes survey will be under close scrutiny to gauge if inflation expectations have eased further. Three months ago, the previous report indicated a decrease in one-year-ahead inflation to 3.3%, marking the lowest figure in two years. While attention remains on next week's BoE policy decision, with no interest rate change anticipated, focus also extends to key UK data releases such as CPI inflation and retail sales for February, alongside flash PMI and GfK consumer confidence surveys for March. Additionally, recent comments by PM Sunak seemingly eliminate the possibility of a May general election, leading to speculation about potential dates in either October or November.

The US Federal Reserve and Bank of Japan are set to provide policy updates next week. While the US central bank is expected to maintain interest rates, there's speculation regarding a potential rate hike by the BoJ from negative territory. Overnight reports suggest that the country's largest union has secured average wage increases exceeding 5%.

Currently, attention is focused on today's US economic data. Recent releases have revealed positive surprises in inflation (both CPI and producer prices) and a weaker-than-anticipated rebound in February retail sales. With Fed policy increasingly focused on inflation, the market has reacted with higher Treasury bond yields and reduced expectations for interest rate cuts. Today's US industrial production data will be closely monitored for signs of a rebound, particularly in manufacturing output, which saw a decline of 0.5% in January. Overall, a 0.3% month-on-month increase in industrial production is anticipated. Furthermore, the NY Fed’s Empire manufacturing survey is set to be released, with expectations of a decline to -8 in March from -2.4 in February, albeit still notably higher than the plunge witnessed at the start of the year. Additionally, the University of Michigan's US consumer sentiment survey will be watched, with a slight rise to 77.5 in March anticipated from 76.9.

Overnight Newswire Updates of Note

Markets Show Signs Of Big Tech Bubble, Crypto Surge, BofA Says

Hamas Statement Delivers Response On Hostage Deal Proposals

China Drain Cash Via Key Funding Tool For First Time Since 2022

China Economy Likely Off To Muted Start, 5% GDP Goal In Focus

Chinese Home Price Slump Continues Despite Support Mounting

Japan Unions Set To Unveil Wage Talks Results, Boding BoJ Shift

Japan’s FinMin: No Longer In Deflation, Wage Hike Trends Strong

Analysts: BoJ To End Negative Rates In April, March High Chance

Poll Sees Australia’s RBA Unchanged In March, Cut Later In Year

UK’s Sunak Dismisses Speculation Around General Election Date

ECB’s Guindos Says Inflation Headed To 2% But Wages Still Risk

ECB Has Achieved Soft Landing For Euro Zone, Stournaras Says

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0940 (EU1.23b), 1.0900 (EU688.9m), 1.0775 (EU656.3m)

USD/JPY: 147.00 ($1.52b)f 149.00 ($1.11b), 146.75 ($775m)

USD/CAD: 1.3135 ($1.56b), 1.3490 ($1.3b), 1.3480 ($1.18b)

USD/CNY: 7.2250 ($622.8m), 7.1700 ($508m), 7.1400 ($500m)

AUD/USD: 0.6400 (AUD615.2m), 0.6547 (AUD432m), 0.6580 (AUD395m)

GBP/USD: 1.2165 (GBP705m), 1.2800 (GBP368m)

NZD/USD: 0.6200 (NZD340.3m)

USD/BRL: 4.9700 ($531.1m)

The Bank of Japan's experiment with negative interest rates may come to an end next week, but the yen's reaction to this event is expected to be relatively low on the drama scale. Reports suggest a March move is favored over April. The impact on FX will depend on rate guidance and the possibility of a hiking cycle. BoJ's Shinichi Uchida suggests that the bank is unlikely to follow up with a series of rate hikes, limiting yen upside. Looking back at the yen's reaction to the initial launch of negative rates by the BoJ may provide insight into its reaction to an exit. USD/JPY initially rallied on the decision, then trended lower for 7-8 months, driven by lower U.S. yields. The flurry of source reports signaling a March move may have a diminished impact on the yen, increasing the risk of the currency being sold.

