Daily Market Outlook, August 11, 2023

Daily Market Outlook, August 11, 2023

Munnelly’s Market Commentary…

Asian equity markets made little positive progress overnight,influenced by a dovish reaction to post-CPI developments in the United States and concerns surrounding Chinese property developers. Trading activity was also hindered by reduced participation as Japanese market participants were absent due to Mountain Day. The Hang Seng index and the Shanghai Composite index experienced declines, primarily driven by the struggles of property developers. Country Garden Holdings faced pressure after announcing a potential loss of up to CNY 55 billion for the first half of the year and enlisting CICC for assistance with debt restructuring. Additionally, Fantasia Holdings saw a significant drop of over 50% upon resuming trading, having been halted since March of the previous year. Market participants were also anticipating details emerging from an emergency meeting between the securities regulator, developers, and financial institutions. Conversely, certain Hong Kong-listed companies performed well. Alibaba, China Mobile, and Li Ning stood out as some of the best-performing stocks, buoyed by favourable results. China's e-commerce giant, Alibaba, surpassed expectations by exceeding both top and bottom-line projections, contributing to its positive performance.

The remainder of today's data dockets appears to be quiet, with no significant data releases in the UK or the Eurozone. Stateside, however, the focus turns to the producer price data for July, which comes after yesterday's July Consumer Price Index (CPI) report. The CPI report indicated a rise in overall inflation but a decline in the core measure, excluding volatile elements. The producer price data will offer insights into inflationary pressures earlier in the supply chain. Over the past year, annual producer price inflation has decreased from over 10% in June of the previous year to nearly zero. Yet, there are tentative indications that this decline might be stabilising. Notably, the recent recovery in oil prices, if sustained, suggests the potential for an uptick in inflation in the latter part of the year. However, it's worth considering that today's data may have been collected too early in the month to fully capture this trend. Recent metrics of consumer confidence in the United States have shown significant improvements over the past couple of months. Despite this, they still remain below the levels observed before the Covid-19 pandemic. This upswing in confidence might be attributed to a growing belief that inflation is receding and to hopes that interest rates have reached their peak. Of particular interest is the University of Michigan's consumer sentiment index, which saw a substantial increase in July. Observing its response this month will provide insights into the ongoing sentiment. It's important to note that this index can be particularly sensitive to short-term fluctuations in gasoline prices. The rise in gasoline prices since late June could potentially have a negative impact on consumer sentiment.

CFTC Data As Of 08-08-23

Tuesday FX close, $IDX +0.52%, hints at little change in Majors positioning

Fri's CFTC spec data release likely to show little chg in EUR, JPY positions

USD largest gain vs AUD, CAD & CNH on lower global growth outlook

EUR$ -0.31% in Aug 2-8 CFTC reporting period, as ECB hike cycle nears end

$JPY +0.1% in period, had rallied 2-big figures off period low

GBP$ -0.22% in period, pair hovers near trend low on lwr BoE rate outlook

BTC +2.6% in period, lower rates seen supporting BTC

Retail extreme net longs in $JPY, EUR$ suggests EUR$, $JPY may be ripe for selling (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD 1.0890-00 (1.44BLN), 1.0925-30 (584M)

1.0950-60 (1.96BLN), 1.0965-75 (629M)

1.0980-90 (1.63BLN), 1.1000 (1.02BLN), 1.1025-30 (1.05BLN)

1.1050 (423M), 1.1100 (995M)

USD/JPY: 143.00 (517M), 143.50 (326M), 144.00 (850M)

145.00 (755M)

USD/CHF: 0.8560 (500M), 0.8750-65 (937M), 0.8825 (463M)

GBP/USD: 1.2530 (311M), 1.2600-05 (380M), (1.2700 (472M)

1.2850 (404M). EUR/GBP: 0.8700 (400M)

AUD/USD: 0.6500 (330M), 0.6520-30 (850M), 0.6550 (271M)

0.6575 (278M), 0.6600 (882M), 0.6675 (1.5BLN)

NZD/USD: 0.6100 (251M)

USD/CAD: 1.3320-25 (3.83BLN)

FX Options Positioning

Implied volatility for near-term contracts in the G10 foreign exchange market continues to decline and has further decreased following the release of the CPI data, as was anticipated. The 1-month benchmark contracts are now approaching the possibility of revisiting their lows from June, indicating a resurgence of the typical FX market conditions during the traditional quieter period of August.

