The FTSE Finish Line: January 23 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Flip From Red To Green As Bullish Momentum Marches On

On Thursday, U.K. stocks initially rotated within a tight range amidst subdued trading conditions as investors looked for direction following the market's recent all-time highs. Initial reports signalled a notable downturn in sentiment within the manufacturing sector; confidence among manufacturers dropped to its lowest point in more than two years, which exerted some downward pressure on the market. Recent data indicated that British inflation unexpectedly decreased last month, with core price growth measures monitored by the BoE declining more significantly, reinforcing expectations for a rate cut next month. However, as buyers entered the market, investor sentiment shifted, pushing the benchmark into positive territory for the session and maintaining levels just shy of the record highs. The cautious atmosphere prevailing in the market is further compounded by concerns surrounding the tariff threats issued by U.S. President Donald Trump, adding an additional layer of uncertainty to the trading landscape. This delicate balance of market dynamics underscores the intricate interplay of economic indicators, geopolitical events, and investor sentiment shaping the U.K. stock market's trajectory.

Single Stock Stories:

Shares of AB Foods, the parent company of Primark, experienced a 2% decline, settling at 1,894.5 pence, positioning the stock as one of the top losers on the FTSE 100 index, which concurrently faced a 0.8% decrease. AB Foods has revised its 2025 sales forecast for its budget clothing business, Primark, lowering the outlook to "low-single digit" growth from the previous projection of "mid-single digit" growth. The company reported a 1.9% decline in underlying sales for Primark in the first quarter of the year. Analysts from Jefferies noted a discernible softening in domestic sales based on the Q1 update. However, they highlighted that the full-year margin guidance remains unchanged at this point. Amid uncertainties regarding Primark's profit potential, Jefferies analysts foresee a potential relief rally following the recent developments. Despite this outlook, the analysts caution that ongoing uncertainties may hinder a sustained rebound in the stock's performance. In 2024, the stock witnessed a 12.8% decline, reflecting the challenges and fluctuations faced by AB Foods in navigating the competitive retail landscape.

CMC Markets Plc witnessed a significant decline, with shares dropping by as much as 10.2% to 238p, leading as the top percentage loser on the FTSE 250 index. In a concise trading statement, the British trading platform affirmed its progress towards achieving the annual net operating income as previously outlined, expressing confidence in meeting its cost forecast. Shore Capital analyst Vivek Raja noted in a report that due to the recent strength in the share price, market expectations were higher, anticipating a more positive trading update from CMC Markets Plc. Moreover, there was a keen interest in updates on the progress of its collaboration with Revolut, which remains a focal point for investors. Despite the recent setback, the stock had shown remarkable performance, surging by 136% in 2024 and registering approximately 7% growth month-to-date as of the previous trading session's close. The fluctuating market response underscores the delicate balance between investor expectations, company performance, and strategic partnerships within the trading platform industry.

Broker Updates:

JD Sports, the British sportswear retailer, observed a 2.3% decline in its shares, reaching 81.1p, marking it as the leading percentage loser on the FTSE 100 index. Citi made significant adjustments by lowering the price target to 95p from 150p and downgrading the stock from 'Buy' to 'Neutral'. This decision followed a subdued peak trading report and a reduction in the annual profit forecast, prompting Citi to revise its estimates for the company. Highlighted in Citi's assessment is the expectation that JD Sports will maintain a high level of pricing discipline, potentially impacting its revenue growth. The brokerage anticipates a revenue decrease of 1.1% to 4.4% for FY25/FY26. Moreover, challenging market conditions are projected to hinder JD's store growth targets' progress, falling short of initial expectations. The broader market mood was reflected in the performance of JD's European counterpart, Puma, which experienced a 15% drop post-reporting a sales and profit miss in Q4. Amidst these updates, JD Sports has seen a 15% decline year-to-date, indicating the hurdles faced by the company within the competitive retail landscape and the evolving market dynamics.

