US Inflation Slows Down as Expected in July. What Does It Mean for the Greenback?

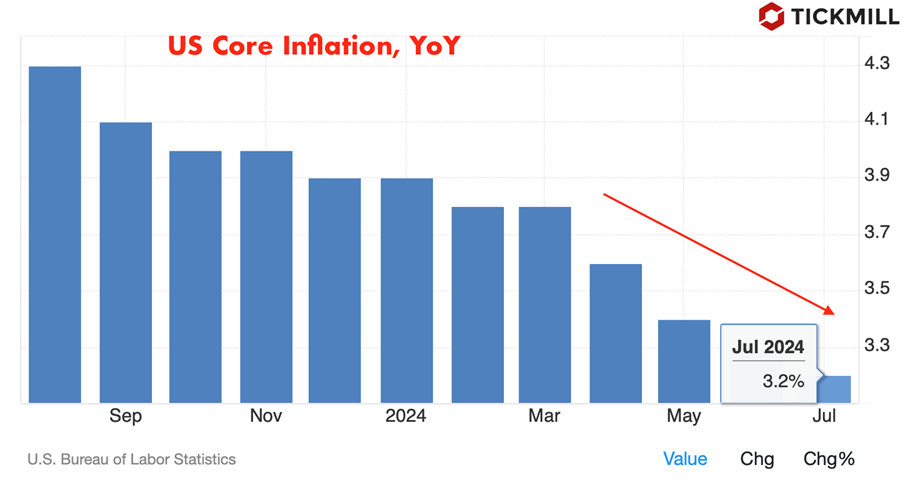

The CPI report for July, a crucial indicator for gauging inflationary pressures in the U.S. economy, revealed that both headline and core inflation figures rose by 0.2% month-on-month, perfectly in line with market expectations. On an annual basis, the headline CPI ticked up at a slower pace of 2.9%, a deceleration from June's 3%, while the core CPI slipped to 3.2% from the previous 3.3%:

This data release caused a whipsaw in USD’s price action. Initially, the Greenback was on the back foot, pressured by the anticipation of softer inflation readings that could embolden the Federal Reserve to pause its tightening cycle. However, when the data aligned with expectations, the U.S. Dollar Index (DXY)—which measures the dollar against a basket of six major currencies—initially surged. Yet, the gains were short-lived as the markets had seemingly priced in the possibility of an unexpected rise in consumer price pressures, a concern that the CPI release ultimately dispelled, causing unwinding of the long USD positions.

On the daily chart, DXY is currently testing a critical horizontal support level around 102.38, a zone that previously acted as a springboard for bullish reversals. However, the current retest following a return to this level suggests weakening momentum, increasing the likelihood of a bearish breakout. The repeated pressure on this support level indicates potential exhaustion of buyers, making it vulnerable to a downside breach. Should the DXY decisively close below this support, it could signal the beginning of a deeper correction, possibly targeting the next significant support near 101.00:

Raphael Bostic, the Atlanta Fed President, provided some insight into the Fed's thinking. His comments suggest a cautious optimism about the trajectory of inflation, acknowledging that recent data increases the Fed's confidence that inflation is on track to return to its 2% target. However, Bostic emphasized the need for additional evidence before endorsing any rate cuts, indicating that the Fed remains in a wait-and-see mode.

This cautious approach aligns with the current market sentiment, as reflected in the interest rate futures, which show a nearly even split in the market's expectations for a 50 basis point rate cut in September. The lack of a decisive move in inflation data keeps the Fed's options open, maintaining a delicate balance between inflation control and economic support.

While the EUR/USD pair navigates these inflation-driven currents, the British Pound is experiencing a more turbulent ride. The latest CPI report from the UK, which came in softer than expected, has sparked a sell-off in the Sterling across most of its major counterparts. The annual headline CPI in the UK rose by 2.2%, slightly below expectations, while the core CPI decelerated more sharply than anticipated. This softer inflation print has intensified speculation that the BoE might soon pivot to a more dovish stance, potentially even cutting rates in the near term.

The BoE had previously warned that inflation could rise again after returning to its 2% target, but the market seems to be betting on a more pronounced slowdown in inflationary pressures, which could compel the central bank to ease its policy sooner than later. As a result, the Sterling is under pressure, reflecting the market's recalibration of interest rate expectations.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.