Overnight Newswire Updates of Note

Dollar Steady After CPI Data Bolsters Fed Pause Bets; Yen Nears 145

BusinessNZ Manufacturing PMI Jul: 46.3 (prev R 47.4)

RBA's Lowe Keeps Door Open To Further Australia Interest Rate Hikes

NZ And Australia Sign Sustainable And Inclusive Trade Declaration

US Democrat Senator Manchin ‘Thinking Seriously’ About Leaving Party

POLL: ECB To Pause In September, Say Slim Majority Of Economist

China To Shift $139 Bln Of Troubled LGFV Debt To Provinces

Oil’s Weekly Gain Fades As Market Watchers Wait For IEA Report

GM, Ford Slide As $80 Bln Union Risk Hits Confidence

Microsoft’s Role In Email Breach To Be Part Of US Cyber Inquiry

Country Garden Expects H1 Loss Of Up To $7.6 Bln

Country Garden Is Preparing For Debt Restructuring Soon

China’s Once-Top Builder Turns Into Penny Stock Amid Debt Woes

Japan To Create Tax Breaks For Battery, Chip Production

Australia Regulator Clears Way For Strike Vote At Chevron LNG Plants

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

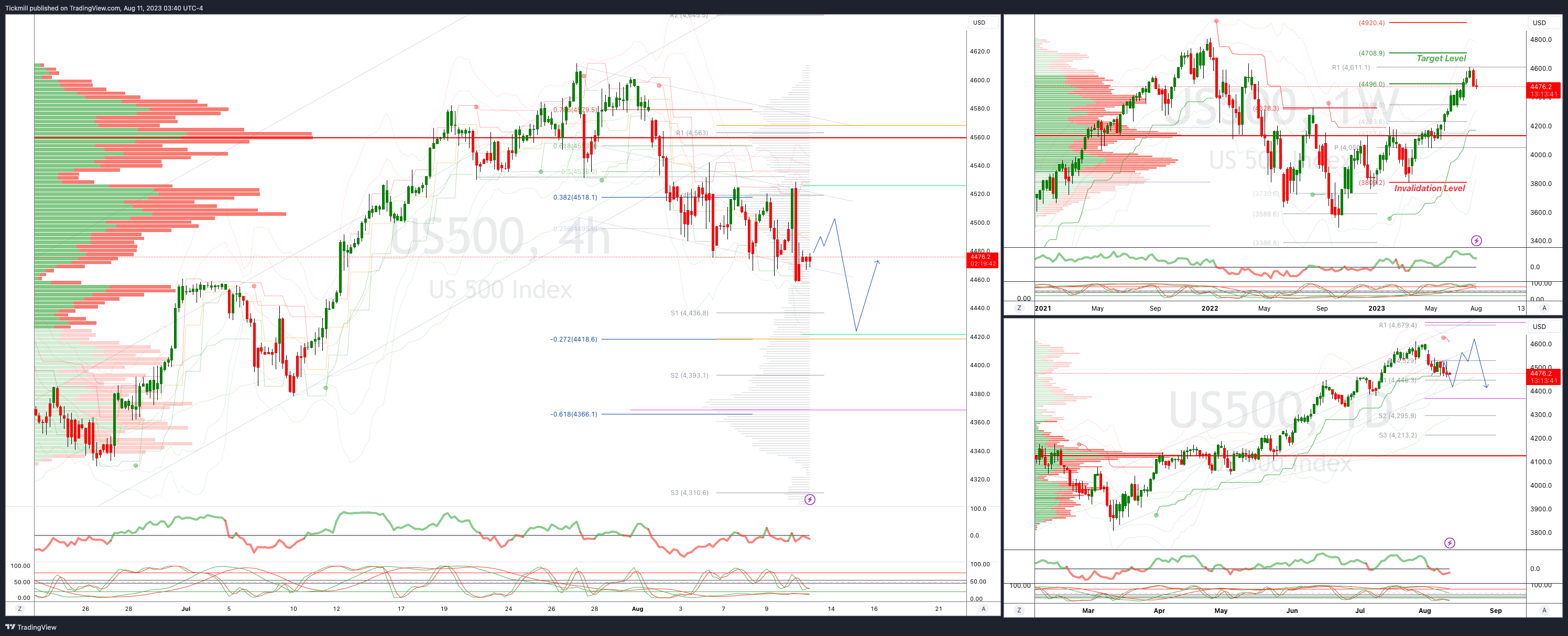

