Daily Market Outlook, August 9, 2023

Daily Market Outlook, August 9, 2023

Munnelly’s Market Commentary…

Asian equity markets are predominantly trading lower against the backdrop of a flurry of earnings releases. Participants are also processing the latest inflation data from China, which presented a mixed picture by indicating consumer prices in deflationary territory for the first time in over two years.

The Nikkei 225 index is experiencing uncertain trading as a result of an influx of corporate earnings releases. The index's most significant gainers and losers are influenced by corporate performance, including SoftBank, which finds itself closer to the bottom of the spectrum following an unexpected loss. Both the Hang Seng index and the Shanghai Composite index are subdued, with the markets reflecting on China's conflicting inflation data. The data revealed that the Consumer Price Index (CPI) year-on-year slipped into deflation territory. However, the drop in prices was narrower than anticipated, and monthly consumer prices unexpectedly increased. On the other hand, China's factory gate prices continued to decline at a more pronounced pace than forecast.

The remainder of the day's data docket lacks noteworthy economic releases in the UK, US, or the Eurozone, and is devoid of any planned addresses from economic policymakers as the summer lull in activity takes hold.

Therefore, while the calendar for today seems light, the market's focus will turn to tomorrow's release of US CPI inflation data. This marks the first of two US inflation reports to be disclosed prior to the next US monetary policy announcement, which holds paramount importance in determining the possibility of a Fed interest rate hike. Following closely, on Friday, there will be a consequential release of UK GDP data. Looking further ahead into the next week, an eventful calendar includes UK reports on inflation and the labour market, both of which will significantly influence the BoE's forthcoming rate decision.

CFTC Data As Of 25-07-23

USD spec net short pared in Jul 26-Jun 1 period, $IDX -0.72%

EUR$ -0.58% in period specs -5,168 contracts, now short 172,062

$JPY +1.75% in period, specs -1,464 contracts into strength now -79,216

GBP$ -0.95% in period, specs -9,433 contracts, specs sell into dip

AUD$ -2.61% in period spec -591; $CAD +0.82% specs +835- just noise

BTC -0.05% in period, specs +106 contracts now -539

Prevailing theme was more-dovish c.bank guidance, USD firm amid high-for-longer vibe (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0890-1.0905 (2.3BL), 1.0930-40 (577M), 1.0980 (673M), 1.10 (251M)

GBP/USD: 1.2600 (683M), 1.2650 (355M), 1.2800 (200M), 1.2825 (277M)

AUD/USD: 0.6500 (426M), 0.6620 (300M), 0.6640 (566M)

NZD/USD: 0.6215 (339M).

EUR/NOK: 11.20 (280M), 11.25 (248M), 11.40 (1.1BLN)

USD/JPY: 142.00 (1.5BLN), 142.35-45 (1BLN), 142.75 (1.8BLN), 143.00 (2.2BLN)

143.25 (325M), 144.50 (730M).

USD/CAD: 1.3385 (655M)

FX Options Positioning

FX option implied volatility experienced a decrease due to anticipated reduced volatility in August, aligning with historical patterns. However, the USD saw a slight increase in value as the market approached Thursday's release of US Consumer Price Index (CPI) data, which prevented more significant drops for the time being. Traders displayed a tendency to purchase declines in AUD/USD implied volatility. This suggests that concerns are present regarding potential further declines in the currency pair towards the 2023 lows situated at 0.6459. These concerns emerged after the 0.6500 barrier options were erased on Tuesday. The EUR/USD currency pair finds itself confined within a range of 1.0900 to 1.1050, characterised by a region of long gamma. This situation serves to limit the movement of the spot rate while also influencing implied volatility. Despite testing the lower boundary of this range, the 1-month implied volatility has managed to hold its ground above the level of 6.5 for the time being.

