Daily Market Outlook, August 4, 2023

Daily Market Outlook, August 4, 2023

Munnelly’s Market Commentary…

Asian equity markets experienced a mixed trading session as most bourses in the region lacked a clear direction. This uncertainty followed a subdued performance in Wall Street, where investor sentiment was affected by concerns about a higher yield environment and mixed economic data. Market participants also took into account earnings releases from tech giants Apple and Amazon, which added to the cautious atmosphere. Additionally, investors paid close attention to the latest support measures announced by the People's Bank of China (PBoC). The Nikkei 225 in Japan fluctuated between gains and losses. After an initial dip below the 32K handle, the index saw some buying interest, but the upward momentum fizzled out. In contrast, the Hang Seng index in Hong Kong recorded a notable gain, while the Shanghai Composite index also showed positive performance. The property sector led the gains in these markets, supported by the PBoC's recent policy pledges. The central bank announced its intention to introduce guidelines to bolster private firms and expand debt financing tools. Additionally, the PBoC revealed plans to implement distinct housing credit policies, which likely contributed to the positive sentiment in the property sector.

In the UK, following yesterday's interest rate hike, BoE Chief Economist Pill is scheduled to hold a briefing with the central bank's regional agents. The purpose of this briefing is to provide further insight into the Bank of England's outlook on inflationary pressures and shed light on potential future developments in monetary policy. As the regional agents are responsible for explaining the decision to various stakeholders, they will likely seek additional details on the central bank's assessment of inflationary trends and clues about the trajectory of monetary policy going forward. Additionally, the release of the July UK PMI construction index will be closely watched as it offers a timely indication of activity in a sector highly sensitive to interest rate changes. In June, the overall PMI construction index dropped below the critical 50 level, indicating a contraction in the sector for the first time since January. This decline was mainly attributed to a significant decrease in housing activity, which more than offset any gains observed in commercial projects and civil engineering. Given the importance of the construction sector in gauging the overall health of the UK economy and its sensitivity to interest rate shifts, investors and analysts will closely analyse the July PMI data for insights into how the recent interest rate hike may impact construction activity and, by extension, the broader economic landscape.

Stateside The US labour market report is always considered a crucial indicator of the country's economic conditions. However, Federal Reserve Chairman Jerome Powell's recent remarks have heightened the importance of the upcoming report, as well as the one in early September. These reports will receive even more attention than usual as they will provide insights into the tightness of the labour market and the pace of wage growth. In the July labour market report, analysts will be closely examining employment growth and the unemployment rate to gauge the overall strength of the job market. Additionally, the focus will be on wage growth, as it has implications for inflationary pressures and the Federal Reserve's monetary policy decisions. Economists predict another significant increase in employment of around 230,000 jobs in July. The unemployment rate is expected to remain unchanged from the June rate at 3.6%. However, there are indications that annual wage growth might slow slightly to 4.3% from the previous reading of 4.4%. This combination of outcomes in the labour market report leaves uncertainty about whether domestic inflation pressures are easing enough to provide confidence to Federal Reserve policymakers in holding off from further tightening of monetary policy, such as additional interest rate hikes or other measures aimed at curbing inflation. The Federal Reserve will be particularly attentive to the data as it assesses the appropriate course of action to support the US economy while maintaining price stability.

CFTC Data As Of 25-07-23

USD net spec short grew in Jul 19-25 period, $IDX +1.34% in period

Rates remain key driver, after period close Fed, ECB lilted dovish

BoJ adjusted YCC JGB 10-yr intervention lvl to 1%, yen whipsawed

EUR$ -1.52% in period, specs -1,602 contracts now -177,230

$JPY +1.34% in period, specs +12,487 into strength now -77,752

GBP$ -1%, specs -4,734 contracts, now +58,995; after below f/c CPI

AUD$ -0.3% in period, specs -800 contracts; $CAD +0.03%, specs +5,009

BTC -1.86% in period specs +516 contract by trend lows now -645 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0950 (794M), 1.0975 (510M), 1.0990-1.1000 (780M)

1.1035 (485M), 1.1050-55 (492M), 1.1075 (800M)

GBP/USD: 1.2600 (447M), 1.2650 (240M), 1.2700 (891M)

1.2750 (330M), , 1.2775 (258M)

EUR/GBP: 0.8575 (741M). AUD/USD: 0.6600 (628M)

USD/CAD: 1.3200 (1BLN), 1.3260-75 (1BLN), 1.3300 (2BLN)

