The FTSE Finish Line - September 04 - 2024

FTSE Recovers From Three Week Lows To Almost Flat On The Day

A widespread drop on Wednesday caused the UK's main stock index to reach a three-week low before recovering early losses to head into the close flat on the session. The inintal decline was driven by worries over the U.S. economy's performance ahead of many central banks' monetary policy decisions later this month. The blue-chip FTSE 100 index saw a 0.03% decline. The local mid-cap FTSE 250 saw a decrease as well, following the largest decline in nearly a month. With declines of 2.1% and 1.4%, respectively, medical equipment and domestic products were the worst-hit industries.

Tuesday's poor U.S. manufacturing statistics exacerbated investor fears over the health of the greatest economy in the world, which had caused a worldwide stock market meltdown in early August and intensified calls for a rate decrease by the Federal Reserve this month. After the dramatic overnight decline on Wall Street, U.S. futures sank, while Europe's STOXX 600 fell 1% for the day. Even though September has been a lackluster month thus far, a variety of factors could determine how the market performs in the future if previous evidence is any indication. Given that the September U.S. rate decrease is nearly fully priced in, investors will be on the lookout for indicators to determine the exact size of the cut.

As it tries to revitalize its company, especially its motor insurance division, UK insurer Direct Line's shares dropped 1.7% to 189.8p after it missed estimates for its operational profit for the first half of the year. Against projections of 85 million pounds, the corporation achieved an ongoing operating profit of 63.7 million pounds. Direct Line was slow to increase pricing, which has resulted in a delayed impact on the profit line

Shares of Airtel Africa plummet after JP Morgan downgrades to "neutral." London-listed Airtel Africa's shares fall by almost 9% to 105.8p, making it the worst performer on the FTSE 100 index. JP Morgan downgrades the stock from "Overweight" to "Neutral." The downgrade is due to lower EBITDA margin projections for Airtel Nigeria, according to the brokerage.JP Morgan also lowers its target price of 121 pence from 139 pence for the shares. As of recent close, the stock had lost 10.5% of its value this year.

