Daily Market Outlook, March 15, 2021

Daily Market Outlook, March 15, 2021

Asian equity markets were broadly trading lower at the start of the new week, as concerns over higher US Treasury yields weighed on sentiment. Longer-dated US yields continued to trade close to their highest levels in over a year, as the $1.9 trillion fiscal package kept the spotlight on inflation risks. Speaking over the weekend, US Treasury secretary Janet Yellen tried to provide some reassurance over the extent to which price pressures were building, noting “I think there’s a small risk and I think it’s manageable”.

Over the weekend, Angela Merkel’s CDU party registered its worst results ever in two regional ballets. With Ms Merkel due to step aside after September’s national election, the results boosted the Green Party’s prospects of seizing the chancellorship. Meanwhile, overnight data releases from China showed economic activity surged in the first two months of the year. Industrial production was up 35.1% in the year to February, while retail sales were up 33.8% over the same period. Both were above expectations, however, a weaker-than-anticipated rise in fixed investment pointed to some unevenness in the recovery.

In a week dominated by three major central bank meetings, today represents something of a lull in the calendar, with no major events or data. Monetary policy updates from the US Federal Reserve and Bank of England will be a key focus for markets in the coming week. In particular, how much these central bank make of the ongoing rise in government bond yields in response to growing concerns over the inflation outlook.

At last week’s ECB meeting, the Governing Council stepped up its rate of asset purchases, reflecting some unease over the recent rise in market interest rates. In contrast, BoE and Fed policymakers have been more relaxed in recent comments with some noting that the rise in bond yields may be a justified reaction to improving economic conditions. While both are expected to express greater confidence over the economic outlook, they are also likely to highlight that any tightening in monetary policy is likely to be some way off still, and that they do not see a significant risk of much higher inflation.

More immediately, today’s focus will be limited to the US Empire State manufacturing survey for March. Following February’s sharp rise to a six-month high of 12.1, expect a further modest improvement this month reflecting the continued reopening of the sector, though global supply chain disruptions pose a key downside risk.

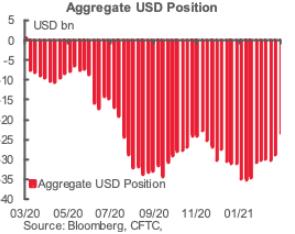

CFTC Data

Position and risk reduction remain the essential drivers of data provided by the CFTC Commitment of Traders Report. The aggregate USD short position inferred from the combined positioning on all the currency contracts we cover fell USD5.5bn in the week through Tuesday, taking the overall USD short position to USD23.5bn, the lowest since July last year. Broadly, positioning remains near, or continues to shift back towards, neutral across most currency contracts.

The EUR contract saw liquidation by gross longs and shorts, driving a reduction of USD3.8bn in the net long position to total USD15.2bn (101.9k contracts, also the lowest since last July). The net EUR long remains the largest single currency position reflected in these data, however. Elsewhere, the positioning changes reflected risk reduction and a lack of conviction among speculative traders.

Investors remain reluctant to buy into the idea of CAD appreciation and trimmed tentative net CAD longs USD344mn back to less than USD1bn in total. Modest net longs in the NZD and (even more modestly) the AUD saw very minor additions only this week. Net positioning in the MXN remains flat (just USD44mn in total net exposure). Speculators remain wary of commodity and high beta FX despite strengthening global growth and stronger commodity prices.

The slashing of net JPY longs (USD1.5bn) to USD751mn makes more sense in the context of the JPY’s marked underperformance through the reporting week. Net GBP longs were cut USD204mn to USD2.9bn but GBP net longs still represent the second-largest bull bet after the EUR. Net CHF longs rose USD264mn in the week to USD1.9n, the only contract that saw an increase in exposure (USD264mn). Net gold longs were cut USD2.9bn to USD30bn.