1.3325 (600M), 1.3390-1.3400 (1.5BLN)

USD/JPY: 142.00 (1.2BLN), 143.00 (900M), 144.00 (359M), 145.00 (1BLN)

Overnight Newswire Updates of Note

RBA Sees Inflation Back Within Target End-2025, Soft Landing For Economy

PBoC: RRR Cuts, Other Policy Tools Need To Be Used Flexibly

PBoC Chief Meets With Property Developers, Vows Funding Help - BBG

China Scraps Australian Barley Tariffs In Place Since 2020

BoE’s Bailey Says ‘Last Mile’ Of UK’s Inflation Fight Will Take Time

White House Urged To Limit US Investment In Chinese Stocks And Bonds

Oil Coasts To Sixth Weekly Gain After Saudi, Russia Extend Cuts

Apple Sees Sales Slump Continuing, Shares Drop Despite Beating Sales Expectations

Amazon Forecasts Third-Quarter Revenue Above Expectations

Gilead Quarterly Profit Falls On COVID Sales Drop, Legal Settlement Charge

Microchip Technology Inc. Q1 Profit Increases, Inline With Estimates

Tiger Global Builds Big Apollo Stake In Shift From Tech Bets

London Stock Exchange Group Teams Up With Microsoft To Develop AI Models

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

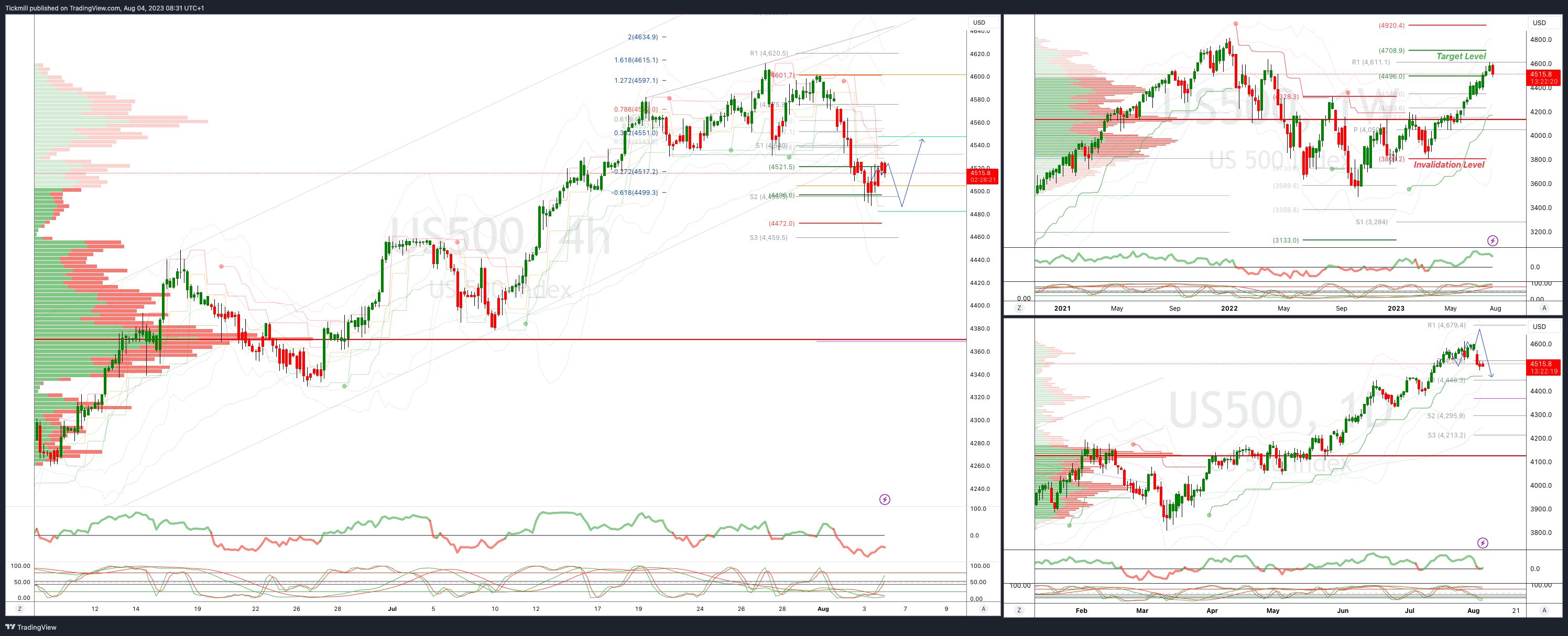

SP500 Intraday Bullish Above Bearish Below 4520

Below 4500 opens 4480

Primary support is 4370

Primary objective is 4630