Technical & Trade View

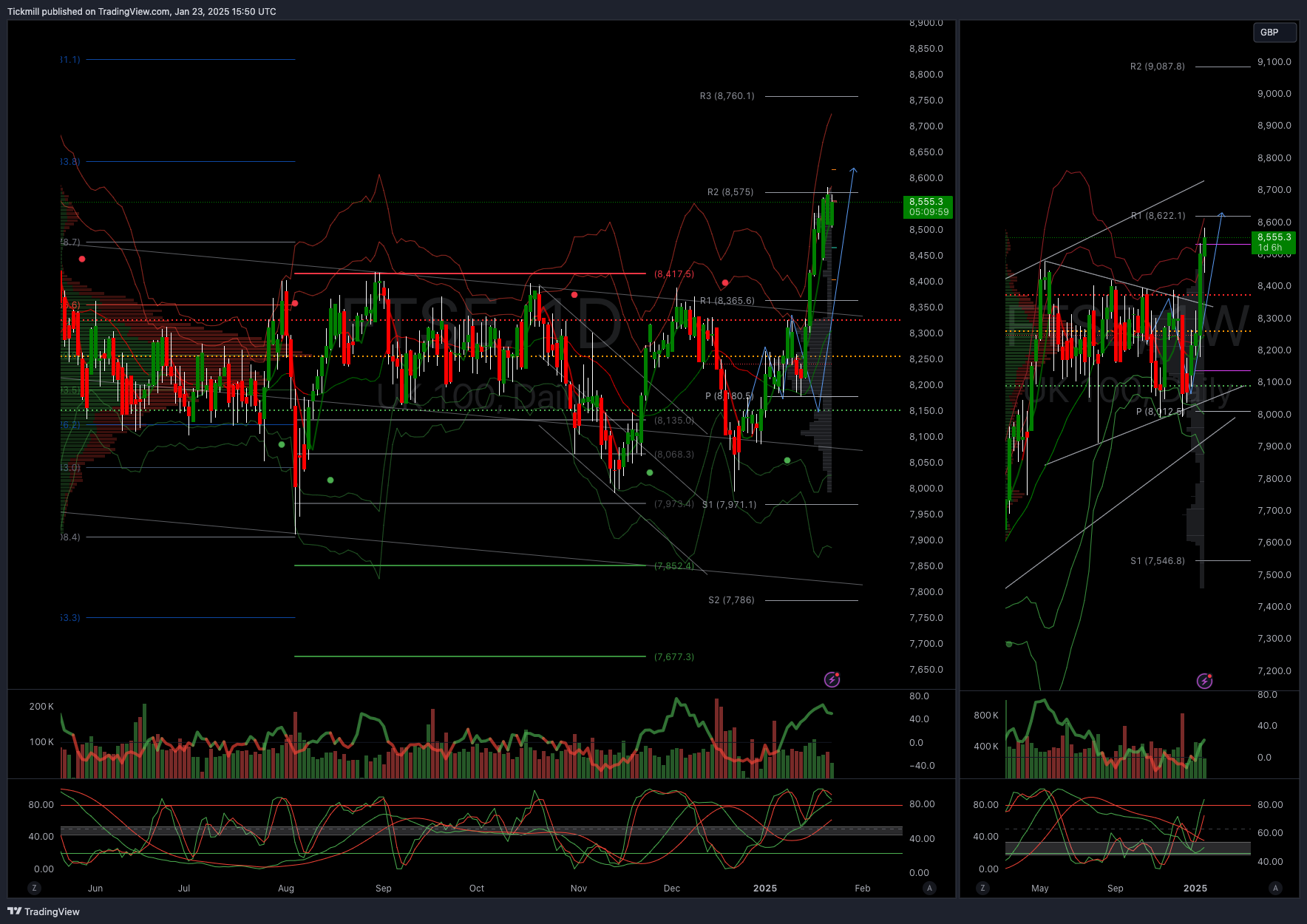

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!