Daily Market Outlook, June 28, 2024

Daily Market Outlook, June 28, 2024

Munnelly’s Macro Minute…

“US PCE Data On Deck, Ahead Of First Round Of French Elections”

Asian equities rose ahead of the release of the Fed's preferred inflation indicator on Friday, following gains on Wall St. This came after a previous session when the region's stocks experienced their first decline in three days. In the US, President Joe Biden and Former President Donald Trump had their first debate of 2024 on Thursday.

It is expected that the May PCE deflator will be reported at 2.6% year-over-year, which is a decrease of 0.1 percentage point from the previous month. The core rate is also expected to be 2.6% year-over-year, showing a 0.2 percentage point drop from April. If the headline PCE deflator is at 2.6% year-over-year, it will be 0.7 percentage points lower than the CPI. The difference between these two inflation measures can be attributed to various factors, with different housing weights playing a significant role. In the CPI, the owners’ equivalent rent (OER) inflation rate is at 5.7% year-over-year, which is 2.4 percentage points higher than the overall CPI. This higher measure of shelter costs has a greater impact on the CPI compared to the PCE, contributing to the 0.7 percentage point gap between the two measures. If the PCE deflator is lower than expected, US Treasury yields are likely to decrease immediately. However, unless the deviation is significant, it is unlikely to significantly alter perceptions of the Federal Reserve’s outlook, especially with attention turning to next week’s labor market report.

This Sunday marks the commencement of the snap French parliamentary elections. The immediate response caused a decline in French government bonds (OATs), resulting in the 10-year yield spread compared to German Bunds reaching around 80 basis points, the widest since the euro area debt crisis. However, this spread has now stabilized, and there has been some short covering observed in OAT futures. The widening of the spread can be considered justified, regardless of the election, due to fiscal fundamentals. The French government had relaxed its fiscal stance last year, aiming for a deficit reduction to the EU limit of 3% of GDP by 2027, a year later than previously planned. Market consensus (according to a Bloomberg survey) estimates this year’s deficit at 5.1%, surpassing the official target of 4.4% and being the highest among developed euro area nations. This fiscal situation led S&P to downgrade France’s credit rating by one notch to AA- last month, aligning with Fitch but still one notch above Moody’s. Credit ratings are closely tied to the relative pricing of Eurozone Government Bonds (EGBs) on asset swap (ASW). While OATs are trading at historically wide levels, this is not excessive given the fiscal context. Further spread widening could occur if the election outcome exacerbates political instability.

Overnight Newswire Updates of Note

Congress' Democrats In "State Of Shock" Over Biden Debate Performance

Fed's Bowman: Not Ready To Cut Rates Until Clearer Inflation Is Ebbing

Von Der Leyen, Costa And Kallas Bag EU Top Jobs

Tokyo Inflation Quickens, Keeping BoJ On Track For Rate Hike

Yen Falls Through 161 Per Dollar As Intervention Wagers Increase

Japan Names A New Currency Czar As Yen Continues Its Slide

Nike Tumbles After Warning That Sales Slump Is Getting Worse

Apple Explores Method For Making iPhone Batteries More Replaceable

Nokia To Buy Infinera For $2.3 Billion To Boost Optical-Networks Arm

MSCI China Enters Correction As Investors Reassess Plenum View

Global Funds Back To Selling Chinese Stocks As Optimism Fades

Mexico Keeps Rate For Second Month On Inflation, Peso Pressures

US, Israel Near Agreement To Send Patriot Systems To Ukraine

US Readies To Evacuate Americans From Lebanon If Fighting Intensifies

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0650 (2.5BLN), 1.0660 (330M), 1.0670 (2.1BLN), 1.0690-00 (2.4BLN)

1.0710-15 (2.4BLN) 1.0725 (1.9BLN)

USD/CHF: 0.9000 (305M). EUR/CHF 0.9590-0.9600 (568M)

