Daily Market Outlook, January 11, 2024

Daily Market Outlook, January 11, 2024

Munnelly’s Market Minute…“Markets Buoyant Ahead of US CPI Data”

Asian stocks followed the upward trend seen in the US despite the absence of significant driving factors, as markets anticipate the release of US CPI data. The Nikkei 225 continued its impressive rally, surpassing 35K for the first time since February 1990. The Hang Seng and Shanghai Comp also saw gains, with Hong Kong showing positivity driven by tech and autos, while the mainland market slightly lagged ahead of potential tensions related to the upcoming election in Taiwan.

This morning, Spain and Italy are set to release their industrial production data for November. Earlier this week, the industrial sector data for the Eurozone displayed mixed results, with France reporting a higher-than-expected increase in output while Germany experienced its sixth consecutive monthly decline. The broader region continues to grapple with a prolonged period of weakness in the factory sector.

Tomorrow, early GDP data for the UK in November is anticipated to show a modest 0.3% month-on-month increase, reversing the 0.3% decline seen in October. The Office for National Statistics attributed the October decline to unseasonably wet weather, and with more normal weather conditions in November, a rebound is expected. However, following a downward revision to growth in the third quarter to -0.1% quarter-on-quarter, any weakness in the fourth quarter could indicate a technical recession for the UK at the end of last year.

Stateside, today’s US CPI release is a crucial data point for the week, closely watched by markets for any new insights into the potential timing and pace of Federal Reserve interest rate reductions. Markets currently anticipate an early start to cuts, with approximately a 70% probability of a move by March and a fully discounted cut by May. US inflation experienced a significant decline throughout 2023, but the December report is expected to show a modest rebound. Gasoline prices in the US continued a slight decline in December, contributing to an anticipated small rise in monthly CPI inflation of around 0.1%. However, the decline in energy prices is not expected to match the one that occurred in December 2022, resulting in a modest acceleration in the annual inflation rate to 3.2% from 3.1%. Conversely, despite the forecast for core inflation to rise by 0.3% for the third consecutive month, the annual rate is expected to decrease to 3.9% from 4.0%. Recent US inflation data show conflicting trends, with goods inflation decelerating sharply while services inflation remains resilient. The Federal Reserve is likely to view this situation reasonably positively but may not see an immediate need to hasten rate cuts.

