The IndeX Files - 04-01-2022

Markets Start On Brighter Note

Despite the uncertainty ahead of the holiday period, it hasn’t been a bad start to the year for markets. Benchmark global equities indices are trading broadly higher this week as markets appear to be downplaying omicron risks as we kick off Q1. With several recent data sets and studies confirming that the variant is a milder strain than its predecessors, there is hope that countries will be able to avoid the sort of widespread lockdowns we saw over Q1 2021. While infections are still soaring in many regions, including the UK and continental Europe, many projections expect the current wave to peak in the next few weeks with hopes that the pandemic is now entering its final stages given the much milder strain. With this in mind, markets are likely to refer back to underlying fundamentals as we push ahead into Q1.

The key themes in focus as we kick off the year are inflation, supply-chain issues and central bank tightening expectations. With price pressures still decidedly elevated and supply chain issues still causing havoc, many central banks face the question of how to balance tightening requirements while still keeping consumers supported. For equities markets, in the near term, the outlook remains favourable as current conditions are likely to see higher asset prices as omicron risks continue to diminish.

Technical Views

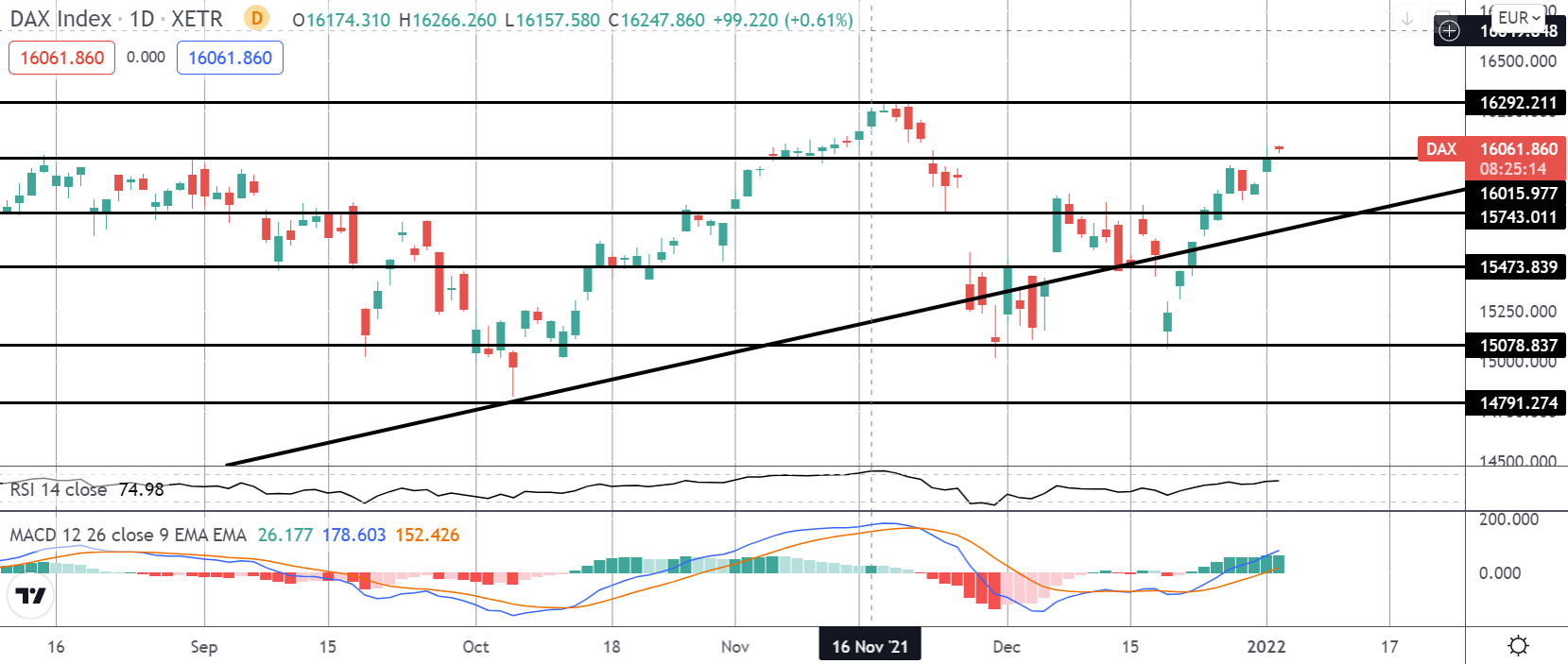

DAX

The DAX is currently once again testing above the 16015.97 region. With both MACD and RSI turned higher here, the focus remains on further upside while price holds above this level. To the topside, the next marker to watch is the 16292.21 level. To the downside, 15743.01 is the next support to watch, with the rising trend line in that region also.

S&P 500

The market broke above the 4744 level into the end of 2021 and remains above the level for now. With both MACD and RSI bullish, the outlook remains in favour of higher prices while this level holds as support. In terms of next levels to note, the 4937.50 level (and bull channel resistance) is the next marker for bulls.

FTSE

The retest of the 7362.6 support has seen the FTSE finding fresh demand with price since turning higher and breaking back above the 7444.3 level. While above here the focus is on a test of the 7558.7 level and channel top next. Bulls will need to see a clean break higher here to maintain momentum. To the downside, any move below the 7362.6 region will turn focus to support at 7241 next.

NIKKEI

The rally off the 28356.6 level base has seen the Nikkei moving higher for a fresh challenge of the contracting triangle top. With both MACD and RSI bullish, the focus is on a continued move higher here. However, bulls will need to see a quick break above the 29464.9 level in order to encourage fresh momentum. This view is further encouraged by retail market data which shows that section of the market holding a near 90% short in USDJPY. To the topside, a break of 116.07 will put the focus on 117.02 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.