Daily Market Outlook, April 22, 2021

Market sentiment appears to have perked up a bit over the past 24 hours, although without any obvious drivers. The S&P500 is up around 0.6% and the NASDAQ0.7%while small cap stocks have outperformed, with the Russell 2000 index 2% higher. Netflix’s disappointing earnings report, particularly its subscriber numbers, hasn’t had much impact on the broader tech sector, although its own share price is down some 7%. In general, earnings results have been overwhelmingly positive, with the more than 70 S&P500 companies to have reported so far having beaten analyst expectations by more than 20% on average.

Covid-19 cases remain very high in some countries, notably India, but the market remains optimistic that the vaccination rollout is making progress in major advanced economies, clearing the pathway for the removal of restrictions over the coming months. In France, the government confirmed it was planning to lift its nationwide travel ban in early May, with schools reopening in the coming weeks and bars and restaurants allowed to open for outdoor dining from mid next month. In contrast, the German government passed a new law allowing it to override regional governments and put in place social distancing restrictions in those areas where cases are running high.

Like global rates, movements in the major currencies (the EUR, JPY and GBP) have been small overnight. The EUR briefly dipped below 1.20, but it has since recovered to 1.2050. There was little reaction to news that Germany’s Constitutional Court had made a summary judgement that allows the German government to participate in the €750b European recovery fund. The USD is down marginally overnight, in index terms, mainly reflecting the appreciation in the CAD.

The European Central Bank (ECB) will announce its latest policy decision at 12:45BST, which will be followed by a press conference at 13:30BST with President Christine Lagarde. Policy settings are expected to be left unchanged on this occasion, with asset purchases under its Pandemic Emergency Purchase Programme (PEPP) conducted at a ‘significantly higher pace’ since the last meeting to prevent a tightening of financing conditions. Eurozone CPI inflation accelerated to 1.3% in March, but that was consistent the ECB’s latest projections. Rising Covid-19 cases in Germany and France may weigh on the short-term outlook, but the vaccine rollout is expected to pick up. Ms Lagarde recently talked about the recovery being “delayed” but “not derailed”. The June meeting will be more significant when the ECB will decide whether accelerated asset purchases should continue into Q3. If there are indications by then that the economy is recovering, the likelihood is that the pace of purchases will probably be pared back.

In the UK, the CBI industrial trends survey for April will receive some attention ahead of tomorrow’s GfK consumer confidence, retail sales and flash PMI reports. This month’s CBI survey will also include additional quarterly questions, including investment intentions – which have been negative over the past year – and business optimism which is expected to bounce back strongly. The GfK report will be released at 00:01BST on Friday and we look for consumer confidence to rise to -13, the highest since March 2020. Look for a rise of 1.2% for retail sales in March (07:00BST on Friday), following the 2.1% increase in February.

In the US, there will be interest in weekly initial unemployment claims. Last week’s figures for the week ending 10 April showed a drop of 193,000 to 576,000, the lowest since the start of the pandemic. Look for a rise to 625,000 for the week ending 17 April, still below the 4-week average. Existing home sales are also due, while improvements are expected in the Chicago Fed’s national activity index and the Kansas City Fed manufacturing survey. President Biden will hold a virtual climate change summit today (Earth Day), bringing together 40 world leaders.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1980-85 (700M), 1.2045-50 (500M)

USD/CHF: 0.9175 (500M)

EUR/CHF: 1.1050-55 (490M)

EUR/AUD: 1.5525 (433M)

AUD/JPY: 83.05-15 (514M)

EUR/GBP: 0.8550 (580M), 0.8590-0.8600 (250M), 0.8640-65 (500M)

AUD/USD: 0.7750 (600M), 0.7820 (480M)

NZD/USD: 0.7060 (1BLN), 0.7090 (900M)

USD/JPY: 108.00 (1.6BLN), 108.30-40 (2.6BLN)