Overnight Newswire Updates of Note

Fed's Williams Flags End Of Banking Sector Stress, Touts Discount Window

JPMorgan Asset Says Fed Rate Cuts May Be Steeper Than Expected

Joe Biden To Send Delegation To Taipei After Taiwan’s Election

US Set To Push Zelenskiy At Davos For Clearer War Plan

Bank of Korea Keeps Rate Unchanged To Extend Inflation Fight

BoJ Warns Of Uncertainty On Whether Wage Hikes Will Broaden

BoJ Fully Prepared To End Negative Rate, Likely In April, Ex-Official Says

OECD Urges Japan's Central Bank To Gradually Raise Interest Rates

Australia Goods Trade Surplus Surges To A$11.4 Bln In November

China Set To Lose Crown As Top U.S. Exporter After 17 Years

Bank Of France Sees Lower Recession Risk This Winter

Japanese Yen Lags Thursday While Dollar Waits On US CPI

PBoC Provides Strongest Boost To Yuan Fixing Since November -

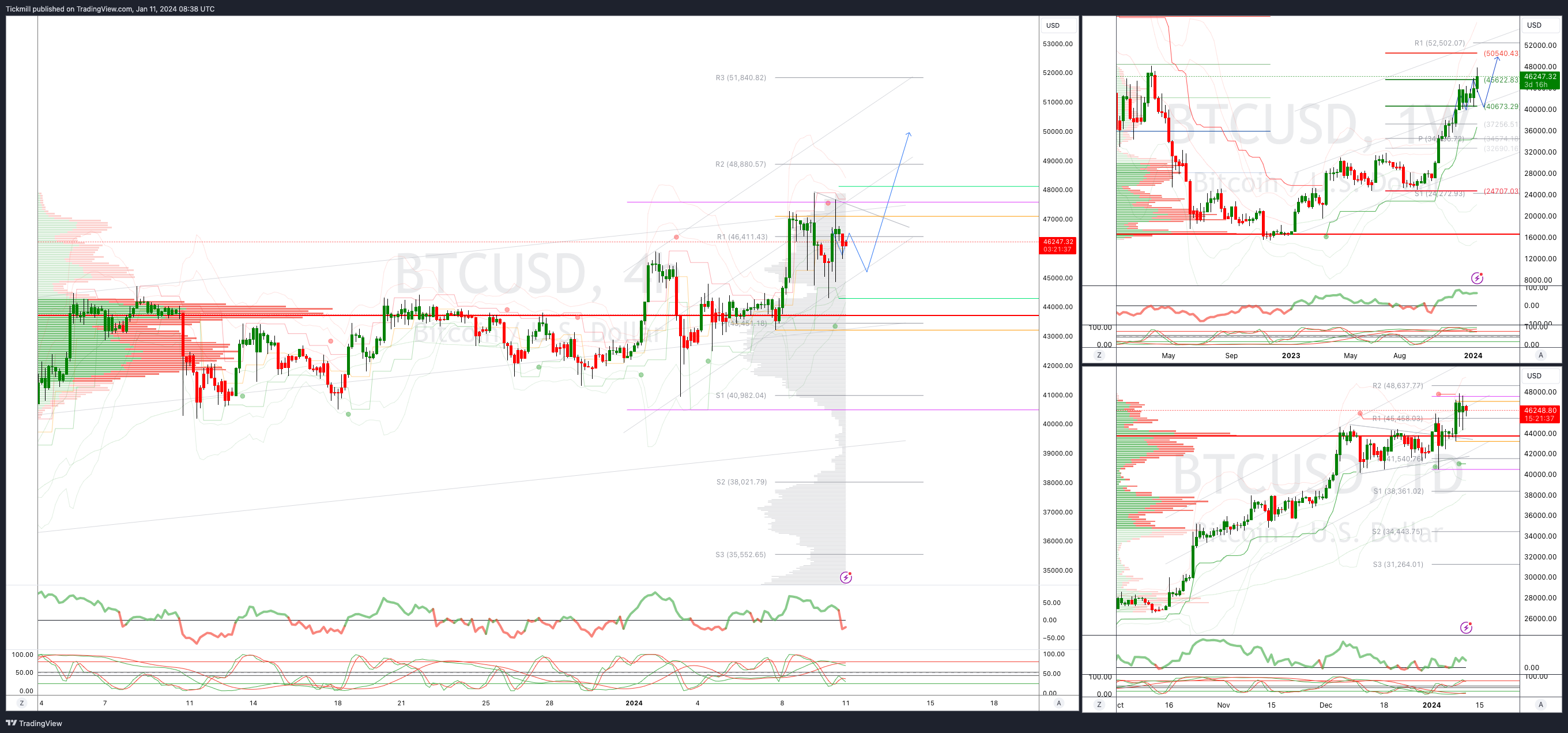

SEC Approves Bitcoin Spot ETF In Milestone For Digital Assets

Bond Sales Reach €108 Billion In A Record Week For Europe

Oil Holds Decline After US Stockpiles Post Unexpected Increase

Asian Markets Rise; Japan’s Nikkei Hits Highest Level Since 1990

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (558M), 1.0950 (431M), 1.0965-75 (375M), 1.1000 (530M),

1.1020 (730M), 1.1050 (1.7BLN)

USD/CHF: 0.8500 (314M). GBP/USD: 1.2790 (429M)

USD/JPY: 144.00 (1.1BLN), 145.00 (279M), 145.40-50 (736M)

AUD/JPY: 97.75 (338M)

Short positions are increasing in the majority of Asian currencies, with strong short positions against the Chinese yuan (CNY), Indonesian rupiah (IDR), South Korean won (KRW), and Philippine peso (PHP). Traders are particularly bearish on the Malaysian ringgit (MYR). However, investors are taking a neutral stance on the Singapore dollar and Thai baht. In contrast, there is a return of bullish sentiment for the Indian rupee, which has reached its highest level since December 2018 in January. It is now anticipated that U.S. rates will decrease in March and fall by 140 basis points in 2024. This surprising trend in the foreign exchange market should not be overlooked, and it suggests that FX traders may sell a significantly larger amount of dollars.