20 Day VWAP bearish, 5 Day VWAP bearish

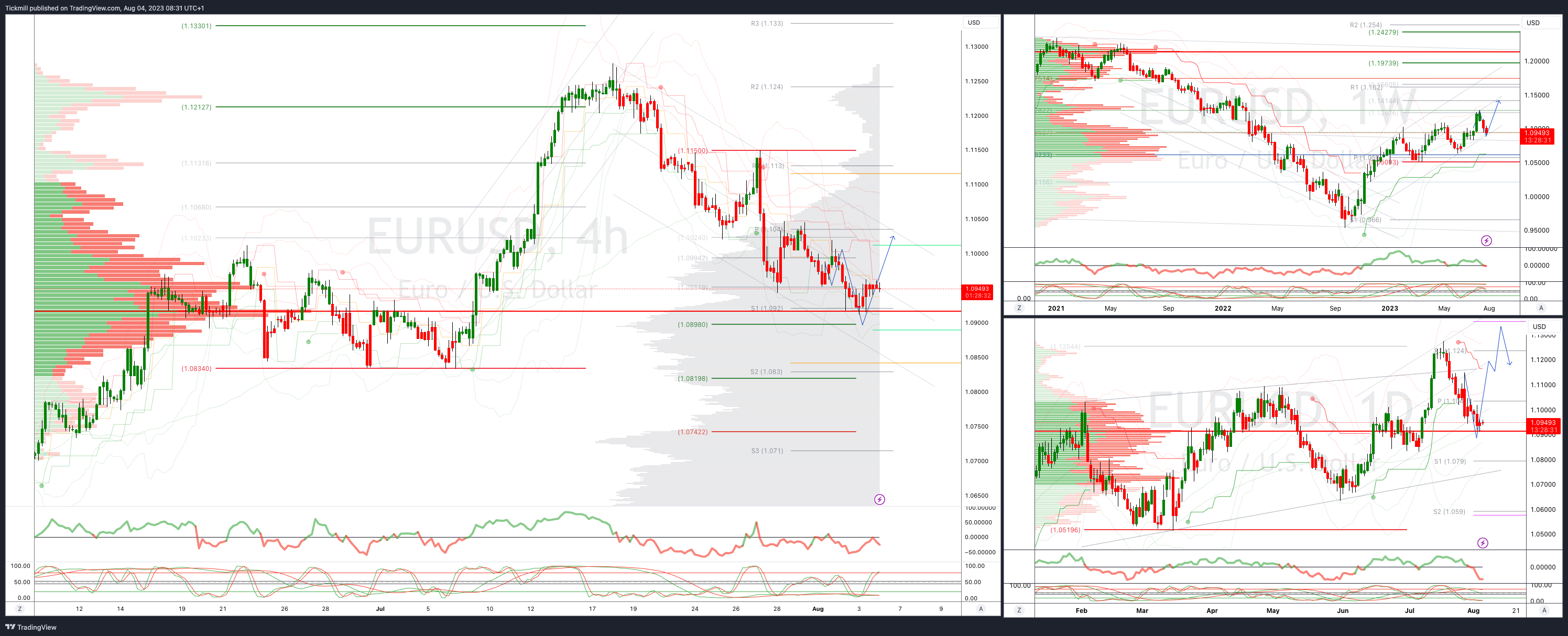

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bearish

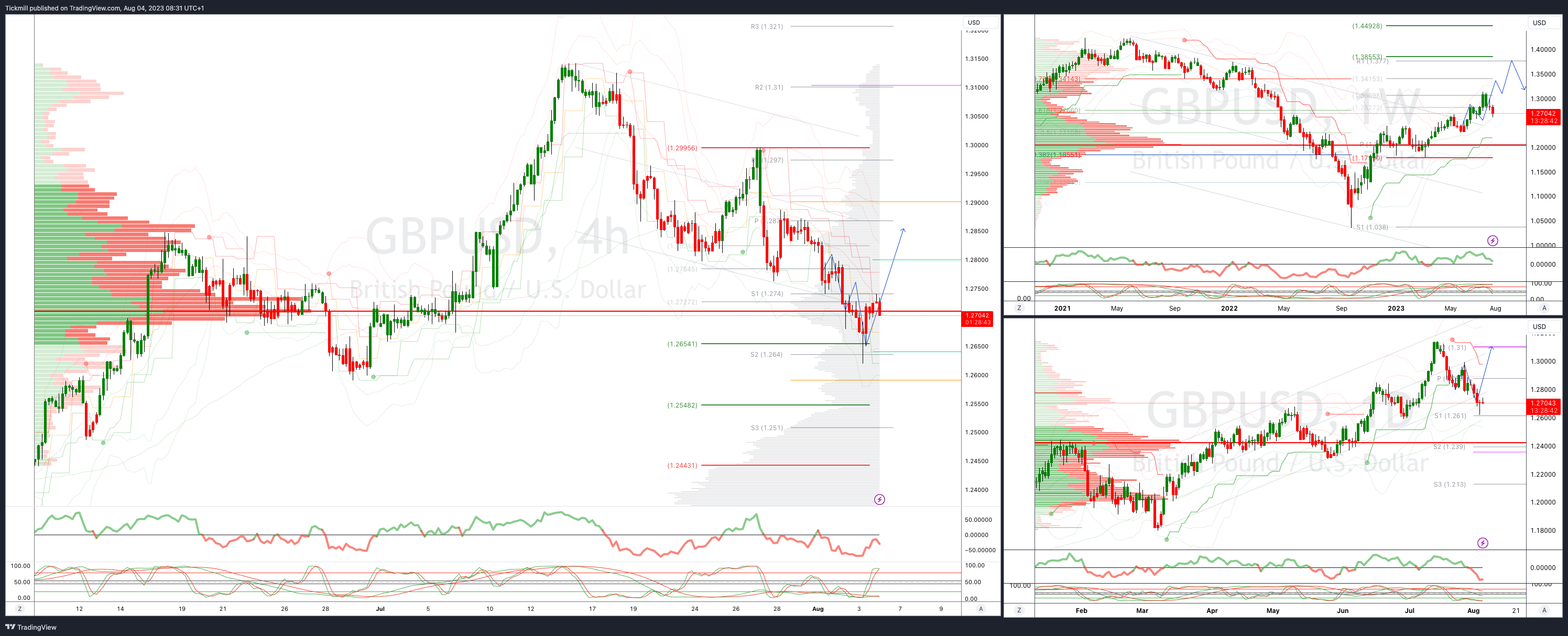

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

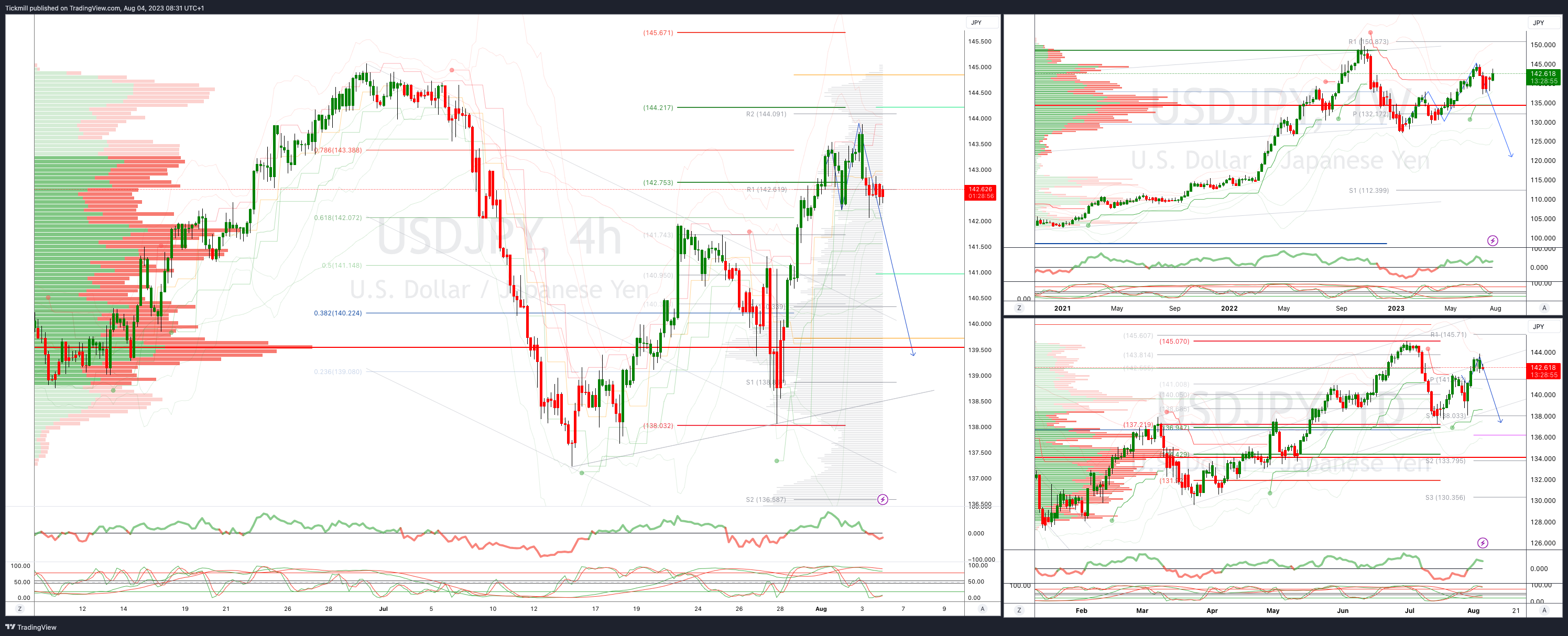

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

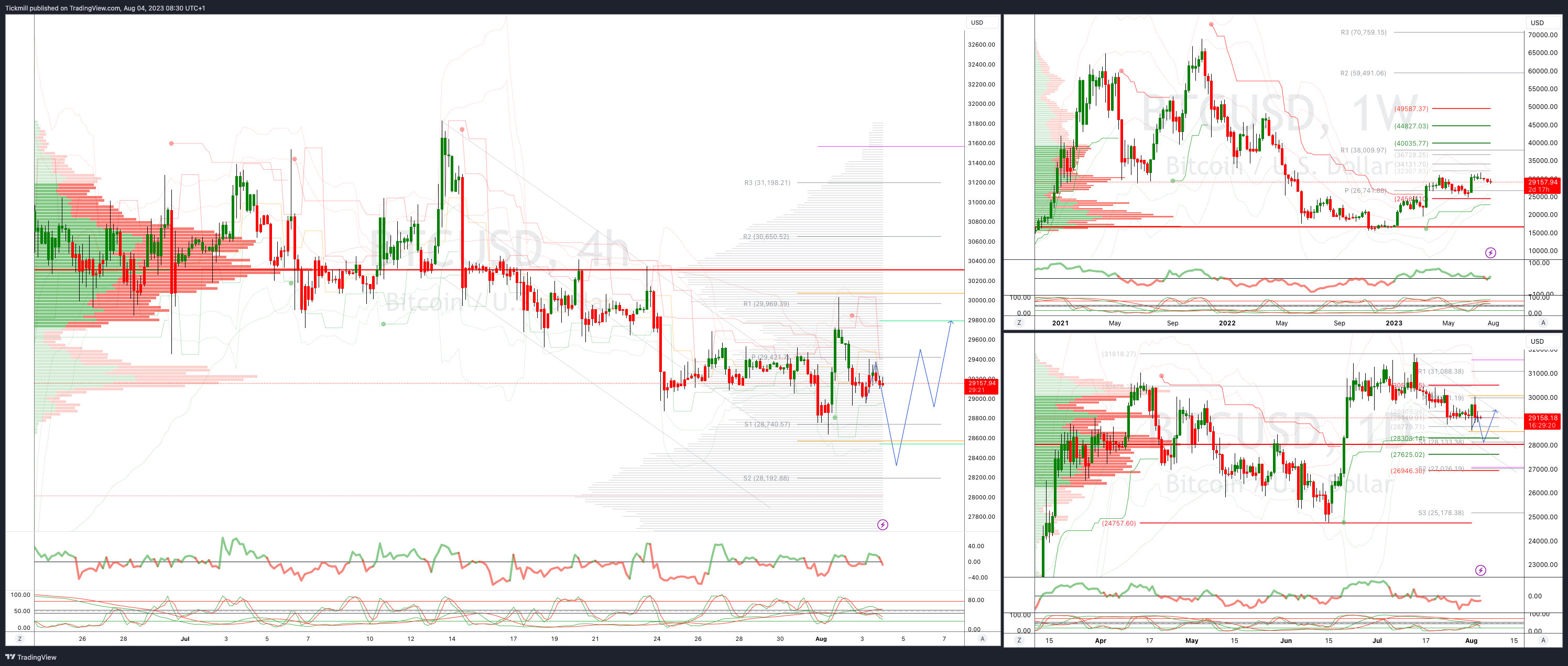

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!