GBP/USD: 1.2645-50 (1.5BLN), 1.2705-15 (418M). EUR/GBP: 0.8500-05 (330M)

USD/CAD: 1.3700 (478M), 1.3715 (335M), 1.3730 (661M), 1.3740-45 (734M)

AUD/USD: 0.6620 (516M), 0.6650 (270M), 0.6670 (334M), 0.6685 (294M)

EUR/JPY: 170.50 (1BLN), 171.25 (297M), 171.50 (460M)

USD/JPY: 159.50 (1.7BLN), 160.00 (2.6BLN), 160.25 (1.1BLN)

160.50 (759M), 161.00 (259M)

Barclays' month end model suggests that there may be dollar selling at the end of the month, despite the dollar index being up almost 1% in June and close to an eight-week high. The model indicates potential dollar selling against most major currencies by the end of the month, based on foreign versus U.S. equity and bond performance. This is driven by a continued rally in U.S. equity markets, while ex-U.S. assets are either stagnating or experiencing losses amid heightened uncertainty. The model predicts higher rebalancing demand in Europe and Japan, as these regions have experienced most of the outflows in equities.

French elections on Sunday with far right leading in polls, posing a risk to euro/FX. FX option premiums have increased significantly since the election was called. Overnight expiry is now 10 am New York on Monday and should include the election result. The break-even for Overnight options reflects additional volatility risk premium. After including Friday's U.S. PCE data, EUR/USD saw an increase of 31 to 40 USD pips on Wed-Thurs, and it further rose to 70 USD pips on Friday due to election risk. Current Overnight expiry EUR/USD option premiums are at new highs for 2024, with demand for additional volatility premium on downside vs upside strike options.

CFTC Data As Of 21/06/24

Bitcoin net short position is -723 contracts

Swiss Franc posts net short position of -37,390 contracts

British Pound net long position is 47,621 contracts

Euro net long position is 7,951 contracts

Japanese Yen net short position is -147,753 contracts

Equity fund speculators increase S&P 500 CME net short position by 112 contracts to 353,049

Equity fund managers cut S&P 500 CME net long position by 7,915 contracts to 960,056