CFTC Data As Of 05/01/24

USD bearish increasing-1,674

CAD bearish decreasing +1,045

EUR bullish neutral +138

GBP bullish neutral +78

AUD bearish decreasing +601

NZD neutral neutral +198

CHF bearish increasing -262

JPY bearish neutral -157

Technical & Trade Views

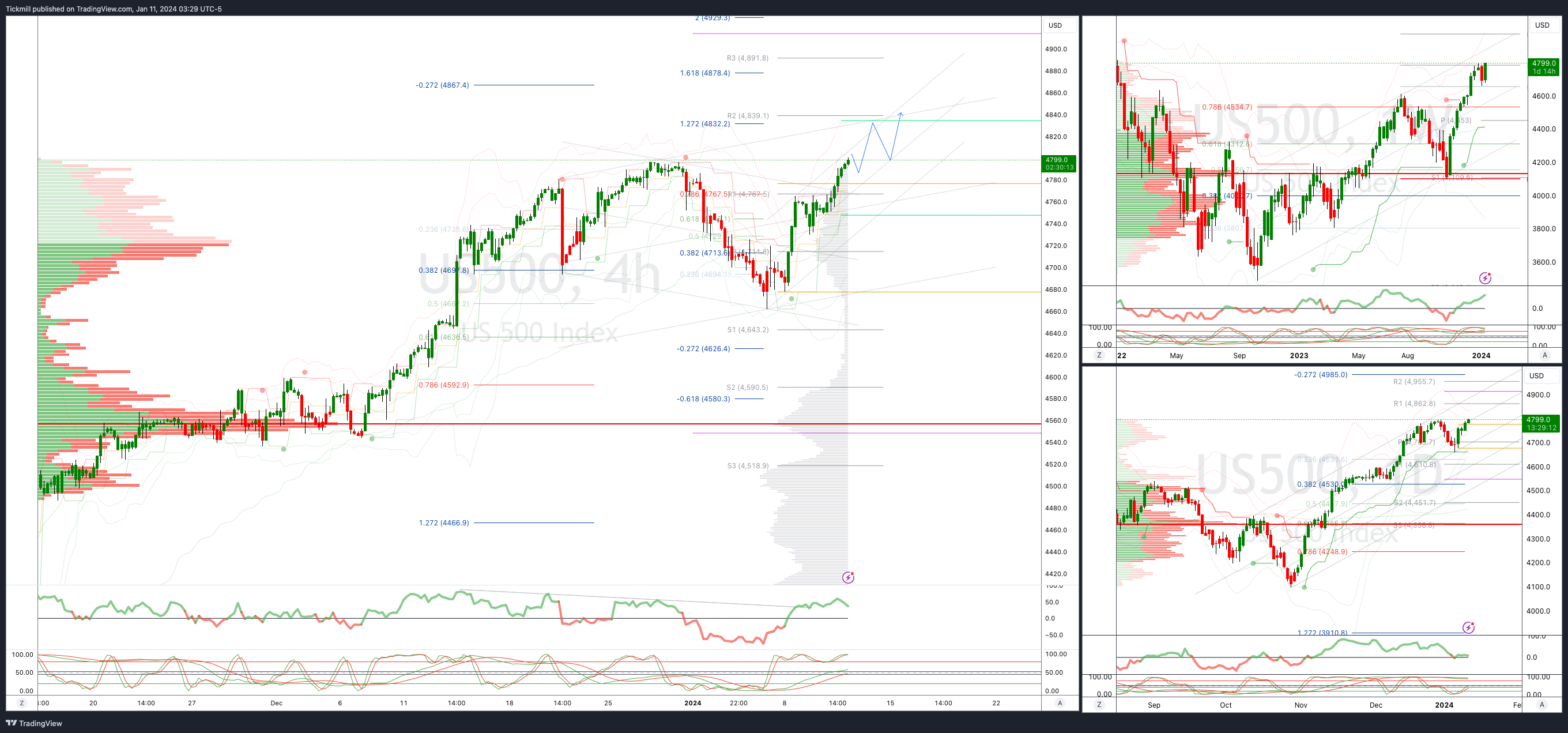

SP500 Bullish Above Bearish Below 4730

Daily VWAP bullish

Weekly VWAP bullish

Below 4730 opens 4700

Primary support 4670

