What Happened To The Ethereum Rally?

ETH Remains Under Pressure

Ethereum prices remain subdued this week with the futures market still caught below the 3,582.5 level resistance. Following an initial breakout move higher last month as speculation grew regarding expected SEC approval of Ethereum ETF applications, the second largest crypto coin has struggled. ETH futures are now down around 23% from those highs, tracking the pull-back in Bitcoin.

Shifting Fed Outlook

A big driver behind the move lower has been the shifting landscape around the Fed. Inflation still above target and robust jobs growth has seen the Fed pairing back its easing projections this year. The US central bank now forecasts just 1 rate cut, down from three prior. This hawkish shift has created a deep ridge of support for USD recently, suppressing demand for crypto. As a result we’ve seen weaker inflows to crypto ETFs in recent weeks, reflected in the price action we’re seeing.

Bullish Drivers

Looking ahead, however, there are still clear reasons to be bullish on ETH. There is a growing level of speculation that ETH ETFs will be approved by early summer and could begin trading as early as July 2nd, according to Bloomberg. Additionally, if we see US inflation start to cool at a quicker pace, this should cause near-term Fed easing expectations to rise, dragging USD lower and allowing crypto demand to rally again.

Technical Views

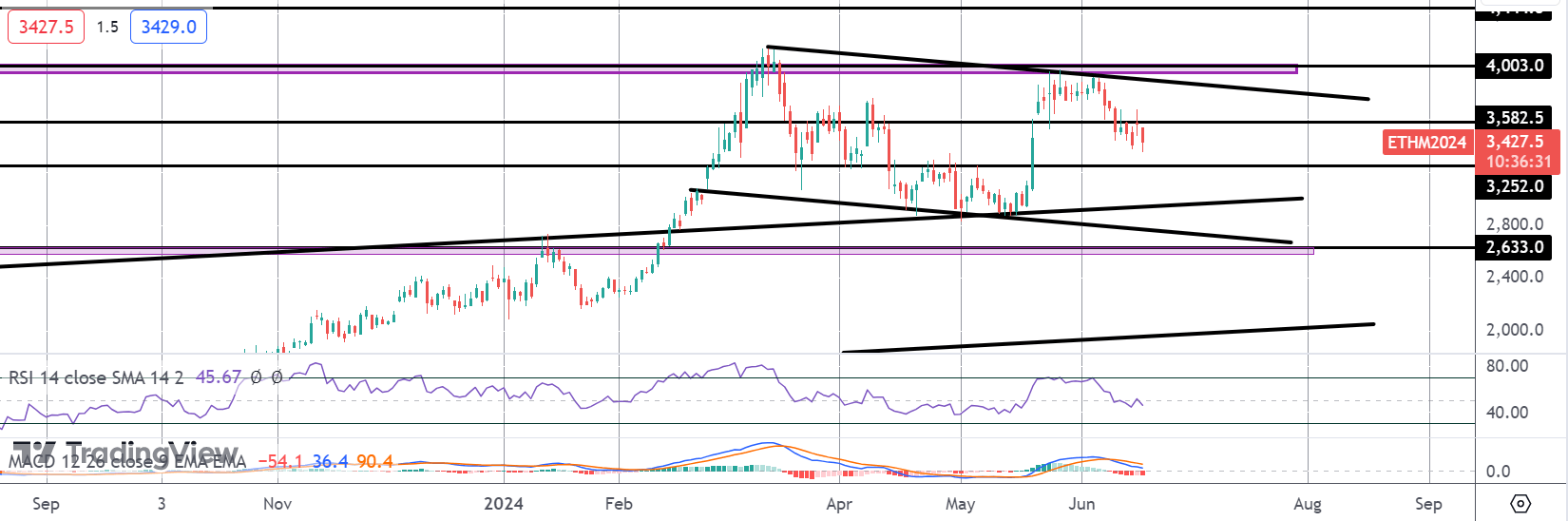

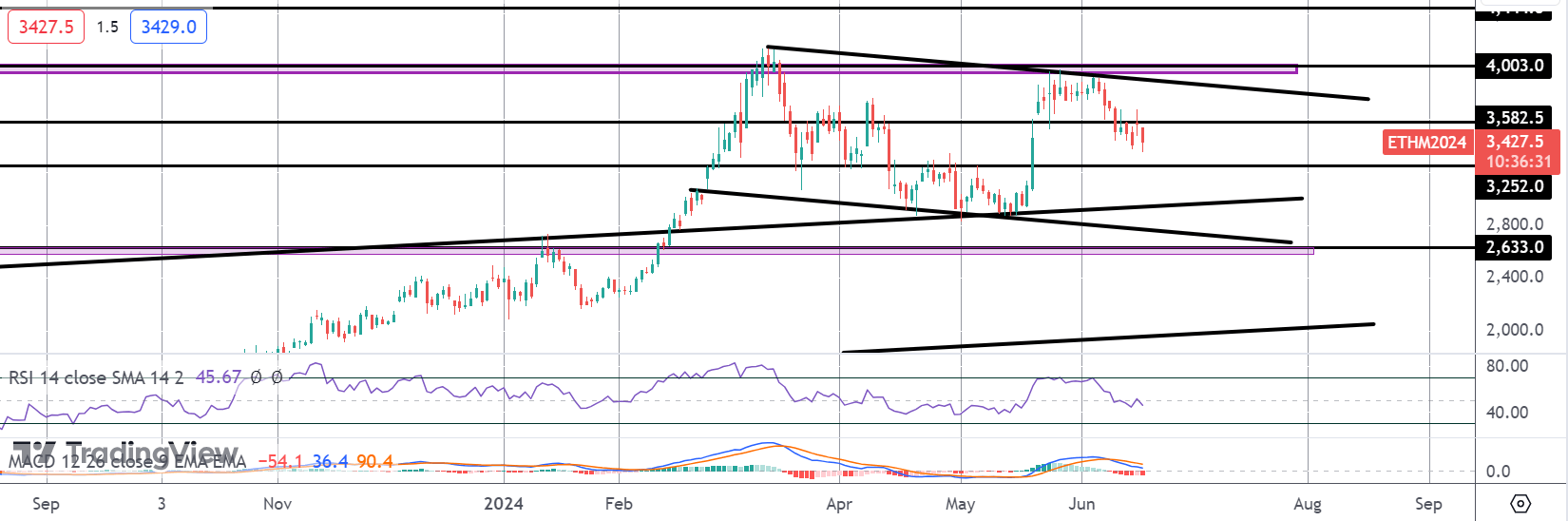

ETH

The failure at the latest test of the 4,003 level has seen the market turning lower within the bear channel. Price is now back below the 3,582.5 level and fast approaching a test of the 3,252 support. Weak momentum studies readings highlight ongoing bearish risks here with 2633 the deeper level to have on your radar.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.