The IndeX Files 04-08-2020

Equities Markets Remain Well Supported Despite Second Wave Fears

Global equities benchmarks remain mostly well supported this week. While upside momentum has certainly slowed over the last week, the residual weakness in the US Dollar is helping keep equities bid at current levels. In terms of downside risk factors, the main threat currently is linked to growing fears of a second wave of the COVID-19 virus. With many post-lockdown countries reporting a fresh increase in infection numbers, the prospect of a global second wave is growing. However, for now it seems that countries appear to be largely reluctant to reimpose national lockdowns are will instead look to counter any further increase in the spread of the virus via local lockdowns, which will have a far lesser impact on individual economies as well as the global economy. Expectations of further central bank easing are also keeping equities sentiment buoyant given that most G10 central banks look likely to ease again in the coming months. In terms of data this week, the key releases to watch will be the BOE meeting on Thursday and the latest round of US labour market reports on Friday. Friday’s release has the potential for big market volatility with US jobs growth expected to have slowed to growth of 1.5 million from the prior month’s 4.8 million.

Technical Views

DAX (Bullish above 11861.85)

From a technical viewpoint. The DAX has broken below the recent bull channel but managed to find support at a retest of the 50dma. Bulls will need to quickly see price back above the 12916.11 level to regain momentum while any downside break of the 1861.85 level will open up deeper reversal chances.

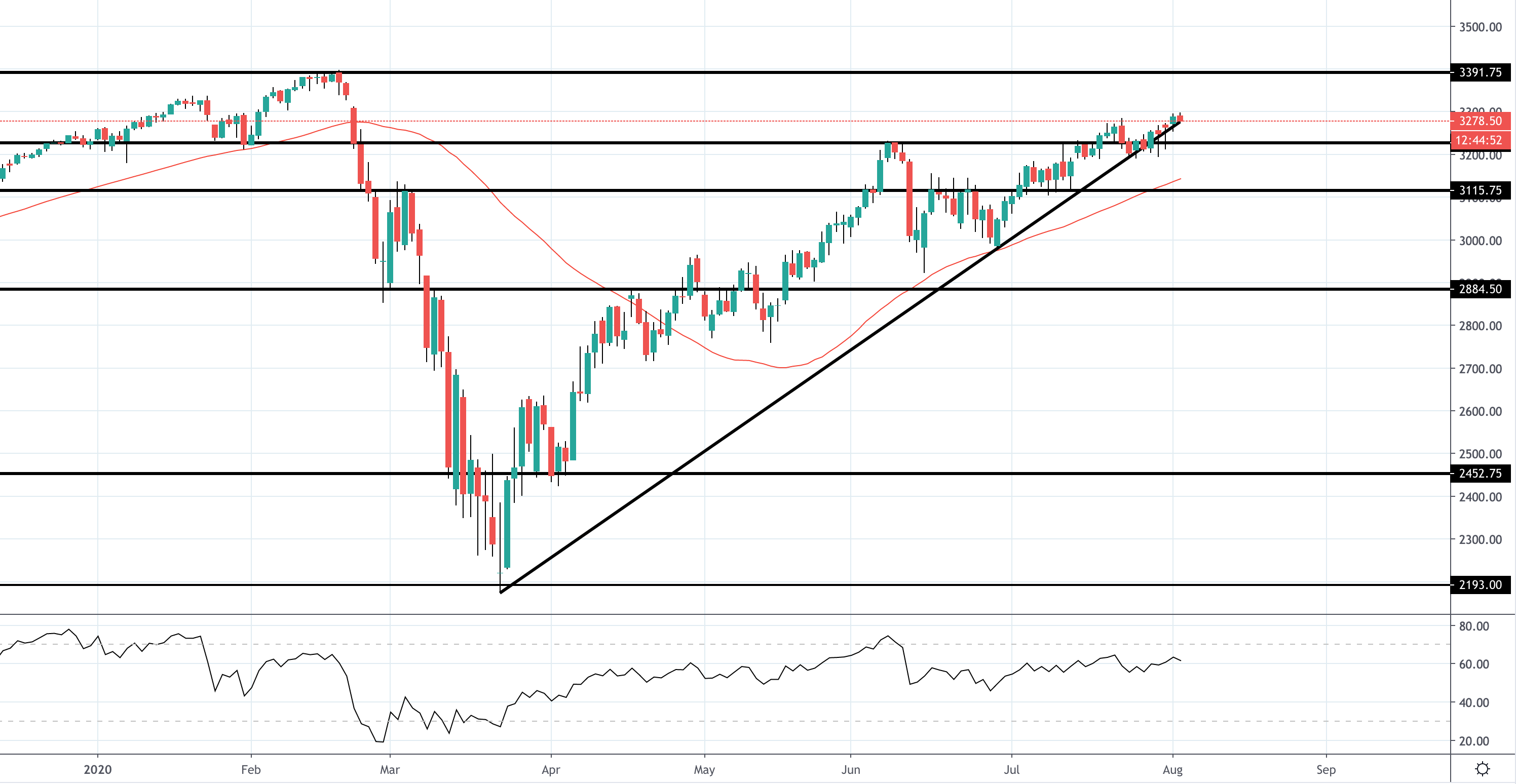

S&P500 (Bullish above 3226.50)

From a technical viewpoint. The S&P remains well supported here. Price continues to hold above the 3226.50 level and is well above the 50dma, keeping the near term outlook bullish with the 3391.75 level the next objective for bulls.

FTSE (Bearish below 5922.4)

From a technical viewpoint. The FTSE is now once again testing the 5922.4 level support. Having broken below the recent bull channel and fallen back under the 50dma, downside risks are growing. A break of the 5922.4 level will turn attention to the next support at 5626.

NIKKEI (Bullish above 21758.9, bearish below)

From a technical viewpoint. The Nikkei has once again tested the 21758.9 level, having fallen out of the bullish channel which has framed the recovery. While the level holds as support, the near-term outlook remains bullish, however, with price having fallen below the 50dma now, downside risks are building.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!