Will Trump Drive Bitcoin to Fresh Highs?

Bitcoin Rally Gathering Pace

Bitcoin prices are trading at their highest level in over a month as the crypto recovery gathers pace. Recent developments in the US elections landscape have swerved in Bitcoin’s favour. Trump’s early performance in the polls was amplified on the back of his recent assassination attempt. Alongside a series of concerning public appearances from Biden, the growing view that Trump is likely to be re-elected has seen continued buying in Bitcoin.

Biden Steps Down from Election Race

This week, traders are digesting news that Biden has now stepped down from the election race with Kamala Harris taking over as the Democrat candidate. With Trump seen as the pro-crypto option, the prospect of him regaining office in the US is helping drive demand across the crypto space.

‘Crypto President’

Trump recently declared that he would be the first ‘crypto president’ in the US and has made his support for the industry clear. The former president has already become the first presidential candidate to accept campaign payments in crypto and is hosting a huge crypto fundraiser this week in Nashville, to be attended by the world’s top crypto executives where he’s expected to further outline his support for the crypto space.

Easier Regulatory Conditions

Given the regulatory crackdown put in place by the Democrat government, crypto bulls are hopeful that a Trump presidency will see this regulatory resistance dismantled, allowing for a new era of crypto business which should help drive demand, and hence prices, higher.