CFTC Data As Of 8/03/24

Bitcoin net short position is -1,352 contracts

Euro net long position is 66,311 contracts

Japanese Yen net short position is -118,843 contracts

Swiss Franc posts net short position of -17,551 contracts

British Pound net long position is 58,385 contracts

Equity fund managers cut S&P 500 CME net long position by 24,150 contracts to 917,973

Equity fund speculators trim S&P 500 CME net short position by 31,617 contracts to 402,895

Technical & Trade Views

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bullish

Below 5090 opens 5060

Primary support 5090

Primary objective is 5220

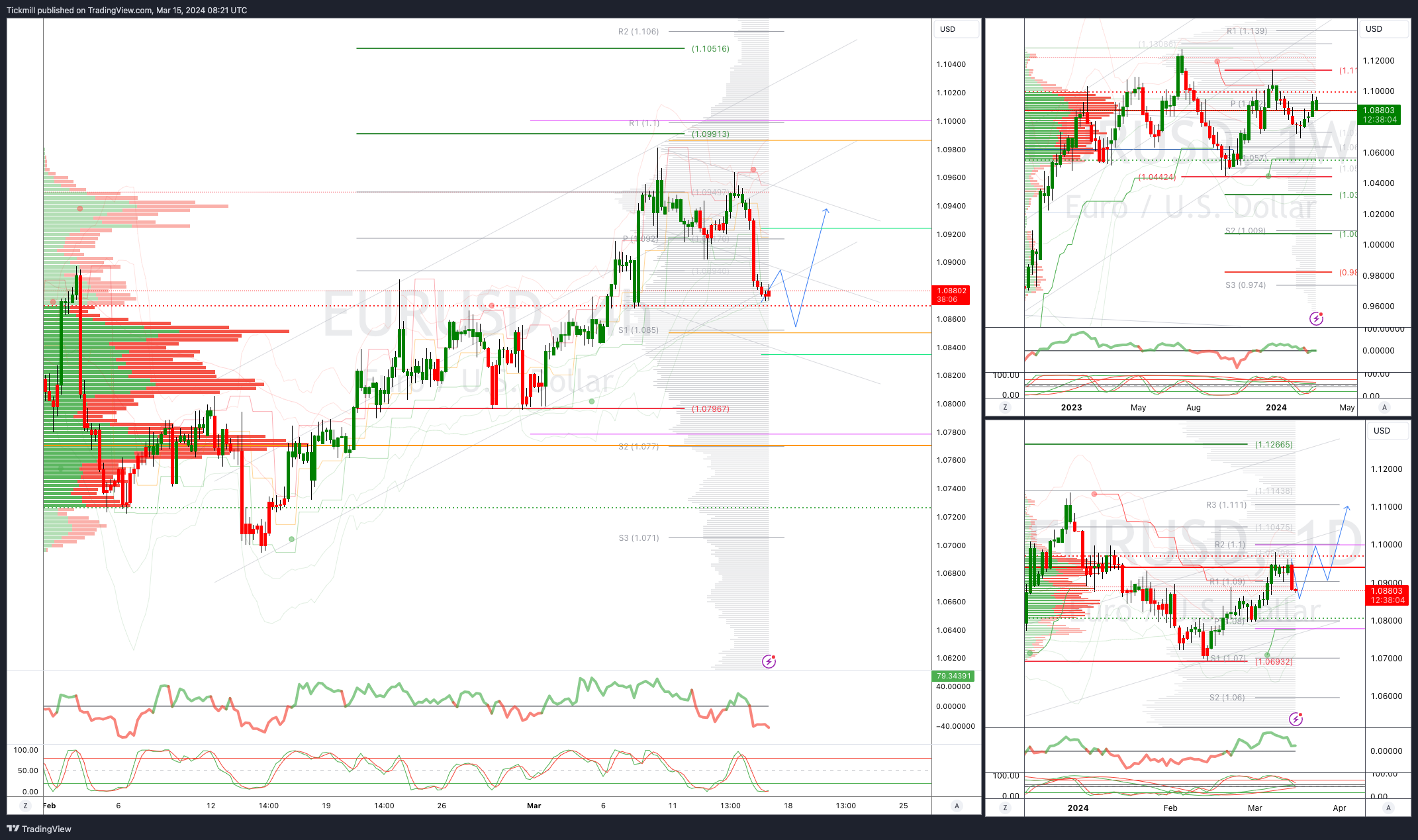

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Below 1.0840 opens 1.08

Primary support 1.08

Primary objective is 1.10

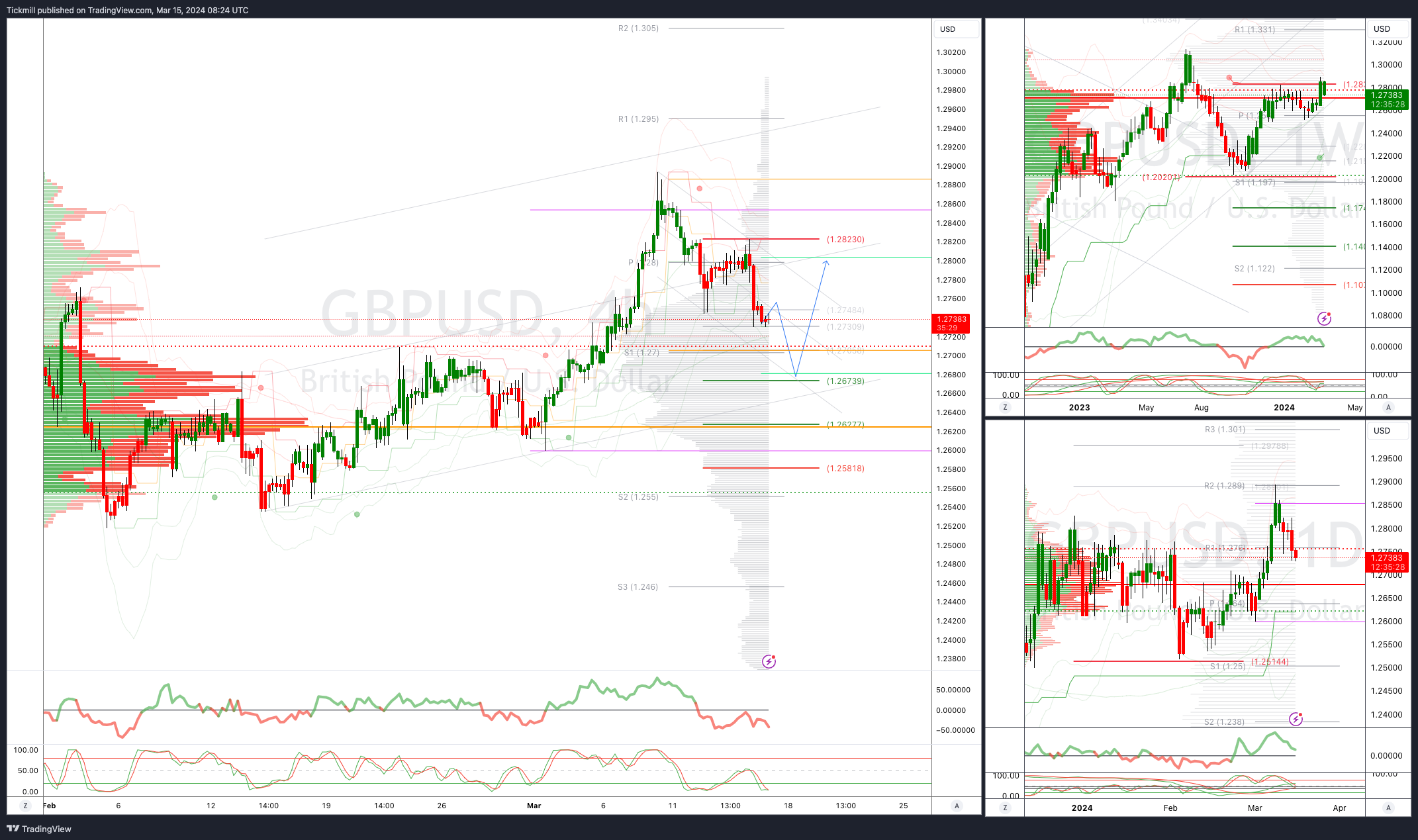

