The Dollar Enters Consolidation Ahead of the EU PMI data, ECB Meeting, and US reports

The US Dollar commences the week with a somewhat subdued stance, encountering selling pressure in Asia early Monday. This prefaces a bustling week on the macroeconomic front, featuring an array of pivotal data points. Notably, the absence of public addresses from US Federal Reserve officials persists as they adhere to the blackout period preceding the January 31 rate decision.

In the economic arena, Thursday and Friday take center stage with the release of the US Gross Domestic Product figures and the Personal Consumption Expenditures Price Index, the Fed's favored gauge of inflation. Concurrently, the European Central Bank is set to unveil its monetary policy decision on Thursday. Until then, Monday portends a tranquil start, devoid of major economic data.

CME Group's FedWatch Tool reflects a 100% market consensus that the Federal Reserve will maintain the current interest rates during the January 31 meeting. This alignment is reinforced by the Fed's blackout period, during which no further communication is anticipated until the conclusion of the month-end meeting.

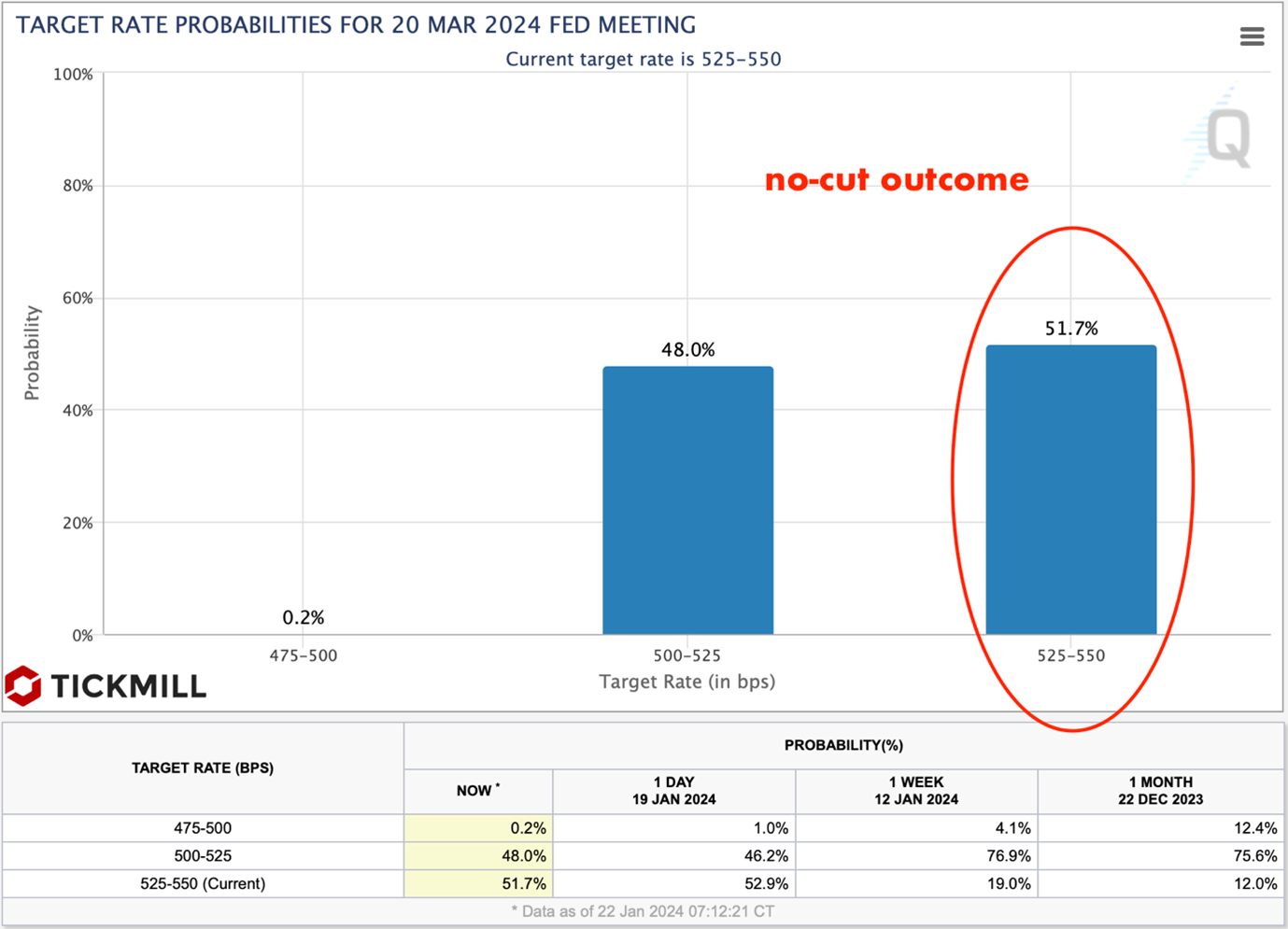

For the first time in several weeks, incoming US data managed to tilt the scales towards the market perception that the first Fed rate cut in this cycle will happen in May instead of March. Fed funds futures assign 51.7% of the chance to a no-cut outcome and 48% to the outcome that the Fed will lower the interest rate:

China disappoints the markets by maintaining its Loan Prime Rates, contrary to the expectations of some market participants anticipating easing measures to prop up the Chinese economy.

San Francisco Fed Bank President Mary Daly, speaking on Friday, asserts that the current monetary policy is well-positioned, with a balanced outlook on risks to the economy. She advocates for a cautious approach to interest rate reduction, emphasizing the imperative of safeguarding the return of inflation to the 2% target. Daly underscores the Fed's focus on achieving full employment this year, diverging from the 2023 agenda of prioritizing price stability.

Throughout the week, market participants will closely monitor the preliminary S&P Global PMIs for January, preliminary Q4 GDP data, US initial claims, and the core PCE price index for December. Positive economic indicators would intensify skepticism surrounding a potential rate cut in March.

Tomorrow, the HCOB agency will release PMI indices for manufacturing and non-manufacturing sectors of EU countries, as well as EU-wide indicators. PMIs have gained lots of attention from market participants, and we also saw increased sensitivity of the Euro to this type of data, which calls for caution about possible spikes on EURUSD on Tuesday.

The EURUSD market was largely in a consolidative range last week (1.085-1.09) which could be a useful signal that major US news has been priced in, which opens the door for the Euro upside in case tomorrow’s PMI data surprises on the upside.

The Gold price experienced a downturn on Monday as investors reassess their outlook on Federal Reserve interest rates. Policymakers consistently advocate for a firm stance on interest rates to ensure the sustained return of inflation to the 2% target. The precious metal contends with a sell-off as expectations for imminent rate cuts wane, influenced by persistent price pressures attributable to robust consumer spending and full employment conditions.

Additionally, the lack of new developments regarding Middle-East tensions diminishes the allure of bullion. Investors should prepare for heightened volatility amid a week filled with substantial data releases.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.