Technical & Trade Views

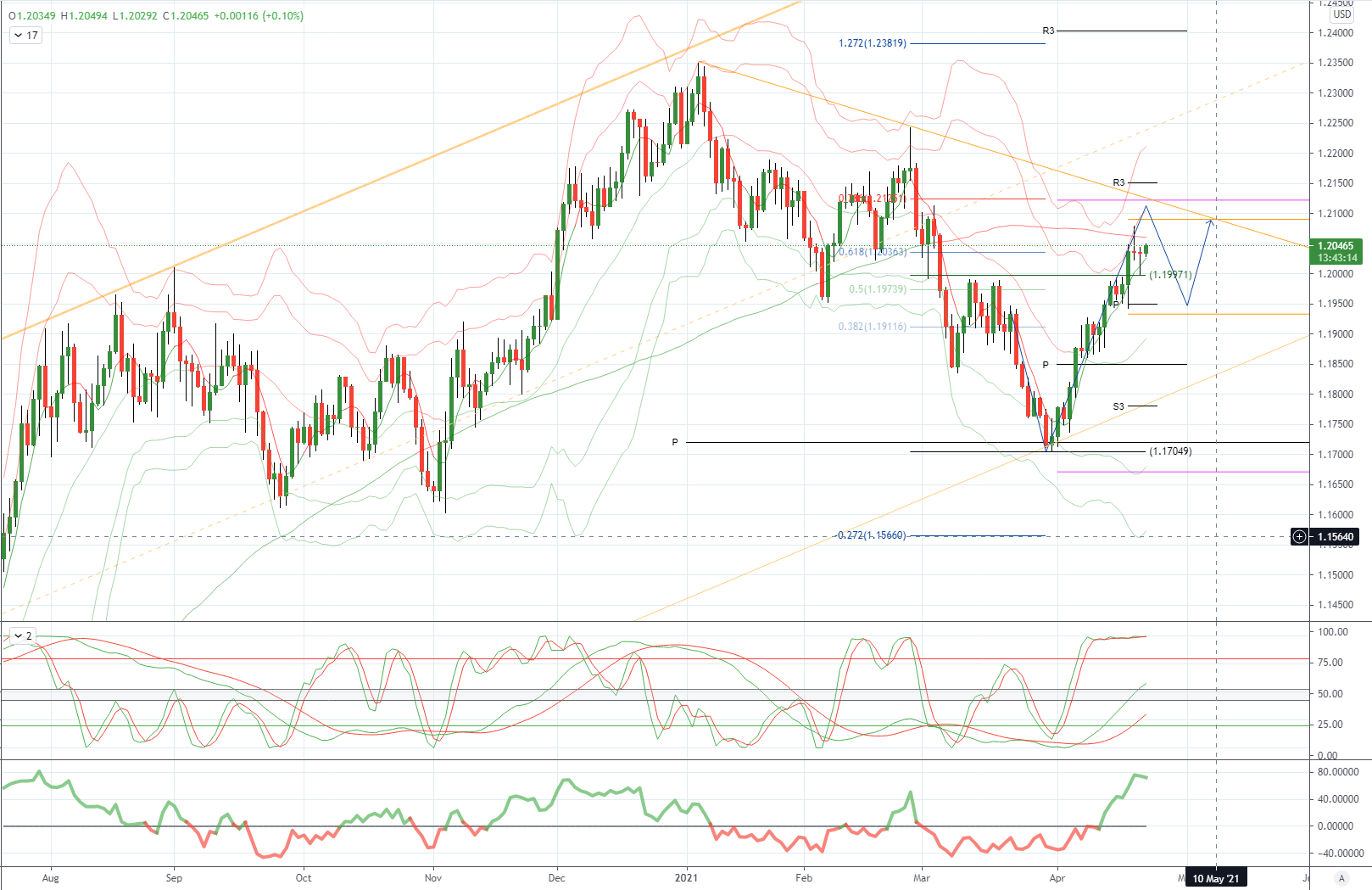

EURUSD Bias: Bearish below 1.1950 bullish above

EURUSD From a technical and trading perspective, the breach of 1.20 resistance opens a test of 1.2090/1.21, as 1.1950 supports look for a test of trendline resistance at 1.2125

Flow reports suggest topside offers start to increase on a move through the 1.2080 area before weak stops appear around the 1.2120 level and given the perchance of some banks to call a move to fade the Euro above the 1.2000 possibly starting to cause pain as option hedges go could see a squeeze higher and into the Feb ranges before seeing offers coming in above the 1.2150 level and increasing. Downside bids light through to the 1.1980 level with weak stops on a breakthrough to the medium congestive 1.1950 and therefore exposing the stronger bids 1.1900 level through to the 1.1880 and strong stops