Primary objective is 4830

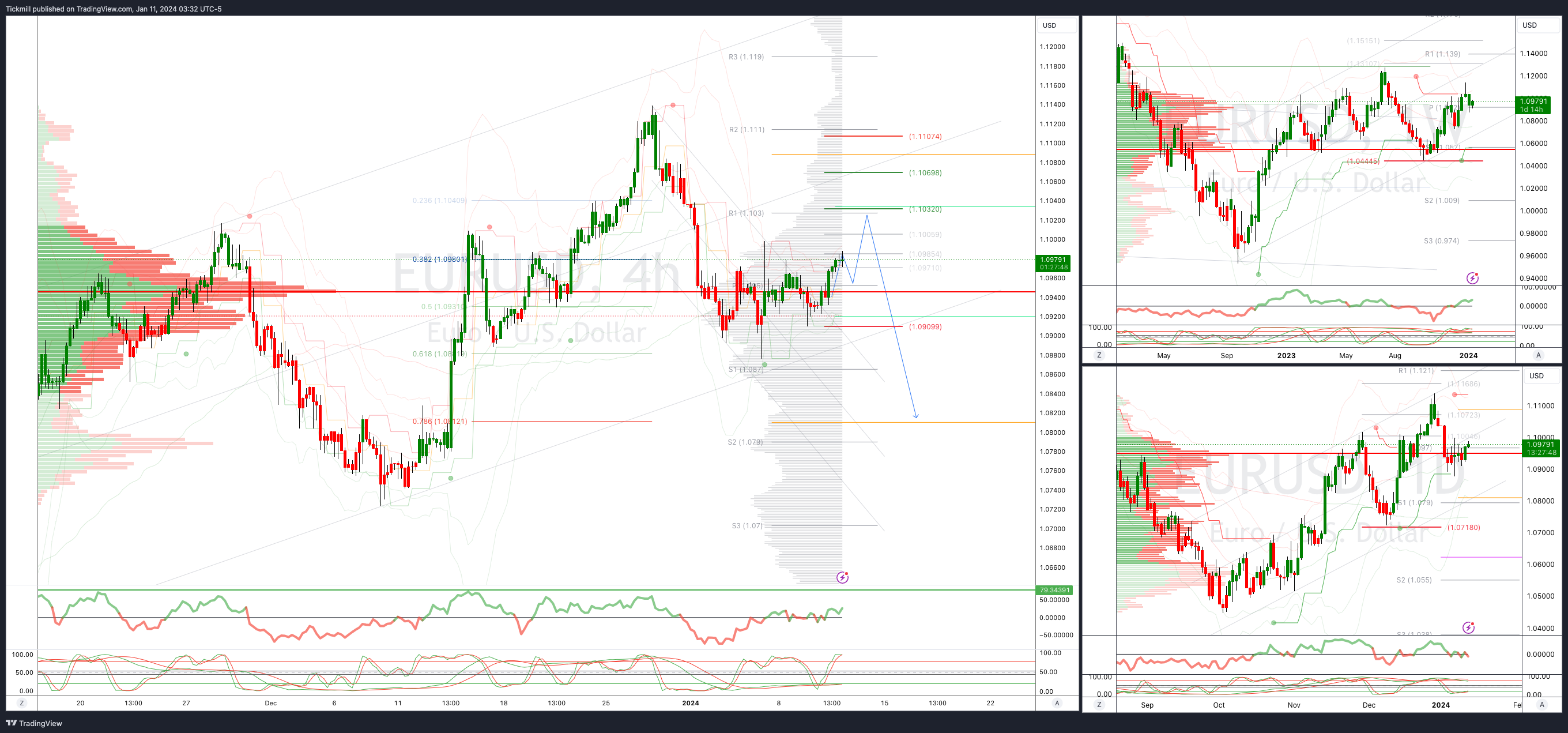

EURUSD Bullish Above Bearish Below 1.1000

Daily VWAP bullish

Weekly VWAP bullish

Above 1.1030 opens 1.1070

Primary resistance 1.1130

Primary objective is 1.0850

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2820

Primary objective 1.2550

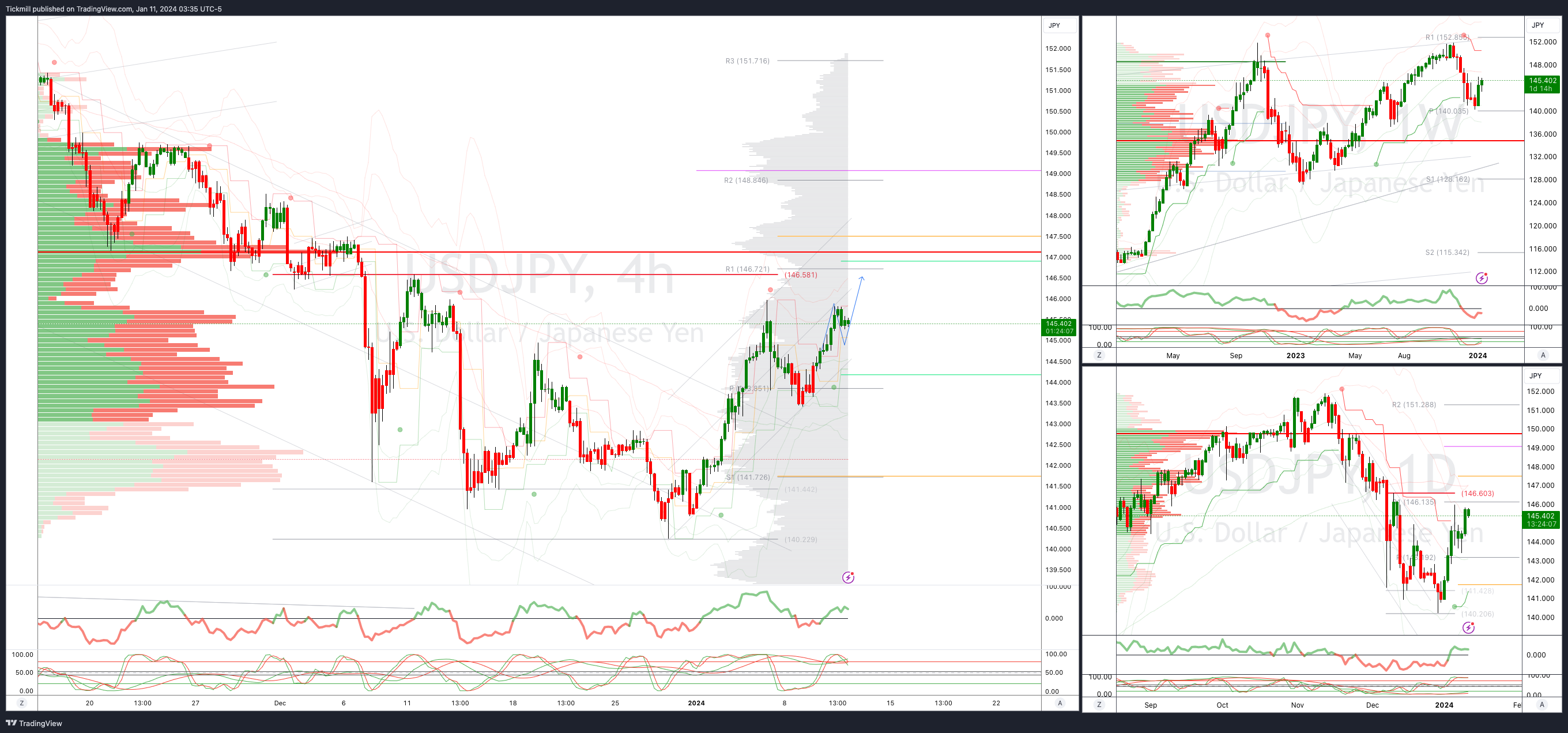

USDJPY Bullish Above Bearish Below 143.50

Daily VWAP bullish

Weekly VWAP bullish

Below 143 opens 142.50

Primary resistance 146.50

Primary objective is 146.50

AUDUSD Bullish Above Bearish Below .6750

Daily VWAP bearish

Weekly VWAP bearish

Below .6660 opens .6550

Primary support .6525

Primary objective is .6933

BTCUSD Bullish Above Bearish below 46000

Daily VWAP bullish

Weekly VWAP bullish

Below 45900 opens 44600

Primary support is 40000

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!