Overnight Newswire Updates of Note

China Stocks Fall As Consumer Prices Drop For First Time In More Than 2 Years

China Slides Into Deflation As Consumer, Factory Prices Drop

Japan’s Defense Ministry To Seek More Than JPY7 Tln Budget

Italy Backtracks With Cap On Windfall Tax After Bank Shares Slide

NIESR: Risk Of UK Recession At Next General Election Is 60%

US Set To Limit Scope Of China Investment Ban With Revenue Rule

Dollar Firm On Safe-Haven Demand As Markets Fret Over China, Banks

Oil Prices Slip As Bearish China Data Fuels Demand Concerns

Nvidia Unveils Faster Chip Aimed At Cementing AI Dominance

Amazon In Talks To Become Anchor Investor In Arm Ahead Of IPO

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

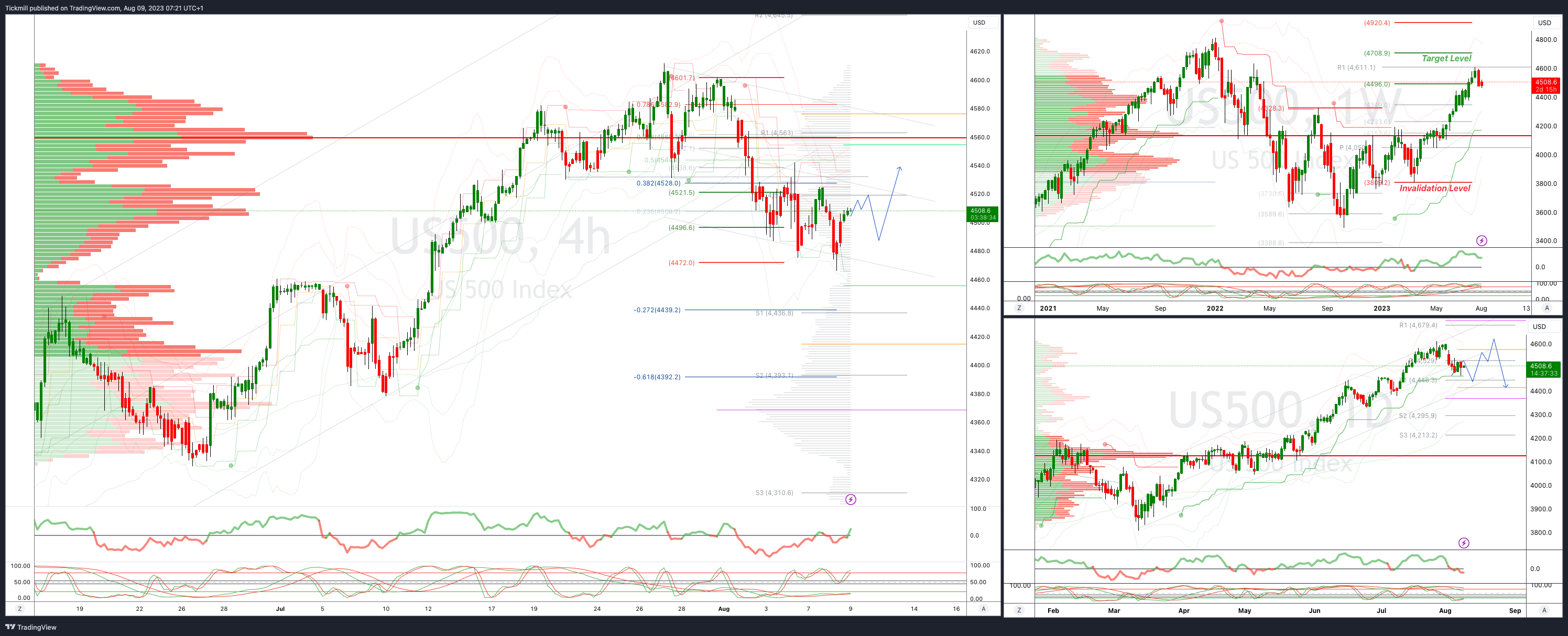

SP500 Intraday Bullish Above Bearish Below 4520

Below 4480 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bearish, 5 Day VWAP bullish