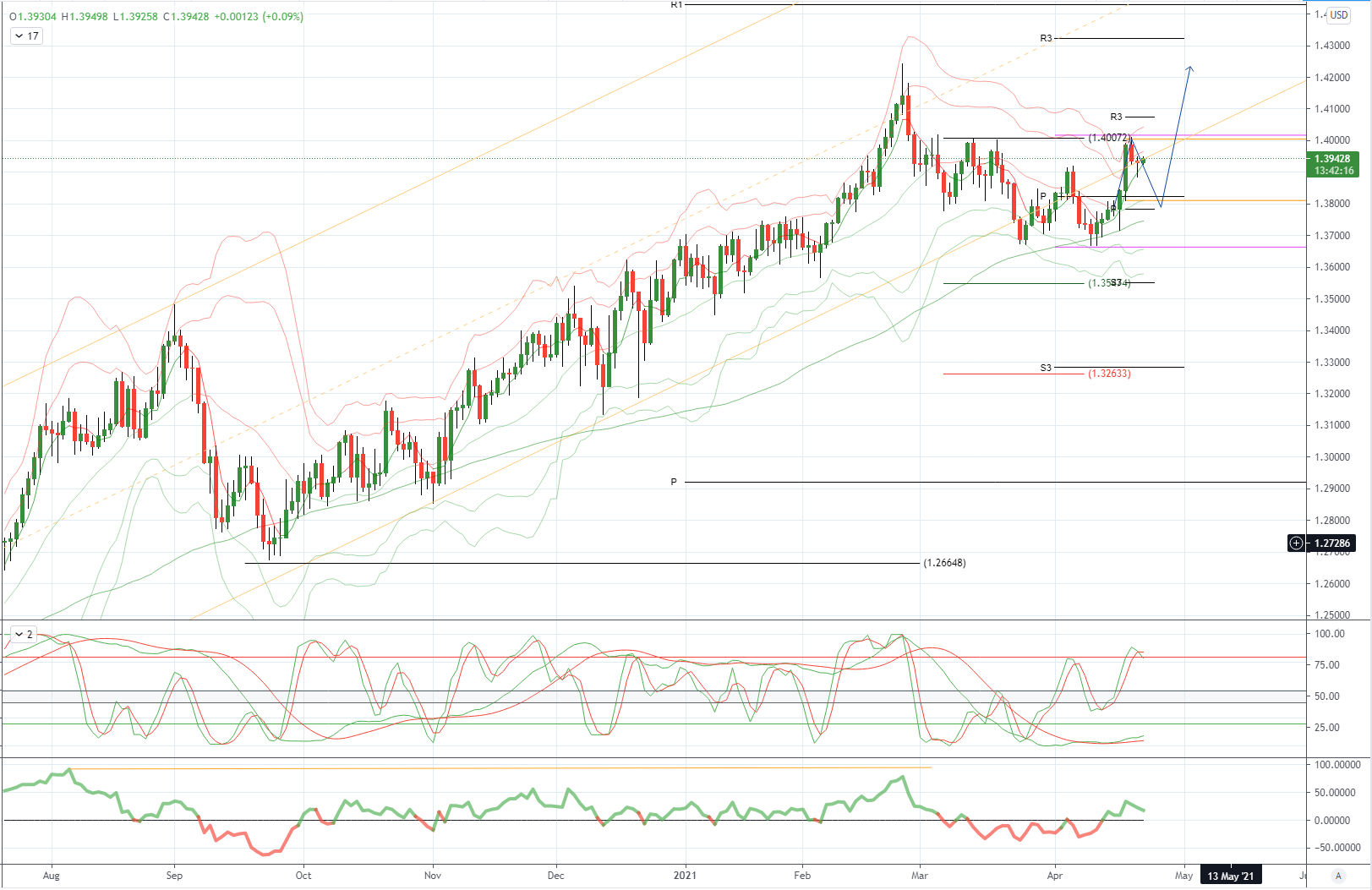

GBPUSD Bias: Bullish above 1.39 bearish below

GBPUSD From a technical and trading perspective, as 1.39 now acts as support bulls will target a test of prior cycle highs at 1.4240

Flow reports suggest topside offers light through to the 1.4000 area with offers into the 1.4010 area and possible option plays around the level before breaking higher and triggering weak stops and possible option players caught short, 1.4050 then sees light congestion and stronger on a move through to the 1.4100 area with topside then open to stronger gains. downside bids light through to the 1.3900 level with limited congestion starting to build in the area before weak stops on a dip through the figure level and opening a move through to the 1.3840 area and stronger congestion appears.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as the equality objective at 108 continues to attract demand bulls will look for a test of 112. A failure below 108 opens a test of trendline support at 107.33

Flow reports suggest downside bids into the 108. 00 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, Topside offers appearing through the 108.80 level and increasing into the 109.00 level light offers until the 109.40 area is likely to see strong congestion increasing through to the 110.00 level before stronger stops are likely to appear

