The FTSE Finish Line - September 17 - 2024

FTSE Prints Two-Week Highs Ahead Of Central Bank Bonanza

On Tuesday, the FTSE 100 reached a two-week high due to the increase in bets on a more substantial U.S. interest rate reduction and the strength of domestic retail shares following an improved forecast from Kingfisher. The FTSE 100, a blue-chip index, reached its greatest level since September 3 by increasing by 0.7%. The pound experienced a minor decrease in value, alleviating some of the stress on the export-oriented companies in the index. Automobile and retail rose 1.7% and 1.6%, respectively, while all main sectoral indexes were in the green. The mid-cap index experienced a 0.2% increase. According to the CME's FedWatch tool, traders have increased the likelihood of a 50-basis-point reduction to 67% from 50% on Monday, as all eyes are on the Federal Reserve's anticipated first interest rate cut on Wednesday. This week, the Bank of England will also convene. Investors will primarily monitor the BoE's course for the remainder of the year and updates on the pace of its bond sales, as analysts anticipate that policymakers will maintain rates at their current level.Additionally, the Bank of England's rate trajectory will be closely monitored in anticipation of the release of UK inflation data on Wednesday.

In single stock stories Kingfisher, a European home improvement retailer, led the FTSE 100 in gains after increasing the bottom end of its profit outlook for the full year. The shares increased by 6.5%, their greatest level since February 2022. The stock was the most significant gainer on the primary index of London. The company has increased the lower end of its profit forecast for the year, citing that seasonal category sales trends have improved since early July, despite the continued weakness in demand for "big-ticket" categories. Kingfisher anticipates an adjusted pretax profit of 510 million pounds to 550 million pounds for 2024/25, an increase from its previous forecast of 490 million to 550 million pounds. In the first half of the year, which ended on July 31, the company's profit decreased by 0.5% to 334 million pounds, and like-for-like sales decreased by 2.4%. The stock had gained roughly 22% year-to-date as of the most recent close.

The FTSE 250 index's top percentage loser is Essentra, which experienced a 23% decline in its shares to a low of 129.60p, which has not been seen in over 15 years. The British plastic and metal components supplier has issued a warning that its annual operating profit will fall short of market expectations due to a slower-than-anticipated recovery in the Americas and weakened conditions in Europe. The company anticipates that its 2024 adjusted operating profit will fall within the range of 40 million pounds to 42 million pounds, which is lower than the market's expectation of 48.4 million pounds to 49.7 million pounds. The organization's obstacles pertain to market volume rather than pricing. The stock has declined by approximately 25% year-to-date, including the session's losses.