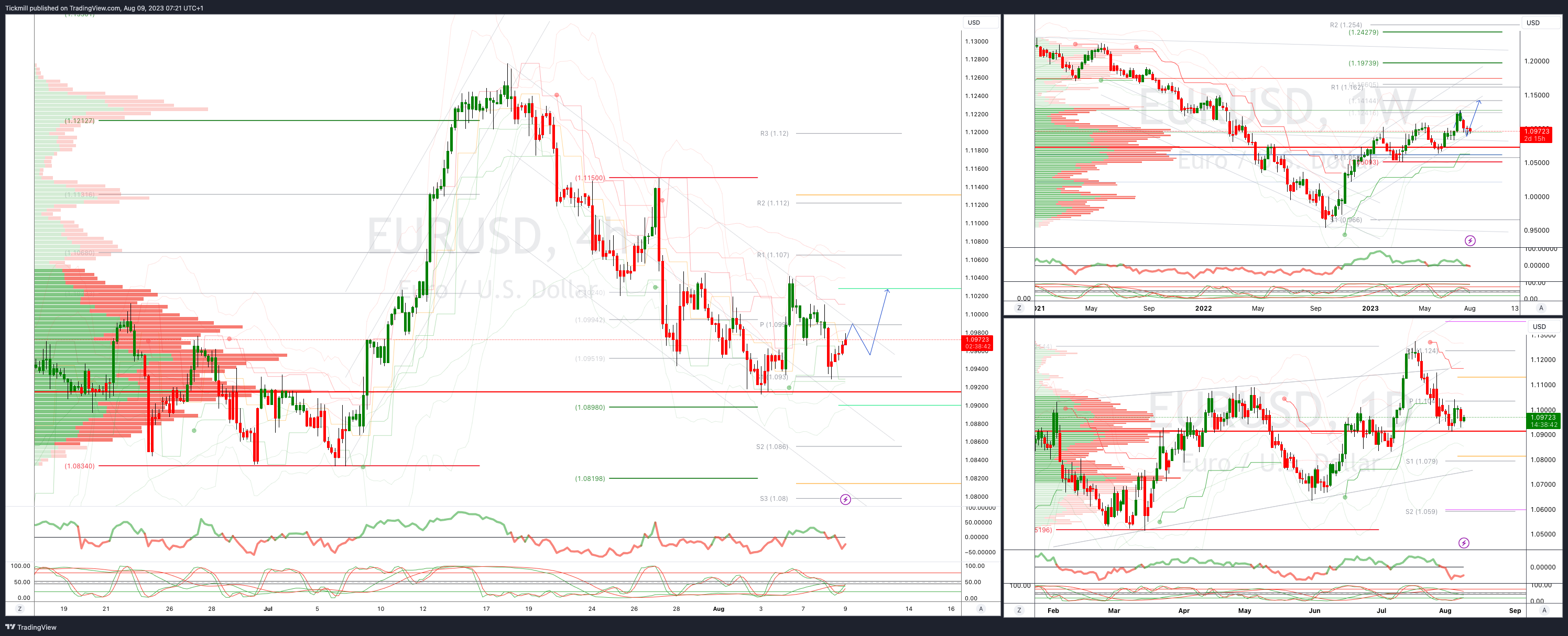

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bullish

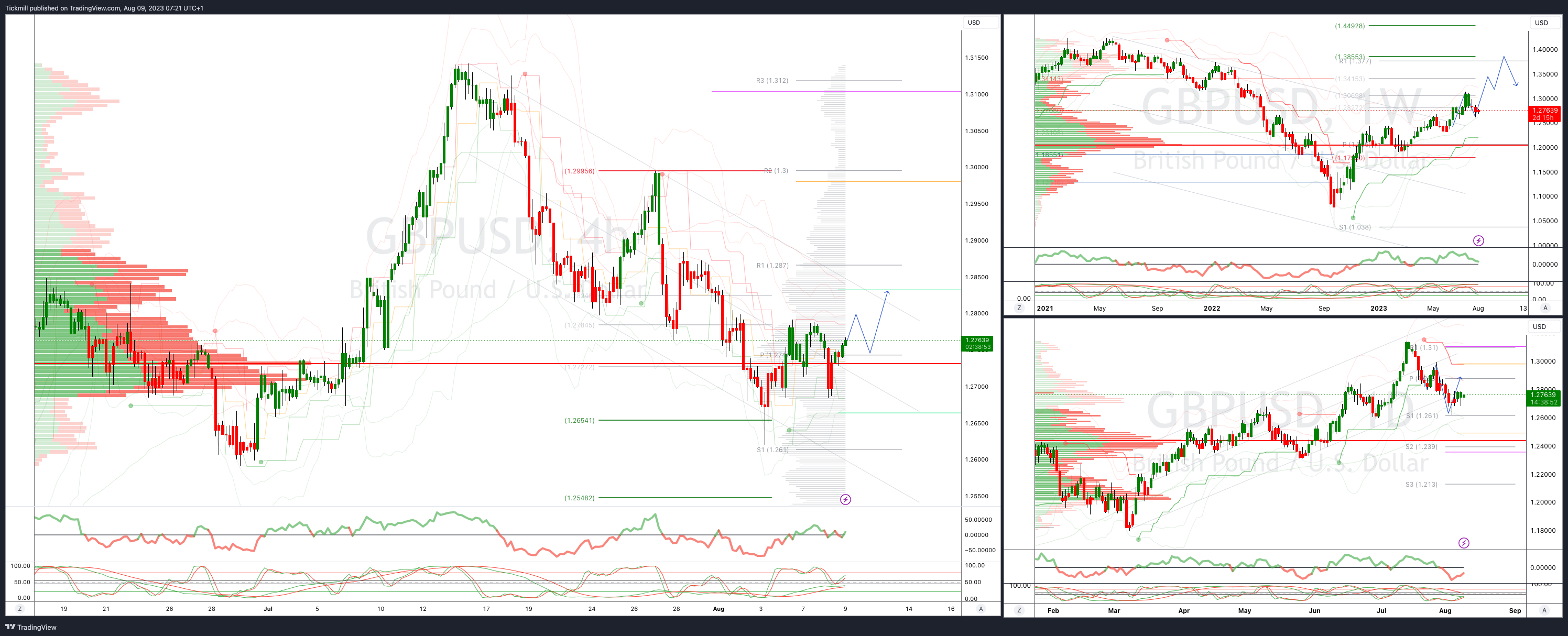