Technical & Trade Views

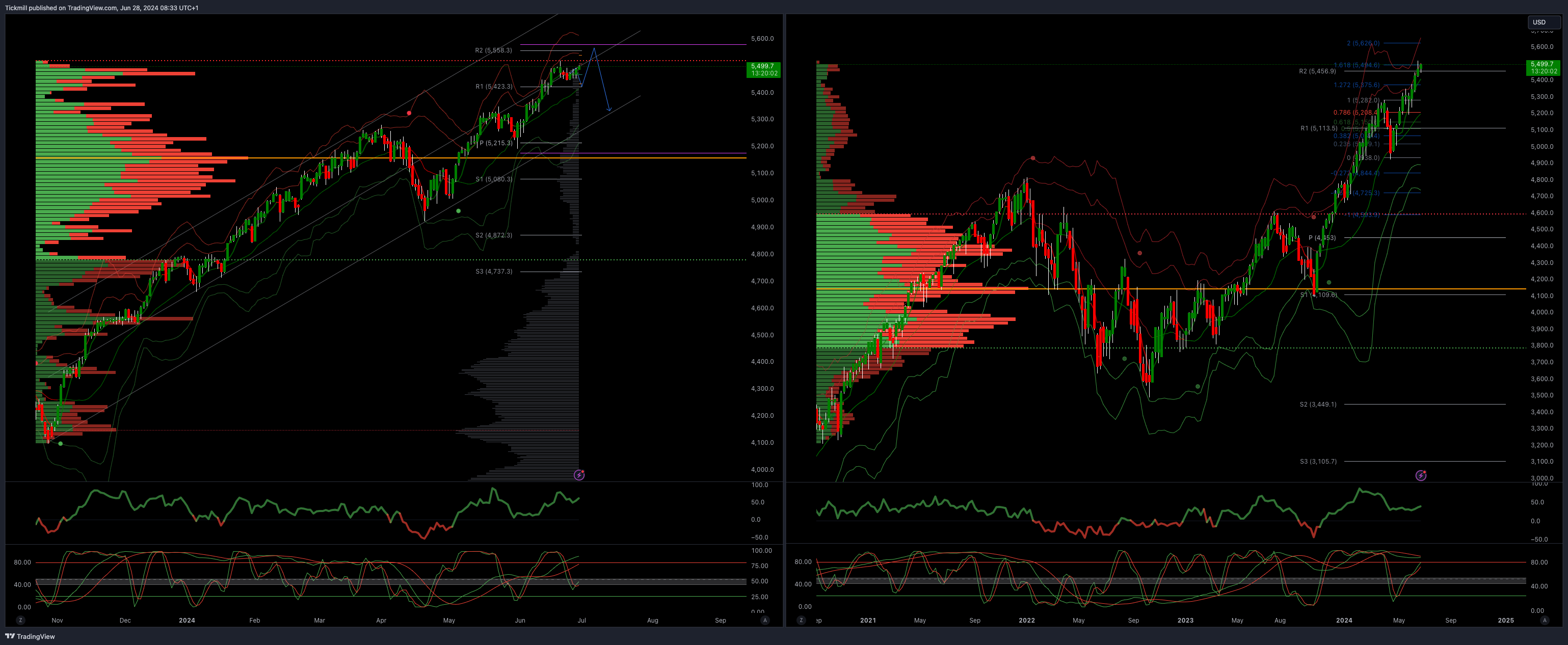

SP500 Bullish Above Bearish Below 5450

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580

