What You Need to Know About the November NFP Besides Headline Figures.

European stock markets kicked off the week with a slight decline amid weak data on the Chinese economy, lack of clarity on December tariffs (despite the looming deadline) and uncertainty before the Fed and the ECB meetings in the middle of the week.

The US labor market data surprised on Friday. Job growth and lower unemployment backs the hypothesis of delayed recession. Nevertheless, the surprise should be taken with a pinch of salt for two reasons:

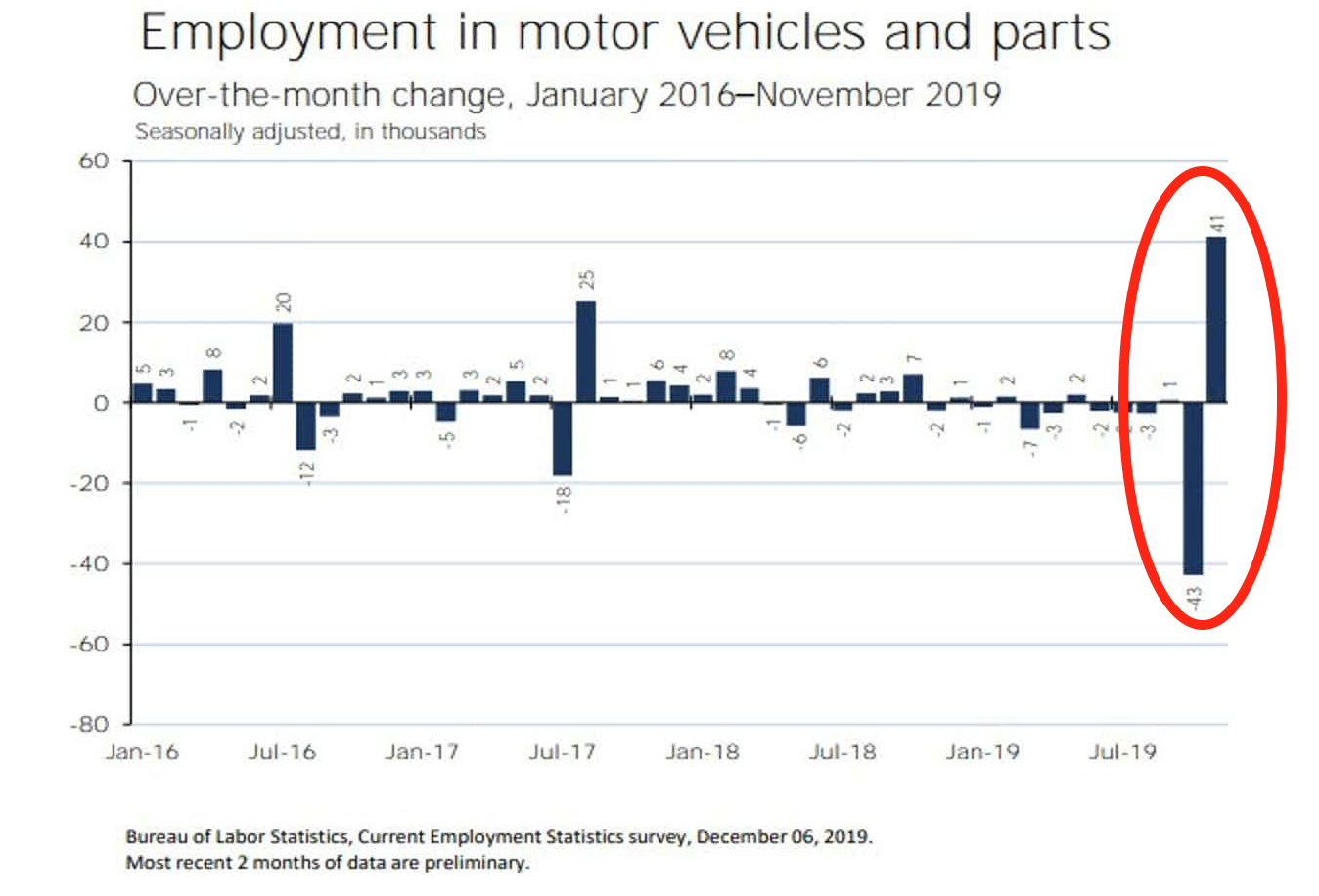

- GM workers are back at their workplaces. The strike pulled down the number of jobs in October, and the end of the strike caused an increase of about the same size in November:

- The adjustment for the seasonal factor - Thanksgiving turned out to be less significant than in previous periods. Especially as Thursday November 28th was the last day of BLS accounting for November. Consequently, part of this seasonal effect will be reflected in the data next month.

It is also worth noting a significant discrepancy between the Payrolls (based on the data from firms, also known as the Establishment Survey) and the Household Survey figure:

Establishment Survey: + 266K

Household Survey: + 83K.

Despite the significantly smaller number of observations in the Household Survey sample (70K versus 700K in Establishment Survey), which implies a greater susceptibility to representativeness error. Household surveys may better capture subtle trends in employment in the early and late stages of the expansion cycle. Why? This is associated with the so-called process of birth/death of firms. The first mechanism of which prevails at the recovery stage (the number of new firms is growing fast), the second - at a late stage of economic expansion. Their effect on employment is usually reflected with some lag. Despite the development of BLS of more advanced models that adjust the totals to the impact of this process, the adjustment becomes visible only in subsequent months (“past NFP revisions”).

Other surprising methodology facts in the calculation of employed and unemployed people:

In the Household Survey, even if a respondent said that he worked one hour a week (for example, selling something on eBay), he is not considered unemployed.

In Payrolls, if a person works at three part-time jobs, he is basically counted three times. It turns out that with the increasing difficulty of finding a full-time job and the rising need to work on several part-time jobs, BLS will reflect this positively by an increase in the number of Payrolls. Therefore, Payrolls alone are not always informative.

However, at Household Survey, a person employed in three jobs, 12 hours a week, will be counted as one full-time worker, so this gauge may in contrast underestimate employment strength.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.