USDCAD Stalls At Resistance Following BOC

BOC Holds Rates Steady

The Canadian Dollar has been a little firmer on the back of the September BOC meeting yesterday. The bank held rates unchanged at 5%, as expected, though signalled that further tightening might still be warranted given the inflation backdrop. In its decision, the BOC acknowledged that the domestic economic outlook had softened, citing the easing of excess demand as a result of its monetary policy decisions. However, the BOC noted that it was still concerned about the persistence of inflation at current levels and warned that it stood ready to tighten further if deemed necessary.

Hawkish Hold

Such an outcome and set of guidance was broadly expected. Whether the BOC hikes again remains to be seen, but warning that further tightening is still an option at least helps mitigate heavy CAD selling. This was a very different pausing message to the one we heard in January this year which heralded a heavy CAD sell off and ultimately saw the bank forced back into tightening.

Market View Shifting

The general consensus among market players is that, barring any upside inflationary shock, the BOC is likely done with tightening and traders will now be closely monitoring incoming CAD data with a view to gauging when the first cuts will likely take place next year. As such, CAD is likely to trade lower off any weaker econ data and firmer on any upside surprises.

Technical Views

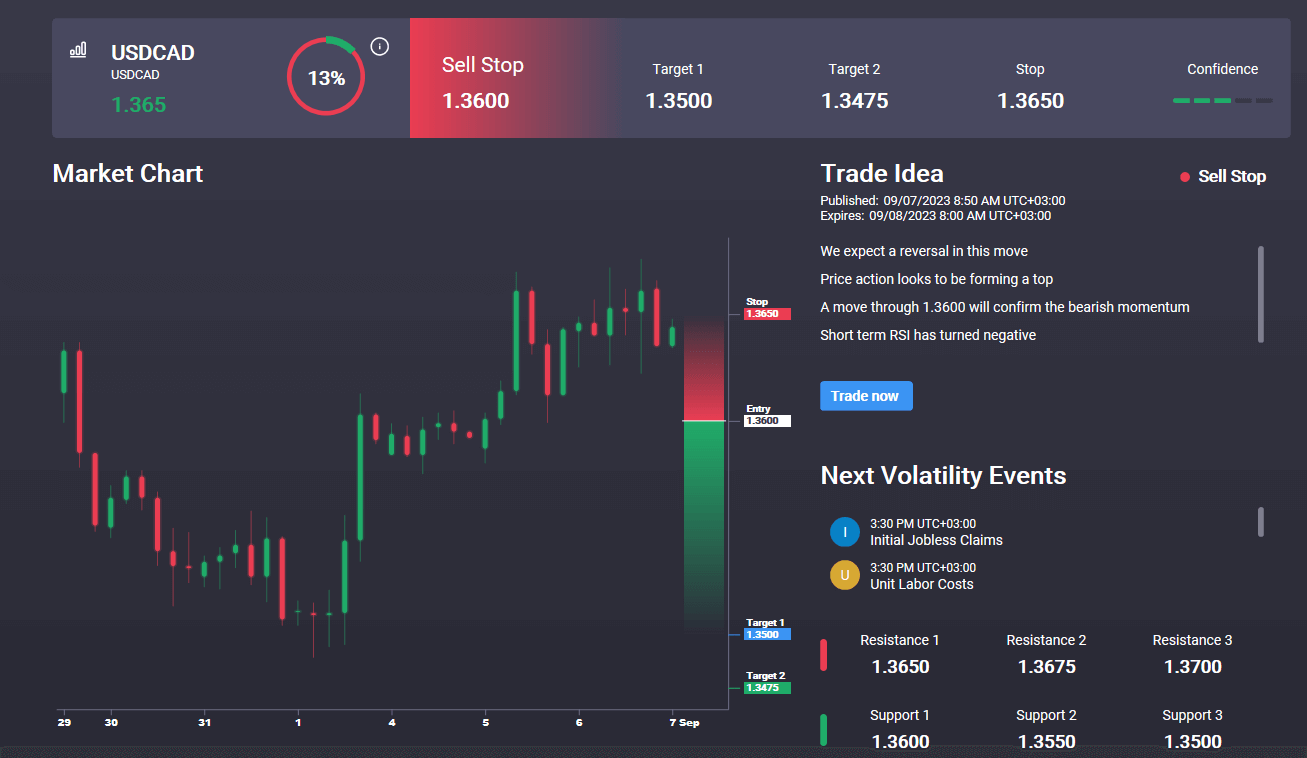

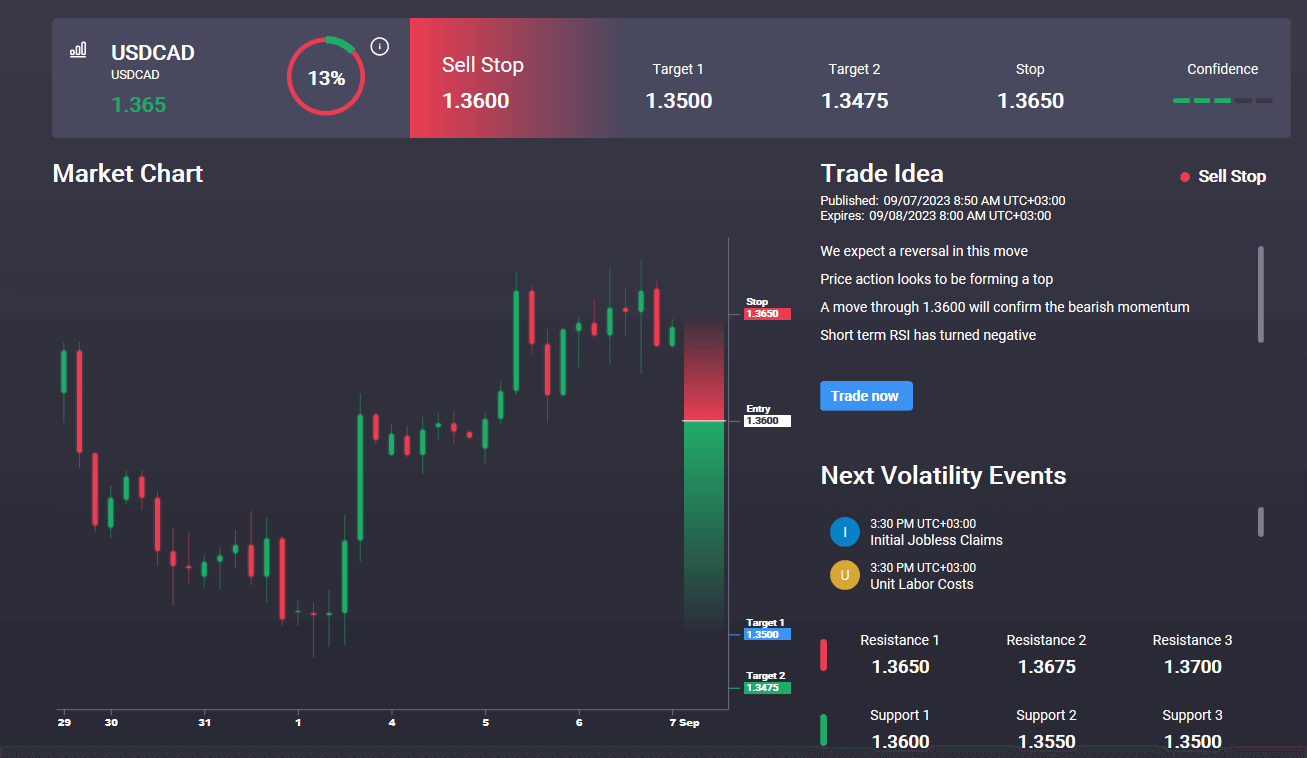

USDCAD

For now, the Loonie remains capped by the 1.3683 level resistance. Bearish divergence on momentum studies raises risks of a near-term reversal. However, while the 1.3501 level holds as support, the focus remains on a further push higher and an eventual breakout towards 1.3839 next. Notably, we have a sell signal in the Signal Centre today at 1.36 targeting a move back down through 1.35

-1694079650.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.