Why Isn't Bitcoin Moving?

BTC Stuck in The Mud

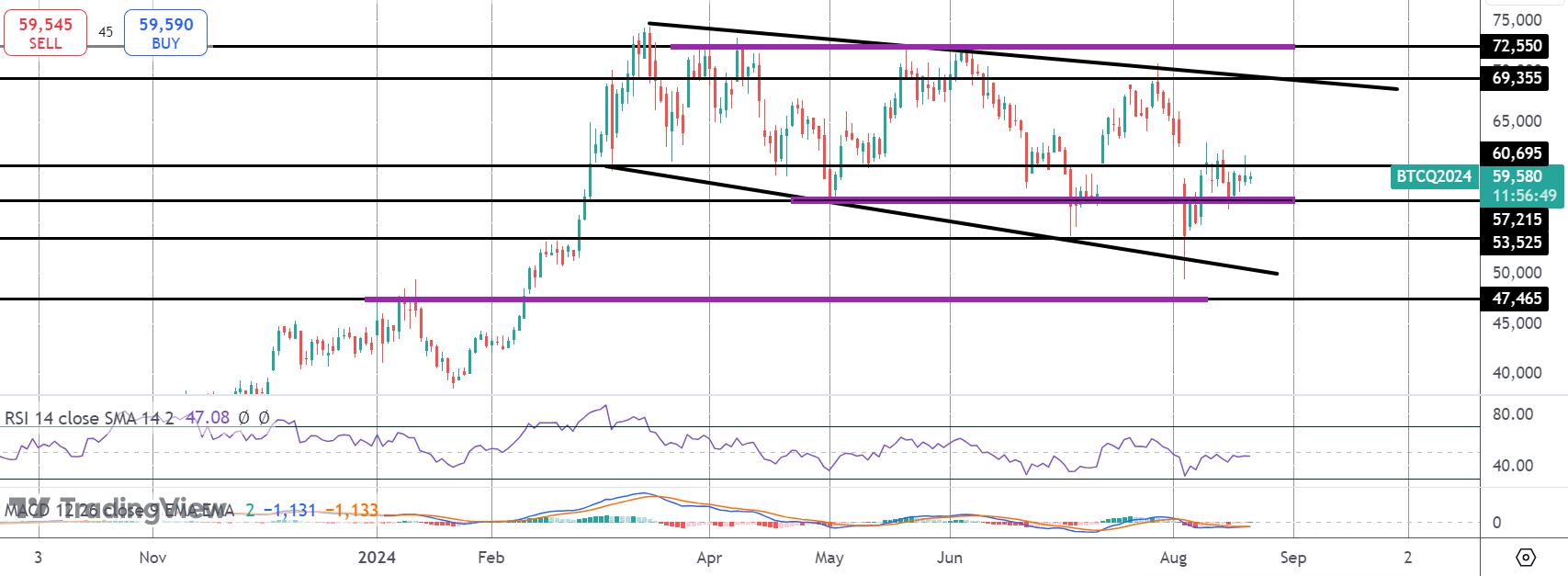

Bitcoin prices have been largely muted over the last week. Despite the sell off in USD and the broad pick up in risk appetite, crypto assets have seemingly failed to benefit with BTC futures stuck in a tightly congested block between 57,215 and 60,695. Prices recovered following the rout we saw at the start of August as risk markets tumbled in response to surging fears over the health of the US economy. However, since those fears subsided in response to a slew of positive data, and despite USD selling off on increased Fed easing expectations, BTC has remained penned in. One likely reason is that stocks have been seen as more straightforward play for the current risk environment. Additionally, with gold prices moving higher too traders have had plenty of options for where to store capital and/or chase returns.

US Political Impact

Another issue stunting Bitcoin sentiment currently is the shift in the US political landscape. Heightened expectations of a Trump presidency had helped boost prices over July, with Trump seen as the crypto-friendly candidate. However, Harris’ popularity and strength in polling results has muddied the outlook, sapping some of the excitement seen among crypto bulls. If Trump starts to gain in the polls again, this dynamic is expected to return. However, if Harris starts to move ahead this will likely sap sentiment further with the current strict regulatory environment expected to continue.

Awaiting Fresh Drivers

Looking ahead, traders will be watching for a catalyst to drive a fresh directional move. This might come this week when we hear from Fed chair Powell on Friday. However, the market could remain range-bound until closer to the US elections or until the market feels it has a strong read on who is likely to win. As such, more summer trading expected near-term.

Technical Views

BTC

The rally in BTC off the 53,525 lows has stalled for now into the 60,695 level with price now stuck in tight consolidation mid-range. 57,215 is an important level for the market and while price holds above here, focus is on a continuation higher and a fresh test of the channel highs and YTD highs. To the downside, 47,465 will be the deeper bear target if we turn lower again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.