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bullish

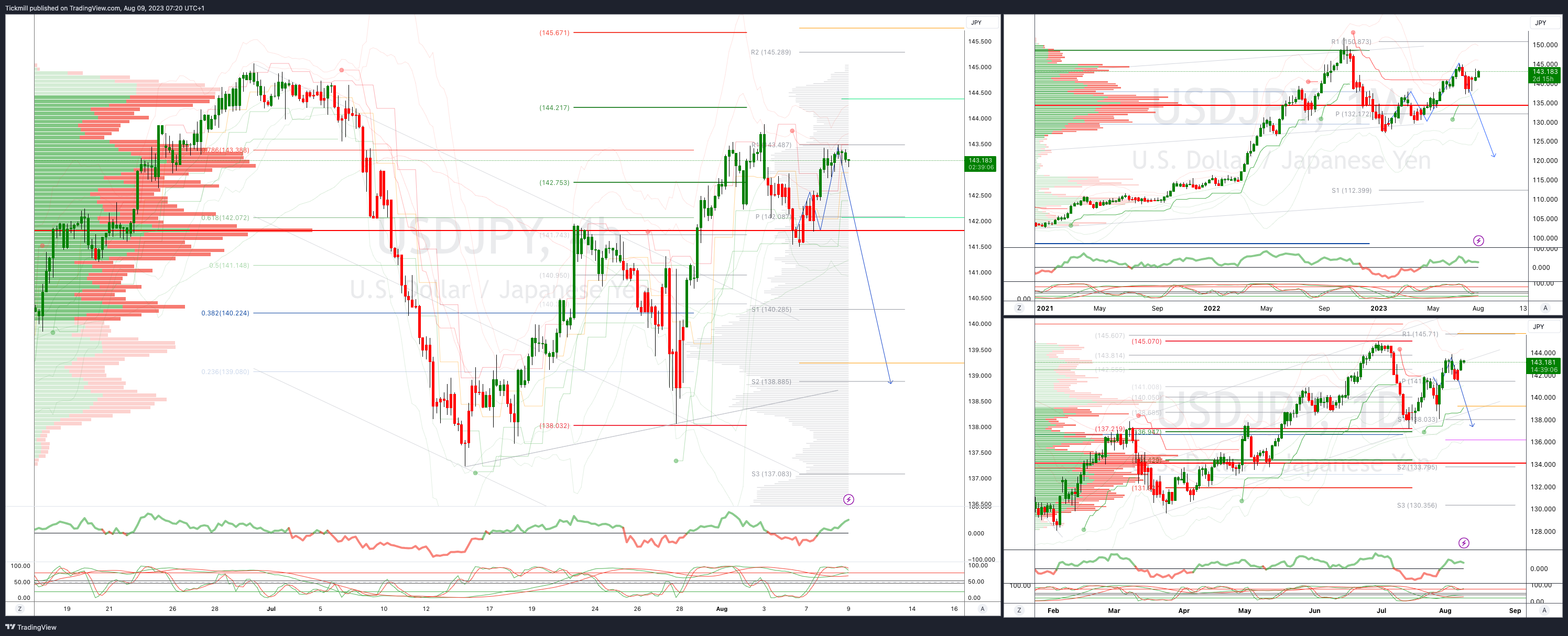

