The FTSE Finish Line - July 12 - 2023

The FTSE Finish Line - July 12 - 2023

FTSE & Sterling Soar As A Weak USD Supports Miners And Banks Pass Stress Tests

The FTSE is firmly in the green heading into the close of trade on Wednesday. The positive momentum was driven by higher metal prices, which lifted mining stocks. Additionally, British banks saw gains after successfully clearing the Bank of England's stress test. By the end of trading, the blue-chip FTSE 100 had increased by 1.79%. Industrial metal miners particularly benefited from a 0.8% gain as prices of most base metals rose, supported by a weaker US dollar, Antofagasta +4.7% sits in second to top spot with Glencore following suit gaining 4.5% . This price movement contributed to the overall positive sentiment in the market. The miners were pipped to the top spot by Smurfit Kappa up 5% as investors cheered the opening of their first North African plant and the announcement that the largest paper and packaging firm intends to expand their North African presence.

The Bank of England's annual stress test results were released this morning, indicating that the eight major lenders assessed would be capable of withstanding a stressed environment with rising interest rates. The test further revealed that none of the banks would need to submit revised capital plans, reinforcing their financial strength and ability to handle adverse scenarios. These developments in the mining sector and the successful stress test results for British banks played a significant role in the positive performance of the FTSE 100, Natwest 3.5% and Barclays 3.4%, .

On the negative side of the ledger IAG sits at the bottom of the index shedding 2.5% on the session after being downgraded by Deutsche Bank, the German investment bank moved its rating to hold from buy as it cut price targets across the European airlines sector. Analyst Jamie Rowbotham said: “We have seen some weakness in our fares data, with 60-day out prices for travel in August having screened ~2% down year over year on average, and walk-up fares in June ~6% down.” He said while the idea of a slowdown did not resonate with the airlines in recent pre-close conversations, “we are nonetheless exercising some caution.” For 2023, the bank has trimmed forecasts for the September quarter more than offset by upgrades to the June quarter and thinks assumptions for the December quarter are sufficiently prudent. For 2024, however, Deutsche predicts fares will fall 6% year-on-year versus flat before. This has “resulted in a material cut to our profit forecasts which now sit ~20% below consensus on average.” Deutsche has lowered its share price target for IAG to 165p from 200p

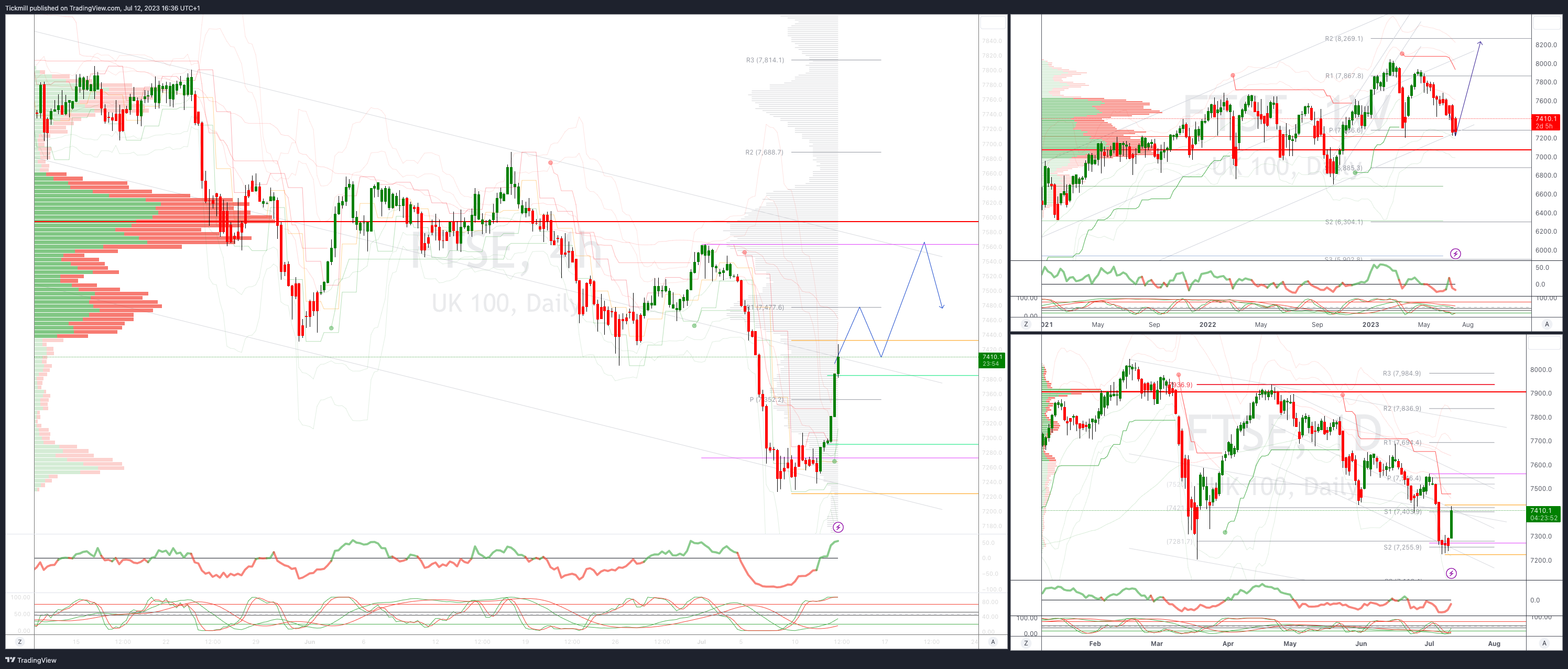

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7193

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!