G10 FX Options Expiries for 10AM New York Cut

USD/JPY: Y108.95-109.00($515mln-USD puts), Y110.00($550mln)

GBP/USD: $1.3950(Gbp311mln)

AUD/USD: $0.7650-65(A$751mln), $0.7700-10(A$500mln), $0.7720-35(A$713mln), $0.7780-90(A$655mln),

$0.7820-30(A$501mln)

USD/CNY: Cny6.41($500mln), Cny6.47($1.35bln-USD puts), Cny6.48($823mln), Cny6.50($596mln)

----------------

Larger Option Pipeline

EUR/USD: Mar17 $1.1900(E1.4bln-EUR puts), $1.2000(E1.2bln), $1.2040-55(E1.6bln); Mar18 $1.1900(E1.3bln-EUR puts)

USD/JPY: Mar16 Y106.00($1.6bln), Y107.00($1.45bln); Mar17 Y108.50-55($1.2bln); Mar23 Y107.95-108.00($2.3bln), Y108.12($1.8bln)

GBP/USD: Mar16 $1.3750(Gbp797mln-GBP puts)

EUR/GBP: Mar17 Gbp0.8600-05(E955mln), Mar18 Gbp0.8600(E1.3bln-EUR puts)

AUD/USD: Mar16 $0.7500(A$1.2bln), $0.7650(A$1.4bln); Mar18 $0.7750(A$1.3bln), $0.7850(A$1.3bln)

AUD/NZD: Mar18 N$1.0770-75(A$1.4bln-AUD puts); Mar23 N$1.0785-90(A$1.7bln)

NZD/USD: Mar22 $0.7080(N$1.1bln), $0.7400(N$1.0bln)

USD/CAD: Mar16 C$1.2800($1.15bln); Mar18 C$1.2685-90($1.6bln)

USD/CNY: Mar18 Cny6.3450($1.2bln), Cny6.43($1.1bln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.20 would suggest further downside opening a potential test of 1.17 yearly pivot...UPDATE responsive buying from the equality objective at 1.1850, through yesterday's highs opens pivotal 1.20 test

Flow reports suggest congestion through the 1.1820-1.1780 area with weak stops possibly being cleared up quickly through to the 1.1750 and again stronger congestion and likely to continue through the 1.1700 level, topside offers light back through the 1.1920 area and weak stops possibly setting up a small short squeeze through to the 1.1980 area before stronger offers start to appear into the 1.2000 level. Topside offers light through to the 1.1950 area with offers then starting to increase through to the 1.2000 level with weak stops above the 1.2020 level before the offers return increasing into the 1.2040-60 level.

GBPUSD Bias: Bullish above 1.3750 targeting 1.44

GBPUSD From a technical and trading perspective,a retest of 1.3750 pivotal trend support has seen fresh demand develop as this level continues to attract support bulls will target a retest of cycle highs en route to 1.44 upside objective.

Flow reports suggest topside offers around the 1.4000 level and slightly stronger stops appear for the market to open to a move through to the 1.4050-1.4100 with patchy resistance until closer to the topside of that range and stronger offers thereafter, downside bids into the 1.3800 level with weak stops likely on a dip through the 1.3780-40 levels with congestion likely to soak up much of the selling through to the 1.3700 level with possibly strong congestion then around the 1.3700 level increasing into the 1.3650 level before being able to make a move to the 1.3600 area and strong bids again

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend. Target achieved, look for a profit taking pause to develop above 108.60, as 107.30 support bulls will target a test of 109.85 next

Flow reports suggest topside congestion is likely to soak up some of the weak stops above through to the 109.50 area where strong congestion is likely to appear and increasing offers into the 110.00 and like the previous spikes at the beginning of last year any move is likely to find resistance above and continuing through the 110.00 with break out stops likely to be a little more nervous, downside bids light through to the 108.00 level with weak stops on any retrace through the 107.80 level and opening a dip to the 106.00 area possible over the coming week

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest topside offers through the 0.7780-0.7820 area with weak stops through the possible strong offers to open a slow grind through to the 0.7840-60 area and then increasing offers onwards through 0.7900, , downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!