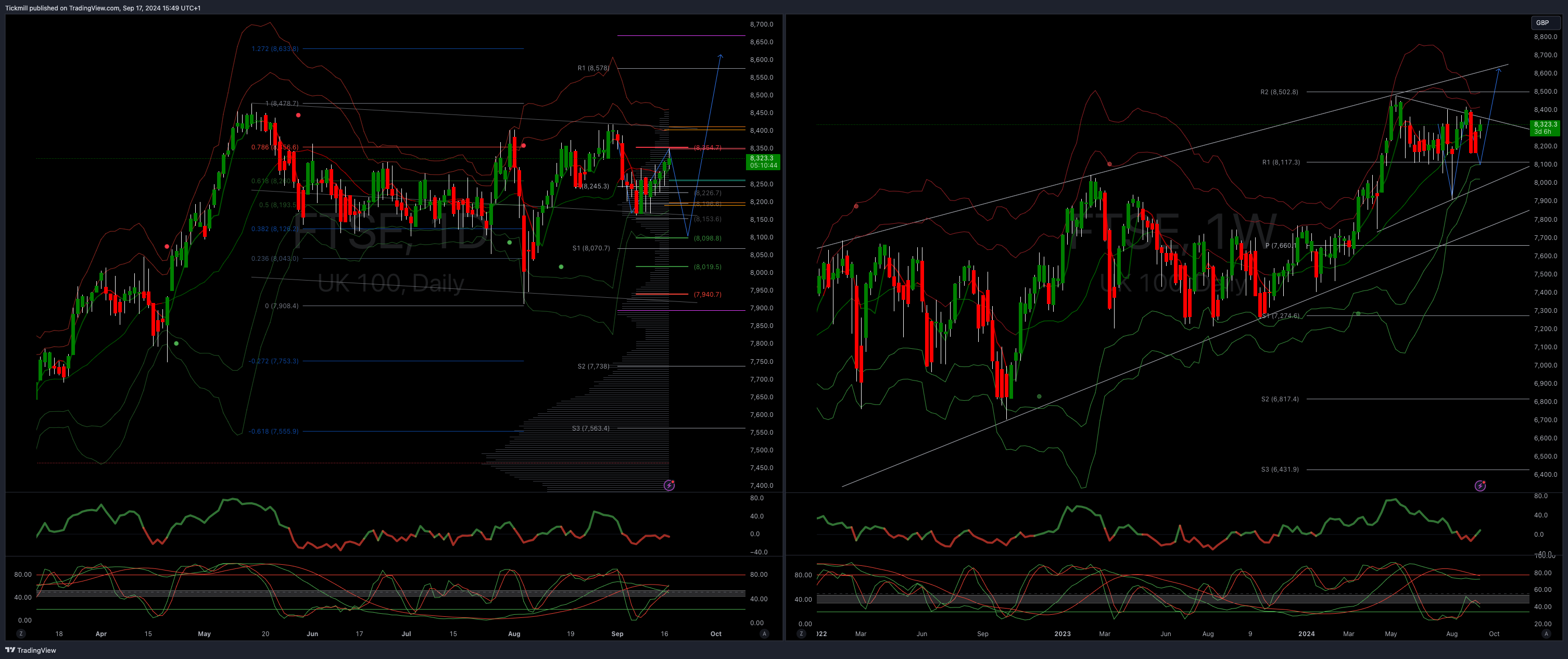

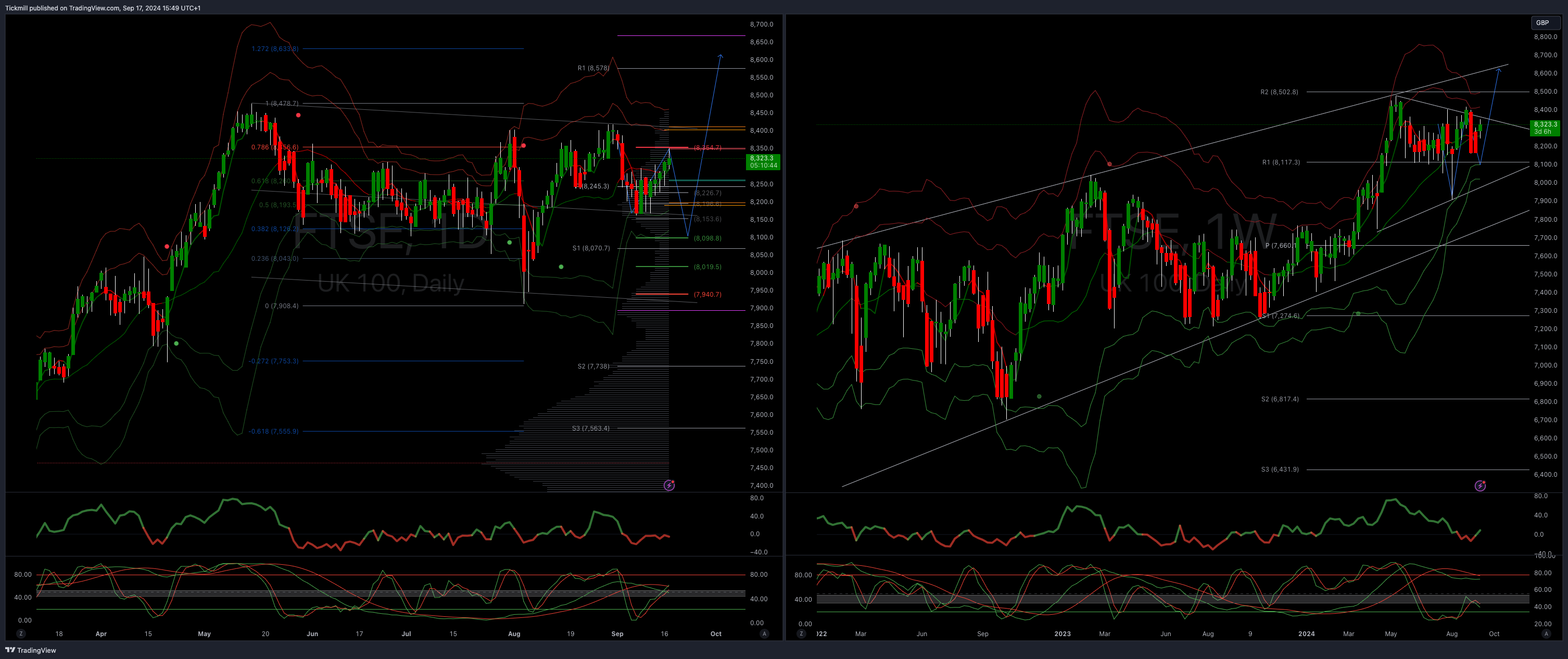

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!