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2630

Primary support is 1.2660

Primary objective 1.29

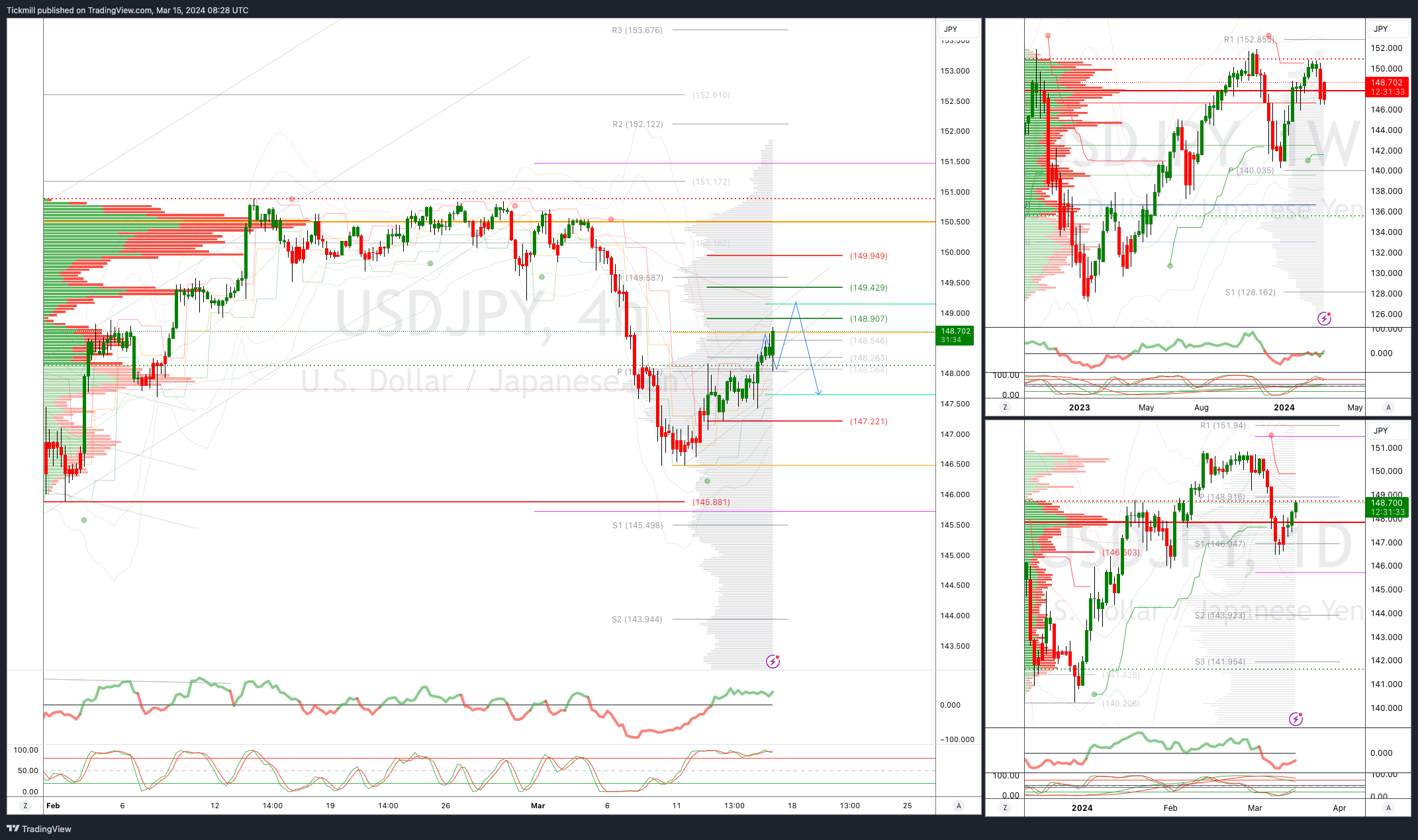

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 149 opens 149.50

Primary support 145.85

Primary objective is 152

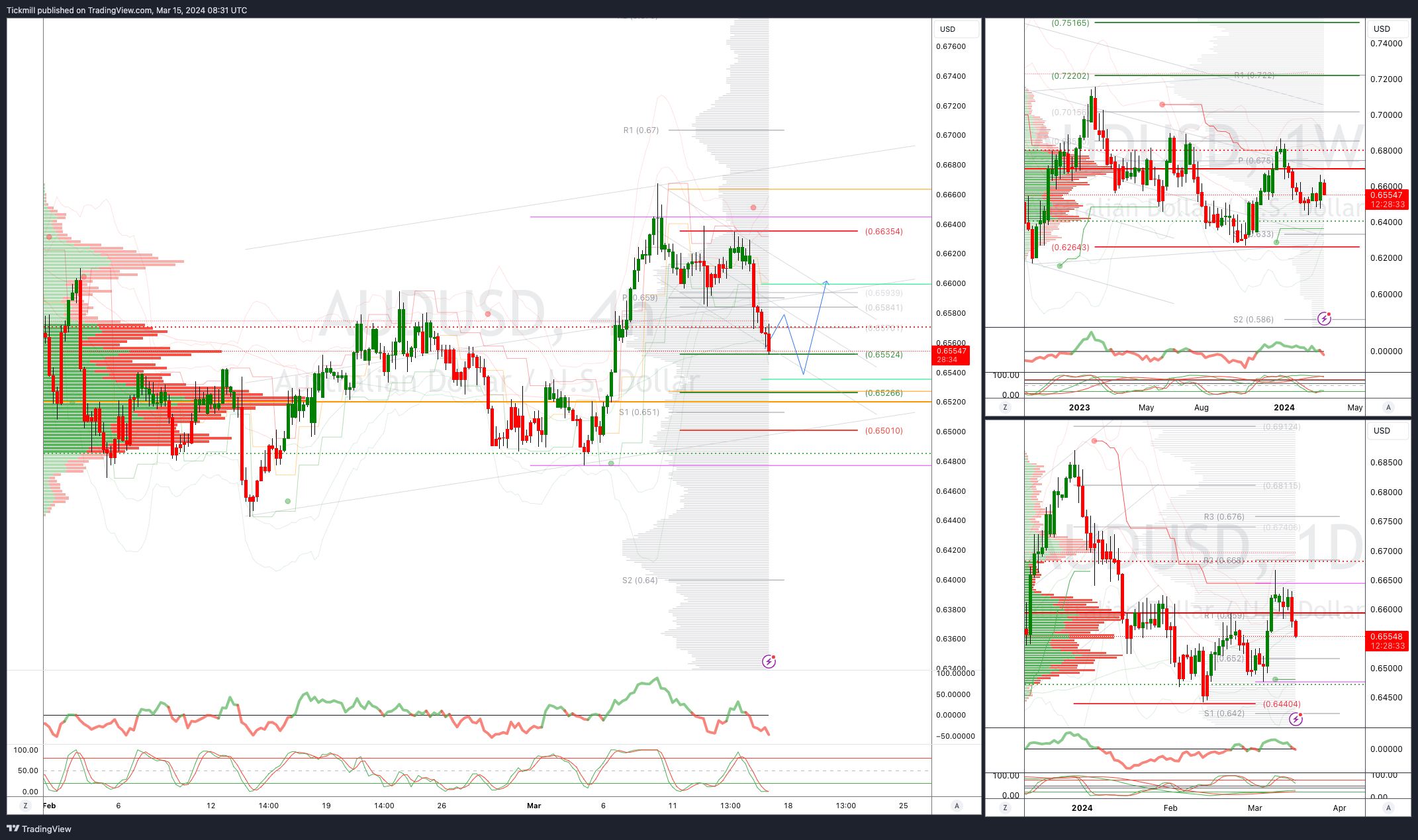