Technical Views

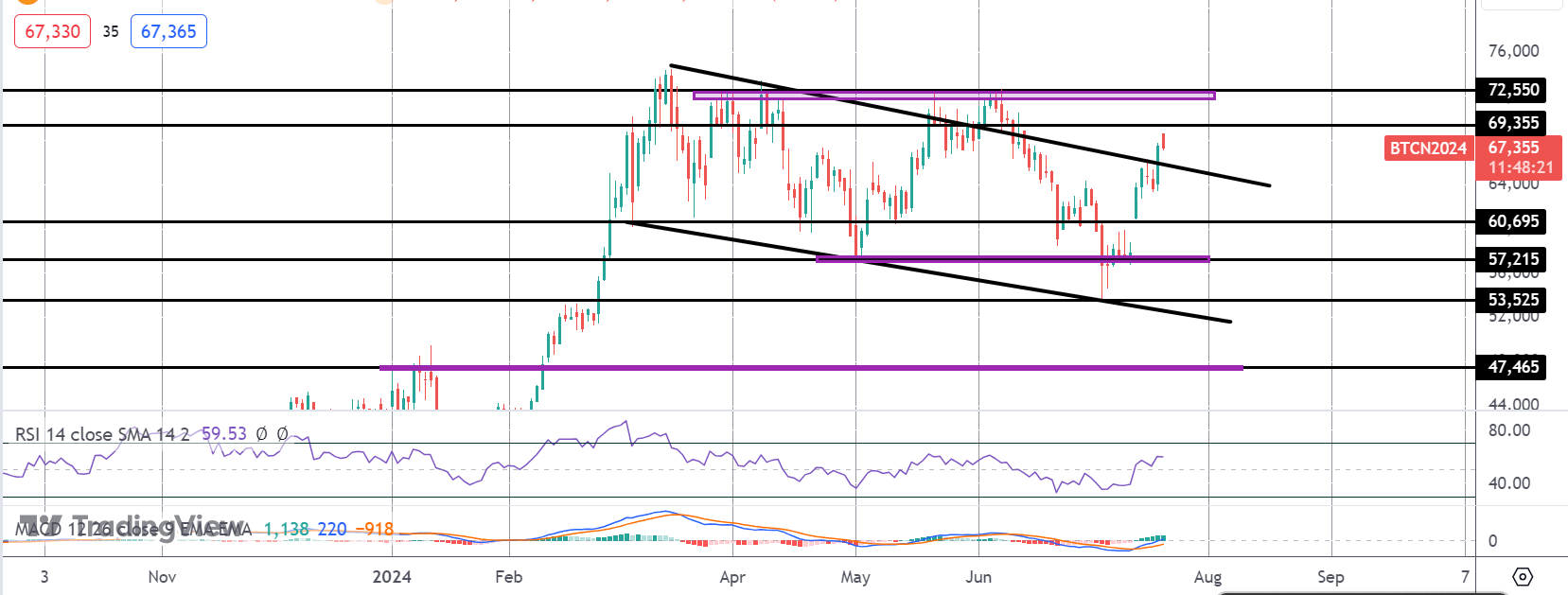

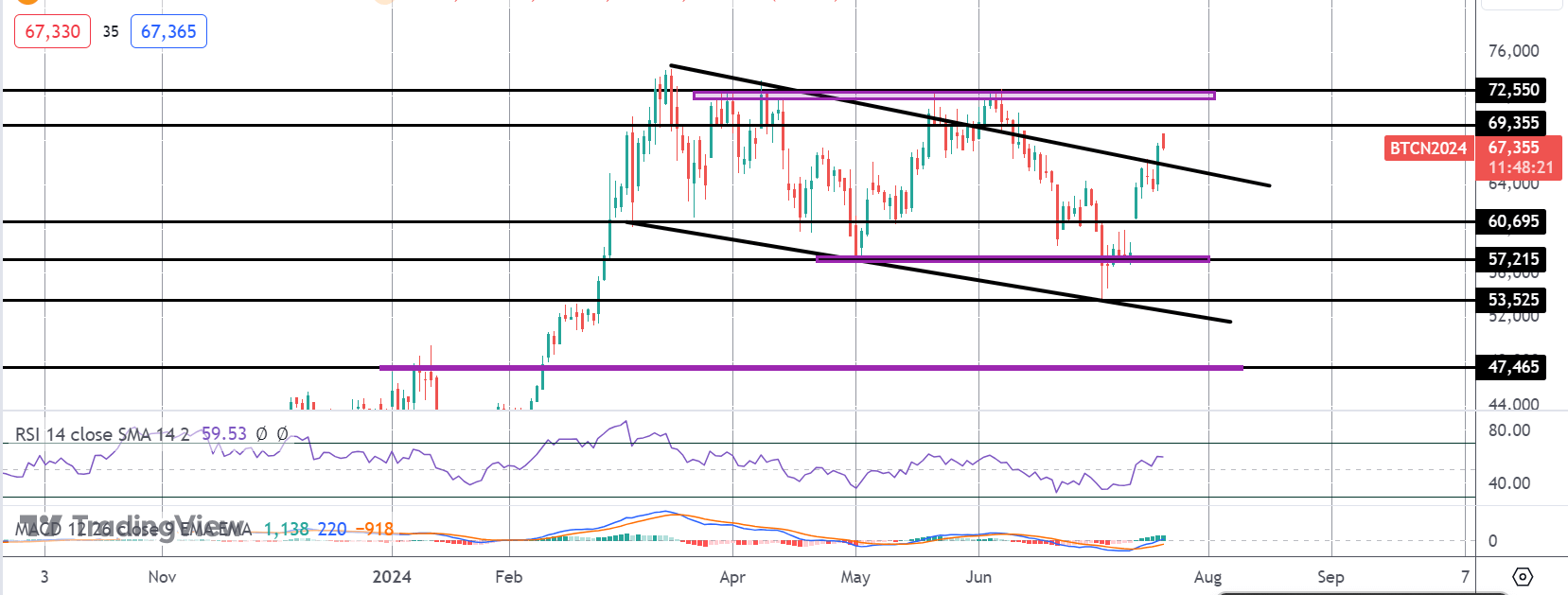

BTC

The rally in BTC off the 52,525 level has seen the market turning sharply higher. Price has broken back above several key levels and is now trading above the bear channel higher. This move can be seen as a bull flag break and, with momentum studies bullish, puts the focus on a test of the 69,355 and 72,550 levels next ahead of fresh highs thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.