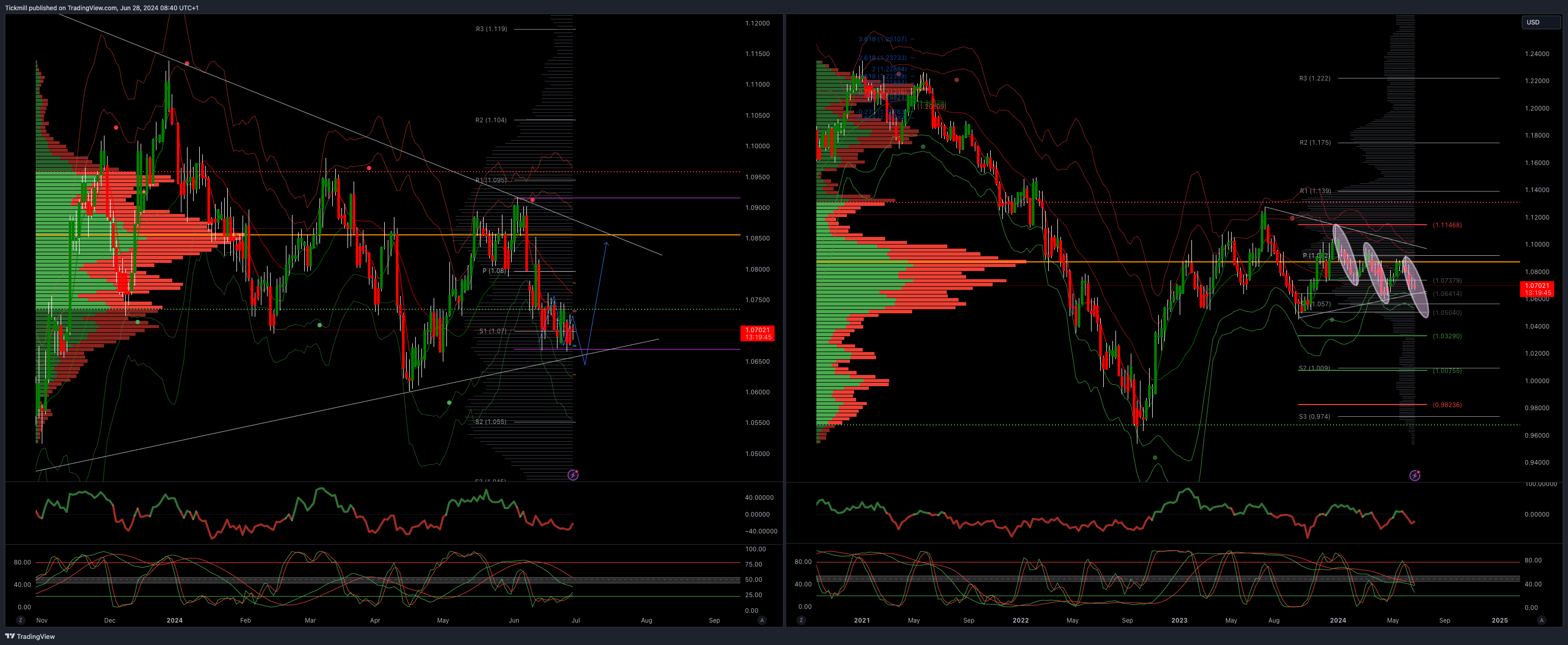

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

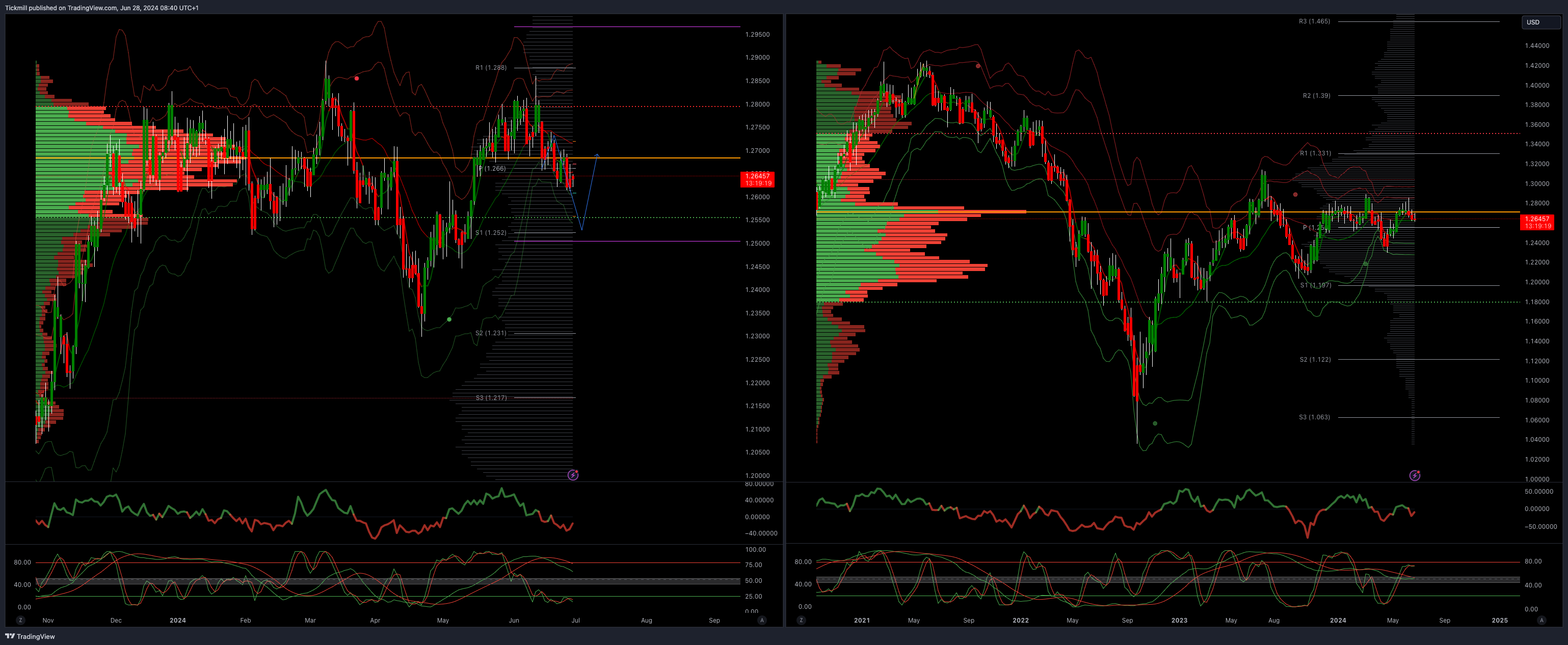

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2570

