USD's Rebound and the Euro's Struggle: A Dive into Market Dynamics

Wednesday saw the EUR/USD pair lose its recovery momentum, slipping below the crucial 1.0950 mark during European trading hours. This decline comes on the heels of a decisive correction in the US Dollar (USD), which touched its lowest level in nearly two weeks at 1.0938.

The Technical Tapestry

Taking a closer look at the technical aspects, the USD index on the 1-hour timeframe presents an intriguing picture. The bearish trend channel that characterized the latter part of 2023 witnessed a notable touch at its lower bound, only to rebound with a 1.8% gain since last Thursday. This hints at the potential for a bullish breakout, suggesting a reversal in the USD's fortunes. The beginning of a new year often marks the initiation of fresh trends, and the current scenario may fuel speculation that the dollar is gearing up for an upward trajectory.

JOLTS Job Openings and Labor Market Dynamics

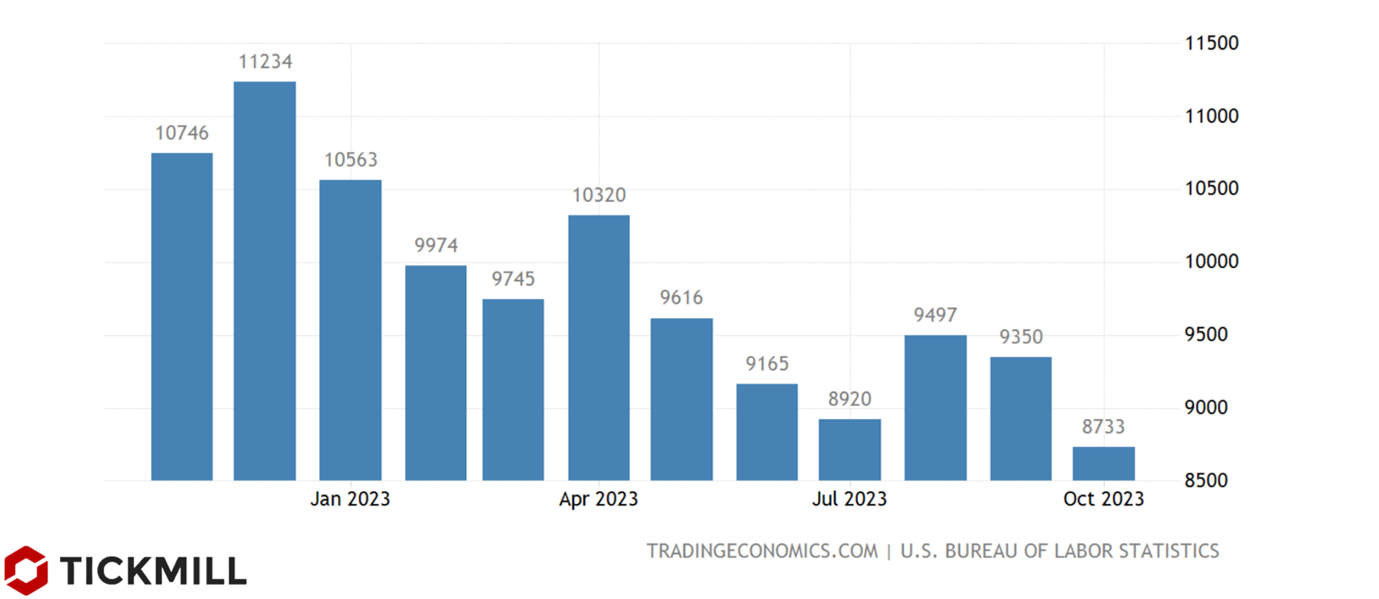

Market participants and Federal Reserve policymakers are particularly attentive to the JOLTS data, seeking insights into the supply-demand dynamics of the labor market—a critical factor influencing salaries and inflation. Despite a trend of declining job openings throughout 2023, the current level remains above pre-pandemic figures. The November data is anticipated to reveal a slight uptick, offering a nuanced perspective on the evolving employment landscape.

ISM Manufacturing PMI

Simultaneously, investors eagerly await the ISM Manufacturing PMI for December, with expectations of a modest rise to 47.1 from November's 46.7. A reading above 50 could potentially boost the USD, signaling economic resilience. Conversely, a noticeable decline in job openings and manufacturing activity may exert downward pressure on the greenback.

Fed's December Meeting Minutes

In the latter part of the American session, the Federal Reserve will release the minutes of its December policy meeting. Chairman Jerome Powell's post-meeting remarks indicated discussions about the timing of rate cuts. Confirmation of such deliberations could challenge the USD's resilience, especially given current market expectations for a potential policy pivot in March.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.