SP500 Intraday Bullish Above Bearish Below 4520

Below 4460 opens 4420

Primary support is 4370

Primary objective is 4630

20 Day VWAP bearish, 5 Day VWAP bearish

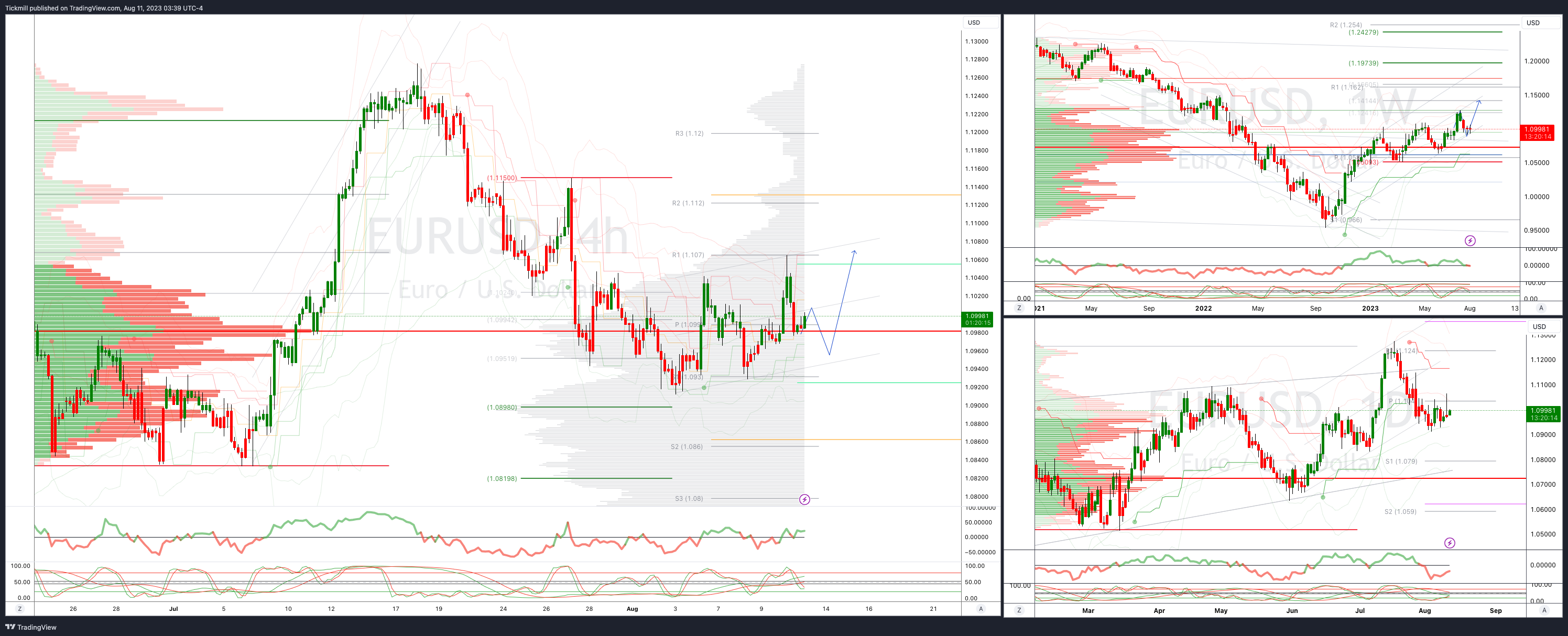

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bullish

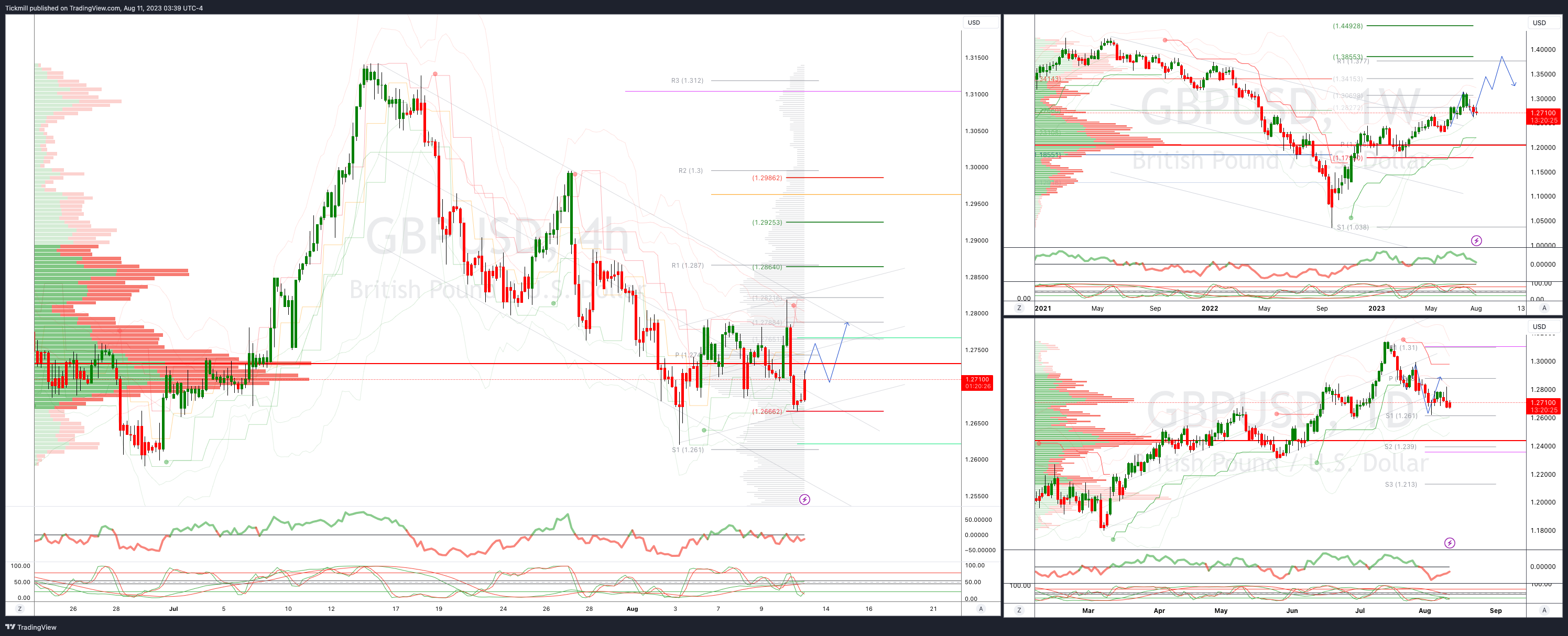

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