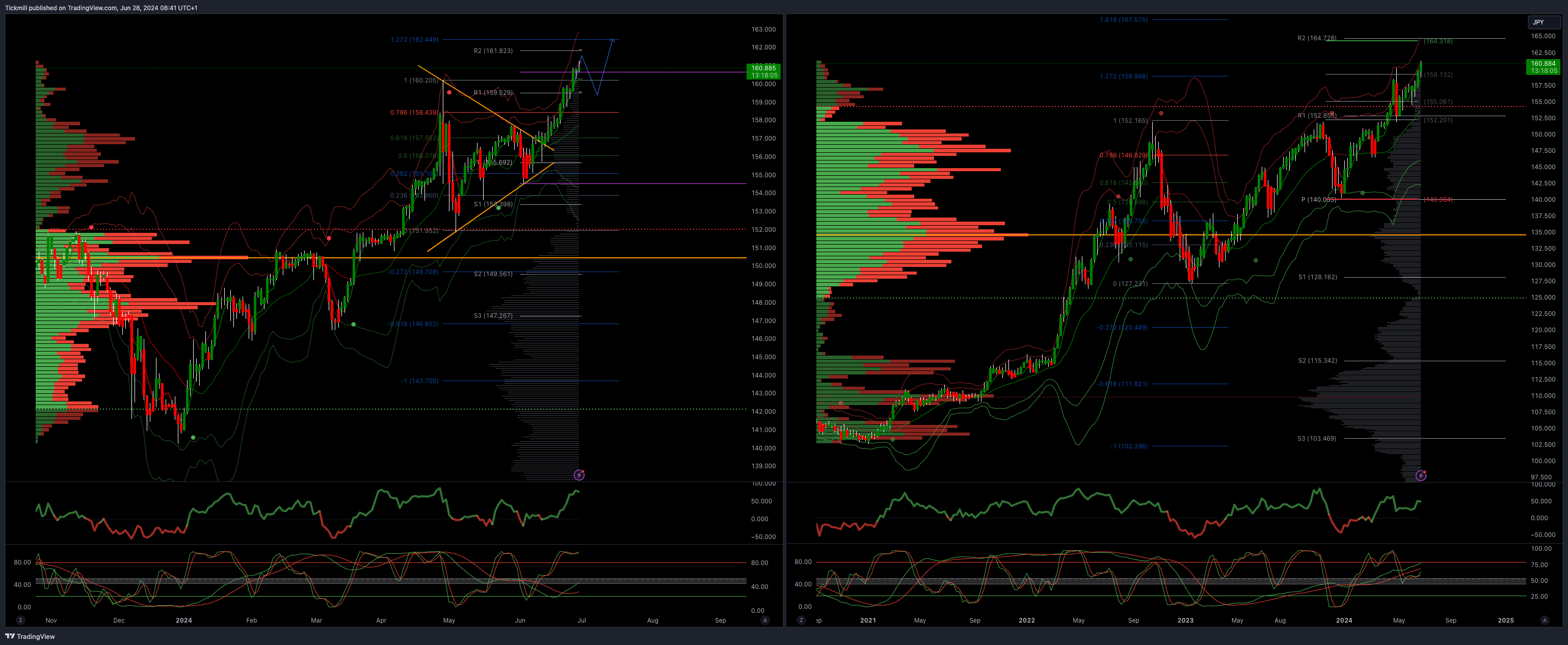

USDJPY Bullish Above Bearish Below 159.50

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160 TARGET HIT NEW PATTERN EMERGIN