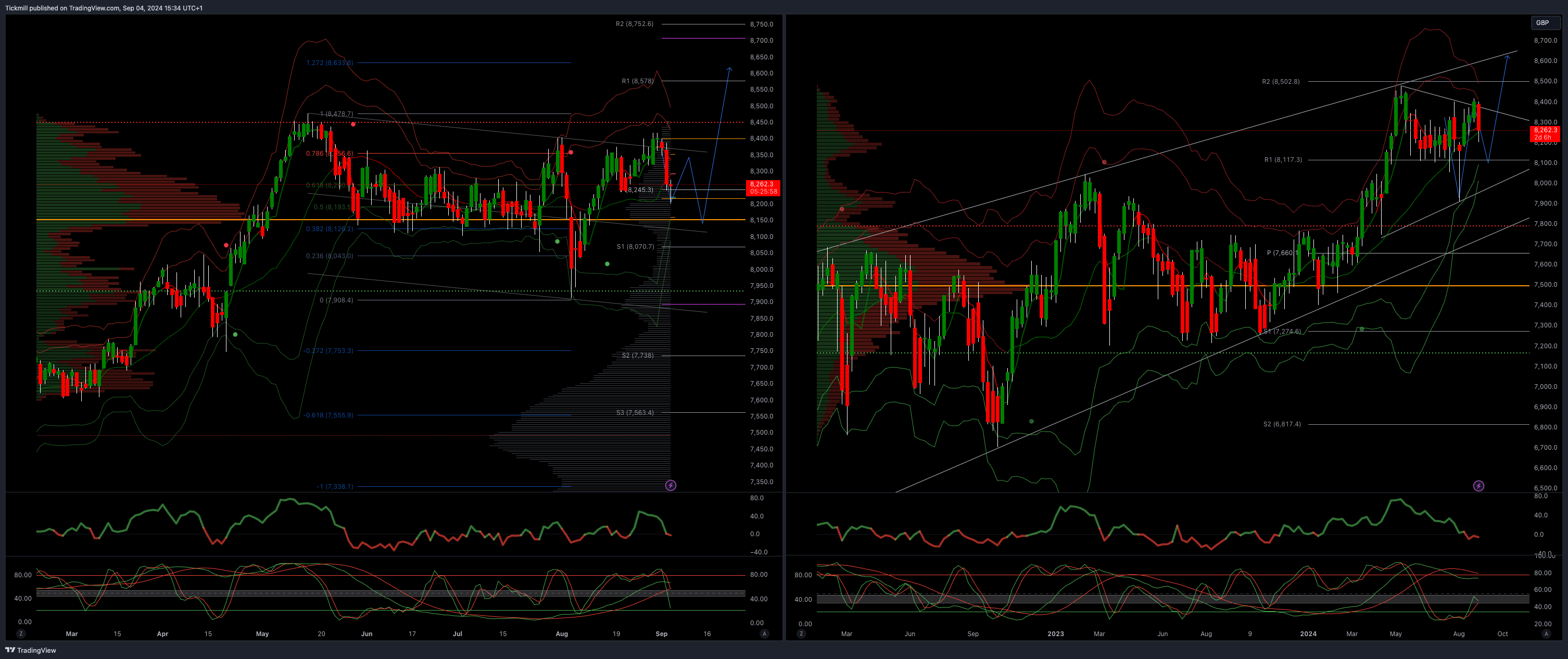

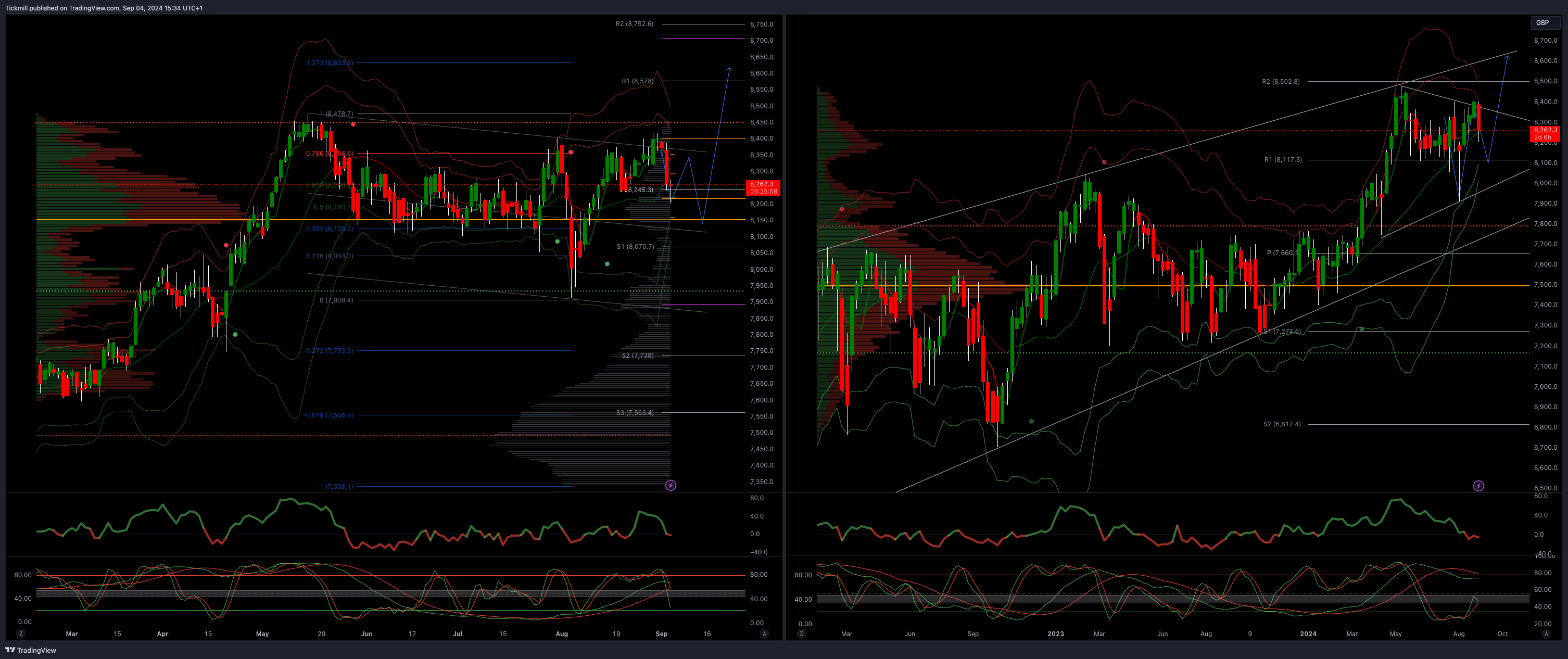

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!