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6520/00

Primary support .6477

Primary objective is .6700

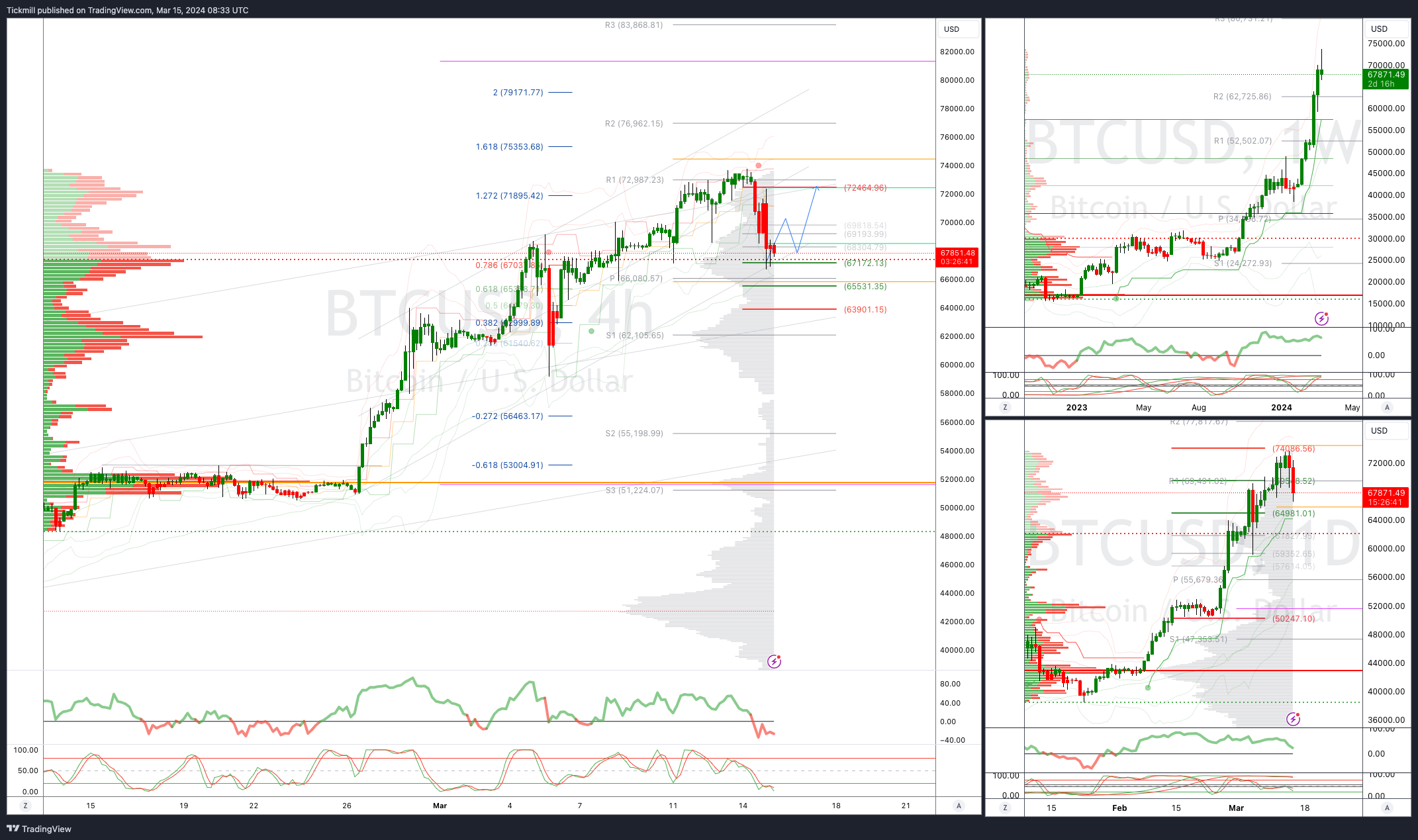

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 66000 opens 62000

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!