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bearish

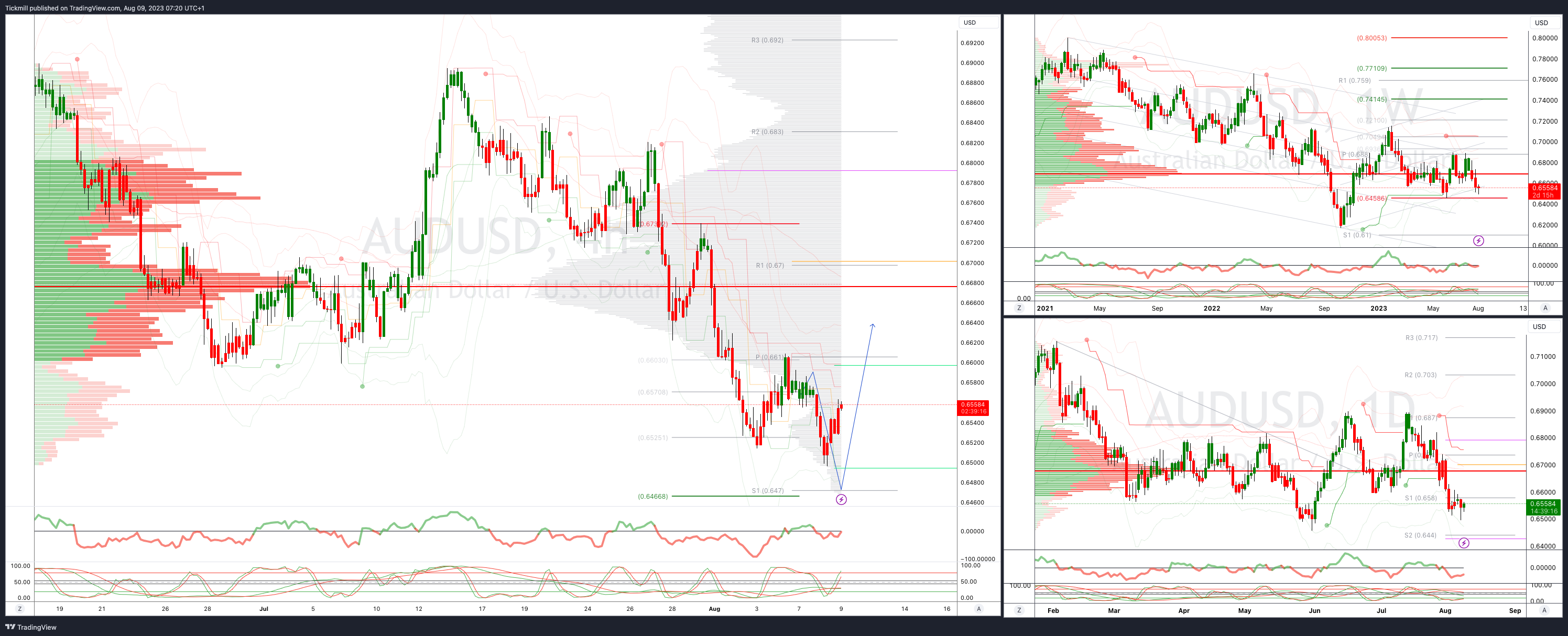