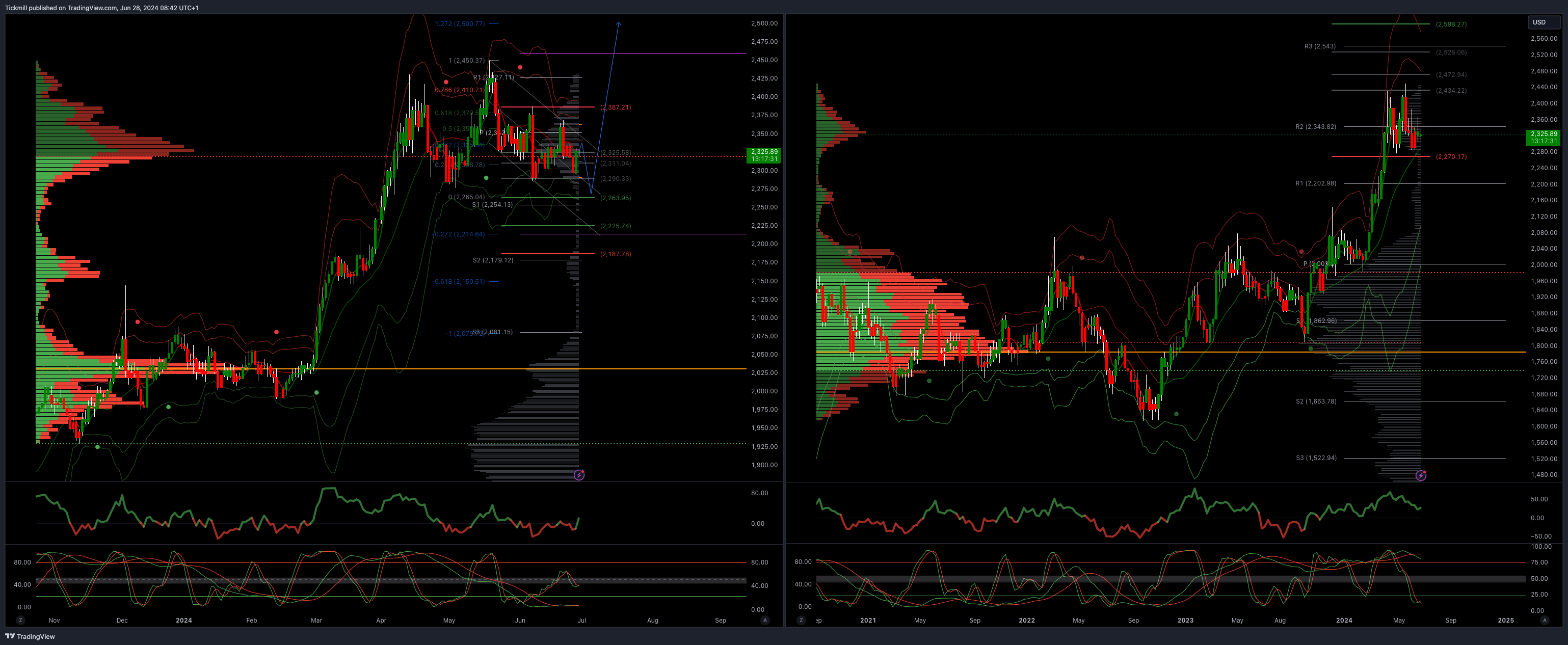

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 64481

Primary objective is 54500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!