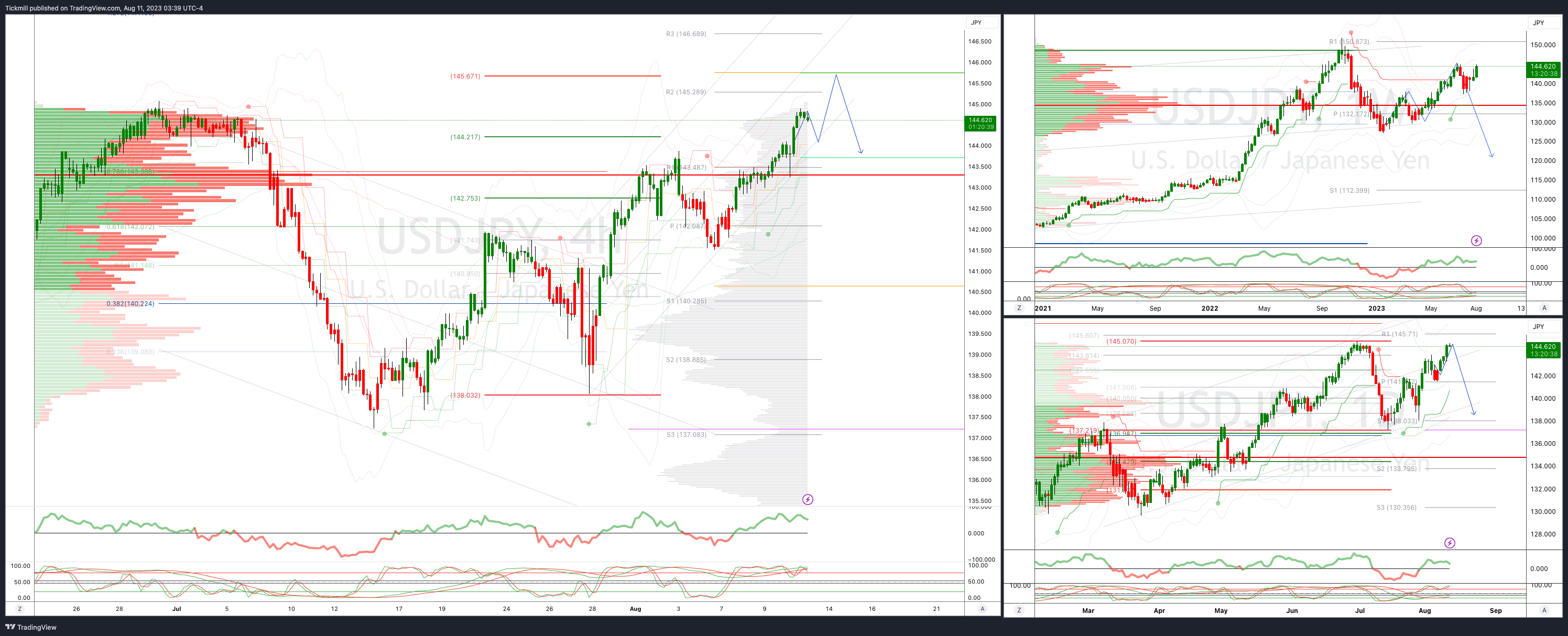

USDJPY Bullish Above Bearish Below 143

Below 143 opens 142

Primary support 140.50

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

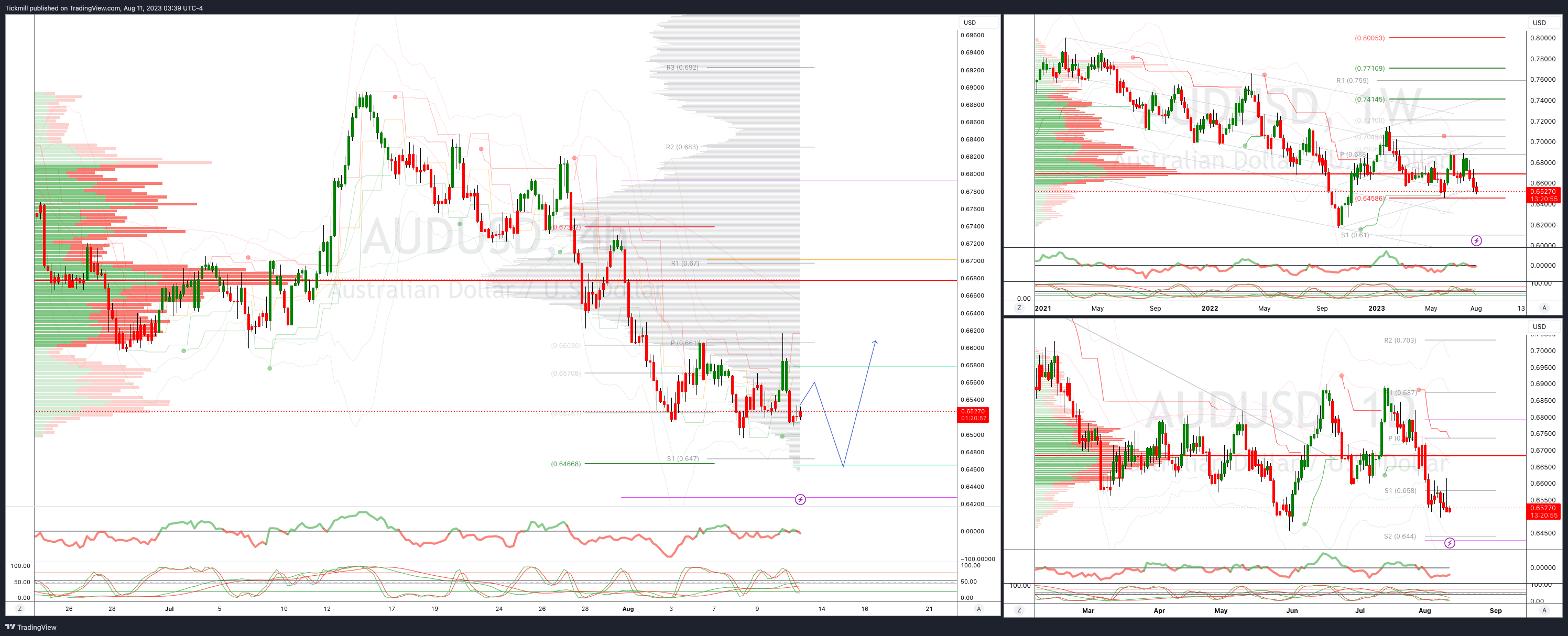

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

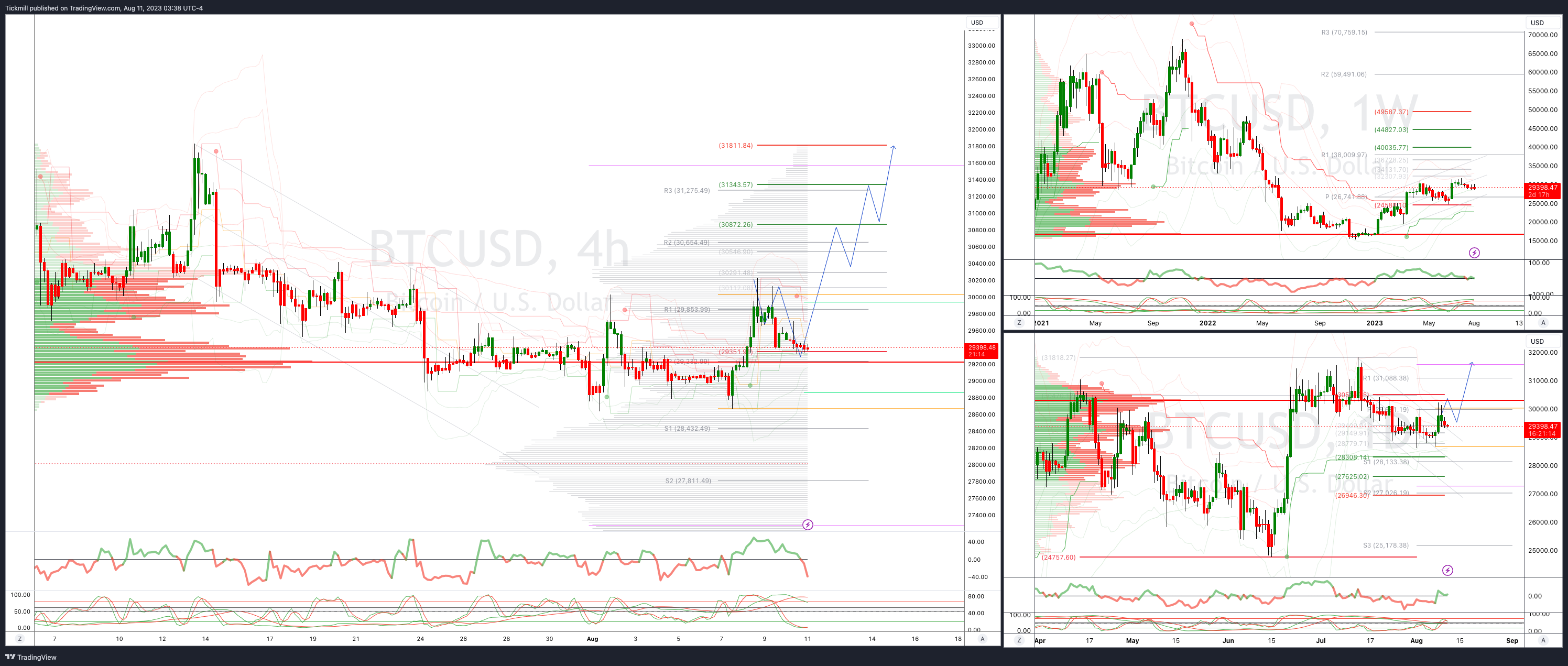

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!