Traders Brace For NVIDIA Earnings Following Price Crash

NVIDIA Earnings Due

Today promises to be an important day for the tech sector with chipmaker Nvidia due to report Q4 earnings after the market closes. The stock plunged more than 6% yesterday, wiping around $100 billion off the company’s value, as traders covered positions ahead of today’s report. The stock has been on an impressive run recently, up around 57% on the year before yesterday’s decline, with investors buoyed by the company’s heavily bullish earnings forecasts.

Expectations for Today

Traders now wait with bated breath to see whether today’s release will provide fuel for a fresh run higher or see the current correction move deeper. On the numbers front, the market is looking for Q4 EPS of $4.953 on revenues of $20.395 billion. If seen, this will mark a jump from the prior quarter and a strong beat on the same quarter a year prior. Given the expectations for today, there is clearly a lot of room for disappointment should earnings/revenues undershoot. If we do miss on the numbers front, the current downturn is likely to deepen as traders book profits for now on recent longs.

Focus on AI Guidance

Alongside the numbers, traders will be looking for clues as to the future of AI. Given the company’s position as the forefront of the AI charge, traders will be looking for clues as to whether the sector is likely to expand next and any new applications/ areas of demand.

Technical Views

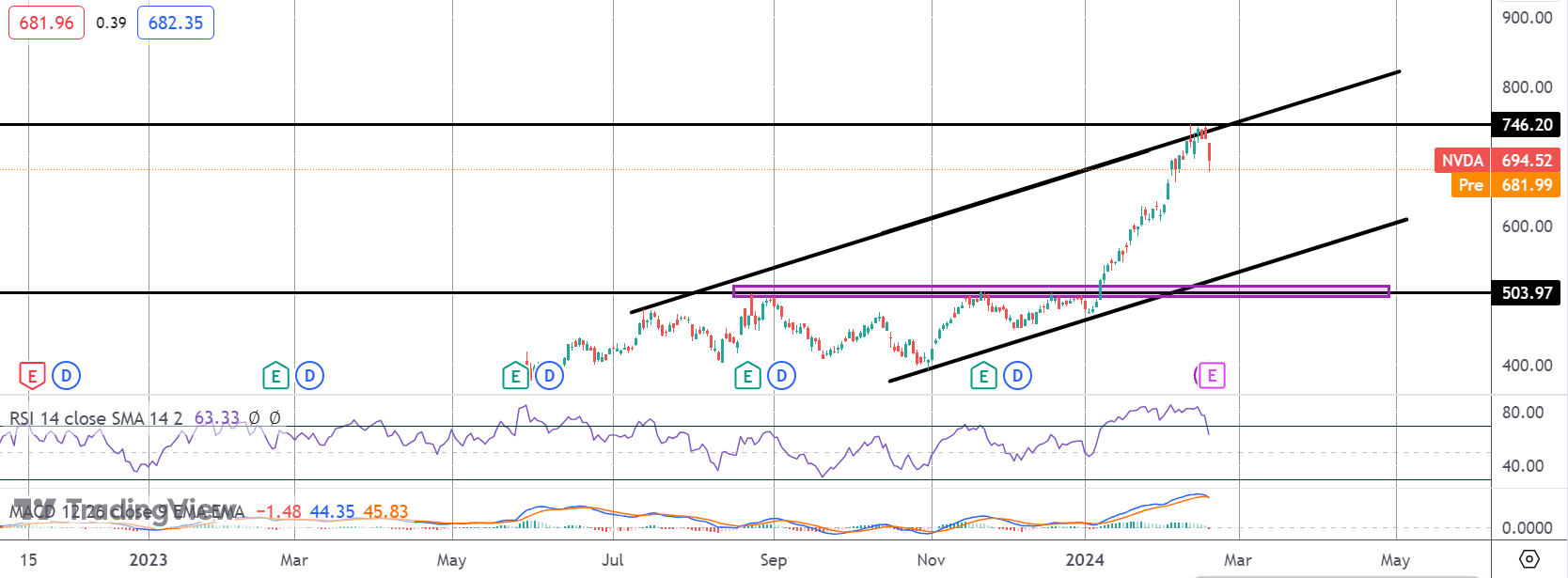

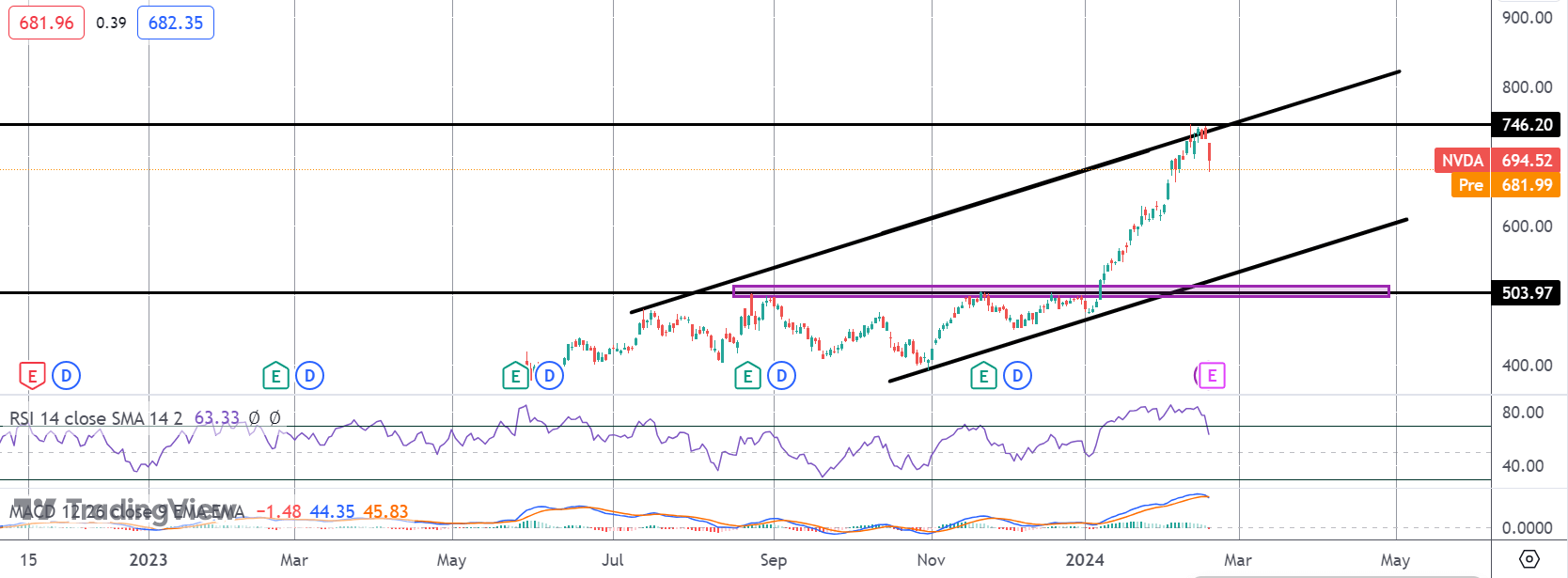

NVIDIA

The rally in NVIDIA stock has stalled for now into a test of the bull channel highs around the 746.20 level. With momentum studies weakening, further downside looks possible. The ley level to watch will be the 503.97 level and the bull channel lows. While price holds this area, the focus remains on further upside.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.