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

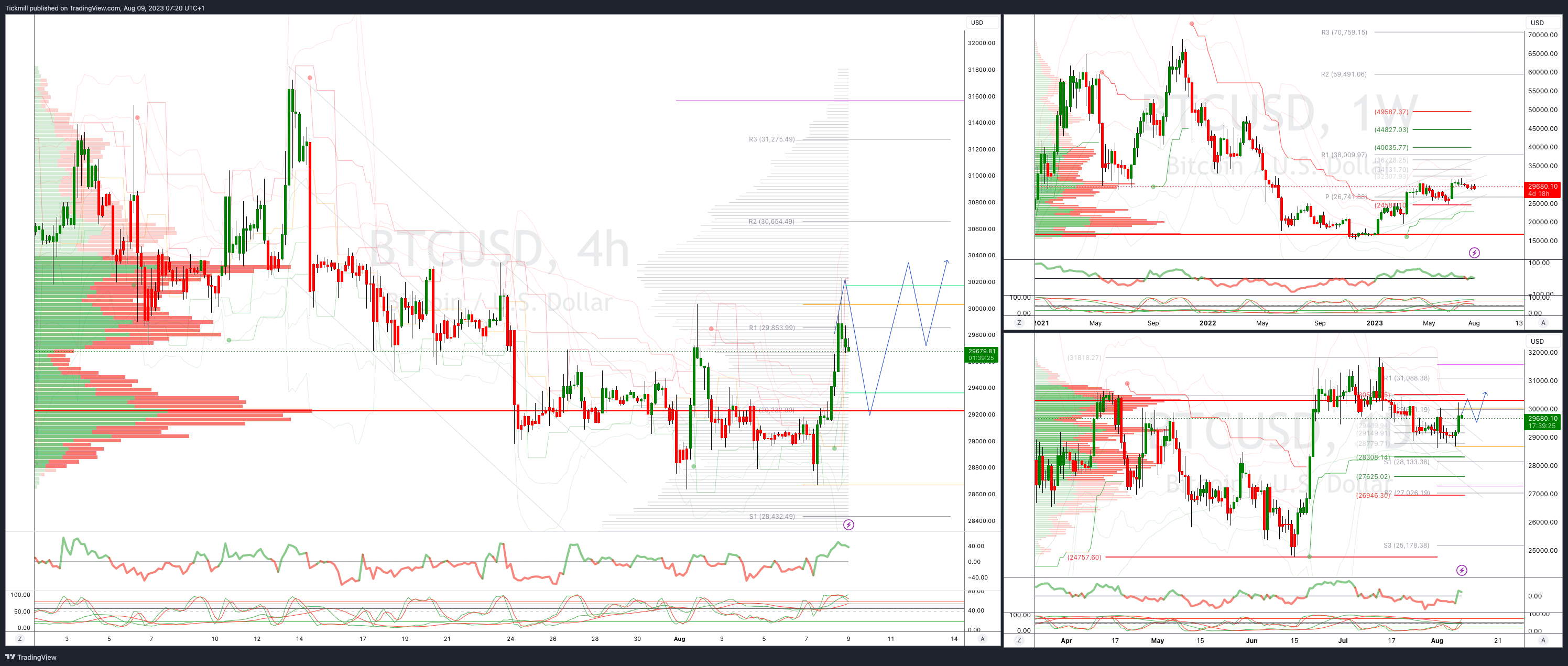

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!