Yen Struggling to Capitalise on Weak USD

Yen Higher This Week

The Yen has risen firmly against USD this week with USDJPY turning lower from the initial highs printed on Monday. USD started the week on a firm footing, boosted by safe haven inflow slinked to uncertainty in the wake of the US airstrike on Iran over the weekend. However, sentiment was seen reversing quickly as Trump announced news of an Israel-Iran ceasefire late on Monday. Since then, USD has moved steadily lower through the week, allowing JPY to gain.

Less Hawkish BOJ Outlook

It's worth noting, however, that JPY remains the weakest performer against USD out of the G10 FX currencies this month. This has largely been due to a dovish repricing of the market’s BOJ outlook. At the last meeting, the BOJ struck a much more concerned tone over various domestic and global risks, citing geopolitical uncertainties and weaker consumption. This week we saw Tokyo June CPI figure come in below forecasts, further dampening the BOJ outlook.

USD Remains Key

While this narrative holds, JPY looks likely to struggle to gain significant ground. Additionally, the easing of Israel-Iran risks means that a better global risk tone is weakening safe-haven demand for JPY, creating further headwinds. Given the backdrop, USD flows are likely to remain the key driver with the pair vulnerable to a deeper move lower if we see accelerated USD selling. Any reversal in USD, however, should see USDJPY trading sharply higher near-term.

Technical Views

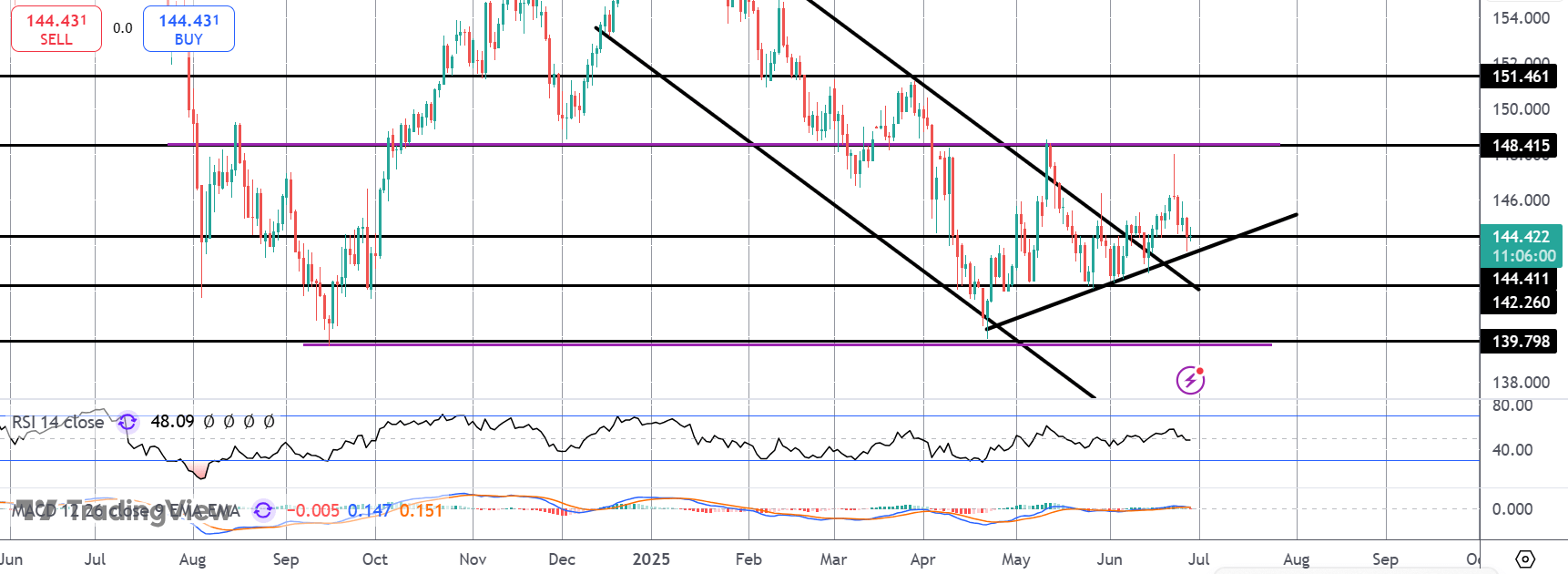

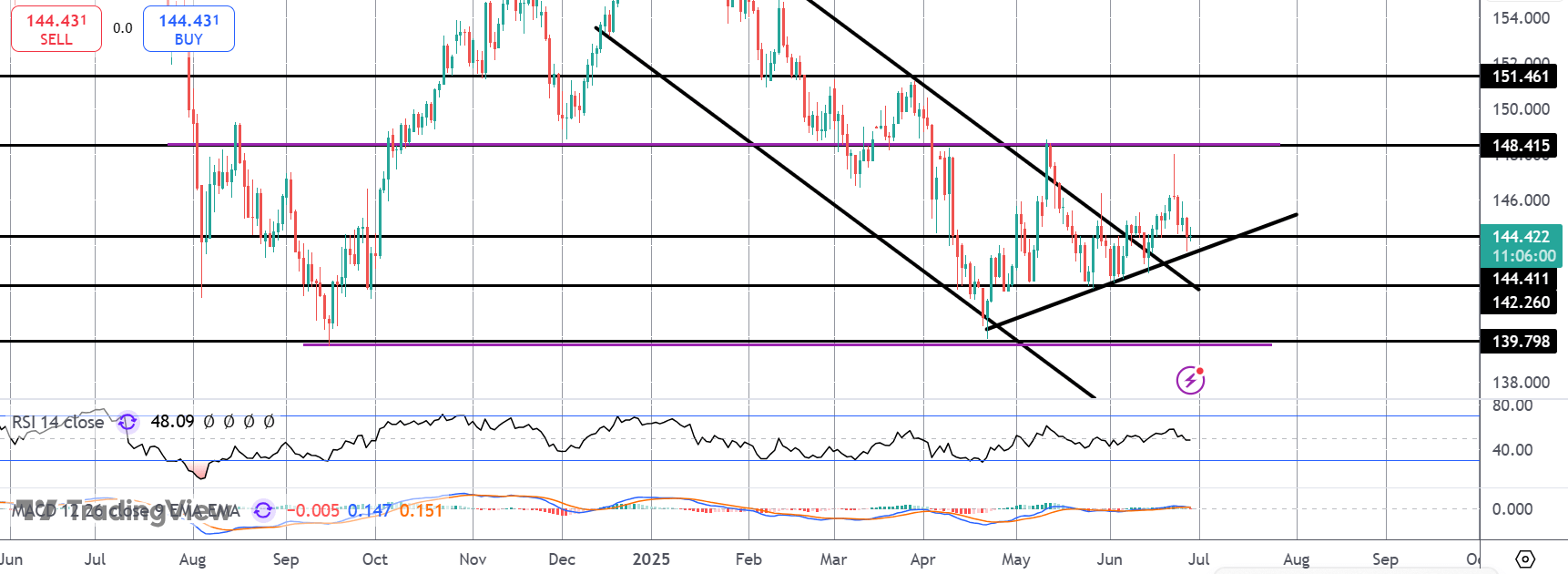

USDJPY

The failure ahead of the 148.41 level has seen the market reversing sharply lower with price now retesting the 144.41 level support and the rising trendline from YTD lows. Bulls need to defend this level to prevent a test of deeper support at the 142.26 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.