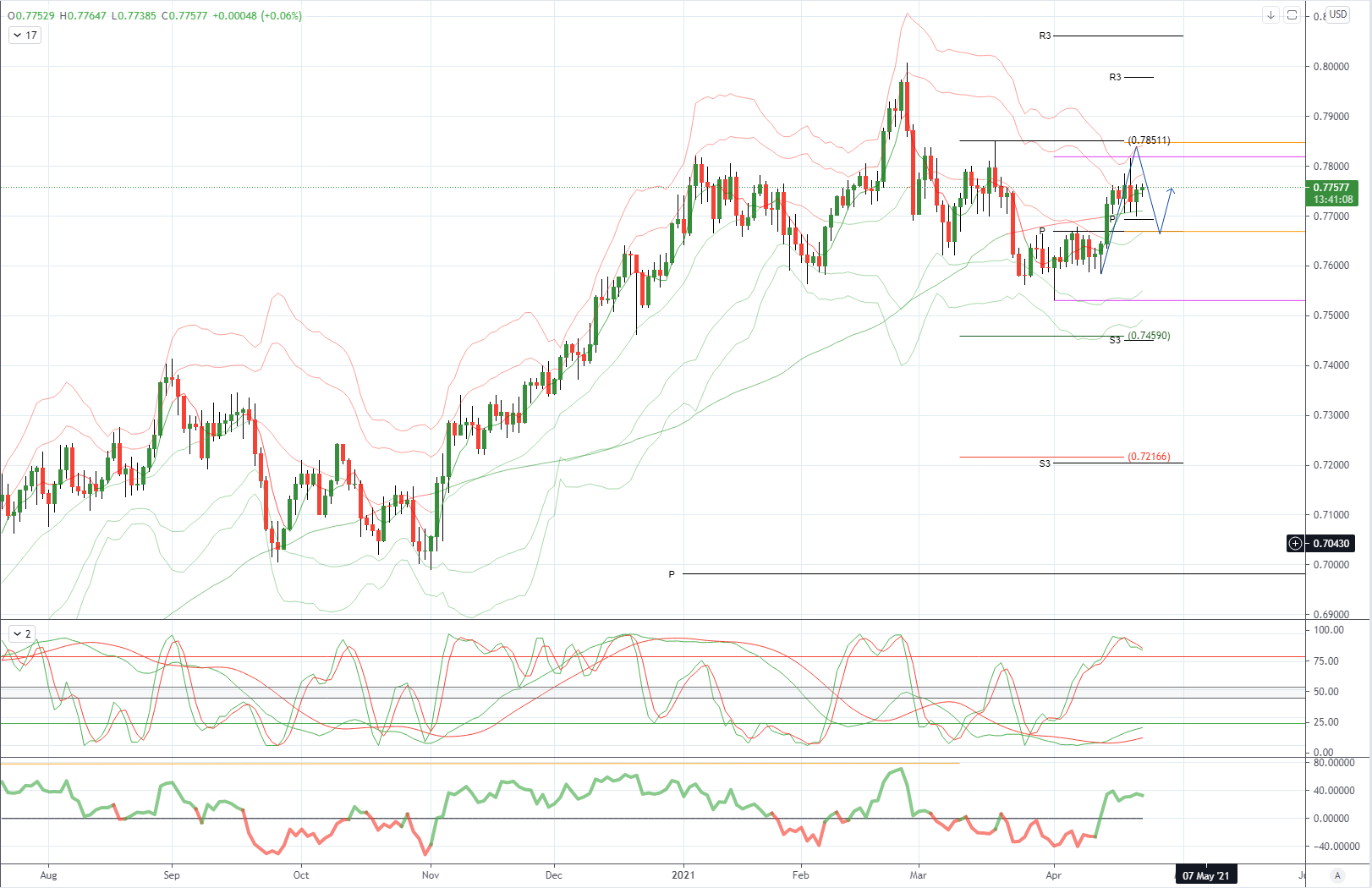

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, the closing breach of .7730 has relieved downside pressure opening a move to test offers towards .7820

Flow reports suggest topside offers continue through the 0.7800 area with a break through the 0.7820 area likely to see weak stops and a test towards the sentimental 0.7850 area however, while there maybe some offers in the area the market Looks to be fairly open through to the 79 cents level and ultimately ranges from the end of Feb, downside bids light through the 0.7700 level with weak stops likely on a move through the 0.7680 before stronger bids around the 0.7650 area and continuing through to the 0.7600 likely increasing in size, any further moves are likely to see strong support into the 0.7550 to calm the situation,

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!