Crude Soars As Trump Threatens Iran Strike

US/Iran Fears Driving Prices

Crude prices are soaring higher through the back end of the week as rising fears around a potential US/Iran conflict take centre stage. Tensions had been rising following news of Trump moving key US naval assets into the Middle East late last week. The move prompted fears that a possible attack was coming though there had been no threat from Trump following his announcement a fortnight ago that any strike on Iran had been postponed after the regime promised to cease violence against protesters. This week, however, Trump warned Iran that time was running out for it to agree a nuclear deal with the US with a ‘massive armada’ on its way and prepared to strike if necessary. Iran in turn warned that it stands ready to “powerfully respond” to any such attack.

Crude to Stay Strong

Against this backdrop, crude prices are soaring as traders eye heavy supply risks if any conflict does emerge. If Iran’s standing as one of OPEC’s top producers, the prospect of a military conflict in the region is a big threat to overall oil output. Additionally, given the impact on US crude production from extreme weather conditions there recently, prices have already been impacted by supply disruptions. As such, any headlines showing a further escalation of tensions, or suggesting that an attack is growing more likely, should see oil prices driving sharply higher. On the other hand, any news that Iran is willing to negotiate, or if Trump walks back his threats, should see crude pries correct lower. As such, plenty of volatility risk near-term.

Technical Views

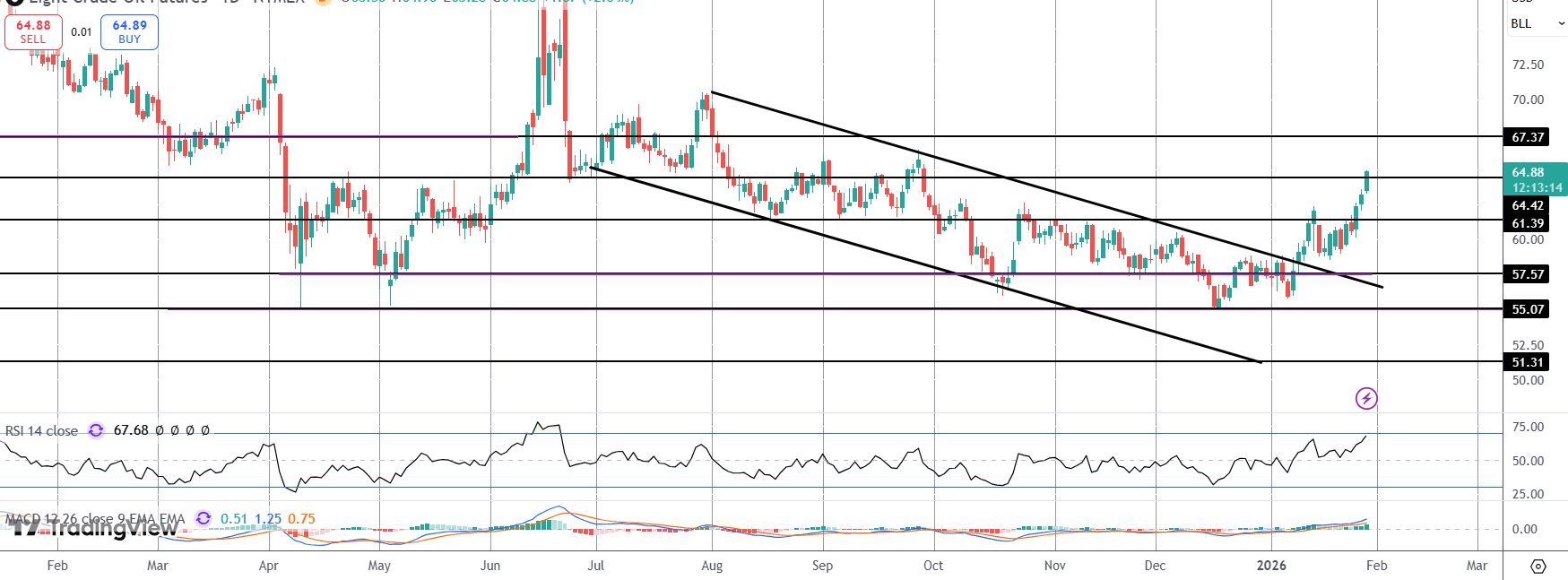

Crude

The rally in crude has seen the market breaking out above the 61.39 level with price now soaring above the 64.41 level. With momentum studies bullish, focus is on a continuation higher and a test of the 67.37 level next. Bull outlook remains while price holds above 61.39.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.